Australia is witnessing a tourism boom, but just four stocks are cashing in

Investors are betting on a tourism comeback with a number of buys in ASX-listed stocks this week. Getty Images.

In the last 12 months, 9.36 million tourists have come to Australia for a holiday.

According to the Australian Bureau of Statistics, China was the largest source (with 1.4 million), but a record number of Americans and Canadians also visited Australia (nearly 700,000 between them in 12 months).

Austrade is predicting the strongest growth in the next couple of years to come from elsewhere in Asia including India, Indonesia, Singapore and Malaysia.

Chinese tourist markets are expected to grow another 200,000 in the next couple of years albeit at a slower growth rate than recently.

Additionally there were 293,860 permanent or long-term arrivals in Australia in the last 12 months.

CommSec senior economist Ryan Felsman said this would continue to support broader economic activity and spending particularly in the housing market.

However, the majority of tourism and leisure stocks have not gained — on average these are down 21 per cent in 12 months.

According to a Roy Morgan report released on Monday, Australia’s own holiday makers (domestically and internationally) had declined in the last 12 months.

Only four stocks have gained, and they are all small caps.

Beyond International (ASX:BYI) is head and shoulders above its peers, up 44 per cent in 12 months.

It specialises in home entertainment and content distribution. In an era when its tough to get people off their couches, it’s not surprising.

But you actually can get people off their couches

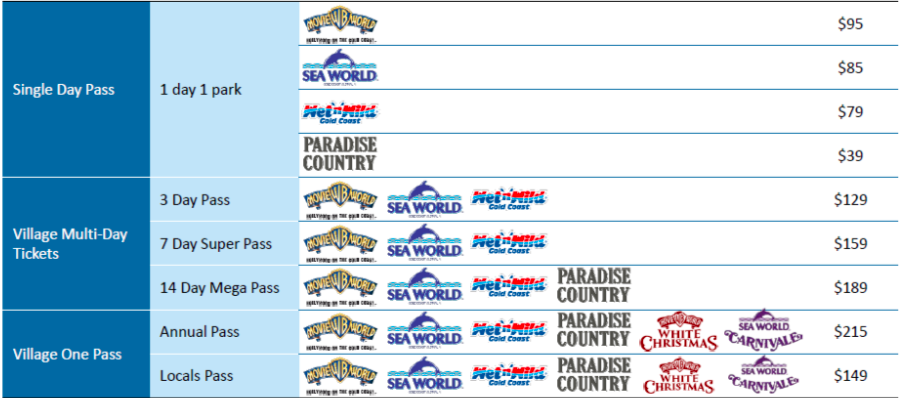

Another stock that has gained is theme park operator and film distributor Village Roadshow (ASX:VRL), which is up 25 per cent. Among its parks are SeaWorld, Wet and Wild and Movie World.

After shares dipped, then stagnated for several months, Village Roadshow has gained from the tourism boom, with visitors up 25 per cent in July.

International numbers have officially recovered from the dip, although interstate and New Zealand patronage has some way to go.

It made a profit of $20.6m and is opening new rides and attractions later in the year.

Baillieu analyst Nick Caley said when Village Roadshow released its report that he viewed the investment decision as positive for the Gold Coast market which had steered away from discounting.

In a similar fashion, real estate investor Elanor Investor Group (ASX:ENN) gained 24 per cent. It owns hotels and shopping centres, including Ibis and Mantra.

Its peer, Eumundi Group (ASX:EBG), has also gained, although only 5 per cent. It too invests in hotels but also has interests in a couple of Queensland taverns.

The laggards

However, all other stocks in the tourism sector lag behind. Casino stocks have been struggling with various problems such as legal fights like Donaco (ASX:DNA).

Its Cambodian casino had its licence suspended due to unpaid rent.

Casinos closer to home, such as Aquis Entertainment (ASX:AQS) in Canberra and Crown (ASX:CWN) in Melbourne, Perth and Sydney, have been plagued by financial or ownership issues and have lost ground too.

The softening domestic tourism market has had an impact as well. While RV renter Apollo Tourism & Leisure (ASX:ATL) still made a profit of $4.7m, this was well down on the $19.2m recorded the year before.

Ferry operator SeaLink Travel Group (ASX:SLG) made a slight improvement in its financial results. But shareholders would have been disappointed as it missed out on winning the Sydney Harbour commuter contract and it anticipates higher fuel prices in the year to come.

| Code | Name | Price | Market Cap | 1Y % Return | 6M % Return |

|---|---|---|---|---|---|

| BYI | BEYOND INTERNATIONAL LTD | 1.005 | $61.3M | 44 | 12 |

| VRL | VILLAGE ROADSHOW LTD | 2.79 | $536.7M | 25 | -16 |

| ENN | ELANOR INVESTOR GROUP | 2.2 | $224.6M | 24 | 36 |

| EBG | EUMUNDI GROUP LTD | 0.94 | $37.2M | 5 | 10 |

| CWN | CROWN RESORTS LTD | 12.31 | $8.3B | -5 | 7 |

| FLT | FLIGHT CENTRE TRAVEL GROUP L | 47.91 | $4.8B | -8 | 14 |

| EVT | EVENT HOSPITALITY AND ENTERT | 12.79 | $2.0B | -9 | 3 |

| SLK | SEALINK TRAVEL GROUP LTD | 3.69 | $362.1M | -10 | -2 |

| SGR | STAR ENTERTAINMENT GRP LTD/T | 4.245 | $3.8B | -16 | -1 |

| AQS | AQUIS ENTERTAINMENT LTD | 0.023 | $4.2M | -18 | -54 |

| HLO | HELLOWORLD TRAVEL LTD | 4.28 | $530.0M | -18 | -8 |

| RCT | REEF CASINO TRUST | 2.28 | $111.9M | -19 | -22 |

| WEB | WEBJET LTD | 12.3 | $1.7B | -25 | -18 |

| EXP | EXPERIENCE CO LTD | 0.27 | $141.7M | -28 | -17 |

| DNA | DONACO INTL LTD | 0.062 | $53.5M | -64 | -9 |

| ATL | APOLLO TOURISM & LEISURE LTD | 0.405 | $75.4M | -70 | -57 |

| CYQ | CYCLIQ GROUP LTD | 0.002 | $2.8M | -76 | -20 |

| IDZ | INDOOR SKYDIVING AUSTRALIA G | 0.01 | $3.4M | -90 | -33 |

| ALG | ARDENT LEISURE GROUP | 1.06 | $503.7M | -50 | -17 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.