Aussie rents smash record highs as we reveal the unholiest 20 suburbs for renters across this fine but fickle land

Via Getty

Let’s dig about in this turgid mess to see if we can start with some good news…

Ok.

Ahead of Australia Day, it looks as if the acceleration of rental growth in this country – which we all know has been moving with the relentless pace of madness – may actually be slowing..

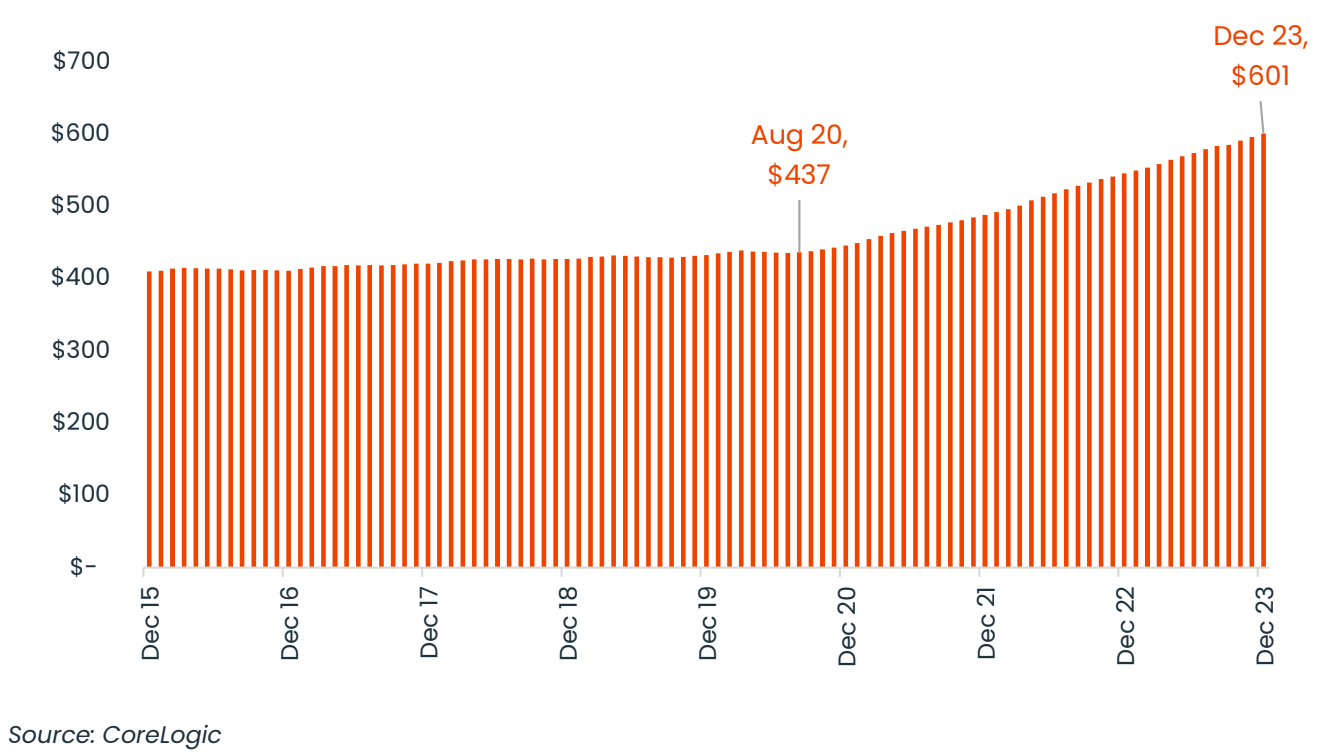

That said, according to the new numbers from CoreLogic, the median rent paid across the country has just tripped over the $600 mark, to the highest ever Aussie rental peak.

For the almost one-third of households renting their homes in Australia, the following data will suck as much as it will not surprise.

Firstly – the median weekly rent here in Sydney is now $745, while over in far flung Perth rents have gone up 13.4% in a year.

Median weekly rent value (reported monthly, national dwellings)

CoreLogic data released overnight shows annual Aussie rental expenses have taken off like low-rise jeans – up by about $8,000 since August 2020 to exactly… $31,252 a year.

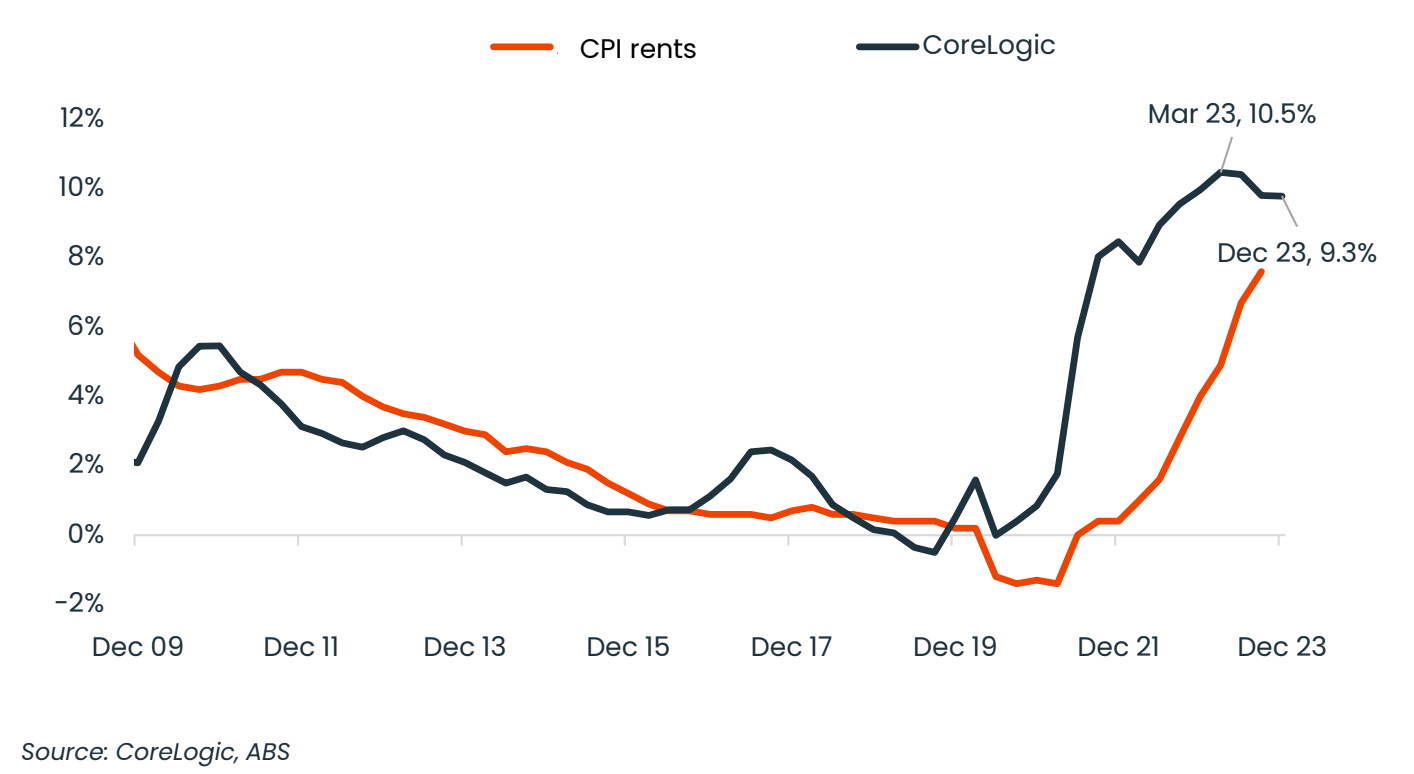

In fact the annual rent increases for the year were up 8.3%, compared to an overall national inflation rate of 4.3%.

Now let’s also recall that wages are pretty much where we left them pre-COVID – while inflation has gone on a world tour, so the cost of living crisis is looking worthy of an emergency Cabinet meeting in Canberra which the PM has been quick enough to get out in front of earlier this week.

Annual change in rents – CoreLogic rental index v CPI

A nation of skint renters

Throughout the 2010s the average annual rental growth rate was 2.0 per cent. In the past three calendar years it has averaged 9.1 per cent each year.

Recent growth in rent values, which averaged 9.1% a year for the past three calendar years, stands in stark contrast to the average annual growth rate of 2.0% in the 2010s.

Summary of rent market performance – December 2023

Eliza Owen, head of Research Australia at CoreLogic, says since the onset of the pandemic three major factors have contributed to the stonking rent rises, including:

-

The incredible shrinking average Aussie household from late 2020, partly driven by a reduction in share housing – meaning more dwellings were needed even when population growth was close to zero in 2021.

-

The supersonic boom in the Australian population from late-2022 as international border restrictions were lifted.

-

A temporary shock to investment housing activity between May 2022 and February 2023 as interest rates rose. Investor activity has picked up markedly since, but there is still a lot of catch up required in establishing new rentals.

“The reduction in social housing supply as a portion of all dwellings over the decades has placed more pressure on the private rental market, as has a declining rate of home ownership.”

She says the average size of an Aussie household has also been gradually declining over decades due to economic and demographic factors (for example, more people living alone) – requiring more dwellings to house a given population.

Rents are up almost everywhere, ‘cept Hobart, really

Rent value increases have broadly outpaced wage and income rises at the national level, meaning rental affordability has also deteriorated, Eliza says.

“The portion of gross median household income required to service median rent rose from 26.7% of income in March 2020 to 31.0% in September last year,” Eliza adds.

Median rents across the capital city markets ranged from $745 per week in Sydney, to $535 per week in Hobart.

Canberra and Hobart were the only markets to see a decline in rent values through 2023, at -1.9 per cent and -3.5 per cent, respectively.

Available places to rent around Australia has basically halved since Hello-COVID.

The national vacancy rate inched up 0.09 percentage points (ppt) from October’s record low in December to 1.12 per cent but it’s a long way from what is typically seen as normal conditions, within the 2-3 per cent range.

Eliza says that while a far higher portion of median income is required to service a new mortgage, renters tend to be on lower incomes.

The latest data from the ABS suggests median gross household income was 41.8% lower across renting households than owner occupiers with a mortgage.

Go West

Perth house prices are set to grow 10% in 2024, according to REIWA’s 2024 property market quarterly update.

Rents are also expected to rise, although the rate of growth may slow.

“The raft of interest rates rises in 2023 did not slow the WA property market,” according to REIWA CEO Cath Hart. “After a slow start, house sale price growth accelerated over the year, recording 2.6 per cent growth in the December quarter and 8.3 per cent over the year to reach a median of $590,000.

Cath says this is a new record for Perth house prices.

“While it is 24.2 per cent higher than the low of $475,000 recorded in 2020, it is only $45,000 or 8.3 per cent higher than the previous peak of $545,000 reached in 2014.”

The median unit sale price was stagnant for many months across 2023 but started to increase at the end of the year, rising 2.0 per cent over the December quarter and 0.7 per cent over the year to a median of $408,000.

“We can expect more increases in the median unit price in 2024,” Hart said.

“With houses in limited supply and prices rising, more people, particularly those seeking to escape the challenges of the rental market, are looking to units as an affordable way to enter the market.

“And while it has risen, the median unit price is still 9.3 per cent below the record of $450,000 set in 2014.”

Back to the good news: Rent growth is starting to slow…

Eliza says while Australia’s annual growth in rents is higher than historic averages, it has broadly slowed. In 2023, rent values rose 8.3%, down from a peak of 9.6% in the year to September 2022.

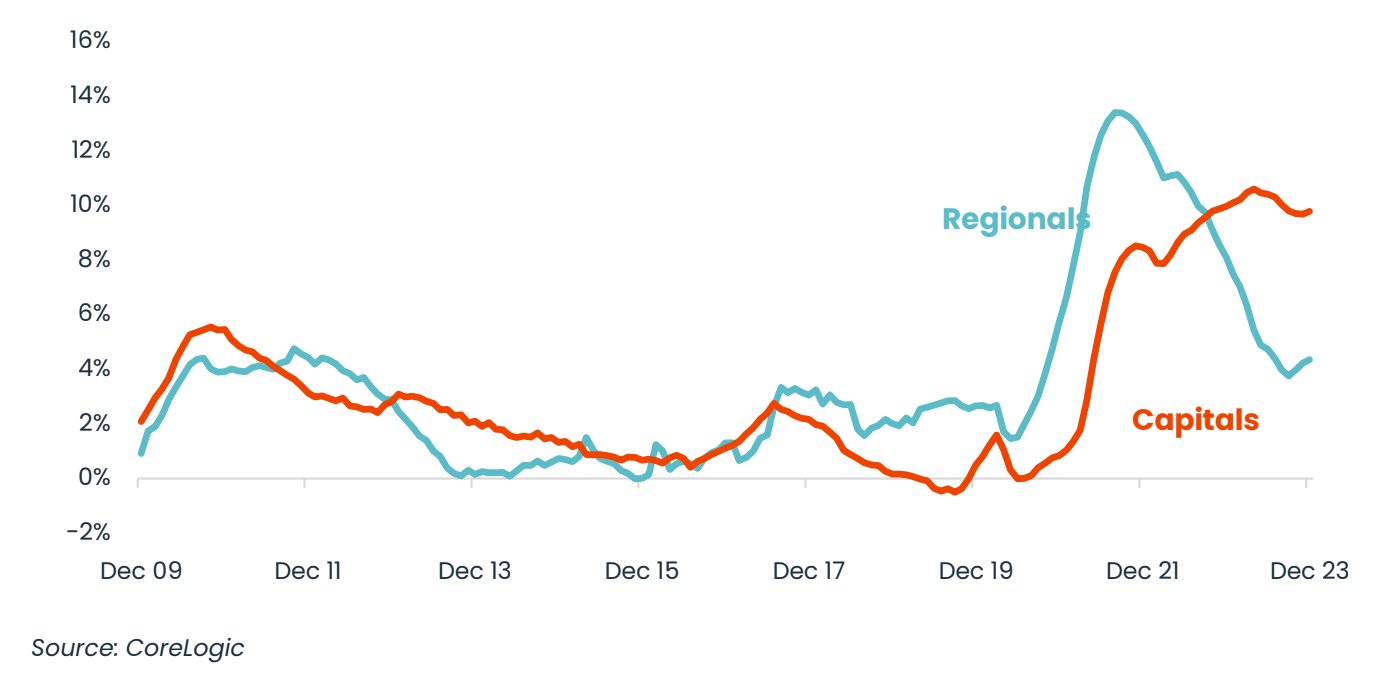

“The slowdown has been most evident across regional Australia, where rents rose 4.3% last year, down from a 13.4% in the year to August 2021.

“The slowdown in capital city rent growth began more recently, easing from a peak of 10.6% in the 12 months to April 2023, to 9.8% by the end of the year.”

Rolling annual change in dwelling rents – Capitals v Regionals

According to property data firm, PropTrack, the punters down in Melbourne copped the greatest tightening in conditions of any Aussie market last year where places to rent (vacancies) declined 0.33 ppt throughout the year, followed by Sydney and regional Queensland.

Vacancy rates remain below 1% in Perth, Brisbane and Adelaide.

Perth and Adelaide have been – and look like – remaining Australia’s tightest rental markets – vacancy rates in both cities are holding below 0.75 per cent, which PropTrack says places both Adelaide and Perth at critical levels of housing shortage.

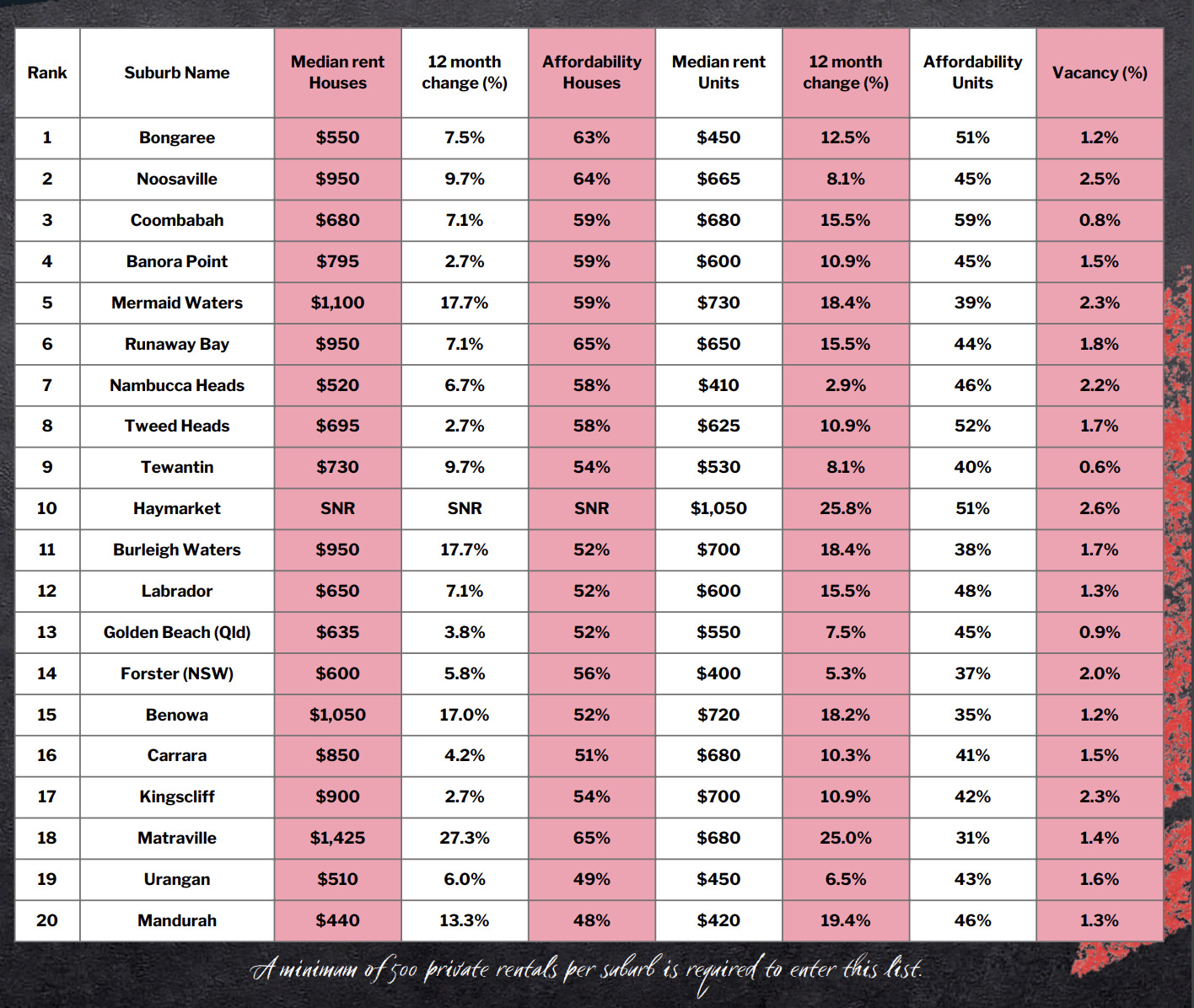

The Lardner Pain Index

Almost half of all Australian suburbs are in extreme pain, as quantified by property research group Suburbtrends.

Founder Kent Lardner says the index takes into account four factors which he pegs at 25 points each for a pain score out of 100.

- Availability

- Affordability

- Vacancy

- Price trends

Anything above 75 is considered “critical” on the level of rental stress.

Australia: Worst 20 Suburbs for Renters 2023

Across Australia, Lardner found almost half the surveyed Aussie suburbs were in or at “extreme pain” based on his rental stress index.

In the top shelf of rent pain are places in Queensland and South Australia, with 58% of suburbs in both states scoring above Lardner’s 75.

The unbearable tightness of being a renter

Eliza, in search of a silver lining, says rent growth is still expected to slow this year, despite the incoming agony of this latest reacceleration.

“The continued increase in investment lending, a normalisation in net overseas migration and the potential for a cash rate reduction could all contribute to a slowdown.”

But there’s a however.

“However, (there it is) in the short term, the burden largely remains on tenants to secure cheaper housing, whether that be by re-forming share house arrangements, or once again looking to regional or outer suburban markets for rental accommodation.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.