Bitcoin halving fails to fuel price rally, but investors are still active

Pic: DKosig / iStock / Getty Images Plus via Getty Images

Bitcoin’s (BTC) market value has remained unchanged over the past week, despite the asset’s price swings before and after the halving.

BTC had undergone a noteworthy 92 per cent price rally in the leadup to the halving. Market value reached US$10,000 ($15,572), a significant value for BTC, the Friday before prices began to fall.

Market value dropped $2,800 in the lead up to the halving, from $15,444 to $12,644.

The most substantial price plummet of 8.31 per cent started Sunday morning during international trading hours. BTC regained some lost ground by jumping $1,564, to $14,841.59. The result is a total weekly loss of 2 per cent.

Alt coins Ethereum (ETH) and Ripple (XRP) moved in correlation to BTC’s pre-halving price drop.

| Asset | Percentage gain/loss May 8-15 | YTD gain/loss |

|---|---|---|

| Bitcoin (BTC) | -0.0085 | 0.46 |

| Ethereum (ETH) | -0.0432 | 0.66 |

| Ripple (XRP) | -0.07 | 0.135 |

| S&P ASX Small Ordinaries (XS) | 0.0023 | -0.1301 |

Source: BTC Markets

News of OmiseGO (OMG) token being listed on Coinbase Pro fueled a 30 per cent price rally.

OmiseGo is a decentralised payment network blockchain. The move brought OMG’s price back to the same levels prior to the March 12 crash.

The total digital asset market capitalisation dropped $15bn this week, after reaching $420bn on May 9.

BTC’s market dominance has remained largely unchanged and currently sits at 67.6 per cent of the total market cap.

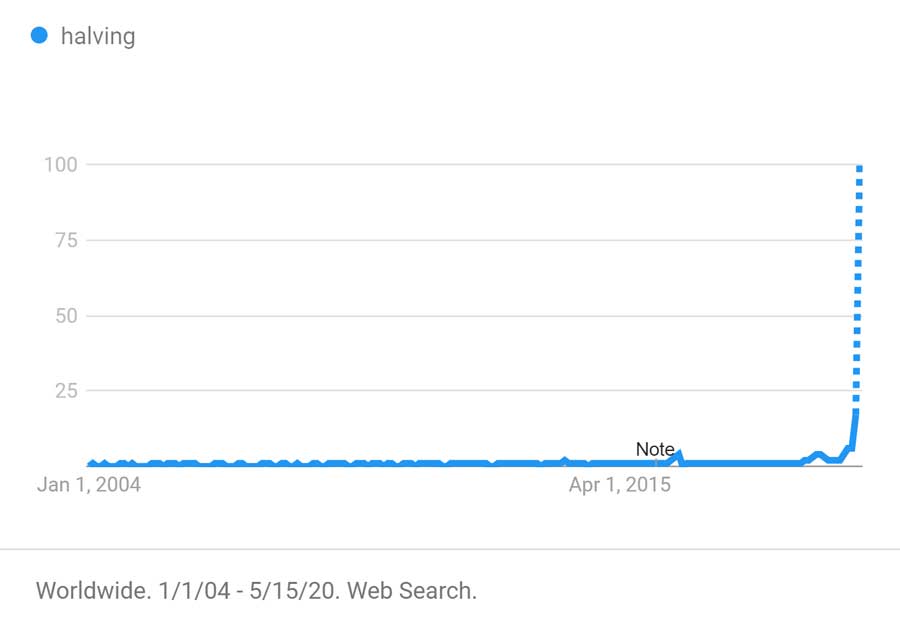

Search interest around the halving continued to climb exponentially in the leadup to the event. Google’s data shows a clear spike in search numbers on May 12, the day of the halving.

Although BTC’s price has remained unchanged, data from skew.com suggests bullish sentiment in the options and futures markets.

Open interest — the total number of options and futures contracts still active — has increased since the halving. This reveals that investors are still active in the market.

BTC’s put:call ratio shows the balance of put and call options contract being traded. The options are the right to sell or buy an asset, respectively, at a set price in the future.

Investors and traders use the ratio to gauge the mood of the market.

The ratio decreased from a pre-halving high of 0.81 to 0.66. This indicates that traders are buying more call contracts, and therefore are speculating that BTC’s price will rise.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.