Aussie home prices are deviant: It’s Perth for profit, Hobart for horror

Hmm. Via Getty

There’s been little relief for homebuyers as the blistering pace of Australia’s property upswing managed to accelerate over the first month of 2024.

The average price for a place to live around the country is now 12.8% more than it was a year ago, according to the January edition of property data firm CoreLogic’s monthly measurement.

Prices rose a further 0.4% in January, which is up from the 0.3% increases seen over November and December, as per the latest national Home Value Index.

CoreLogic’s research director Tim Lawless says that’s now 12 straight months of home value rises for us.

Perth outperforms

But, and there’s always a few, Tim says take a moment to look under the hood, and it’s pretty evident that the Aussie housing market is still a mixed bag.

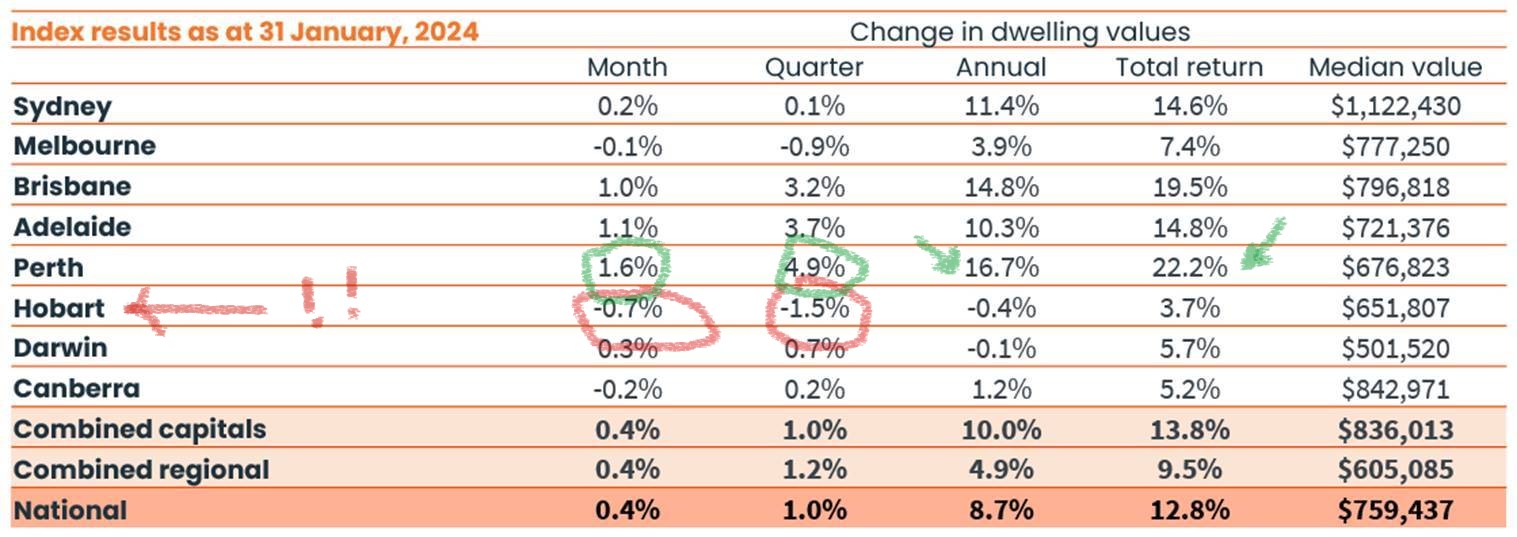

Over January three major capitals went backwards, logging “a subtle decline” over the month.

Those retreats were in Melbourne (-0.1%) and Canberra (-0.2%), while Hobart prices are off in a direction all their own – down 0.7%.

On the other end of the stick, it’s Perth, Adelaide and Brisbane – where home prices are moving higher with increasing velocity – each city climbing at a monthly rate of 1% or more.

Mnsr Lawless identified Perth as the standout among the capital cities for “a persistently rapid rate” of capital gains.

“Perth home values rose a further 1.6% in January, on par with the city’s growth trend in November and December and only slightly lower than the recent high of 1.8% recorded in October. The western capital continues to see housing demand outweigh supply, helping to push values 16.7% higher over the past 12 months.

“Despite that, housing prices remain relatively affordable compared with most capital cities, with the median dwelling value sitting just under $677,000.”

CoreLogic: Home Value Index (January)

Houses and units

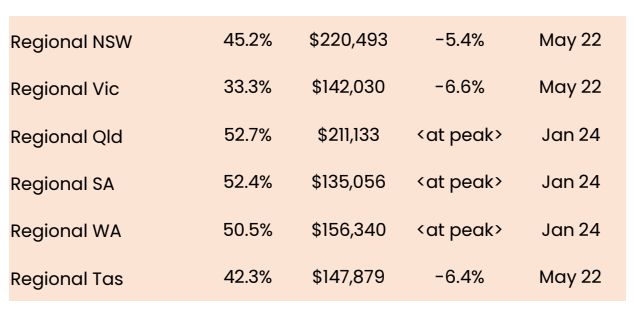

Australian house values have continued rising at a faster clip relative to units in January, and the gap is widening.

CoreLogic says the diff between median capital city house and unit values is now at a record high of 45.2%.

Across the combined capitals, detached housing values rose by half a per cent over the month, adding the equivalent of around $4,800 to the median house value while units increased a smaller 0.1%, equivalent to a $900 lift.

“Since the commencement of the upswing, capital city house values have surged 11.0% higher while unit values are up 6.9%. It seems that most Australians are willing to pay a higher premium than ever for a detached home,” Lawless says.

Town and country

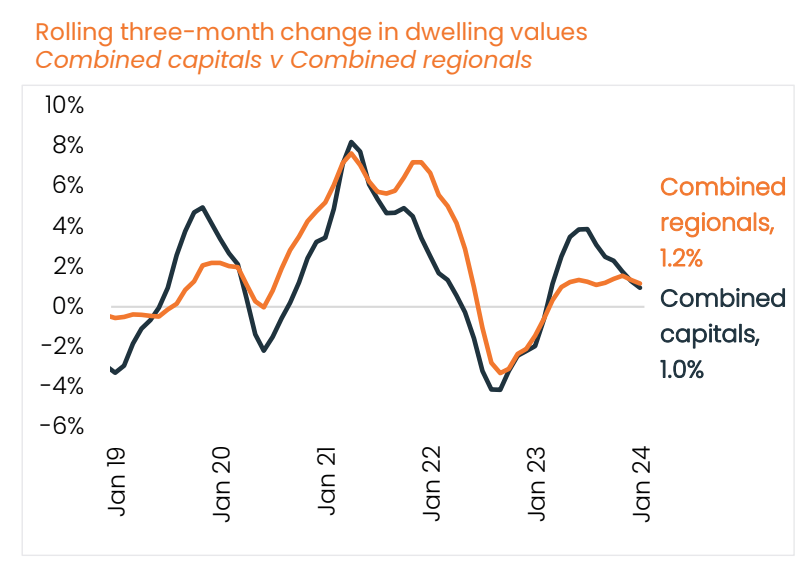

Regional markets are now showing a stronger trend in value growth relative to the capital cities. The combined regional index rose 1.2% over the rolling quarter compared with a 1.0% rise across the combined capitals index.

“While both the combined capitals and combined regional markets are losing momentum in the pace of value growth, the capital city trend has slowed more sharply, mostly due to the flattening of growth conditions in Melbourne and Sydney,” Lawless says.

“Across the other states, regional WA, SA and Queensland continue to record a slower pace of growth relative to their capital city counterparts; these are also the three regional markets where dwelling values are at record highs.”

Never waste a decent crisis

Despite worsening housing affordability, the volume of home sales has held slightly above average over the past three months.

CoreLogic estimates there were 115,241 dwellings sold over the three months ending January; 11.9% higher than the same period last year and 0.5% above the previous five-year average for this time of the year.

“Despite ongoing cost of living pressures, high interest rates, low consumer sentiment and affordability constraints, homes are still selling. Housing demand has been buoyed by high migration, but also tight rental markets that have probably incentivised renters to transition towards home ownership if they can afford to do so,” Lawless said.

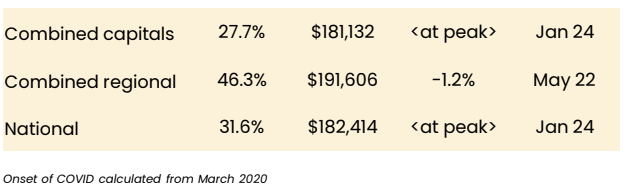

Changing home values over the recent cycles

Rents lifted faster through January, Tim says, as leasing markets enter the seasonally stronger first quarter of the year.

The national rental index recorded its strongest monthly rise since April with rents up 0.8% in January, following a 0.6% rise in December.

“Most years see rental growth accelerating through the March quarter as competition from students and new year leases adds to rental demand, ” Tim says.

“It’s looking like we will see a similar trend this year with the usual pattern of higher rental growth emerging in January.”

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.