Aussies vs Kiwis: Who won December markets and took out 2022?

The benchmark S&P/ASX 200 holds on amid global volatility falling just 1% in 2022. Pic: Getty Images

- Both the S&P/ASX 200 and S&P/NZ 50 fell last month in line with global December markets

- The S&P/NZX 50 lagged significantly in 2022 with a 12% loss, the first annual drop in over a decade

- The S&P/ASX 200’s exposure to resources helped curb losses to 1% for 2022

For some, it’s a gentle rivalry. For others, it’s an ongoing feud that steadfastly refuses to be settled – like the Hatfields and the McCoys, if they lived on either side of a very, very wide creek and one family spoke with a weird accent and said “bro” a lot more than could be plausibly defended.

But for us here at Stockhead, the ongoing quest to be better than our neighbours across the Tasman at as many things as possible is something that drives our urge to crunch the numbers, wade through the data and analyse things more closely than a short-sighted science nerd.

And that is why we bring you the ultimate in full-contact financial competition.

It’s Kangaroo vs Kiwi, Wombat vs Weta, and Kookaburra vs Kakapo all rolled into one – a veritable Bledisloe of the Bourse, if you will – to find out whether it’s Australia or New Zealand who gets crowned Best in Show for Market Performance, every single month until we lose a few on the trot and pretend this never happened.

Everyone here is excited, the referee (certified Not French) is ready to blow his whistle, so let’s stop with the waffling and get down to brass tacks to see whose numbers have stacked up best, between the ASX and the NZX.

And the winner is…

Drum roll please for the BIG finish to a tumultuous 2022 for global equity markets…

While New Zealand won December, Australia has taken out 2022 according to data released by S&P Dow Jones Indices, a financial market benchmark provider.

A 3% drop in December dragged Australia’s S&P/ASX 200 into just-negative territory for the year, with the Australian benchmark slipping 1% in 2022.

New Zealand’s S&P/NZX 50 Portfolio fell just a third as much in December but it lagged significantly over the year with a loss of 12% – the first annual drop in over a decade.

The New Zealand loss was in line with the majority of their international peers, with the S&P Global BMI also down 12% over the year.

Larger New Zealand companies outperformed, with the S&P/NZX 20 flat in December and down 9% in 2022.

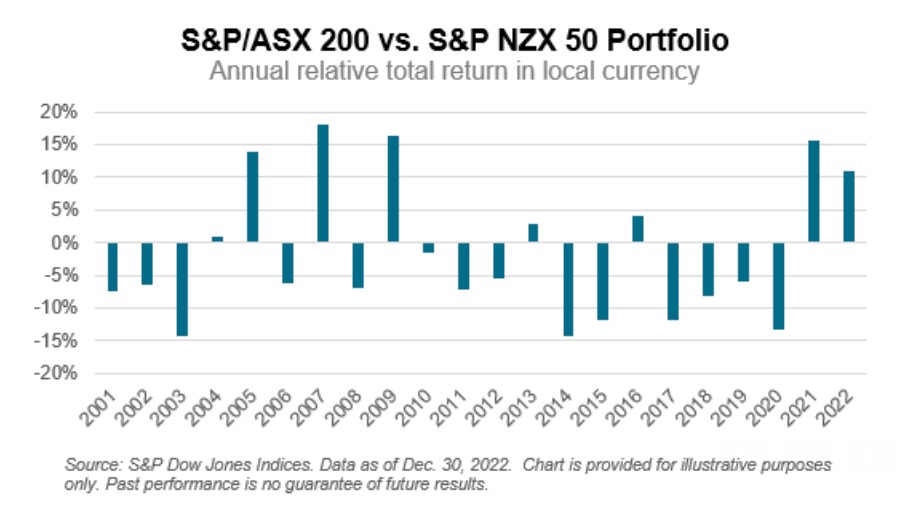

S&P Dow Jones Indices director of Index Investment Strategy Benedek Vörös said Australian equities significantly outperformed their Kiwi peers for the second straight year.

“The S&P/ASX’s 11% outperformance over the S&P NZX 50 Portfolio index (in total return terms) is second only to last year’s 16% in the past decade,” he said.

ASX Energy sector rises 83% in 2022, while IT falls 34%

Performance of Australian sectors in 2022 varied enormously, with 83% separating best-performing Energy, which rose 49%, from laggard Information Technology, down 34%.

S&P noted perhaps surprisingly in a year of rising interest rates, Utilities also had a great year, up 30%, while Real Estate’s 21% drop was a textbook performance in a year when bonds suffered steep losses.

Enhanced Value and Value both recorded gains of 6% in 2022 with the latter outperforming Growth for the second year.

At the back of the factor pack, Shareholder Yield suffered a 14% fall during 2022.

Australia’s exposure to energy and materials boosts performance

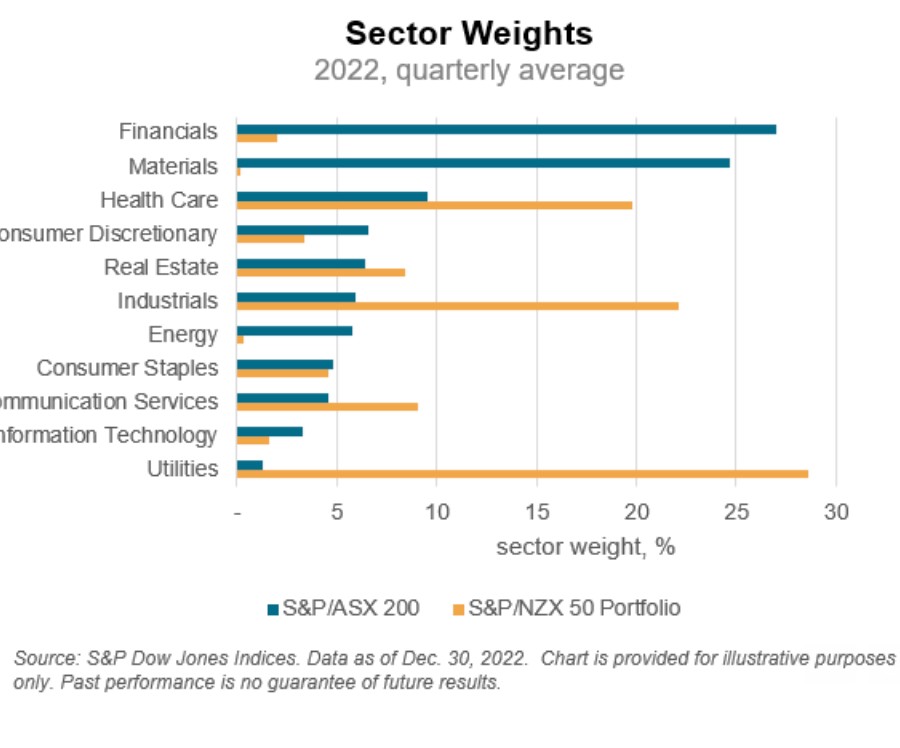

Vörös said a major driver of the significant performance differential between the two countries’ equities have been New Zealand’s minimal weights in Energy and Materials, two of last year’s best-performing sectors.

“While the S&P/ASX 200 had a combined 30.5% allocation to the two sectors that can be classified as resources, the corresponding weight for the S&P NZX 50 Portfolio was a minuscule 0.5%,” he said.

Vörös said Energy and Materials can be classified as resources under the industry-standard Global Industry Classification Standard (GICS).

GICS is a method for assigning companies to a specific economic sector and industry group that best defines their business operations.

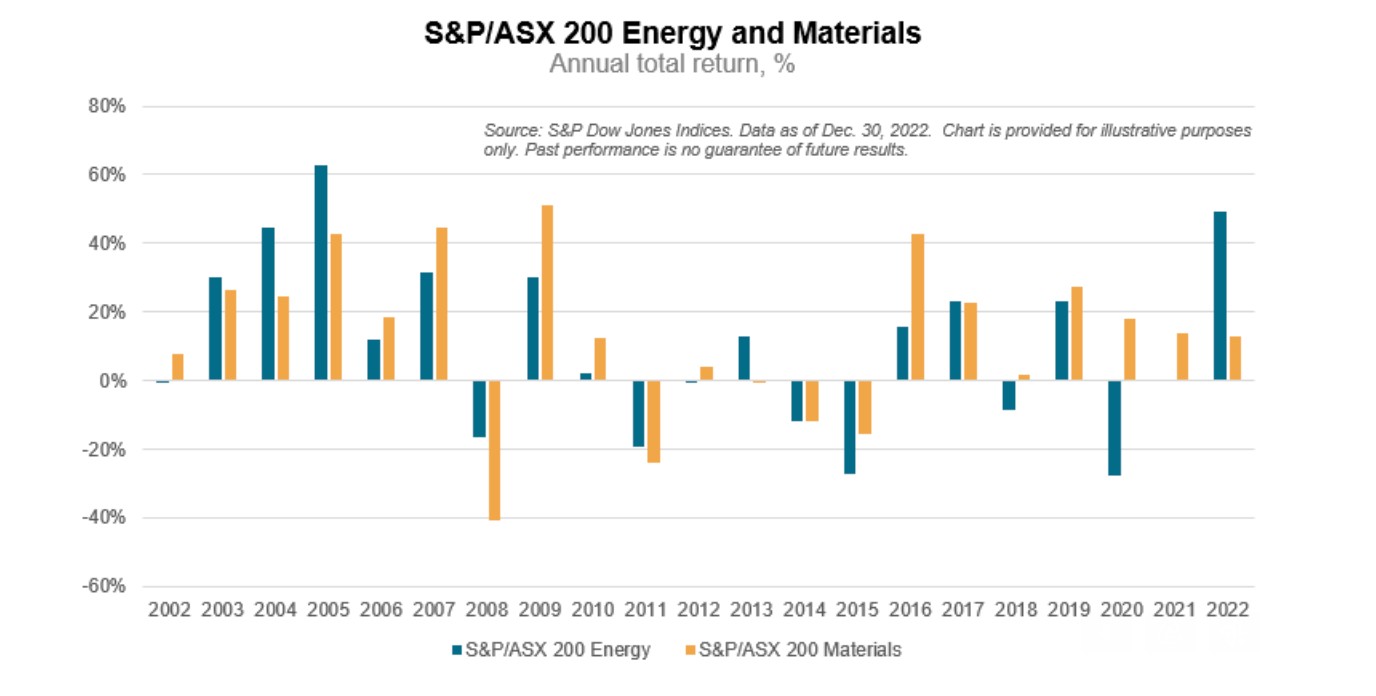

“Both had a stellar year in Australia in 2022, with Energy the best-performing sector with 49% total return, and Materials producing the third-highest return, up 13%, also in total return terms,” Vörös said.

“Energy stands out in particular, with its annual total return the highest since 2005 in absolute terms and the best ever in relative terms (compared to the benchmark S&P/ASX 200) since the launch of sector indices in Australia.”

Topsy-turvy turbulent year for bond markets

Vörös said fixed income instruments had a challenging year in 2022 around the world, and Australia and New Zealand were no exception.

Rising inflationary pressure together with tighter monetary policy by the Reserve Bank of Australia and Reserve Bank of New Zealand meant a turbulent year for Australia’s bond markets.

Australian 10-year benchmark yields began the year at 1.75%, rose to 4.2% in mid-June, fell back to below 3% in August, then spiked again to 4.2% by late October, before declining and rising once more to finish the year just above 4%.

“The broad-based S&P/ASX Fixed Interest shed 11%, its worst year on record, and our broad indices for corporate, investment grade and sovereign bonds also ended the year deep in the red on both sides of the Tasman Sea,” Vörös noted.

“Historically a declining inflationary and interest rate environment tended to give a fillip to bonds, both corporate and sovereign, so fixed income market participants are likely to scrutinise these macroeconomic indicators for clues about the asset class’ performance.”

In a sign of hope perhaps 2023 will be better with the S&P/ASX 200 VIX Index, sometimes referred to as the ‘fear index’, finishing the year at 12 – near to the lowest levels it reached in 2022.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.