Aussies vs Kiwis: Who won February? Or – which bourse lost less in a rough month?

NZ took out February but like Australia its bourse still finished in the red. Pic: Getty Images

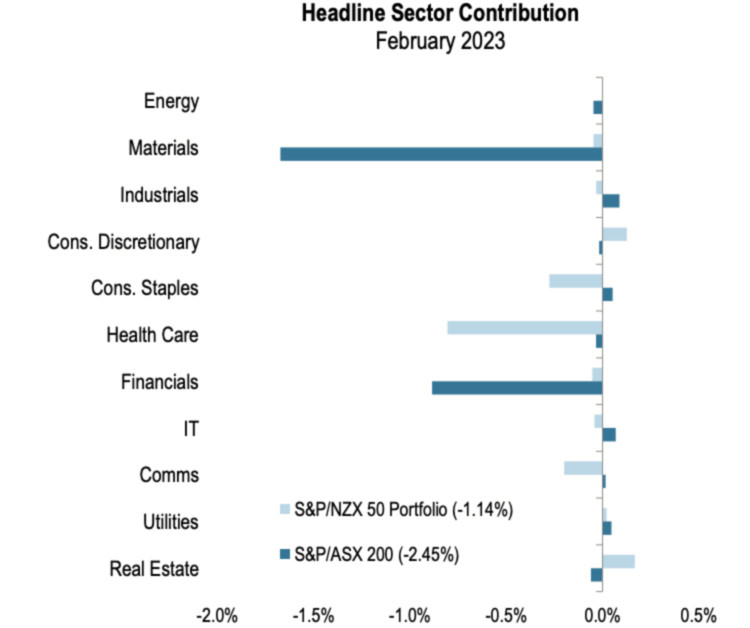

- New Zealand’s S&P NZX 50 portfolio fell 1.1% while the S&P ASX 200 lost 2.5%

- Mid and small caps lag their blue-chip peers in February in both countries

- All Australian equity factor indices drop in February, with losses for fixed income

For some, it’s a gentle rivalry. For others, it’s an ongoing feud that steadfastly refuses to be settled – like the Hatfields and the McCoys, if they lived on either side of a very, very wide creek and one family spoke with a weird accent and said “bro” a lot more than could be plausibly defended.

But for us here at Stockhead, the ongoing quest to be better than our neighbours across the Tasman at as many things as possible is something that drives our urge to crunch the numbers, wade through the data and analyse things more closely than a short-sighted science nerd.

And that is why we bring you the ultimate in full-contact financial competition.

It’s Kangaroo vs Kiwi, Wombat vs Weta, and Kookaburra vs Kakapo all rolled into one – a veritable Bledisloe of the Bourse, if you will – to find out whether it’s Australia or New Zealand who gets crowned Best in Show for Market Performance, every single month until we lose a few on the trot and pretend this never happened.

Everyone here is excited, the referee (certified Not French) is ready to blow his whistle, so let’s stop with the waffling and get down to brass tacks to see whose numbers have stacked up best, between the ASX and the NZX.

And the winner is…

New Zealand! Fresh after trouncing the Poms at cricket, our Kiwi bros have taken the winners trophy for the first time in 2023, according to S&P Dow Jones Indices Australia and New Zealand Index Dashboard for February 2023.

Although, let’s be honest – the shortest month of the year did not provide much reason to celebrate for either Kiwi or Aussie investors, with both bourses finishing in the red. It’s a case of which lost less.

The S&P ASX 200 dropped 2.5% in February, reducing YTD gains to 3.6%, while across The Dutch, New Zealand’s S&P NZX 50 portfolio gave up 1.1% with YTD gains of 2.96%.

Much-needed solid gains were made for both Australia and New Zealand in January with cause for optimism for 2023.

But as latest economic figures came in with inflation proving sticky in both countries, investors got jittery about just how high central banks will need to hike rates.

The RBA has raised interest rates nine times since May 2022 bringing the cash rate to 3.35% from 0.10% with the central not ruling out more interest rate hikes to tackle inflation which hit a 32-year high of 7.8% over the year to December 2022.

The Reserve Bank of New Zealand (RBNZ) in February raised interest rates by 50 basis points to a 14-year high of 4.75% with inflation currently running near three-decade highs of 7.2%.

ASX and NZX mid and small caps lag

Mid and small caps lagged their blue-chip peers in February in both Australia and New Zealand.

The S&P ASX MidCap 50 and the S&P/ASX Small Ordinaries gave up 3.2% and 3.7%, respectively. In New Zealand the S&P NZX 50 portfolio also finished February in the red, down 1.1%, while the S&P/NZX Emerging Opportunities Index shed 3.5%.

ASX utilities stages a come back

Utilities went from being the worst-performing Australian sector in January, falling 3% to the best in February, gaining 3.4%.

Six out of 11 Australian sectors contributed negatively to February returns, with S&P labelling back-of-the-pack materials “the real villain” plunging 6.6% and responsible for more than two-thirds of the S&P/ASX 200’s losses.

All equity factors and fixed income fall

S&P Dow Jones Indices reported all Australian equity factor indices dropped in February, with low volatility holding up best, down 0.7% while at the other end of the spectrum, Growth gave up 3.2%.

S&P Dow Jones described February as “a dismal month for fixed income”.

“Only short duration bills finished the month in the black in both Australia and New Zealand, while the biggest losses were to be found among inflation-linked bonds in both countries.

The S&P ASX Government Inflation-Linked Bond 0+ Index falling 2.2% while the S&P NZX Inflation Indexed Government Bonds Index losing 3.8% in February.

However, despite broad-based losses in both equities and fixed income, Australian equity implied volatility barely budged, with the S&P ASX 200 VIX Index closing February unchanged.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.