Aussies are still moving to the country, eating lots of peaches and finding a bunch of cheaper properties to buy

Via Getty

PropTrack’s Eleanor Creagh has led the data work on another historically unexpected year of Aussie regional property buying, unearthing a good many gems for us all.

Nationally, prices have been turned right around, but in the country the slowing property market conditions are coming on the back of the greatest ever pandemic-induced ‘regional property renaissance’ since, I guess, ever.

The last few years, regional house prices grew at their fastest annual pace in 35 years.

But first up, let’s get straight to the bargains.

So, where are we now?

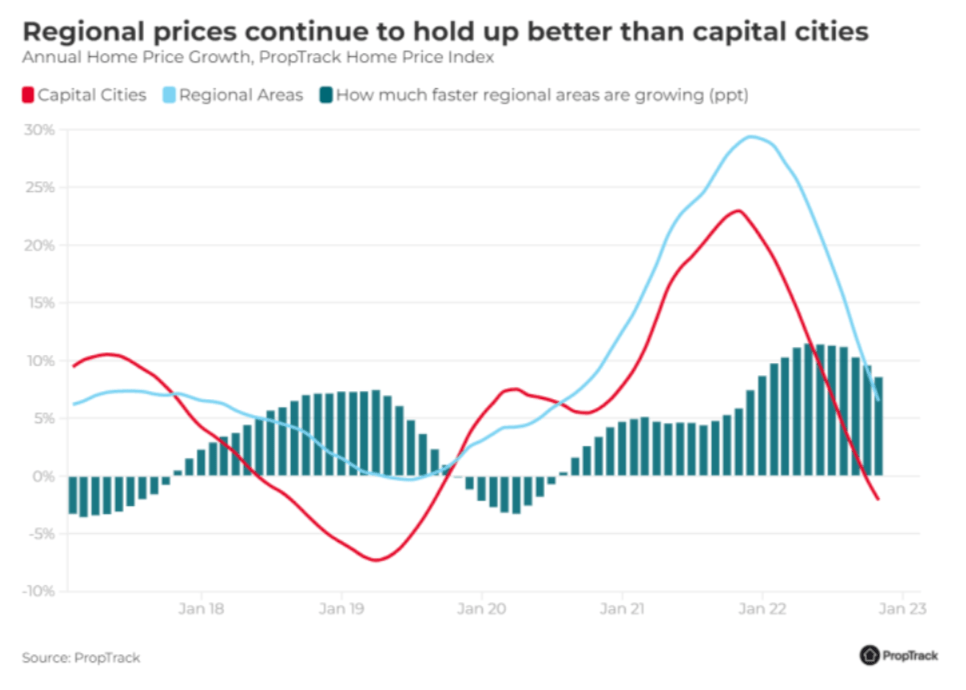

Home prices in regional Australia have softened, declining 2.2% since their peak in April 2022, after rising at an exceptional pace throughout the pandemic.

But despite some recent slowing in prices – and if you’ve enjoyed a drive around the great state of NSW lately, for example you’ll have noticed – these regional prices are still doing well compared to the big cities.

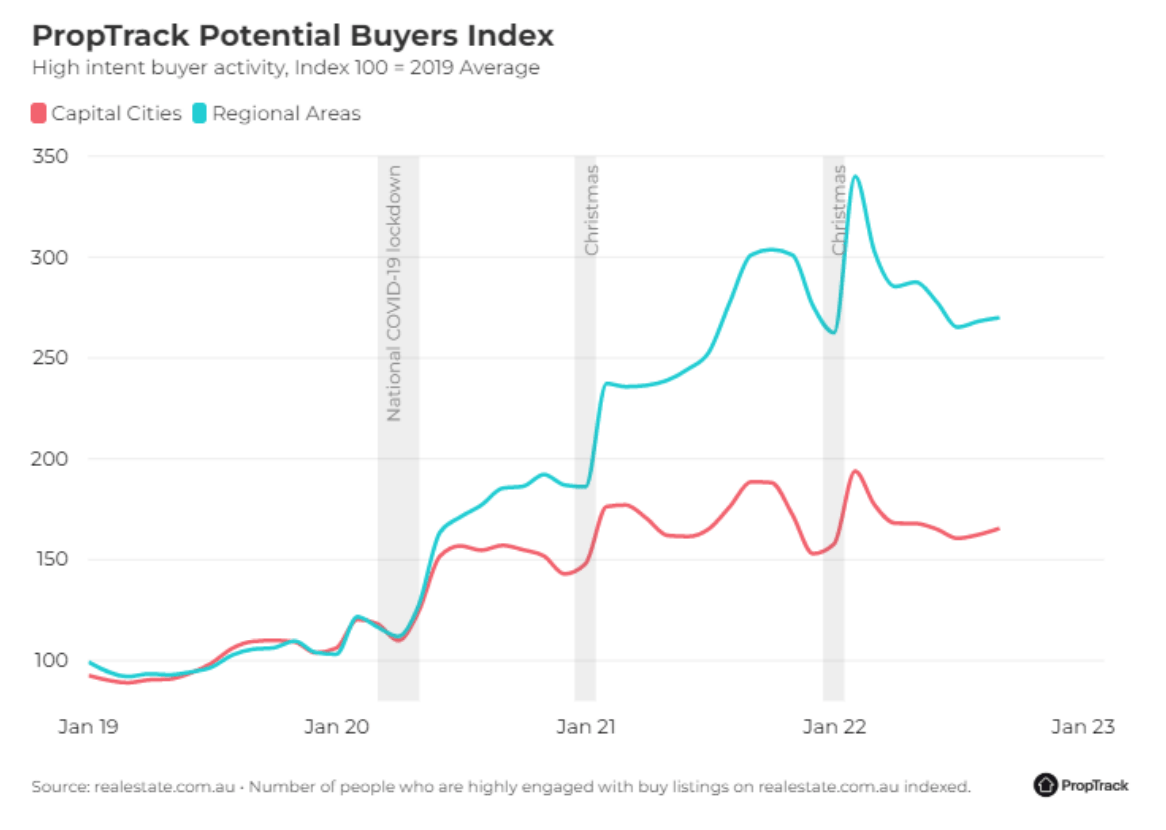

While the whole COVID-kick shifted all kinds of property preferences around the country – most particularly in this case – driving massive, fresh regional demand over the past two years, that urge for country-living has eased as interest rates have tightened.

According to the new numbers, the volume of potential buyers per listing in regional Australia has really slumped – some 22% from the peak back in January 2022.

That said, it remains – lemme see – about x 3 what it was pre-pandemic levels and hella stronger relative to the capital cities.

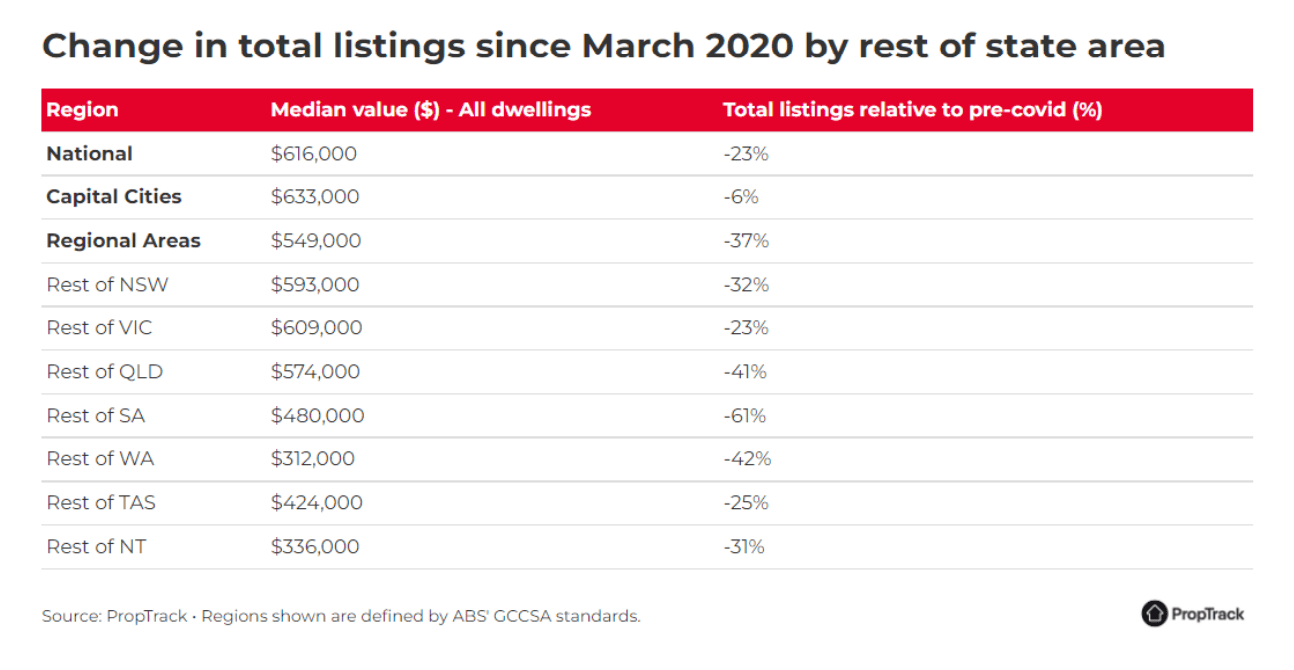

The stock of properties for sale in regional markets remains limited, down 37% on pre-pandemic levels.

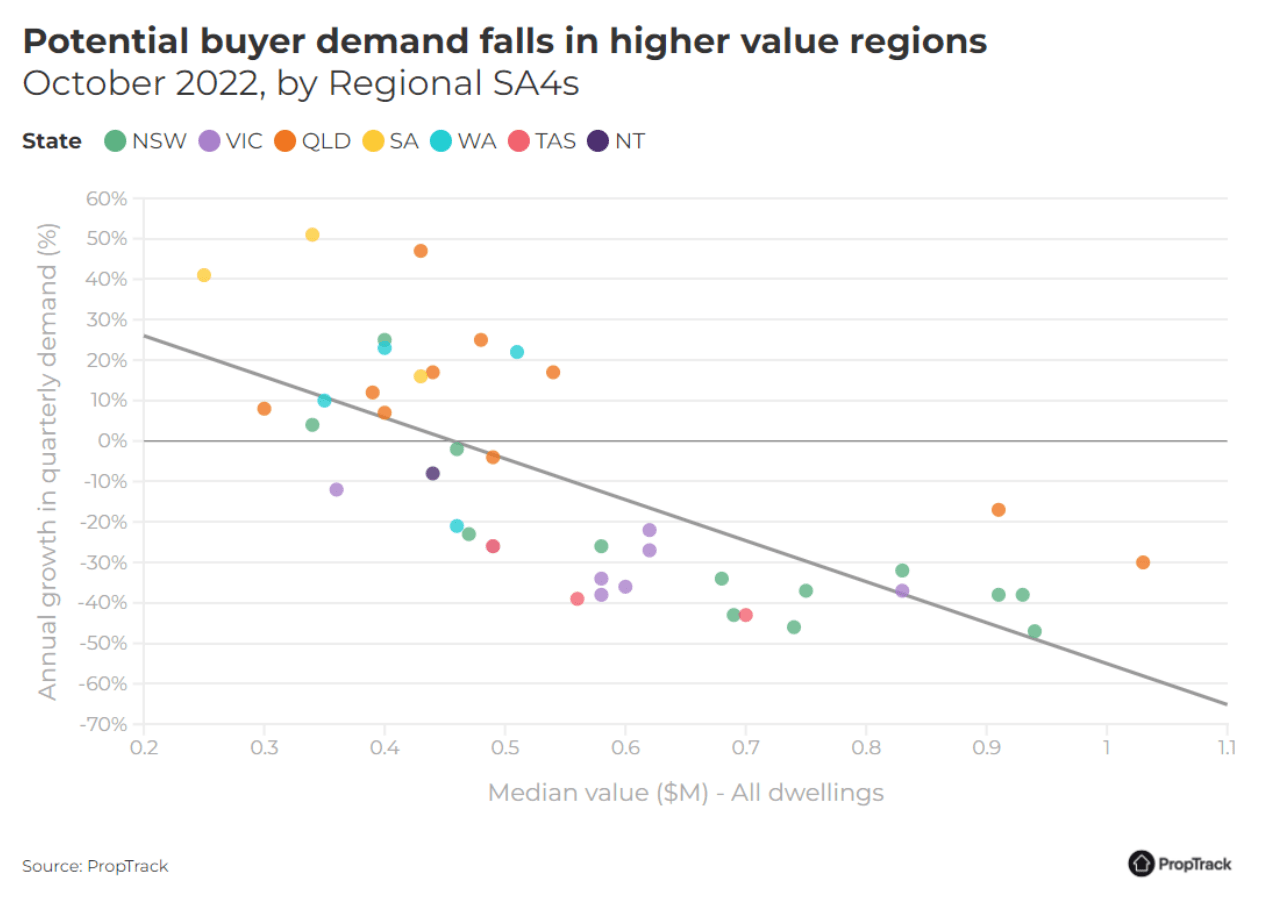

Regional prices are expected to continue to slow amid headwinds from monetary tightening and reduced net migration flows to regional areas while comparatively higher value regional areas are falling faster and the more affordable regions are seeing prices hold up.

Okay, regional prices might have a few headwinds – there’s less domestic migration for example and interest rates aren’t restricted to Double Bay, of course – these spots are expected to continue outperforming the capitals, ‘cos we got limited supply, still toppy demand and still relative affordability.

According to report author and one of Aussie’s best economists, Eleanor Creagh as a nation we’ve had a bit of a lifestyle rethink and that’s playing out across real estate, big time.

“Throughout 2020 and 2021, we saw the pandemic, multiple lockdowns and more time spent at home lead many to reassess their housing wants and needs.

“Housing markets in regional Australia thrived as people sought more space and more affordable homes. Remote working opportunities and preference shifts drove strong population growth in regional areas at the expense of the capitals, predominantly Sydney and Melbourne.

“As public health restrictions have eased and interest rates have quickly risen, the boom has been replaced with slower growth and elevated uncertainty.

Creagh says while it remains a relative bright spot in the current housing market, regional home prices are falling.

“Regional prices are expected to continue to decline amid monetary tightening and reduced net migration flows to regional areas.”

“However, regional markets are likely to continue to exhibit a slower pace of price falls compared to capital cities. They remain buoyed by shifting lifestyle priorities, migration trends and affordability advantages that are still in play.

“In addition, conditions remain tougher for regional buyers, with the number of properties listed for sale still well below pre-pandemic levels, which is also seeing some markets remain more competitive and shielding home values.”

Eleanor says these are a few of the other things you should probably take away from the year of data she’s poured over.

• The share of property sales below their original list price increased 20 percentage points to 49% in October 2022, the highest it has been in two years.

• Demand for homes in regional Queensland, South Australia, and Western Australia continue to exceed that of homes in regional New South Wales and Victoria.

• Regional Queensland is the top searched location for interstate property seekers in regional Australia. Close to a third (31%) of all searches in regional Queensland are from interstate property seekers.

• Regionally, the median number of days a property was listed on realestate.com.au before selling hit just over 50 days in October, up from last year’s record low of 29 days.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.