Australian house prices are losing steam, but ‘crash landing’ talks may be far-fetched

Australian house prices softened in July. Picture: Getty Images

Is the Australian property market finally losing steam?

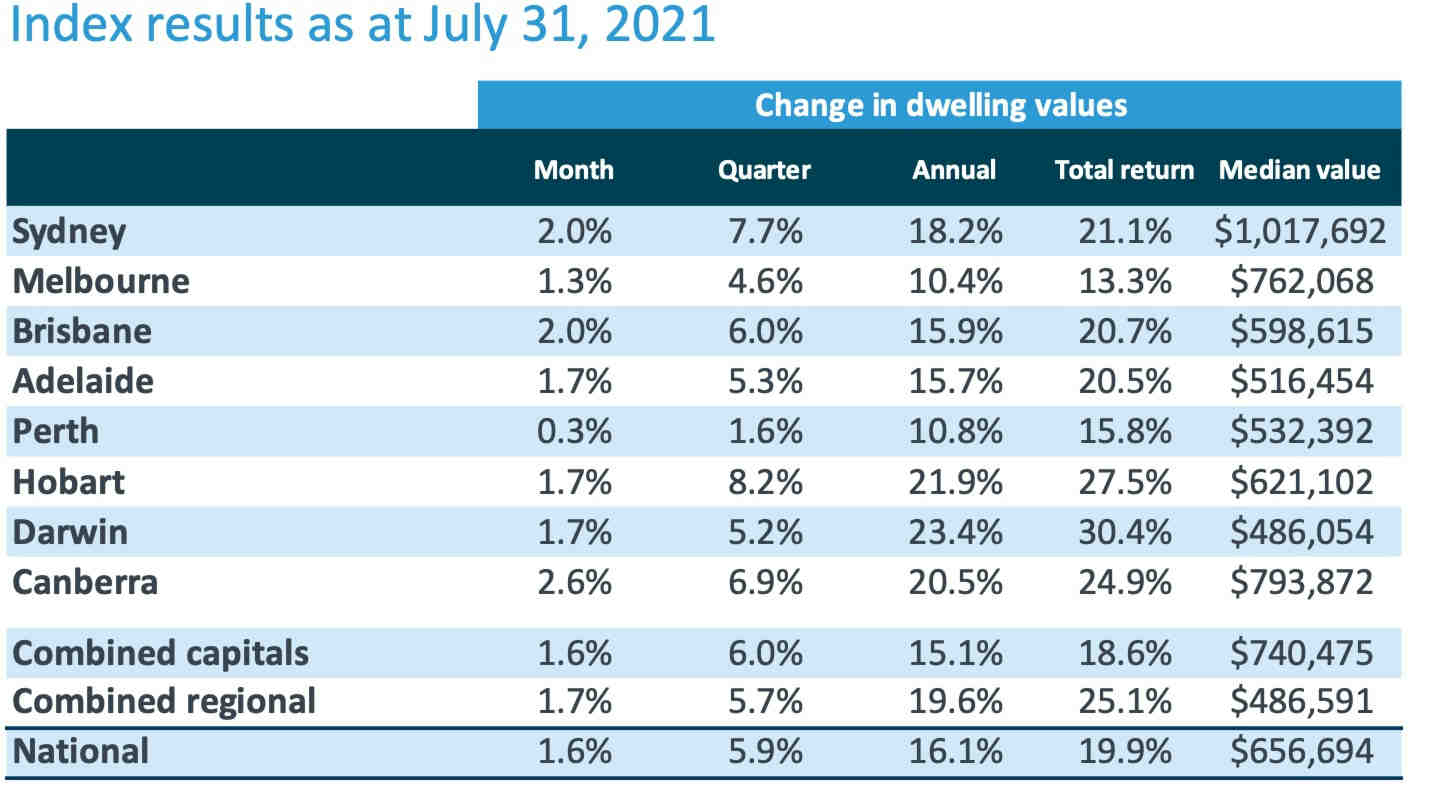

The latest data from CoreLogic shows Australian housing values have again increased by 1.6% in July for a yearly rise of 16.1%, but the growth rate has gradually softened since March.

“The 16.1% lift in national housing values over the past year is the fastest pace of annual growth since February 2004, however the monthly growth rate has been trending lower since March this year when the national index rose 2.8%,” says CoreLogic’s research director, Tim Lawless.

Lawless attributes the softening markets to several factors, including declining affordability.

“With dwelling values rising more in a month than incomes are rising in a year, housing is moving out of reach for many members of the community,” he pointed out.

In addition, Lawless said the fiscal support that was given earlier by the government has run its course, although new measures are being rolled out as the COVID outbreak worsens.

Demand is also being propped up by record low mortgage rates, but how much longer will we see these elevated levels?

“Interest rates will remain low for an extended period of time,” explained Lawless.

“Dwelling sales are tracking approximately 40% above the five-year average, while active listings remain about -26% below the five-year average.”

This mismatch between demand versus supply, according to Lawless, will remain a key factor placing upwards pressure on housing prices.

Australian property outlook for the next six months

According to the report, dwelling price appreciation has slowed across each of the capital cities.

Sydney has recorded the sharpest fall, with monthly capital gains falling from 3.7% in March, to 2% in July.

Perth meanwhile, showed the least growth during the month of July, rising by just 0.6%.

At the macro level, house prices have risen twice as high as units in the 12 months to July – 18.4% vs 8.7% respectively.

Although the number of home sales have been well above average, CoreLogic expects this to slow down over the next six months.

“With affordability constraints starting to impact purchasing capacity, it’s possible market activity could reduce through the second half of the year, helping to rebalance the market and take some heat out of the rate of house price growth,” Lawless said.

Other potential headwinds, including the possibility of tighter credit policies and an earlier than expected lift in interest rates, would also likely have an immediate dampening effect on housing markets.

Could the Australian property market collapse?

According to analysts, there is a lot of vested interest to keep the Australian real estate market stable.

CoreLogic Head of Australian Research, Eliza Owen, said the real estate market is an extremely important pillar of the Australian economy, making up half of household wealth.

“The property market is also a crucial pillar of retirement, in the sense that when people get older they use equity in their homes to support expenses in aged and health care,” Owen said in an interview with Wealthi.

“Because of that reliance built into the Australian households on property, it’s a sector that needs some stability around it. “

“I don’t blame the doomsayers who are calling a 30 per cent crash, but the key aspect that analysts often miss is that we often underestimate the institutional response in keeping the property market stable.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.