ASX Small Caps Weekly Wrap: Who are we blaming it on this week? It’s China again, right?

Glub glub glubbedy glub. Pic via Getty Images.

- The ASX 200 fell hard several times this week

- In fact a great week to have your mattress money-stuffed

- Who won the Small Caps race? Read on to find out…

It’s Friday afternoon, and it’s the end of a harrowing week for a number of reasons – the most germane of which to this regular story is the tale of woe that came screeching like a banshee on bald tyres out of the ASX this week.

The short version of the story is that local markets endured a thorough beating this week, and it’s largely the fault of two things: A string of flubs among the Giants of Tech on Wall Street, and the persistent howls of disappointment over the state of the Chinese economy.

The Wall Street thing was gruesome, as whatever happens there has a tendency to influence whatever happens here the following session – so when New York got busy rotating out of the market’s big techies and trying on some Small Caps for size, our local tech stocks had a couple of trips out to the woodshed to endure.

And then, there’s China – and it’s been a helluva week for our biggest trading partner, with a bunch of really unhealthy economic data weighing heavily, and the country’s construction sector in something that looks a lot like freefall.

It’s the latter part of China’s influence that is causing more than its fair share of dispepsia among some of the ASX’s biggest names – with the “making big stuff” part of China’s economy shuddering like a mid-poop pooch, there’s significantly less appetite for what Australia’s beginning to the table: commodities.

At the time of writing this, it’s bleak on the commodities ladder. Copper is down 4.3% for the week. Silver’s down 6.3%. Iron ore fell below $100, twice. The list goes on.

Gold fell, too. It’s down 3.2% this week. I wasn’t going to mention it, because it’s one of those things that I write about so much these days, it’s starting to haunt my dreams.

All of that has put some intolerable downward pressure on our Resources sector, but the biggest drop of the week belongs to the Energy sector, where some big names have posted some horrendous nosebleeds since last week.

Before the market opened on Friday morning, Woodside Energy Group (ASX:WDS) had shed 8.98% in a week. Whitehaven Coal (ASX:WHC) lost 7.98% over the same period. Paladin Energy (ASX:PDN) was down 11.32% for the week.

The bleeding, however, seems to have stopped – for now. But China’s troubles are far from over, the US volatility is still definitely a thing, with some analysts saying that it’s looking more and more like a correction.

But next week is, like, a few days away. Let’s worry about it all then.

WHAT THE SECTORS DID

Here’s what the market sectors did:

There was, nominally, a winner among the ASX sectors, and it was Industrials, which eked out a 0.24% rise against the backdrop of a very difficult week, while Consumer Discretionary saw out the tail end of a beating with one nostril above the water line.

The rest of the sectors went backwards, but none quite so far and so fast as Energy stocks, which collectively shed 6.3% and made a lot of people very cross in the process.

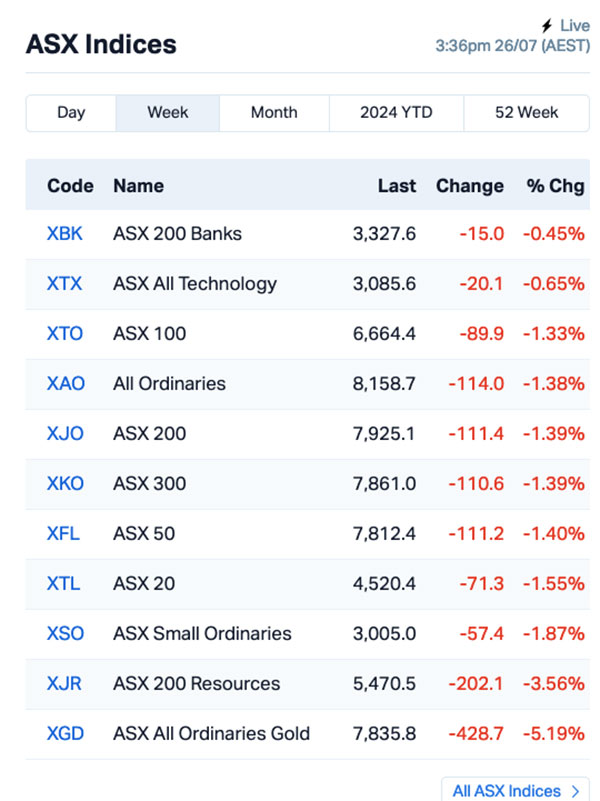

A look at the ASX indices, and… yikes. The best of them was the Banks, and they were down 0.43%. That’s the good score for the week.

The ASX 200 finished down 1.4% or thereabouts, and the goldies really got hammered this week, losing 5.25% on a very tough wicket.

THIS WEEK’S ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| AEV | Avenira Limited | 0.01 | 125% | $21,141,307 |

| AHN | Athena Resources | 0.00 | 100% | $4,281,870 |

| AUK | Aumake Limited | 0.01 | 100% | $11,486,441 |

| RMX | Red Mount Min Ltd | 0.00 | 100% | $6,847,155 |

| DEL | Delorean Corporation | 0.09 | 98% | $19,414,882 |

| ATV | Active Port Group | 0.06 | 58% | $19,712,375 |

| QHL | Quickstep Holdings | 0.42 | 51% | $27,255,961 |

| AOA | Ausmon Resorces | 0.00 | 50% | $3,176,998 |

| FIN | FIN Resources Ltd | 0.01 | 50% | $5,194,150 |

| HXL | Hexima | 0.02 | 50% | $3,006,713 |

| MCT | Metalicity Limited | 0.00 | 50% | $8,971,705 |

| MTB | Mount Burgess Mining | 0.00 | 50% | $1,947,220 |

| RML | Resolution Minerals | 0.00 | 50% | $4,830,065 |

| TRP | Tissue Repair | 0.38 | 50% | $25,999,882 |

| IKE | Ikegps Group Ltd | 0.68 | 50% | $83,396,374 |

| E79 | E79 Gold Mines | 0.04 | 47% | $3,473,530 |

| ALC | Alcidion Group Ltd | 0.08 | 39% | $98,000,545 |

| WCN | White Cliff Minerals | 0.02 | 38% | $27,699,586 |

| RIM | Rimfire Pacific | 0.04 | 38% | $94,070,444 |

| ATX | Amplia Therapeutics | 0.09 | 34% | $27,421,199 |

| DES | Desoto Resources | 0.12 | 34% | $6,165,563 |

| DYM | Dynamic Metals | 0.18 | 33% | $6,480,000 |

| FFF | Forbidden Foods | 0.01 | 33% | $2,726,682 |

| ICE | Icetana Limited | 0.02 | 33% | $5,292,569 |

| INP | Incentiapay Ltd | 0.00 | 33% | $4,975,720 |

| ME1 | Melodiol Global Health | 0.00 | 33% | $2,430,946 |

| MSG | MCS Services Limited | 0.00 | 33% | $792,399 |

| MVL | Marvel Gold Limited | 0.01 | 33% | $6,910,326 |

| SIS | Simble Solutions | 0.00 | 33% | $3,013,803 |

| SP8 | Streamplay Studio | 0.01 | 33% | $9,204,990 |

| SRY | Story-I Limited | 0.00 | 33% | $1,505,619 |

| TMX | Terrain Minerals | 0.00 | 33% | $5,726,683 |

| ASQ | Australian Silica | 0.03 | 32% | $6,764,649 |

| IND | Industrial Minerals | 0.25 | 32% | $12,376,800 |

| CLU | Cluey Ltd | 0.04 | 31% | $7,891,437 |

| ORD | Ordell Minerals Ltd | 0.26 | 30% | $8,597,441 |

| ESK | Etherstack PLC | 0.16 | 29% | $18,460,244 |

| ALY | Alchemy Resource Ltd | 0.01 | 29% | $10,602,686 |

| WHK | Whitehawk Limited | 0.02 | 29% | $8,516,028 |

| DAF | Discovery Alaska Ltd | 0.01 | 27% | $2,576,582 |

| KNO | Knosys Limited | 0.05 | 27% | $8,213,271 |

| CSX | Cleanspace Holdings | 0.39 | 26% | $28,630,042 |

| OCA | Oceania Health | 0.70 | 26% | $510,582,876 |

| CTO | Citigold Corp Ltd | 0.01 | 25% | $13,500,000 |

| ESR | Estrella Resources | 0.01 | 25% | $8,796,859 |

| LPD | Lepidico Ltd | 0.00 | 25% | $17,178,250 |

| LVH | Livehire Limited | 0.03 | 25% | $9,979,143 |

| MEG | Megado Minerals Ltd | 0.01 | 25% | $2,544,556 |

| RLG | Roolife Group Ltd | 0.01 | 25% | $3,970,732 |

| TAS | Tasman Resources Ltd | 0.01 | 25% | $3,563,346 |

Super quickly, here’s how the Small Cap winners ended up where they were on the ladder.

Avenira (ASX:AEV) was at the top of the list, but that was without any news. Well… any public news. Because there was news, but not everyone knew about it – which meant the ASX stepped in, demanding an explanation and the company went into a trading halt.

It turns out that Avenira had signed a binding term sheet for a cap raise through another company, listed somewhere else in the world, and that’s probably why its price went crazy for ‘no reason’. We’ll get to learn which company it is later on tonight, because Avenira can’t announce here until the other entity is ready to simultaneously announce wherever it is.

Athena Resources (ASX:AHN) took second place for the week on news the company has appointed a new non-executive chair in the formidable shape of ex-Wallaby hard man and resources guru John Welborn. The appointments follow the approval by shareholders of a $1 million Convertible Notes issue to Fenix Resources (ASX:FEX), where Welborn is King.

and AuMake International (ASX:AUK) was up for the week on news that the company has entered a non-binding three (3) year strategic co-operation framework with Chinese State-Owned Enterprise Yangtze River New Silk Road International Logistics, to “establish a comprehensive end-to-end supply chain network for Australian goods and services”.

THIS WEEK’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| NTM | NT Minerals Limited | 0.01 | -58% | $5,087,015 |

| M2R | Miramar | 0.01 | -46% | $2,763,457 |

| IMI | Infinity Mining | 0.01 | -44% | $1,662,547 |

| AGY | Argosy Minerals Ltd | 0.05 | -40% | $49,501,312 |

| PIL | Peppermint Innovations | 0.01 | -38% | $19,092,225 |

| SRJ | SRJ Technologies | 0.06 | -34% | $10,513,433 |

| TD1 | Tali Digital Limited | 0.00 | -33% | $3,295,156 |

| TX3 | Trinex Minerals Ltd | 0.00 | -33% | $4,571,631 |

| 88E | 88 Energy Ltd | 0.00 | -33% | $86,678,016 |

| BCB | Bowen Coal Limited | 0.04 | -33% | $125,312,242 |

| BDG | Black Dragon Gold | 0.02 | -30% | $4,547,800 |

| KLI | Killi Resources | 0.09 | -30% | $10,699,913 |

| NWM | Norwest Minerals | 0.03 | -30% | $13,098,227 |

| MRQ | Mrg Metals Limited | 0.00 | -30% | $10,846,075 |

| CTN | Catalina Resources | 0.00 | -29% | $3,096,217 |

| GCM | Green Critical Min | 0.00 | -29% | $3,466,463 |

| NRZ | Neurizer Ltd | 0.01 | -29% | $9,512,153 |

| NUC | Nuchev Limited | 0.15 | -29% | $23,414,288 |

| NIS | Nickel Search | 0.02 | -28% | $3,630,222 |

| PUA | Peak Minerals Ltd | 0.00 | -28% | $4,789,506 |

| PLN | Pioneer Lithium | 0.19 | -27% | $6,006,000 |

| HE8 | Helios Energy Ltd | 0.02 | -27% | $49,476,939 |

| NGSDA | NGS Ltd | 0.02 | -27% | $1,224,542 |

| NVA | Nova Minerals Ltd | 0.16 | -26% | $41,404,670 |

| OZM | Ozaurum Resources | 0.05 | -26% | $8,255,000 |

| PKO | Peako Limited | 0.00 | -26% | $2,108,339 |

| FRB | Firebird Metals | 0.12 | -26% | $16,371,561 |

| ENL | Enlitic Inc | 0.13 | -26% | $11,413,621 |

| C29 | C29 Metals | 0.09 | -25% | $12,012,583 |

| IEC | Intra Energy Corp | 0.00 | -25% | $1,690,782 |

| TKL | Traka Resources | 0.00 | -25% | $2,918,488 |

| WFL | Wellfully Limited | 0.00 | -25% | $1,478,832 |

| DOU | Douugh Limited | 0.00 | -25% | $3,246,207 |

| ECT | Env Clean Tech Ltd. | 0.00 | -25% | $7,929,526 |

| AMD | Arrow Minerals | 0.00 | -25% | $31,618,095 |

| TIG | Tigers Realm Coal | 0.00 | -25% | $39,200,107 |

| SLZ | Sultan Resources Ltd | 0.01 | -25% | $1,185,519 |

| MEI | Meteoric Resources | 0.11 | -25% | $238,814,381 |

| CGR | CGN Resources | 0.12 | -25% | $10,439,492 |

| SRL | Sunrise | 0.40 | -25% | $36,993,274 |

| AGH | Althea Group | 0.02 | -24% | $7,295,984 |

| GAS | State GAS Limited | 0.10 | -24% | $27,422,679 |

| BUR | Burley Minerals | 0.10 | -23% | $15,037,094 |

| MGL | Magontec Limited | 0.25 | -23% | $25,486,005 |

| PTL | Prestal Holdings Ltd | 0.08 | -23% | $14,318,598 |

| PTR | Petratherm Ltd | 0.02 | -23% | $4,300,077 |

| BIO | Biome Australia Ltd | 0.51 | -23% | $113,080,223 |

| ALM | Alma Metals Ltd | 0.01 | -22% | $10,100,152 |

| ASP | Aspermont Limited | 0.01 | -22% | $20,000,093 |

| MAG | Magmatic Resources | 0.05 | -22% | $21,269,586 |

HOW THE WEEK SHOOK OUT

Monday 22 July, 2024

Astute Metals (ASX:ASE) was up early on Monday morning, reporting assay results from a further four drillholes at its Red Mountain lithium project in Nevada, USA – and the news is good. Astute says drilling has found thick intersections of lithium above 1,000ppm, with the standout result being 13.7m @ 1,070ppm Li / 0.57% Lithium Carbonate Equivalent1 (LCE) from surface, including 83.8m @ 1,230ppm Li / 0.65% LCE from 16.8m.

AuMake International (ASX:AUK) was up on Monday morning on news that the company has entered a non-binding three (3) year strategic co-operation framework with Chinese State-Owned Enterprise Yangtze River New Silk Road International Logistics, to “establish a comprehensive end-to-end supply chain network for Australian goods and services”.

EV Resources (ASX:EVR) made headway on news that surface rock chip samples of up to 71% Cu and 874g/t Ag demonstrated previously unknown copper and precious metals potential at the Khartoum project in northern Queensland, with the company reporting that the high-grade copper values include 10.9% Cu, 9.11% Cu, 8.6% Cu and 4.16% Cu.

And Swoop Telecommunications (ASX:SWP) was on the move thanks to news that it has signed a key customer contract and committed to construct, own and operate a significant new fibre infrastructure network in Melbourne, with initial committed revenues of a minimum of $24 million and up to $36m over the next 22 years.

Jupiter Energy (ASX:JPR) made a late rush off the back of a decent quarterly, with the company announcing that it had sold about 56,000 barrels of oil, for an unaudited oil sales revenue (including VAT) total for the Quarter ending 30 June 2024 of ~$US2.3 million (~$3.5 million).

Tuesday 23 July 2024

Delorean (ASX:DEL) was leading the way at lunchtime, gaining ground after issuing guidance for its FY24 results, announcing unaudited revenue for the year of between $27m and $28m, a record NPAT and targeting an eventual EBITDA of between $4.5 million and $5.1 million.

Melodiol Global Health (ASX:ME1) was also off to a flying start, after announcing a $12 million cash asset sale to bolster its bank account. The company has signed a non-binding LOI with Canadian-based Nacerna Life Sciences to sell its Mernova production facility and land in Nova Scotia, with two earn-out provisions totalling $2.2m which are payable to Melodiol on completion of each earn out provisions.

Resolution Minerals (ASX:RML) released its quarterly report this morning, revealing that it spent $49,000 on exploration activities in the June quarter, leaving the company with $239,000 in the bank.

Quickstep Holdings (ASX:QHL) was rising on news via a business update, with the company revealing that restructuring activity, announced to the market in June 2024, has been successfully completed, and a number of key business strands, including work on the C-130 and F35 aircraft, have been planned out. The company also highlighted record drone production output in Q4 FY24 from the Company’s Geelong facility.

EV Resources (ASX:EVR) was up on yesterday’s news that surface rock chip samples of up to 71% Cu and 874g/t Ag demonstrated previously unknown copper and precious metals potential at the Khartoum project in northern Queensland, with the company reporting that the high-grade copper values include 10.9% Cu, 9.11% Cu, 8.6% Cu and 4.16% Cu.

Vital Metals (ASX:VML) was up on news that it has received assays from the final 24 drill holes completed in its 2023 resource definition exploratory work at its Tardiff prospect, with the program continuing to return shallow high grades including 53.5m at 1.5% TREO from 6.7m incl. 1.8m at 8% TREO within 15.8m at 2.6% TREO, and 27.45m at 1.5% TREO from 4.55m incl. 2m at 6.3% TREO.

Wednesday 24 July, 2024

Biotech Hexima (ASX:HXL) sucked up most of the glory on Tuesday arvo, adding about 58% on plans to raise about $4 million towards “commercialising its Autonomous Intelligent Software Agent Platform (AiSAP) based on the Belief, Desire, Intention (BDI) model of human practical reasoning.”

“RealThing’s Autonomous Intelligent Agents take advantage of advancements in generative AI (such as chatGPT), combined with the logical reasoning capabilities of BDI agents that are connected to the real world to drive real actions.” the company says.

Peak Rare Earths (ASX:PEK) was the big ressie winner, after US$2bn market-capped Chinese rare earths major Shenghe offered a cool $96m, signing a non-binding term sheet for a 50% interest in the company’s stake in the Ngualla project in Tanzania.

Peak previously held an 84% stake, with the rest held under the African nation’s mining laws by a free-carried Tanzanian Government.

Meanwhile, Galilee Energy (ASX:GLL) is still gaining handsomely on a June quarterly update.

Alcidion (ASX:ALC) was selected as the preferred EPR supplier by North Cumbria Integrated Care NHS Foundation Trust (NCIC) for its new Electronic Patient Record (EPR) system.

“They provide hospital and community health care for approximately half a million people across two acute care hospitals, eight community-based hospitals, eight Integrated Care Communities (ICC) and a number of support staff locations over a large geographical footprint, working collaboratively with primary care networks, including 39 General Practices and an out of hours GP service.”

So that’s a lot of patient records which need digitisation.

Thursday 25 July, 2024

Tissue Repair (ASX:TRP) won the day on Thursday, with a great big new approval from the local TGA (Therapuetic Goods Admin), which in short says that TRP “has secured a TGA approval for TR Pro+TM the Company’s first advanced wound healing gel product containing the proprietary active ingredient, Glucoprime (0.1%), derived from yeast.” The TGA listing will help Tissue Repair and its approved yeast in 10g and 50g tubes and 3g sachets, to promote the co’s scientific and clinical data more broadly.

Athena Resources (ASX:AHN) was up on news the company has appointed a new non-executive chair in the formidable shape of ex-Wallaby hard man and resources guru John Welborn. The appointments follow the approval by shareholders of a $1 million Convertible Notes issue to Fenix Resources (ASX:FEX), where Welborn is Still King.

Amplia (ASX:ATX) went flying on news that that three patients enrolled in the Company’s Phase 2a clinical trial investigating its drug narmafotinib in the treatment of advanced pancreatic cancer (the ACCENT trial) have recorded a “confirmed partial response” – which translates to at least a 30% decrease in the overall size of tumour lesions and no new tumour lesions in these patients sustained over a two month period.

Dotz Nano (ASX:DTZ) was rising nicely late on Thursday, following what must have been a brilliant investor webinar in the morning, which I haven’t had time to sit down and watch yet, but I will one day, I promise.

Javelin Minerals (ASX:JAV) was performing well on the heels of news that its capital raising round has finally been completed, with the company banking more than $2 million (before costs) and issuing a bunch of shares in a manner that is far too complicated to unpack here.

Cluey (ASX:CLU) was making moves on Thursday: raising capital and expecting to hit profitability in CY2026. The edutech says its re-scaling ‘to achieve expected profitability is complete,’ after the implementation of a bunch of cost saving initiatives resulting in “a significant improvement in Group Cash Burn”, which means the company “expects to break-even during H2 FY25 and to be profitable thereafter.”

Also up nicely on Thursday morning was the wee explorer Pure Resources (ASX:PR1), which has entered into a binding option agreement to acquire the Reedy Creek Project located 90 kms north of Halls Creek, Western Australia. The project is a hard-rock, high-grade, outcropping industrial garnet deposit and consists of a live mining lease M80/416 that covers an area of 359.60ha and has been granted until 2038.

Delorean (ASX:DEL), a vertically integrated bio-energy focused operator of both renewable energy and waste management, picked up from where it left off on Tuesday when the company lifted FY24 earnings guidance, saying its strong results are largely thanks to high performing project delivery across the group.

Friday 26 July, 2024

E79 Gold Mines’ (ASX:E79) initial reconnaissance sampling program at Mountain Home has returned some promising rock chip assays, with the company announcing it’s found samples clocking in at 28.9% Cu, 0.16 g/t Au, and 0.11% Cu, 11.75 g/t Au.

Argosy Minerals (ASX:AGY) was up Friday morning on the back of a positive quarterly report, with the company’s flagship Rincon lithium project getting EIA regulatory approval for development of a 10,000tpa LCE production operation expansion, and the company’s finances in good order as well.

Eastern Resources (ASX:EFE) was up on news that it has retained Nagom, an experienced lithium consultancy in Perth, to handle a fresh round of metallurgical testwork on samples taken from its Lepidolite Hill project, which has already returned some positive samples earlier in the year, including 13m at 1.47% Li2O from 19m.

And eMetals (ASX:EMT) has jumped Friday morning on news that it has inked a deal to buy 80% of the ordinary shares in Sifang, which is the 100% legal and beneficial owner of the Mubende Gold Project and four exploration license applications located in central Uganda.

NZ-based ikeGPS (ASX:IKE) climbed higher on Friday, after revealing that it has signed a contract for significant product expansion with a longstanding partner in the United States, which the company says should result in revenue of $19 million over the next 36 months.

Industrial Minerals (ASX:IND) was up on news that is has received results from High Purity Quartz Processing Testwork1 completed by North Carolina State University’s Mineral Research Laboratory, where a maiden sample from the Mukinbudin Project achieved >99.991% SiO2 from a simple processing flow sheet, which is a Good Thing.

And for today’s episode of “I think I need to re-read this, to make sure I’ve got the story right”, Dynamic Group (ASX:DDB) has revealed that it has received notice of an on-market takeover offer from Australian Meat Industry Superannuation, with the latter offering $0.28 per share for the percentage of the company that it doesn’t already own.

And that’s it from the newsroom for this week, because I’ve run out of puff and “being horizontal” is now top of my list of things I must be doing immediately. Join us again next week, when the market hosts what amounts to a giant game of high-stakes Yahtzee, and we all get to roll the dice once more.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.