Aussies vs Kiwis: Who won October?

Rusty picked the right side. Picture: Getty Images

For some, it’s a gentle rivalry. For others, it’s an ongoing feud that steadfastly refuses to be settled – like the Hatfields and the McCoys, if they lived on either side of a very, very wide creek and one family spoke with a weird accent and said “bro” a lot more than could be plausibly defended.

But for us here at Stockhead, the ongoing quest to be better than our neighbours across the Tasman at as many things as possible is something that drives our urge to crunch the numbers, wade through the data and analyse things more closely than a short-sighted science nerd.

And that is why we bring you the ultimate in full-contact financial competition.

It’s Kangaroo vs Kiwi, Wombat vs Weta, and Kookaburra vs Kakapo all rolled into one – a veritable Bledisloe of the Bourse, if you will – to find out whether it’s Australia or New Zealand who gets crowned Best in Show for Market Performance, every single month until we lose a few on the trot and pretend this never happened.

Everyone here is excited, the referee (certified Not French) is ready to blow his whistle, so let’s stop with the waffling and get down to brass tacks to see whose numbers have stacked up best, between the ASX and the NZX.

And the winner is…

While both share markets fell in broad sell-offs in September it was a welcome change of pace in October with both markets joining a vast global rally to regain some steep losses the previous month.

But drum roll please… bragging rights for October go to Australia with the S&P/ASX 200 rising 6.04%, while Across the Dutch, New Zealand’s S&P/NZX 50 Portfolio rose 1.94%, according data released by S&P Dow Jones Indices, a financial market benchmark provider.

All is right in the world.

Equities rose across the capitalisation range in September with large caps lagging their mid and small caps, which were the best performers in Australia.

The S&P/ASX MidCap 50 was up 7.09% and the S&P/ASX Small Ordinaries up an impressive 6.46%. The S&P/ASX Emerging Companies index was up 2.93% in October.

In New Zealand, the S&P/NZX 50,20 and 50 High Dividend indexes all rose in October, but the S&P Emerging Companies Index fell 1.73%.

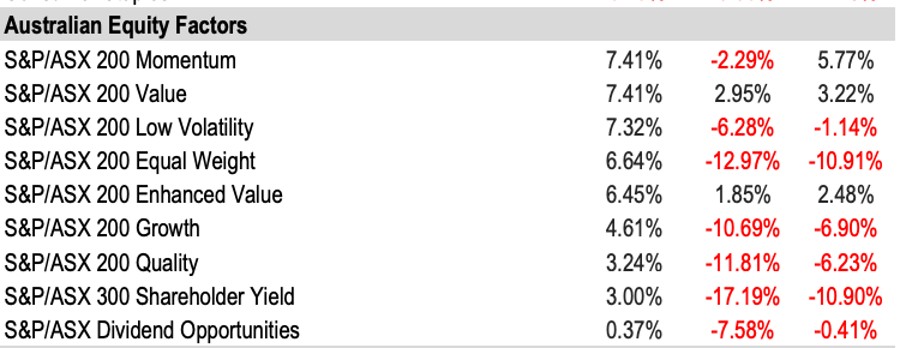

All Australian factors gained, led by momentum.

Financials was the standout sector, followed by energy and real estate. Materials and consumer staples were the only sectors in the negative.

Fixed income rises in both countries

Fixed income indices largely rose in the region, with inflation-linked bonds providing the highest returns in both Australia and New Zealand.

The S&P/ASX Government Inflation-Linked Bond 0+ Index climbed 4% and the S&P/NZX NZ Inflation Indexed Government Bond Index gained 2% in October.

S&P Dow Jones Indices director of Index Investment Strategy Benedek Vörös said a smaller-than-expected rate rise in October was good news for bonds.

“Australian bonds outperformed as the Reserve Bank of Australia surprised market participants with a smaller-than-expected 25 basis points interest rate hike at its October policy meeting,” he said.

“The central bank signaled concerns about the domestic economy’s resilience to higher interest rates, trimming back its GDP forecasts to just 1.5% in 2023 and 2024 against the backdrop of a sharply decelerating housing market.

“Although to a lesser degree than its larger sibling across the Tasman Sea, the New Zealand housing market has also shown signs of slowing down, driving expectations for less restrictive monetary policy than previously anticipated, which in turn gave a fillip to New Zealand bonds in October,” Vörös said.

Santa may bring a Christmas rally

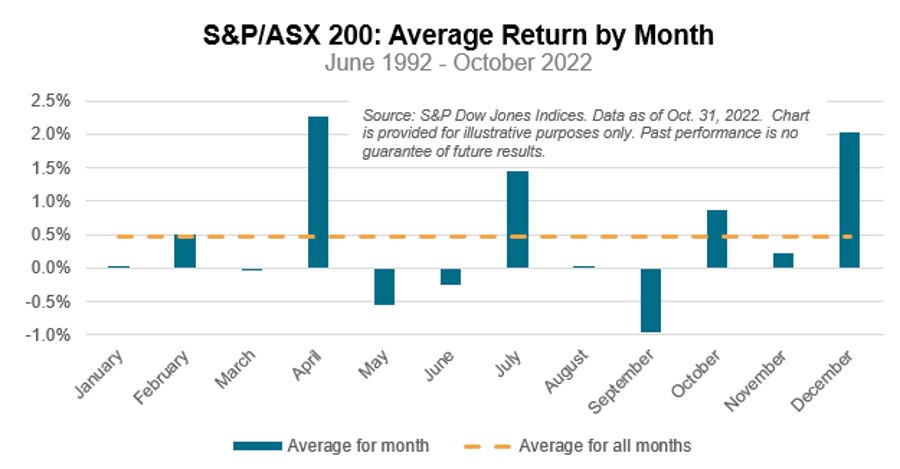

Vörös said while market returns vary from year-to-year, equity indices tend to produce strong returns at the end of the year, especially in December.

“Based on data from the past 30 years, December was the second strongest month of the year for the S&P/ASX 200 with an average return of 2.0%,” he said.

Reflecting the easing of jitters in regional equity markets, the S&P/ASX 200 VIX Index dropped 5 points in October to close the month at 16.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.