Aussie housing crisis solved: Golden Age of Granny Flat begins

Via Getty

We’ve got a bit of a residential real estate crisis thanks to a structural housing deficit and a bevvy of intersecting irritants including rampant population growth, renewed foreign investors, lax lending policies, inner-city shortages, surging rents, prices and building costs, construction bankruptcies… oh, and a cost of living crunch super-charged by rising interest rates.

But now this from CoreLogic and some people who build granny flats:

New analysis of all residential properties across Australia’s three largest capitals has plucked out more than 655,000 sites ‘suitable for the construction of a granny flat, offering a solution to help ease the housing shortage.’

The town planner Archistar, construction lender Blackfort, and property data firm CoreLogic have gone and assessed ‘every residential block across Sydney, Melbourne and Brisbane’ to put a number to just how many individual properties could whack in a self-contained two-bedroom unit, should the need arise.

And the need has arisen…

The slow fix

Last month, Aussie state governments in cahoots with the Albanese team announced a shared target to build 1.2 or so million new homes in five years.

Albo’s cabinet pushed through the National Planning Reform Blueprint, which will stimulate medium to high-density housing in “well-located areas close to existing public transport,” (yikes) as well as re-jigging each local governments’ strategic plans to reflect housing policy targets.

The federal government has $3 billion in cash incentives for states and territories that help reach that target.

State governments have been urged to raise eligibility requirements for first home buyer assistance schemes since a minuscule number of properties would be cheap enough to qualify under current rules.

Current requirements for the $10k First Home Owners Grant stipulate buyers must purchase house and land packages under $750,000 or newly built units under $600k.

Anyone wanting to access the full exception on stamp duty taxes need to buy homes with a value under $800,000, while a discount is available for purchases under $1m.

Every state for themselves

The Western Australian Treasury is launching a specialised crack unit to tackle the housing supply problem and will take the lead on the flow of incoming Commonwealth funding.

The formation of the Housing Supply Unit comes as Perth’s rental vacancy rate dropped to 0.7% in September, according to data from the Real Estate Institute of Western Australia (REIWA).

State governments have made efforts to improve the rental crisis, such as the ACT government capping rental increases to inflation plus 10%, Victorian legislation to remove no-grounds evictions and Queensland’s legislation to limit rent raises to once per year.

While these changes have been impactful to existing renters, they do not address the lack of rental supply and affordability.

Adelaide, according to CoreLogic, has the lowest rental vacancy rates in the country – both for houses (0.5%) and units (0.3%).

“I don’t think you can actually go lower than that,” CoreLogic’s research director Tim Lawless says.

And that’s naturally putting enormous upwards pressure on home values. Rental prices for houses are rising at 8% per annum, while apartments are rising at 11%.

In New South Wales the plan for now is to allow for high density (actually the word is higher) development – if developers commit to setting aside 15% of stock for affordable housing, which means for tighter margins.

The fast fix

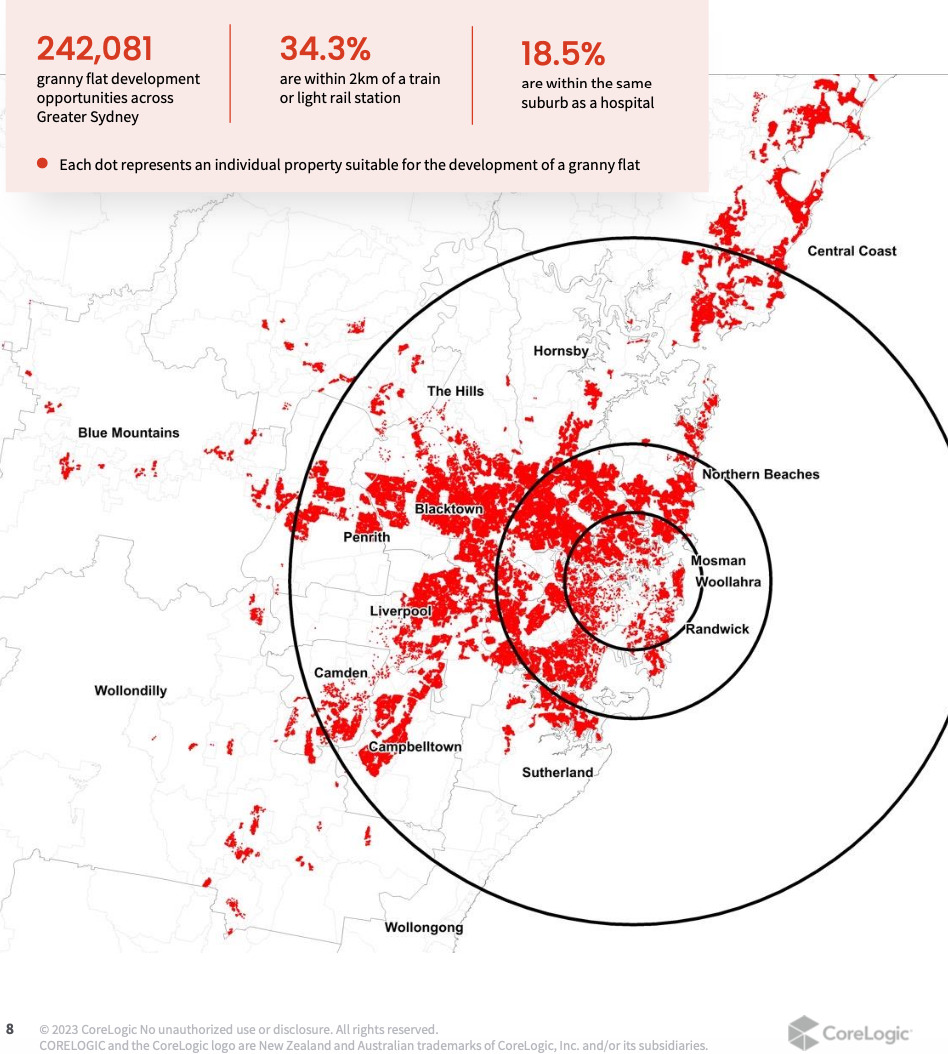

Good news then that Sydney wins the Australian city with the most granny flat development potential, according to the Granny Flat Plan. It has circa 242,000 suitable properties, which is exactly 17.6% of the metro region’s housing stock.

Melbourne has almost 230,000 potential sites, representing 13.2% of stock, while Brisbane has almost 185,000 suitable sites, representing 23.3% of houses across the metro region.

Of these sites, more than a third (36%) are within two klicks of a train or light rail station and 17% have a hospital nestled inside the suburb boundary – this CoreLogic says, demonstrates the winning combination of accessibility and opportunity to fast-track housing options for essential workers in the health care sector.

Lawless says the report highlights ‘significant untapped development potential’ which could help a lot toward fast tracking a ‘partial remedy’ to the big city/small housing problem.

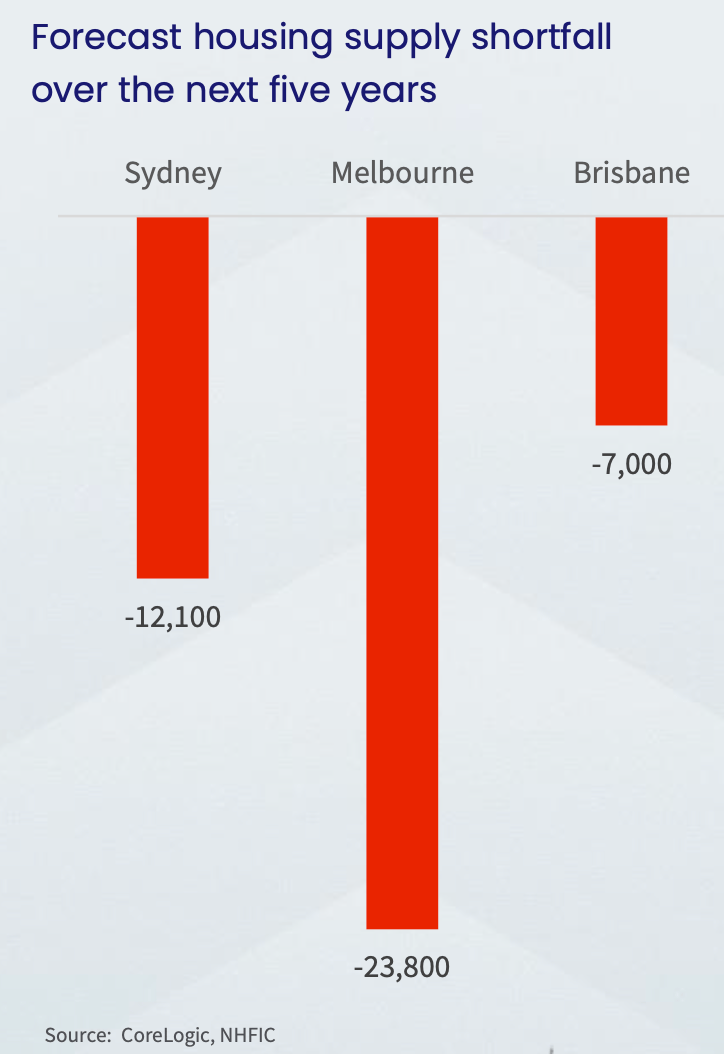

“NHIFC* forecasts indicate the national housing market is likely to be undersupplied to the tune of 106,300 dwellings over the next five years,” Mr Lawless said.

*Ed: From last week (12 October 2023), the National Housing Finance and Investment Corporation (NHFIC) has become Housing Australia. It sounds nicer and follows the passage and Royal Assent of the Federal Government’s Housing Legislative Package, that included both a name change, as well as expanding the agency’s responsibilities to support delivery of the Government’s Housing Policy agenda

“As Housing Australia, the agency will continue to operate as a corporate Commonwealth entity governed by an independent board. It will continue to deliver the Home Guarantee Scheme, Affordable Housing Bond Aggregator and National Housing Infrastructure Facility (that will receive an additional $1 billion investment from the Federal Government). The agency also takes on additional responsibilities to support delivery of 40,000 more social and affordable homes for Australians in need, under the new Housing Australia Future Fund and National Housing Accord.

“Since the agency was established in 2018, the Federal Government programs that it administers have supported over 17,800 new and existing social and affordable homes with loans to 38 community housing providers (CHPs) totalling more than $3.4 billion through the bond aggregator; fast-tracked much needed housing through the infrastructure facility; and helped more than 114,000 Australians into home ownership.”

Back to the granny flats… the Lawless one reckons they ‘present an immediate and cost-effective’ way to deliver housing supply within existing town planning guidelines.

“For homeowners, the addition of a second self-contained dwelling provides an opportunity to provide rental housing or additional accommodation for family members, while at the same time, increasing the value of their property and potentially attaining additional rental income.”

Archistar co-founder Dr Benjamin Coorey said accommodating the growing population within Bris-Melb-Syd – the larger capitals – is a critical issue that flexible housing solutions can help address – ‘cos granny flats ‘leverage existing lots and skip town planning regulation’.

“They offer an immediate opportunity to address housing shortages and affordability pressures expected in the coming five years for both buyers and renters.”

Running out of time and space

According to CoreLogic Sydney’s household formation is forecast to outpace supply from 2025, with the most significant undersupply expected through 2025 and to persist up until 2026 at -15,900 dwellings.

“Melbourne is expected to face a major housing shortage from 2023 to 2027, with a deficit of 23,800 dwellings, which is nearly twice the anticipated shortfall of 12,100 new dwellings in Sydney during the same period,” Lawless said.

While Brisbane’s housing supply shortfall is more imminent relative to the larger capital cities, with the current forecast of newly built housing supply short by 3,100 this year.

Granny flat upside

Lawless said there are immediate lifestyle and financial upsides for investors whose properties met the planning requirements.

“Adding a granny flat accommodates extra living space for extended family, multi-generational households or rental purposes, thereby boosting a property’s value and potentially creating extra income for rising living costs.”

“CoreLogic figures show an extra two bedrooms, and an additional bathroom could add around 32% to the value of an existing dwelling. For a house worth $500,000, the addition of a granny flat has the potential to add approximately $160,000 to the value of the property.”

Dr Coorey said research showed more than a third of the sites identified are close to existing amenities and services such as transport or a hospital.

“Granny flats present a cost-effective opportunity to boost housing supply for growing capital populations close to existing infrastructure such as railways, bus routes and major road networks for state and local governments.”

“While building regulations for secondary dwellings differ state to state, this unlocks a combination of accessibility and opportunity to fast track affordable housing options for all demographics, particularly essential workers in industries such as the health care sector.”

Go big or go home

The national property market is forecast to increase by up to 5% by the end of this year.

Home prices across regional SA have far outpaced growth in any other regional or capital city market, up almost 10% over the past year, with PropTrack’s latest Home Price Index showing property values across the state’s regional areas climbed 0.17% in September and 9.86% over the past year to a new peak of $399,000.

Regional QLD was the rural market with the next highest annual growth at 4.89%, while Perth was the standout capital city with a 9.24 per cent rise over the past year.

All capital cities except Hobart (-3 to -6%) and Darwin (-3 to 0%) are expected to see more price growth over the remainder of 2023.

The strongest is expected in Perth (4 to 7%), Sydney and Adelaide (both 3 to 6%), and Brisbane (1 to 4%).

And looking further ahead, Sydney’s housing market is set to run away again over the next two years as well – by mid-2025 Sydney’s average house prices will surge to well over $1.5m and apartments going for an average $850,000, according to data from PropTrack and KPMG.

That’ll be an extra $200k for each house and about $$100k for a flat (sans Granny).

Granny flat attack plan (Sydney)

Median prices will also top $2m for the first time in 43 Sydney suburbs in the next two years, lifting Sydney’s total suburbs in the $2m category to over 200 – or roughly a third of the Harbour City.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.