Bitcoin couldn’t escape the US stock market rout

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Bitcoin (BTC) dropped on Friday in reaction to US stock markets taking on significant daily losses.

The Dow Jones Industrial Average sustained a 6.9 per cent drop amid fears of a re-acceleration of COVID-19 cases in America. The S&P 500 followed suit, dropping 5.89 per cent.

BTC wasn’t immune from the chaos of the US markets as its price dropped over 4 per cent. This caused a cascade of losses across all digital assets on BTC Markets.

Digital asset Basic Attention Token (BAT), Power Ledger (POWR) and Chainlink (LINK) were the worst affected, all taking on losses over 10 per cent.

Weekly price actions

BTC’s prices dropped $318 late last Friday (June 5) to close at $13,864.

The drop may have been due to strong gains made on US stock markets that day.

Bloomberg reported that funds had been moving away from stocks benefiting from the stay-at-home market into airlines, automakers and banks.

Two day later, BTC’s price once again fell by 2.6 per cent to $13,592. The move was fleeting as prices recovered $360 above its daily low.

Prices continued to creep higher until peaking at $14,336 on Friday, June 12. However, BTC’s market value plummeted 4.17 per cent the same day in reaction to US stock markets crashing.

As a result, BTC’s value took on an overall loss of 1.85 per cent this week. The total digital asset market cap currently sits at $388bn, with BTC dominance at 65 per cent.

Derivatives markets

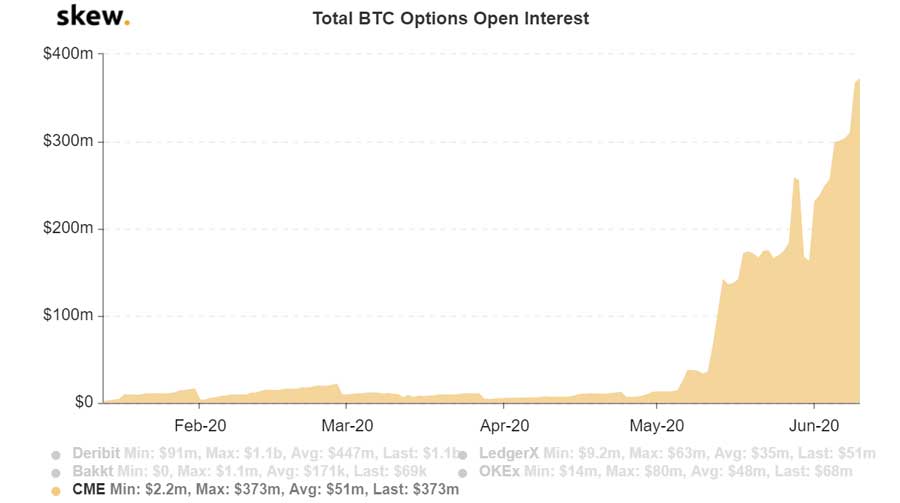

Institutional investors continue to pour funds into BTC derivative markets.

The Chicago Mercantile Exchange (CME) is used by institutional investors due to the high minimum trade size.

Open interest (OI) of CME’s BTC options and futures markets have seen a 99 and 74 per cent increase respectively since the beginning of 2020.

CME’s BTC options market continues to break an all-time high level.

OI peaked at $US373m ($543m), a $US74m increase from last week. Total OI on the exchanges BTC futures markets increased by $US51m over the same period.

The ever-increasing momentum of funds flowing into BTC derivatives suggests the asset is moving towards mainstream adoption by investors.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.