Back by really unpopular demand: RBA rates day, RBA rate hikes and not much new bank lending

Here we grow again: economists expect the RBA to raise rates again on Tuesday. Via Getty

First a message from your central bank:

Hi, thanks for calling all of us here at the Reserve Bank of Australia (RBA), we’re glad you did. Unfortunately no one is available to answer the phones because inflation.

Please hold while we transfer you to a cheaper customer service bot.

Hola Senor! or Friend of Senor, hola! er… espere mientras lo transferimos a otro robot con un mensaje grabado… hold the phone, por favor.

Hi. In determining the size and length of this customer service message the Reserve Bank has a duty to contribute to the quality of the recording, clarity of message, use of grammar and the welfare of the customer. To achieve these customer service objectives, the Bank uses the equation ‘makes sense over minimum effort’ (MS/ME) and seeks through this message and others like it to maintain consumer service messaging in the target band of 2–3% of MS/ME, on average, over the medium term.

In support of this policy, we ask you not to call again.

If you would like to file a complaint press 1 through 8. If you would like to know the official cash rate as it Monday September 5, press 9.

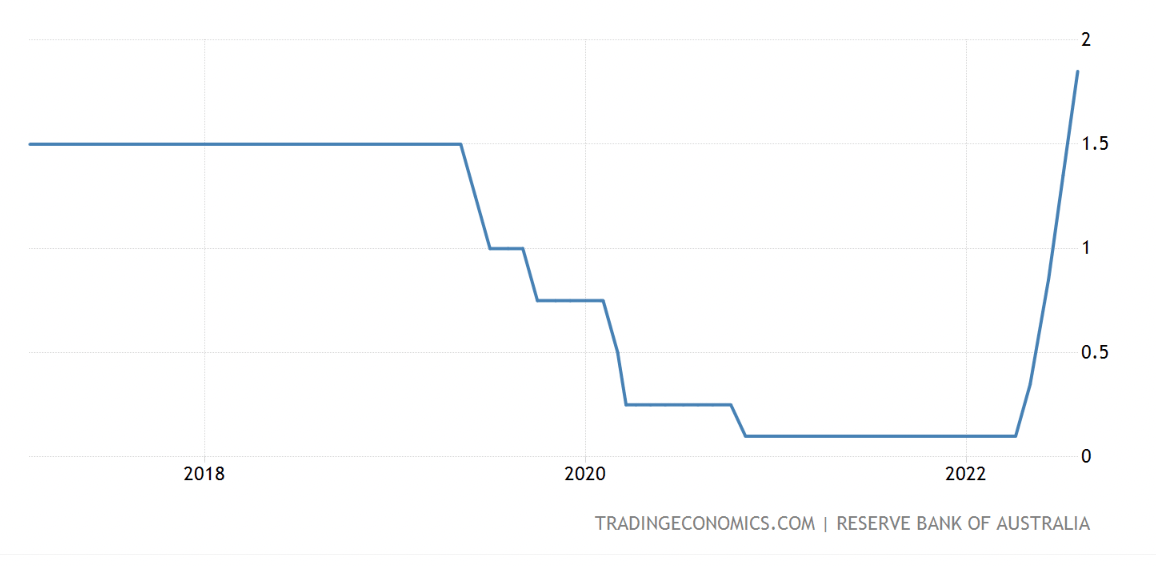

Hi. The Board would like to thank you for not pressing 1 through 8. That was a trap. Your country’s current Official Cash Rate is 1.85% as determined by your governing buddies at the Reserve Bank Board

The Board raised interest rates by 0.50% at its last August board meeting.

The next RBA meeting is today, September 6 … wait, what? That can’t be right. Already!? Dammit! Get the Doc. Sorry, hanging up now!

Here’s a drawing of the cost of money: not Van Gogh, but it paints a picture

The RBA is about a million-to-one to raise the OCR again on Tuesday, which’d be the fastest consecutive rise in rates since Forrest Gump and as viewers of that dark moment in cinema often say to themselves during the opening credits: things can only get worse from here.

ANZ economists led by David Plank are banking on a a 50 basis point pump on Tuesday, with another similar hike for good measure to follow in October 2022.

“Regardless of what (Governor) Lowe says, it will be the data that matters. Given our expectations, we think a 50bp rate hike in October is more likely than 25bp,” Plank said.

Across Martin Place there’s general agreement, although the Commonwealth Bank’s top economic honcho, Gareth Aird, says September may be the last 50-point hike in 2022.

Aird says there’s likely a 25 bp hike in the post before the RBA pauses for a few months to survey the damage.

“Even with the RBA pausing rate hikes the economy may continue to tighten, as over the next eighteen months more and more fixed rate home loans revert to higher variable rates,” Aird warns.

It’s already hitting both sides of the transaction hard.

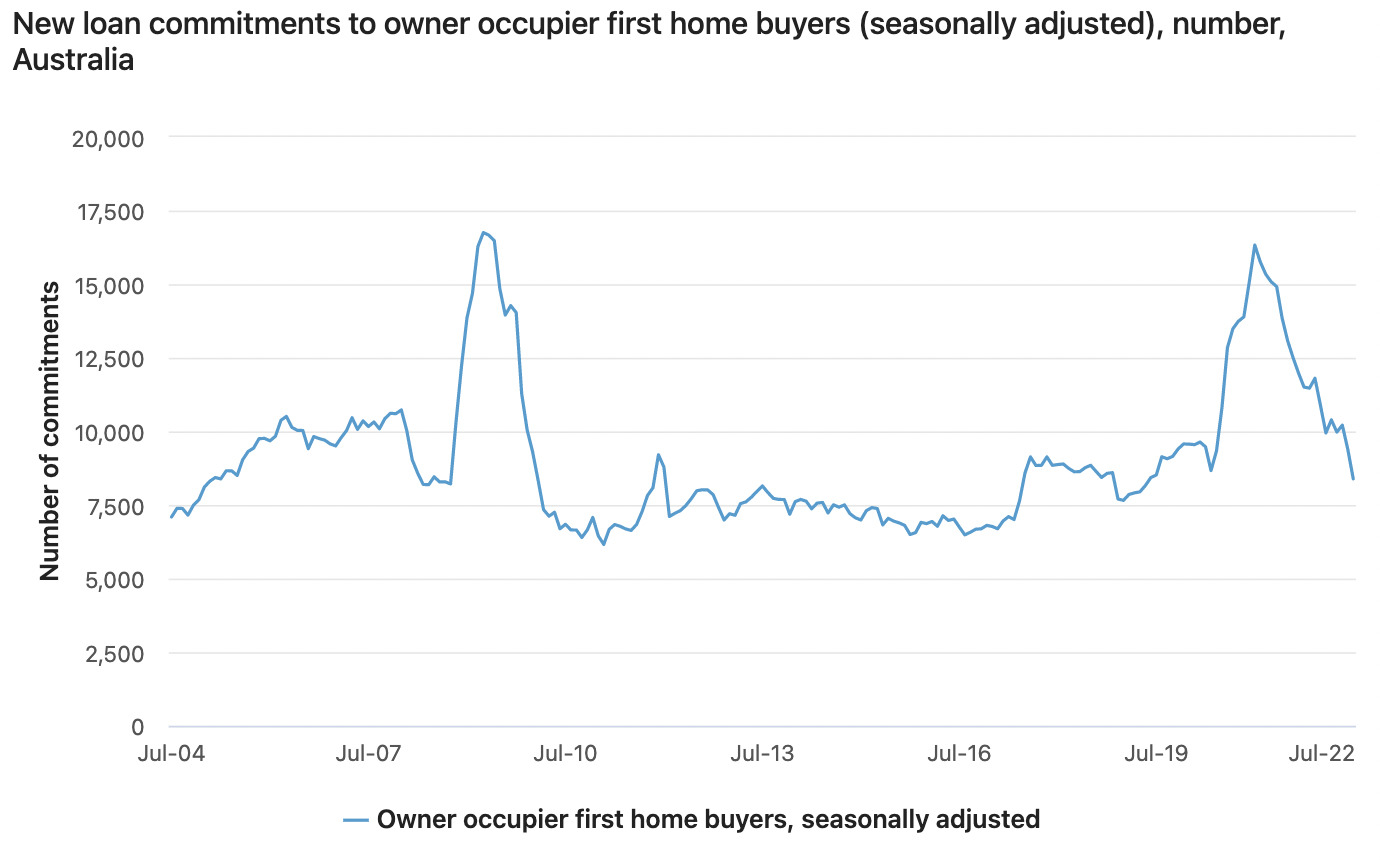

First against the wall when the revolution comes: First-home buyers

The number of first-home loans was down 10.7% in July and by well over a third on last year, data released by the Australian Bureau of Statistics shows.

These persecuted fringe-dwellers are disappearing from the market as any backward price movements are overwhelmed by the rising cost of servicing loans.

Now travelling at an increasing reverse velocity, new loans have already passed the pre-pandemic level of February 2020 and – for 1st home buyers – in their total loans shrank $427m in value over July alone.

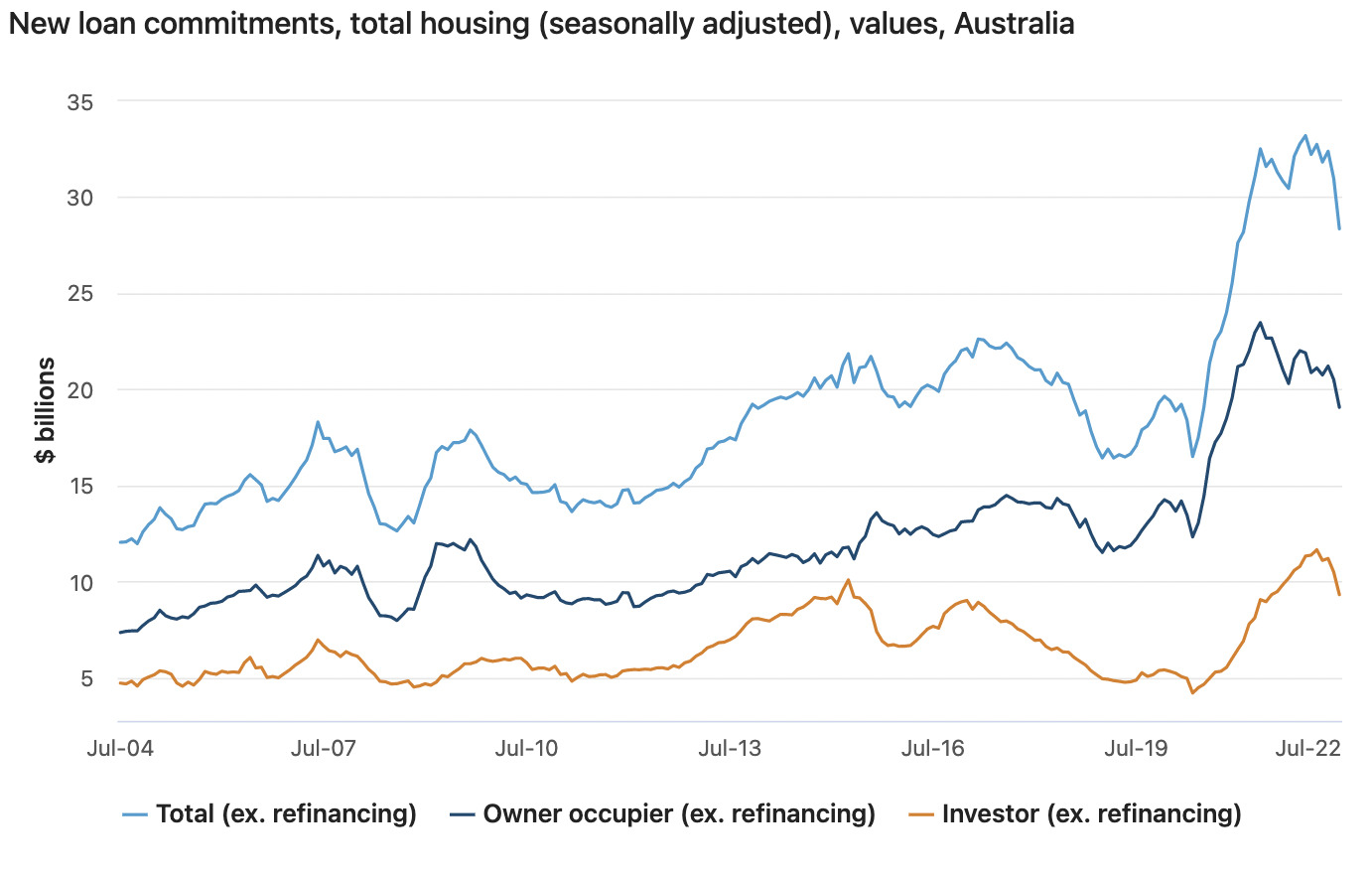

The total value of new home lending for July fell $2.62 billion, or 8.5% – CBA says that’s the sharpest drop on record – as the impact of rising interest rates subdues demand for new housing credit.

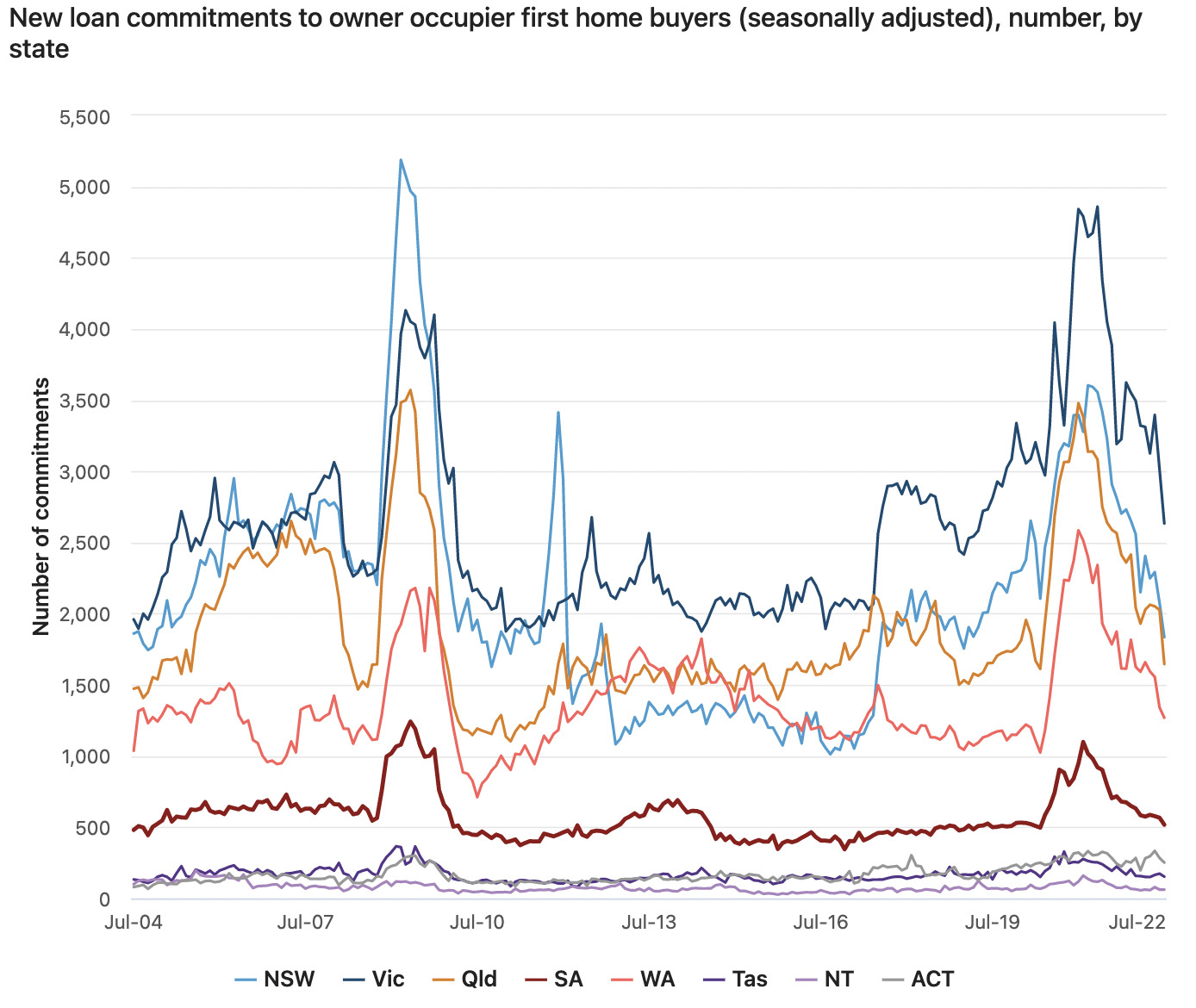

The falls across the country were all over the place, hardly anywhere was safe bar a few corners of the market in SA and WA.

The shrinkage in new lending is the direct result of the RBA’s tighter monetary policy and the banks’ enthusiasm to pass it on. This rapid tightening cycle is sucking up the oxygen for housing credit.

The numbers didn’t get the jump on the Commonwealth bank at least. The broader data was in line with CBA expectations (-6.0%) but it was a much harder fall then the market was expecting (-3.5%).

The country’s largest home loan lender knew what was coming it seems, with CBA’s economic team bracing for the biggest falls across the Aussie forecasting community.

Lending to owner-occupiers fell by 7.0% in the month but it was investor lending that really crashed, down 11.2% for the month.

The monthly fall in the flow of new lending is the largest in the history of the series excluding May 2020, the very onset of the pandemic.

CBA anticipates a further softening from here.

“The July fall follows a 4.4% contraction in June pointing to a trend of much softer new lending than we have seen through the pandemic. Every state in the country recorded a fall in total new lending with Queensland registering the largest drop, down 10.6% in July,” CBA said in a note.

Victoria (-8.7%), Tassie (-8.7%), NSW (-6.3%), South Aussie (-6.2%) and West Aussie (-5.3%) also took large backward in the distribution of housing credit.

“Deeply negative real wages growth in addition to the higher cost of borrowing are having an effect on the national housing market,” CBA added.

The impact of the rate hikes are already being felt by these forward looking indicators. Data released last week showed that dwelling prices across the country fell by 1.6% in August, with the largest market in Sydney down a startling 2.3%.

Despite the fiesty ABS data showing local demand for home loans contracting like a prostate before an exam, fewer households are crashing out to mortgage arrears, according to Fitch ratings.

Record-low unemployment is offsetting rises in interest rates and inflation, the agency’s analytic team postulates.

According to Fitch, Australia’s 30-day mortgage arrears was down seven points quarter-on-quarter to 0.82% in the three months to June 30 due to record-low unemployment, the Fitch Dinkum RMBS Index indicates.

Ninety-day arrears also fell by four points to 0.4% qoq. Fitch says that late-stage mortgage arrears are looking pretty stable in 2022.

The extent of the pressure, however, will depend on the speed and level of interest rate rises and inflation.

Fitch warns home prices to fall for the remainder of 2022 and into 2023 on affordability constraints and credit tightening. According to CoreLogic, Aussie home prices fell in Q1 2022 across Australia’s combined capital cities to the tune of -0.8%. A multi-decade high (or low, pick one.)

Finally, Gareth Aird at CBA warns that Aussie home borrowers have “barely felt” the impact of the RBA’s historic 175bp of tightening since 4 May – from a cash flow perspective.

“There is on average a three month lag between an RBA rate hike and when CBA borrowers on variable rate mortgages experience an increase in their home loan repayments,” Aird says.

So actually that punchy retail data we’ve been getting isn’t an anomaly, it’s just late to the party.

Aird says the lag explains why the official spending data has stayed strong – while the regular measures of consumer sentiment show us shopping with a very heavy heart – with levels just awful and pretty much consistent with a recession or some major negative economic shock.

“We expect consumer spending to slow materially as the lagged impact of rate hikes hits home borrower cash flow,” Aird said, adding another nail to Monday morning.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.