Bank of America says global fundies fear factor is at record highs

Picture: Getty Images

Well, if you were thinking the year on markets thus far has been pretty crap, you’d be both right and hell wrong.

The word overnight, according to the latest Bank of America survey of global fund managers, is not encouraging. In fact, the monthly report which canvasses the views of circa 300 of the best paid institutional, mutual and hedge fund managers from around the world has never, ever delivered the collective groan of pessimism as it did overnight.

These mega fundies – who control a collective of US$830 billion of assets – usually have a lot to smile about, but from their POV, it looks like the crapness of 2022 may actually have just been but a wee sample of the larger looming crapness about to unfold over the next 12 months.

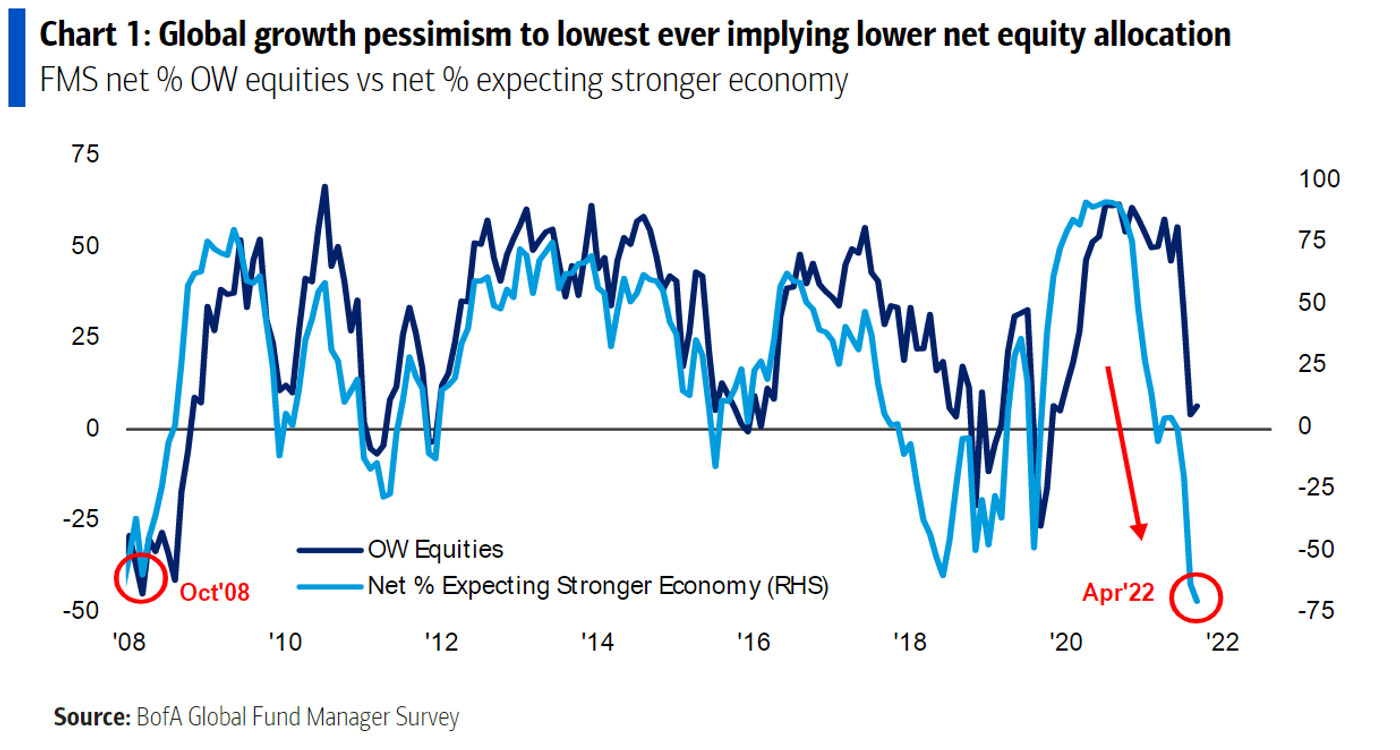

BoAML says that institutional fears for the outlook of global economic growth have hit their highest fear factor since the new century began. That means if stocks took a bit of a wee hit earlier this year, it might just be a sample of what’s to come.

With fundie pessimism at its worst ever, their future allocations into equity markets should be getting a solid haircut sometime soon.

With Russia both humiliated and infuriated as President Vladimir Putin’s un-special military operation in Ukraine enters its third month, April’s survey response spoke to the heightened concerns that rip-roaring inflation will pressure The Fed into some kind of policy faux pas that could escalate all kinds of trouble or perhaps just trigger a global recession.

Over 70% of fund managers surveyed in March see the global economy weakening this year – a historic low for a survey that’s been measuring monthly data since this happened…

or this happened

or though we try to forget, since this actually happened.

1995 – a shocker for cinema, a good year for starting financial surveys.

Don’t have faith in The Fed

The BoA says fundie fears that the Federal Reserve will overshoot their brief and start raising rates too quickly also hit an all-time high of 83%.

Respondents think the central bank will raise short-term rates at least seven times this year as it looks to control inflation running at its fastest annual pace in more than 40 years.

“Investors are struggling with the prospect of a really big slowdown in economic growth over the next six months,” said the bank’s chief investment strategist Michael Hartnett. “It is still only a minority that believe that a recession is coming but that view is changing quickly.”

Despite the undeniable volatility roiling global markets – and the combined fears of hundreds of top shelf fund managers – equities have proven relatively resilient.

In fact, the disassociation this month between global growth expectations and equity allocation was pretty hard for BofA analysts to wrap their heads around.

They called it a “staggering disconnect” which has popped up between investors’ downbeat expectations for economic growth and the way global fund managers have been pouring other people’s money into net overweight stock positions.

“Everyone is bearish on the outlook for growth, inflation, the Fed and US interest rates, but asset allocators are still overweight equities,” the bank said.

And yet, after bouncing back from the low watermarks of early March, overnight the S&P 500 closed 8% below its record high from early January, the Dow Jones Industrial Average was under its record by just 7%, while at least the tech-growth fireball we once knew as the Nasdaq – exposed the most of all to rising interest rates – has the decency to be some 17% under its mad record highs from November.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.