Aussie property reached record orbit in April, but Eleanor says velocity is fluctuating

Via Getty

Don’t bother looking startled.

A thorough autopsy of the nation’s national residential property market in April, led by PropTrack senior economist Eleanor Creagh shows Australia’s home prices rose 0.23% for the month to hit a new record high.

Eleanor says the price of an Aussie home is now 6.60% more than it was in April last year.

“Strong buyer demand has outpaced the rise in new listings this year.”

However, the current pall of inevitability around record high prices is not entirely without caprice.

PropTrack says the upward trajectory is losing velocity.

“While demand remains robust – national home prices hit a new record in April – the pace of price growth is beginning to slow.”

According to Eleanor, the stable interest rate environment has been a driver of confidence among both buyers and sellers.

“Higher than expected inflation in the March quarter has pushed back the expected timing of rate cuts but most expect that the next move for interest rates will be down although the timing remains uncertain.”

Home values across the combined capital cities rose 0.21% to a new peak in April, with prices now up 7.19% since April 2023. However, performance has diverged significantly between the capitals.

All capitals bar Melbourne (-0.10%) and Hobart (-0.24%) saw prices rise in April, though the pace of growth has slowed since March in all cities except Adelaide and Darwin.

City vs Country

Prices in capital cities have outpaced regional areas over the past year.

However, regional areas lifted 0.30% in April to a new peak, outpacing the 0.21% growth across the combined capitals. Regional NSW (+0.50%), regional WA (+0.33%) and regional Queensland (0.30%) led growth in April.

“Strong population growth, tight rental markets, low unemployment and home equity gains are stimulating housing demand. Meanwhile, the supply side of the housing market has fallen short in responding to substantial demand. Building activity is at decade low levels, exacerbating the housing supply shortage.

“Despite some easing in population growth, this mismatch between supply and demand is expected to persist in mitigating the downward effects of affordability challenges and a decelerating economy. As a result, prices are expected to remain on the rise in the months ahead.”

Mate against mate (state against state)

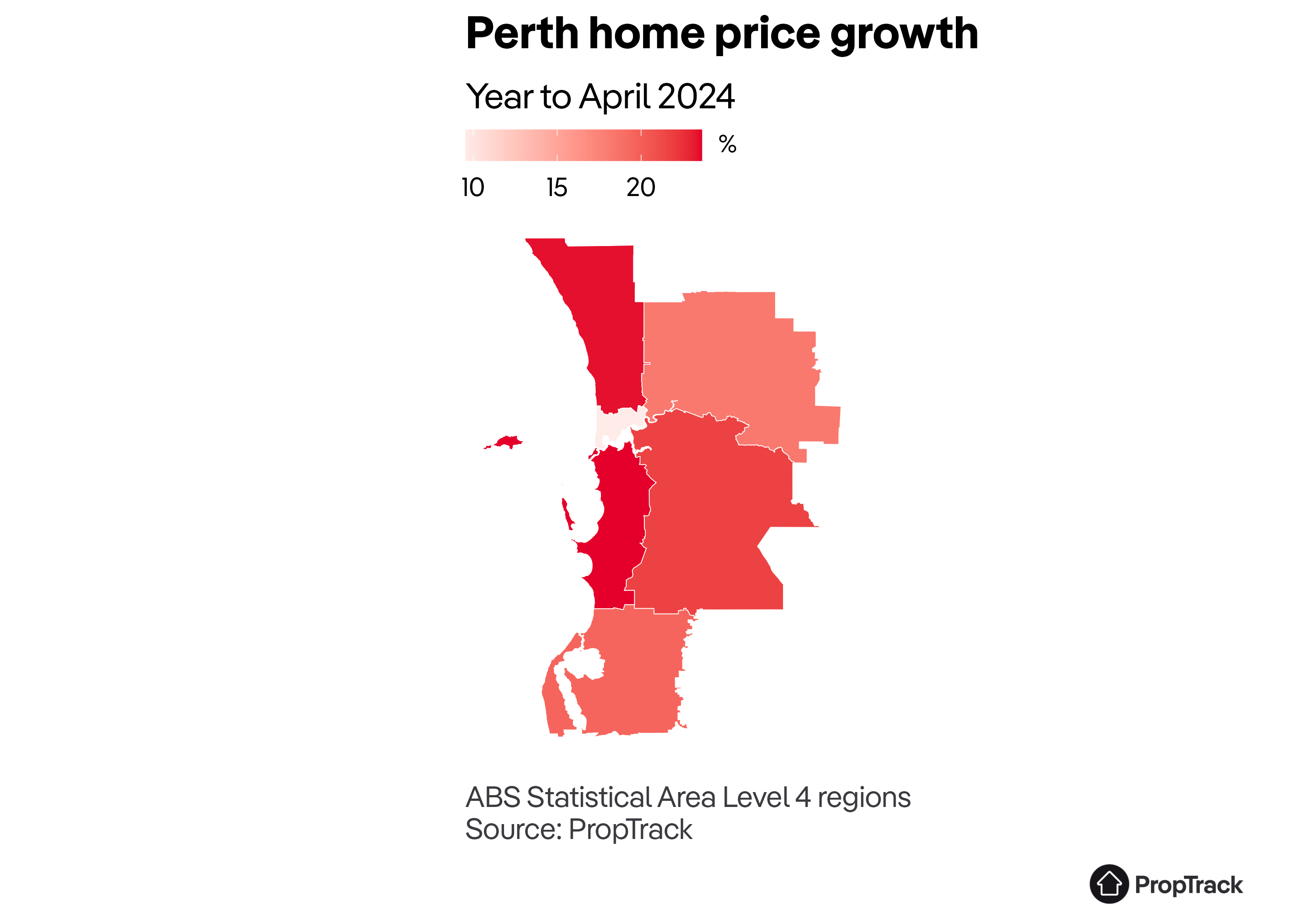

Perth and Adelaide remain the strongest performing markets and recorded the fastest monthly growth in April, up 0.83% and 0.55% respectively.

Perth prices are up 20.16% over the past year, while Adelaide has grown 13.99%.

Perth has maintained its streak of relative outperformance and remains the strongest market in the country for monthly and annual home price growth. Prices lifted 0.83% in April and are up 20.16% on April 2023 levels.

Record low supply amid strong buyer demand has resulted in a sellers’ market.

The relative affordability of the city’s homes, population growth, and very tight rental markets are also supporting home values.

Adelaide home prices rose 0.55% month-on-month in April to a new peak.

Adelaide remains one of the country’s top performing markets, with home prices up 13.99% year-on-year.

The comparative affordability of the city’s homes has seen prices defy the significant increase in interest rates since May 2022.

Low stock levels are also intensifying competition, with home prices in Adelaide rising at a fast pace over the past year.

And on the flipside…

Down in Tassie, home values in the unsunny capital Hobart continued to dash themselves spectacularly against a wall in April.

By dashed to the wall, we mean prices slipped another 0.24% to now sit 1.98% below the levels seen this time last year.

Hobart remains the weakest capital city market when comparing annual price growth as well as the change from peak (-8.54%).

However, this comes after several years of outperformance, as well as strong growth during the pandemic which has seen affordability deteriorate.

But fret not.

Home prices in Hobart are still up 35.4% since March 2020.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.