Aussie property prices expected to jump as much as 5% by Christmas

Pic via Getty Images

REA Group’s biannual compilation of learnings – the PropTrack Property Market Outlook August 2023 Report – a stunning combo of post-match analysis AND pre-game residential property market crystal balling, has these several points (below) to make.

The report analyses consumer behaviour in real time by eking out property market insights from the 12.1 million Australians who visit realestate.com.au each month. Key metrics include price changes, sale volumes, new and total listing volumes, enquiry, potential buyers per listings, and days on site.

Get a pen. I’ll add some visuals:

PTPMO 2023 key take-outs:

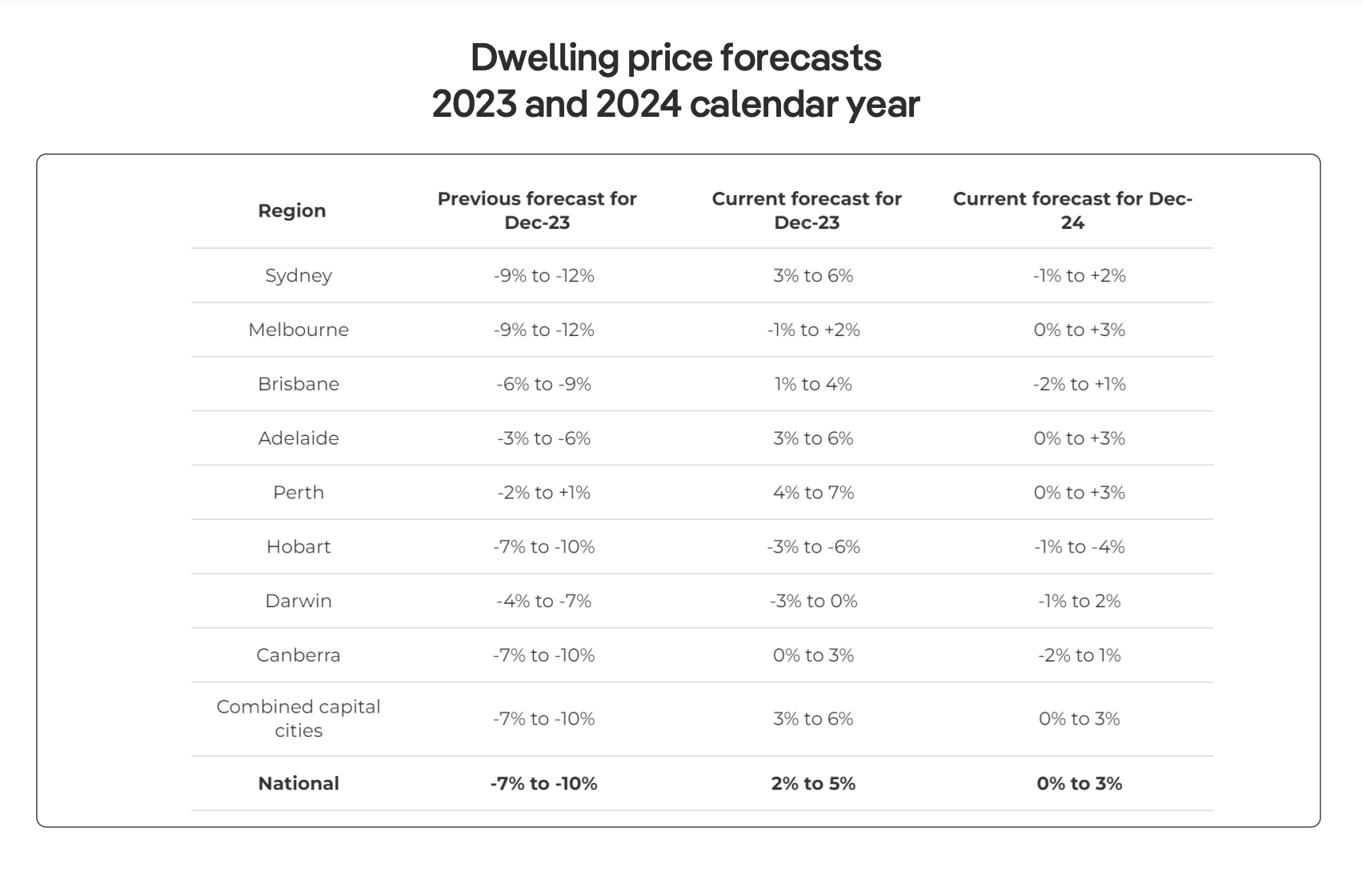

National property prices are expected to increase between 2% and 5% by the end of 2023.

This comes following a 2.3% increase in property prices over the first six months of the 2023 calendar year.

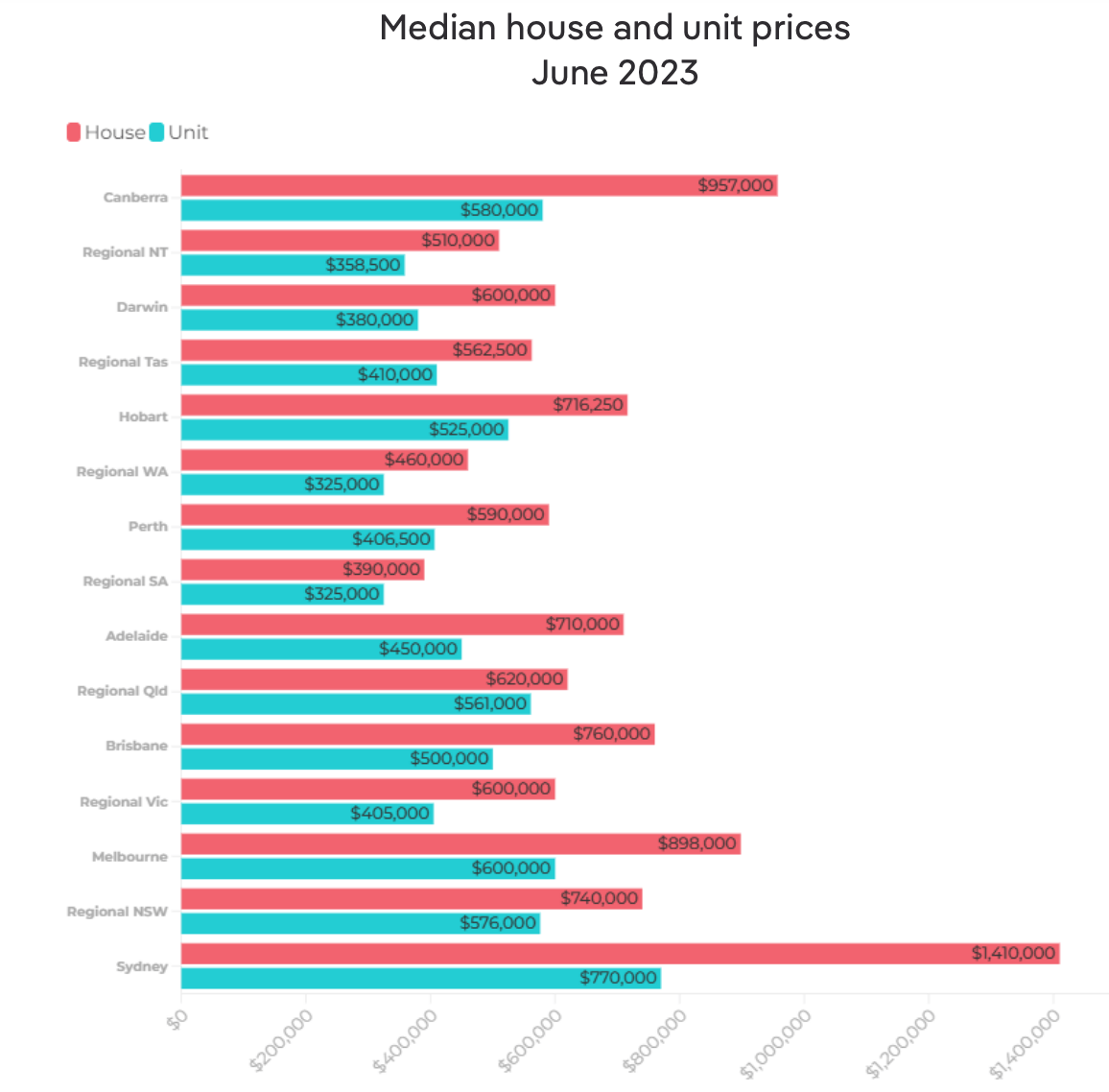

The national median house price over the three months to June 2023 was $770,000, while the median unit price was $590,000.

Across the combined capital cities, median house prices were $856,000, while units were $610,000. By comparison, regional median house prices were $625,625 and regional unit prices were $526,000.

Prices are forecast to increase between 3% to 6% across the combined capital cities. All capital cities except Hobart (-3% to -6%) and Darwin (-3% to 0%) are expected to see positive price growth over the remainder of 2023.

The strongest growth is expected in Perth (4% to 7%), Sydney and Adelaide (both 3% to 6%), and Brisbane (1% to 4%).

Melbourne (-1% to 2%) and Canberra (0% to 3%) are forecast to see growth, albeit less pronounced than other capital cities.

This forecast is based on a prediction that the cash rate is nearing the peak of the rate hiking cycle.

The RBA lifted the cash rate another 25 basis points this week, the 13th hike this tightening cycle. This brings the cash rate to 4.35%, its highest level since November 2011.

REA’s top economist Eleanor Creagh says with both consumer spending and economic activity expected to continue to slow in the coming months, the board decided it was appropriate to keep the cash rate on hold.

“This gives the RBA more time to assess the impact of rate rises already deliveredon households, businesses, and economic conditions.

“This was considered against signs the substantial tightening already pushed through is weighing on economic activity. Consumer spending is slowing, while business surveys indicate weaker conditions areexpected in the coming months as economic activity slows,” she added.

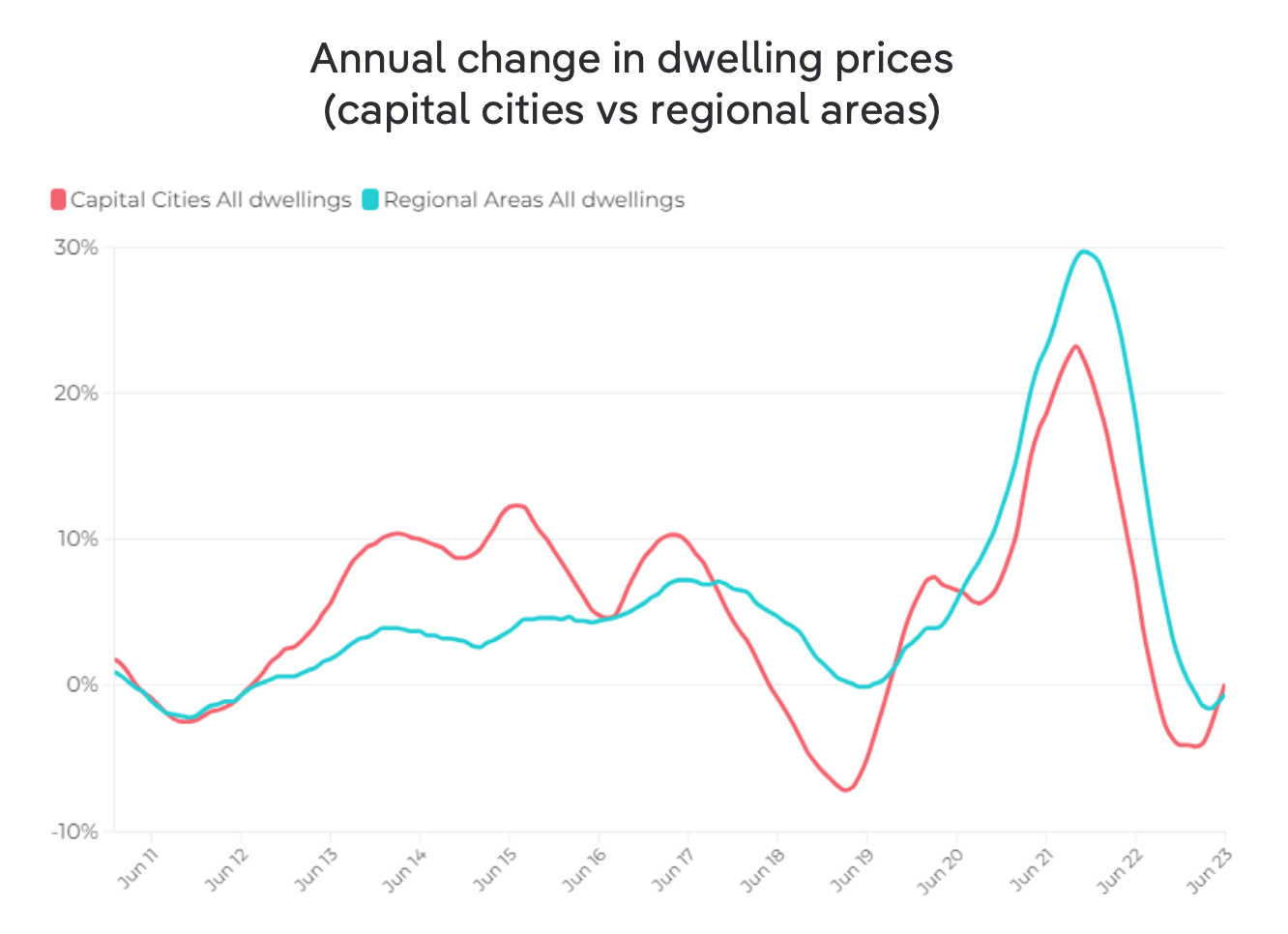

• The rebound in property prices has occurred despite interest rates continuing to rise, reducing borrowing capacities. From here, the direction of the housing market is likely to be influenced by the volume of stock available for sale.

The turnaround

PropTrack King of Economic Research and report author, Cameron Kusher, put it this way:

“The property market has seen a turnaround this year with six consecutive months of property price

growth. Limited supply of available properties for sale was a key factor contributing to buyer

competition and price growth.“National property prices increased 2.3% over the first six months of 2023, signalling a shift in

the housing market and reversing the declines experienced in the prior six months. We saw

price increases despite rising interest rates and reduced borrowing capacities and anticipate

moderate price increases to continue over the coming months.“We expect property prices to increase by up to 5% nationally over the remainder of 2023, with

greater growth projected in the larger capital cities.“The outlook for 2024 is much less clear with a large cohort of fixed-rate borrowers’ mortgages

set to expire from current interest rates of around 2% and reset to around 6%. Interest rate

changes act with a lag, and as such, the possible impact of higher repayments on these

borrowers won’t be seen until 2024. At this stage, we are forecasting modest price growth in

2024.”

Additional rip-offs taken directly from the report

In June 2023, preliminary sales volumes were 3.7% lower year-on-year. However, sales volumes were consistently higher than over any of the final six months of 2022, indicating that sales volumes will likely remain quite strong over the coming months.

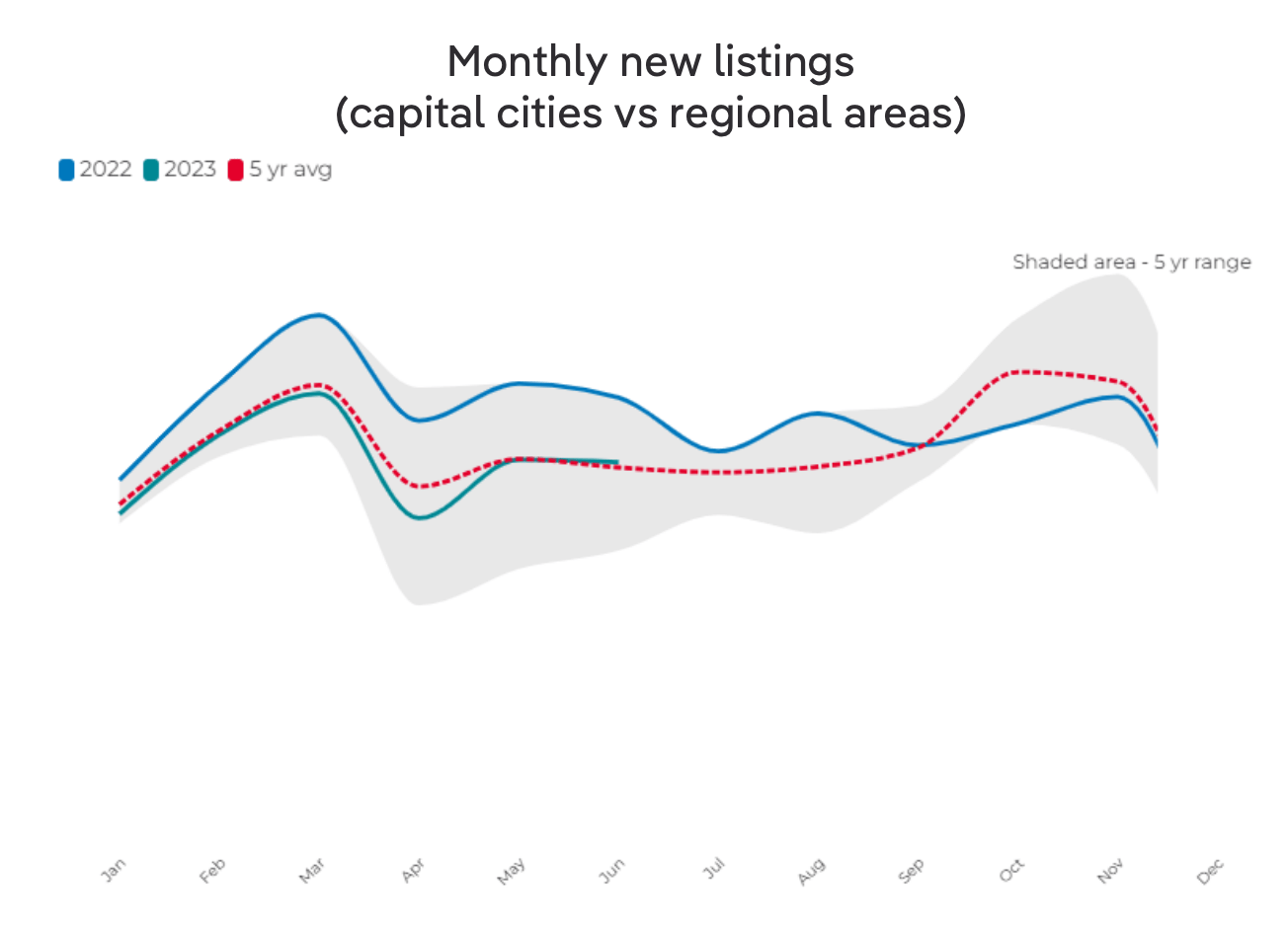

Across the capital cities, the volume of total stock for sale remains historically low, with the total number of properties listed for sale on realestate.com.au down 9.6% year-on- year in June 2023.

The ongoing low supply of properties available for sale has contributed to the price rebound in 2023 so far.

Nationally the volume of new stock coming to market has trended lower since its peak in March 2022, sitting 14.8% below June 2022 levels in June 2023.

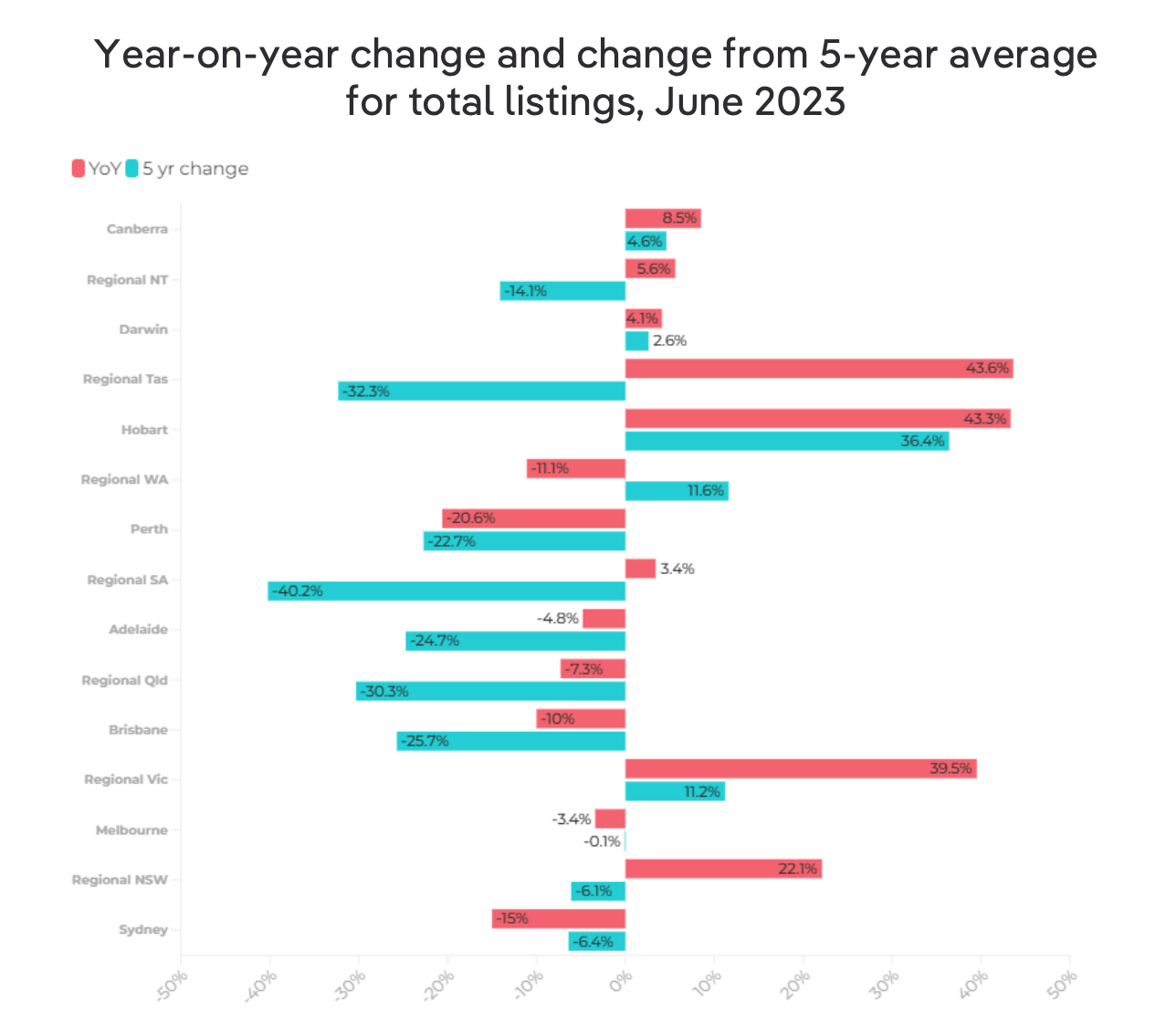

Regional Tasmania (43.6%), Hobart (43.3%) and regional Victoria (39.5%) recorded the greatest year-on-year increases in total listings across capital city and regional areas.

At the same time, Perth (-20.6%), Sydney (-15%) and regional WA (- 11.1%) had the largest declines in total listings.

Despite this, there are now some signs that vendors are increasingly prepared to list. Should a lift in new listings occur, more choice for buyers may result in a slowing of these expected price increases.

Buyers are competing for a relatively low volume of stock resulting in the number of enquiries per listing on realestate.com.au increasing 10% year-on-year in June 2023.

The median number of days a property was listed on realestate.com.au before selling in June remained unchanged from the previous month at 43 days, sitting 4 days higher than a year earlier.

.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.