ASX Small Caps Weekly Wrap: The ASX bounced back like an exonerated executive this week. Thanks, Wall Street.

Sandra is undeniably a winner, which is remarkable given that she's clearly lost her focus. Pic: Getty Images.

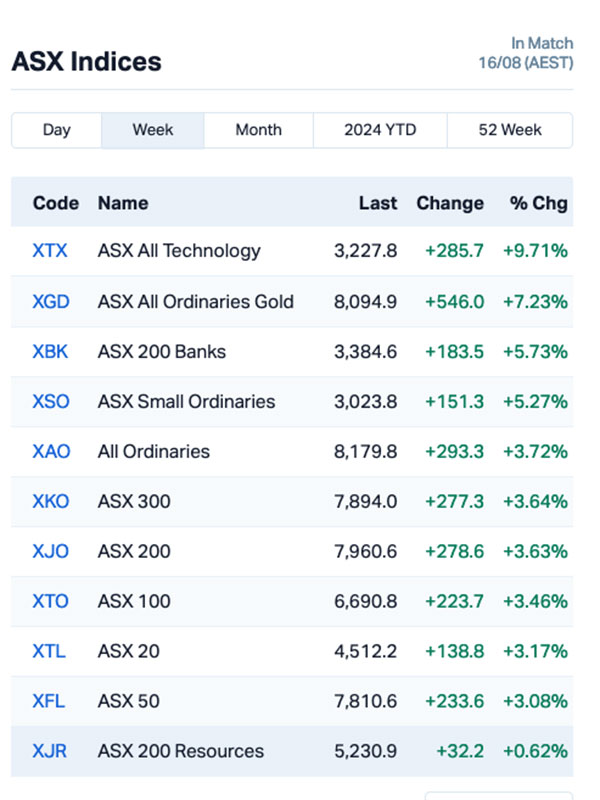

- The ASX 200 put on about 3.5pc this week after a strong recovery

- It was a great week for InfoTech, which piled on over 9.0pc

- Who won the Small Caps race? Read on to find out…

So, you remember how last week was a bit of a disaster, right? Well… this week was quite a turnaround, thanks in no small part to a remarkable rally led by Wall Street’s return to stunning health, which left the local InfoTech sector up more than 9.0% for the week.

That’s a lot by any reasonable measure, and even healthier when you match it with the goldies (which added 7.0%) and the banks (which climbed better than 5.0%) since last week.

It is almost entirely thanks to Wall Street throwing a six-strong series of winning days out in front of us every morning since mid-last week, which helped reinvigorate local investors’ love of making money doing risky things.

That’s not to say that there wasn’t a big chunk of ‘safe’ investing going on as well – last week’s slump presented a golden opportunity for bargain hunters to get in and spend, and the biggest six companies on the ASX have grown handsomely this week as a result.

That includes, of course, the Big Four banks – the worst performer of those was Westpac (ASX:WBC) on a relatively slim 0.8% for the week – plus Health giant CSL (ASX:CSL) (up 1.3%) and the Big Australian BHP (ASX:BHP), up 1.4%.

The combined market cap of the top 6 is now on the happy side of $880 billion – and it’s probably worth noting out of interest more than anything else that of those, only Westpac and Commonwealth Bank (ASX:CBA) are in the green for the past month.

Westpac’s monthly climb is the best of them, up 5.1% while CBA’s is smaller in percentage terms (3.61%) but seriously bigger in real dollar terms.

Outside of who’s winning what at the big end of town, talk was (once again) all about interest rates, because those lucky ducks in the US are probably just a few short weeks away from rate relief, after a swag of data dropped in support of Jerome Powell smashing that “drop” button.

While the jury is still out on just how big that drop will be, there are a number of influential rate drop hawks calling for a strong response to keep the US economy warmer than its current tepid temperature, plumping hard for a 50 basis point cut.

But the smart money’s on a 25 basis point cut in mid-September, with a 4-8 week period of J-Pow’s famous “let’s do nothing and see what happens” thrown in as dessert.

Locally, there are still some people – I’m looking at you lot in the wonk lab at Commsec… – that reckon Australia will get a rate cut in the short term as well.

It’s super-unlikely, though – and we know this because just this morning, RBA Governor Michelle Bullock unequivocally hosed down even the slightest hint of rate relief hopium most people have been holding onto.

According to the RBA, there’s a chance that Australian inflation won’t be back within the rate cut window for as much as two years, and honestly I don’t know if I can face the idea of writing about things the way they are for another 24 months.

Anyway – here’s what else happened this week:

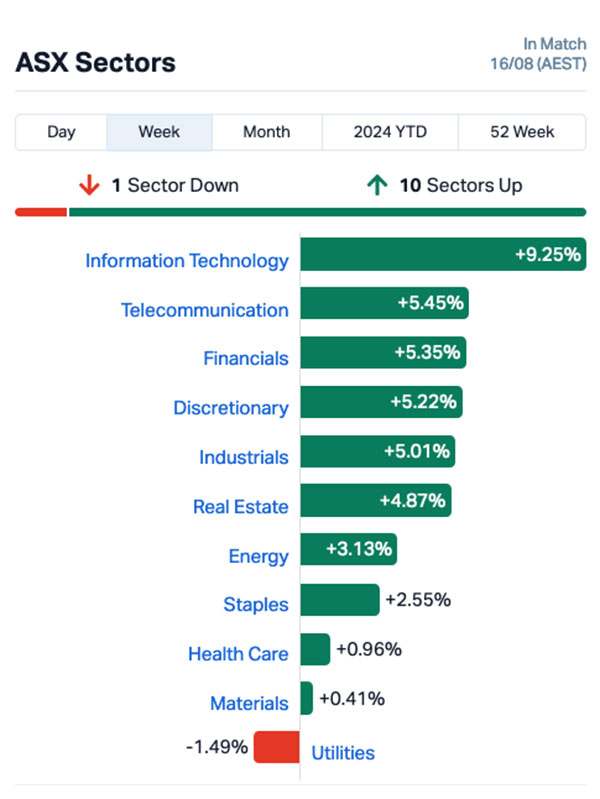

WHAT THE SECTORS DID

Here’s what the market sectors did:

As stated earlier, it’s been a bonza week for the local techies, goldies and the banks – what I didn’t mention before, though, is the hard yards that have been put in by the local Small Caps, which collectively piled on 5.3% this week, which is a crackerjack result.

Utilities, however, has gone backwards this week – and that’s largely due to Origin’s not-very-optimistic outlook for next year, which sent investors storming the exit this week to the tune of -9.6%. Yikes.

THIS WEEK’S ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| RIL | Redivium Limited | 0.005 | 150% | $8,192,564 |

| ARV | Artemis Resources | 0.016 | 100% | $23,002,589 |

| GCR | Golden Cross | 0.002 | 100% | $2,194,512 |

| KPO | Kalina Power Limited | 0.006 | 100% | $12,431,970 |

| LVH | Livehire Limited | 0.046 | 70% | $17,001,503 |

| MOV | Move Logistics Group | 0.325 | 63% | $41,474,556 |

| IMI | Infinity Mining | 0.016 | 60% | $1,543,794 |

| NME | Nex Metals Explorat | 0.041 | 58% | $10,346,562 |

| LTP | LTR Pharma Limited | 1.26 | 56% | $116,584,944 |

| ODY | Odyssey Gold Ltd | 0.02 | 54% | $17,078,552 |

| ABE | Australian Bond Exchange | 0.043 | 54% | $4,957,397 |

| LRS | Latin Resources Ltd | 0.19 | 52% | $517,892,601 |

| L1M | Lightning Minerals | 0.08 | 51% | $6,326,565 |

| LPD | Lepidico Ltd | 0.0015 | 50% | $17,178,250 |

| SUM | Summit Minerals | 0.2525 | 49% | $15,813,146 |

| SNG | Siren Gold | 0.07 | 46% | $12,844,781 |

| AGC | AGC Ltd | 0.305 | 45% | $79,545,139 |

| RHY | Rhythm Biosciences | 0.068 | 42% | $16,904,579 |

| RLT | Renergen Limited | 1.02 | 42% | $30,477,606 |

| APX | Appen Limited | 1.115 | 41% | $201,816,487 |

| ECG | Ecargo Holdings | 0.007 | 40% | $3,691,500 |

| MTM | MTM Critical Metals | 0.035 | 40% | $9,276,526 |

| WTM | Waratah Minerals Ltd | 0.405 | 40% | $74,932,466 |

| HE8 | Helios Energy Ltd | 0.011 | 38% | $28,644,544 |

| ZMM | Zimi Ltd | 0.019 | 36% | $2,406,630 |

| B4P | Beforepay Group | 0.79 | 35% | $32,793,003 |

| A8G | Australasian Metals | 0.12 | 35% | $5,733,254 |

| NHE | Noble Helium | 0.078 | 34% | $37,978,418 |

| AS1 | Asara Resources Ltd | 0.012 | 33% | $9,703,929 |

| JAY | Jayride Group | 0.012 | 33% | $2,126,782 |

| MEL | Metgasco Ltd | 0.004 | 33% | $5,790,347 |

| MRZ | Mont Royal Resources | 0.056 | 33% | $4,761,668 |

| SIS | Simble Solutions | 0.004 | 33% | $3,013,803 |

| SLZ | Sultan Resources Ltd | 0.008 | 33% | $1,580,692 |

| SNS | Sensen Networks Ltd | 0.036 | 33% | $28,004,715 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| TYX | Tyranna Res Ltd | 0.004 | 33% | $13,151,701 |

| VAR | Variscan Mines Ltd | 0.008 | 33% | $3,424,003 |

| ZNC | Zenith Minerals Ltd | 0.048 | 33% | $16,914,282 |

| PDI | Predictive Discovery | 0.225 | 32% | $528,952,946 |

| ASL | Andean Silver | 0.745 | 32% | $75,835,777 |

| ASQ | Australian Silica | 0.029 | 32% | $8,173,951 |

| EXR | Elixir Energy Ltd | 0.1225 | 32% | $131,612,675 |

| CPM | Cooper Metals | 0.072 | 31% | $5,406,540 |

| GW1 | Greenwing Resources | 0.051 | 31% | $10,044,526 |

| NYR | Nyrada Inc | 0.051 | 31% | $9,292,644 |

| MIO | Macarthur Minerals | 0.074 | 30% | $13,177,924 |

| PAM | Pan Asia Metals | 0.105 | 30% | $19,479,426 |

| BMG | BMG Resources Ltd | 0.009 | 29% | $5,470,377 |

| LSA | Lachlan Star Ltd | 0.09 | 29% | $18,681,588 |

Here’s how the Small Cap winners ended up where they were on the ladder.

Out in front was emerging lithium-ion battery recycler Redivium (ASX:RIL), which went soaring on news that it’s now dual-listed on the Frankfurt Stock Exchange, part of the company’s efforts to broaden its investor base into a far larger European marketplace.

Artemis Resources (ASX:ARV) was next best this week, after the company hit some solid gold at its Titan prospect during a recent ground reconnaissance program at its Karratha Gold Project, in the Pilbara region of Western Australia.

Artemis isn’t on to brag, but… the rock chip samples they picked up included a couple that tested so high for gold, it was above the testing equipment’s upper limit of 10,000g/t Au, so little wonder it’s seen some action this week.

Golden Cross Resources (ASX:GCR) is on the list there, but probs doesn’t need to be – it’s seen little to no volume in recent months, and the 100% that’s showing is the needle moving from $0.001 to $0.002, which isn’t hard for a company worth about $2 million.

So in third place, let’s say it’s Kalina Power (ASX:KPO), because that company did have some news, and it was positive – Kalina has set out some highly important MoU’s with natural gas producers for its project development portfolio of Alberta based power plants incorporating CO2 capture and sequestration, setting the company’s near future up with achievable goals to hit moving forward.

THIS WEEK’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| ACW | Actinogen Medical | 0.0265 | -65% | $73,218,017 |

| ICU | Investor Centre Ltd | 0.002 | -50% | $1,218,045 |

| MTB | Mount Burgess Mining | 0.001 | -50% | $1,947,220 |

| RNE | Renu Energy Ltd | 0.002 | -50% | $2,178,402 |

| ATV | Active Port Group | 0.042 | -40% | $13,989,427 |

| SVL | Silver Mines Limited | 0.091 | -35% | $233,745,620 |

| 8VI | 8Vi Holdings Limited | 0.086 | -34% | $3,813,939 |

| CNJ | Conico Ltd | 0.001 | -33% | $2,201,528 |

| DMG | Dragon Mountain Gold | 0.004 | -33% | $1,578,687 |

| RMX | Red Mount Min Ltd | 0.001 | -33% | $3,873,577 |

| SFG | Seafarms Group Ltd | 0.002 | -33% | $12,091,498 |

| PIL | Peppermint Inv Ltd | 0.0075 | -32% | $16,970,867 |

| BXN | Bioxyne Ltd | 0.005 | -29% | $10,233,227 |

| FGL | Frugl Group Limited | 0.026 | -28% | $3,147,259 |

| AS2 | Askari Metals | 0.021 | -28% | $1,863,333 |

| NGS | NGS Ltd | 0.022 | -27% | $2,712,639 |

| ICL | Iceni Gold | 0.042 | -26% | $12,547,008 |

| EMN | Euro Manganese | 0.035 | -26% | $7,847,079 |

| AUH | Austchina Holdings | 0.003 | -25% | $8,401,535 |

| BNL | Blue Star Helium Ltd | 0.0045 | -25% | $7,779,541 |

| CT1 | Constellation Tech | 0.0015 | -25% | $2,212,101 |

| EDE | Eden Inv Ltd | 0.0015 | -25% | $6,162,314 |

| EXL | Elixinol Wellness | 0.003 | -25% | $3,963,547 |

| FGH | Foresta Group | 0.006 | -25% | $14,132,274 |

| GTR | Gti Energy Ltd | 0.003 | -25% | $7,649,841 |

| HOR | Horseshoe Metals Ltd | 0.006 | -25% | $4,642,972 |

| MTL | Mantle Minerals Ltd | 0.0015 | -25% | $9,296,169 |

| SHO | Sportshero Ltd | 0.003 | -25% | $1,853,499 |

| SI6 | SI6 Metals Limited | 0.0015 | -25% | $3,553,289 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| MCM | MC Mining Ltd | 0.105 | -25% | $57,961,869 |

| RFA | Rare Foods Australia | 0.019 | -24% | $5,167,682 |

| OCN | Oceana Lithium | 0.03 | -23% | $2,474,940 |

| MI6 | Minerals260Limited | 0.12 | -23% | $25,740,000 |

| 8IH | 8I Holdings Ltd | 0.007 | -22% | $3,133,448 |

| BSX | Blackstone Ltd | 0.028 | -22% | $14,211,795 |

| MHI | Merchant House | 0.125 | -22% | $14,139,974 |

| SRJ | SRJ Technologies | 0.055 | -21% | $11,309,905 |

| BDG | Black Dragon Gold | 0.015 | -21% | $4,012,765 |

| TFL | Tasfoods Ltd | 0.015 | -21% | $6,556,433 |

| GRE | Greentech Metals | 0.091 | -21% | $8,058,758 |

| DES | Desoto Resources | 0.115 | -21% | $6,991,875 |

| SGA | Sarytogan | 0.115 | -21% | $17,847,999 |

| ZGL | Zicom Group Limited | 0.069 | -21% | $14,804,641 |

| AKO | Akora Resources | 0.1 | -20% | $12,048,738 |

| ALR | Altair Minerals | 0.004 | -20% | $17,186,310 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | $15,000,000 |

| ICR | Intelicare Holdings | 0.012 | -20% | $3,782,996 |

| NGY | Nuenergy Gas Ltd | 0.02 | -20% | $29,619,110 |

| OVT | Ovanti Limited | 0.004 | -20% | $6,090,422 |

HOW THE WEEK SHOOK OUT

Monday 12 August, 2024

Pharm X stock surged just a few days after tanking on the bombshell news of failed legal proceedings against Fred IT. PharmX Technologies will be required to repay to Fred IT the circa $8.1 million Fred paid to PharmX on 3 June 2023, and to pay to Fred IT as yet unquantified additional amounts for interest on that sum, and Fred IT’s costs of the trial and the appeal.

St George Mining (ASX:SGQ) dropped an urgent sounding update on its proposed acquisition of the “advanced, high-grade niobium-REE Araxá Project in Minas Gerais, Brazil.” SGQ then shot up 40% on refuting claims on social media that its ownership of the world-class Araxa niobium project in Brazil was impeded by environmental concerns.

“The Company is aware of misinformation circulating in online chat rooms and social media regarding Araxá – particularly claims that an active tailings dam is located within the Project area and that significant high-grade mineralisation discovered at the Project is beneath the tailings dam – and SGQ says it’s all nonsense and not to be believed.

Woomera Mining (ASX:WML) was up alongside Kincora Copper (ASX:KCC) after they announced a deal in the shape of a legally binding earn-in term sheet which grants Woomera a 100% earn in interest in KCC’s Bronze Fox Project, located in the world-class Southern Gobi copper belt in Mongolia.

Tuesday 13 August, 2024

Packaging giant Orora (ASX:ORA) saw its share price lift 18% in morning trade after announcing it had rejected a $2.55/share takeover offer by US private equity group Lone Star, describing it as “opportunistic” and “conditional”.

“The board, together with its advisers, carefully considered the indicative proposal and determined that it is not in the best interests of its shareholders to further engage with Lone Star on the basis of the indicative proposal, which materially undervalues Orora,” ORA says in an ASX announcement.

Variscan Mines (ASX:VAR) is up 17% after announcing it has appointed Square Trading as its exclusive marketing manager for the worldwide sale of zinc concentrates from its Novales-Udias and Guajaraz Projects in Spain.

VAR says Square Trading will also assist the company to secure third-party financing to construct and operate the mines it is developing. Square Trading is a shareholder in Zinc GroupCo, which is VAR’s largest shareholder.

LTR Pharma (ASX:LTP) is up 25% today after announcing it has entered a co-development agreement with Aptar Pharma for Spontan, its nasal spray treatment for erectile dysfunction (ED). LTP says the deal will combine LTP’s pharmaceutical development capabilities with Aptar Pharma’s expertise in nasal spray technology, supporting a streamlined regulatory pathway and market access for Spontan.

Rock chip sampling of Leeuwin Metals’ (ASX:LM1) West Pilbara iron ore project has has shown values of >50-55% iron along a 1.7km strike. Satellite imagery and mapping turned up the prospectivity for lucrative channel iron deposits (CID), with multiple target areas present within the project area.

CID’s are a major source of cheap iron ore that is close to the surface and can be calcined into 63%+ iron, mined nearby at Rio Tinto’s (ASX:RIO) 326Mt at 56.3% iron Mesa A and CZR Resources’ (ASX:CZR) 33.4Mt at 55% iron Robe Valley in the Pilbara’s Robe River region. Further ground exploration is about to commence at West Pilbara to try and prove up the CID targets, which could turn the project into another Robe River iron ore mining operation.

Wednesday 14 August, 2024

LiveHire (ASX:LVH) was leading the way on Wednesday after news broke that MA Moelis Australia, on behalf of Humanforce Holdings, has launched an on-market takeover of Livehire, offering $0.045 per share – a substantial premium to the stock’s overnight close of $0.024 per share. The offer to purchase shares at that price will remain open until September 30.

Noxopharm (ASX:NOX) jumped more than 40% on Wednesday morning after releasing promising new data about its CRO-67 drug, which targets pancreatic cancer. The drug is designed to overcome the challenge posed by the dense barrier of cells surrounding pancreatic tumours, which typically protects the tumours from both anti-cancer drugs and the body’s immune system. CRO-67 works by targeting and destroying both the cancerous cells and these protective barrier cells.

Estrella Resources (ASX:ESR) was rising on news that the company has applied for four additional highly prospective Exploration and Evaluation Licences in Baucau Municipality, Timor-Leste, covering 194.4km2 and valid for four years. Estrella says that manganese mineralisation has already been spotted from surface within the application area.

Gold Mountain (ASX:GMN) was up on news of high-grade results from channel samples from the Irajuba tenements in its Down Under Project area, with peak values of 1045 ppm TREO apparent in a strongly weathered profile, alongside magnet REE of up to 33.6% of TREO, and heavy REE of up to 19.1% of TREO. The company says that augur drilling is next on the list of activities at the site, to drill below the strongly leached zone into saprolite to test the boundaries of the find.

Forbidden Foods (ASX:FFF) was also climbing on news of an acquisition, this time via a share purchase agreement (SPA) that has been executed to purchase leading plant-based non-dairy business Oat Milk Goodness, under which Forbidden Foods will acquire 100% of the shares in OMG for a consideration of $3.42m via the issue of 285m ordinary shares priced at 1.2c per share, subject to conditions precedent and shareholder approval.

Evion Group (ASX:EVG) was up on news that the Madagascan government has confirmed a new Mining Code which includes granting of development and production licences for compliant graphite projects, and has set out a programme for the issuing of new mining permits.

Titomic (ASX:TTT) was up on news that it has received further purchase orders from a global U.S. aerospace and defence prime totalling $577,000, and says that the orders represent “a significant milestone in the Company’s relationship with this global US aerospace and defence prime reflecting a qualification period spanning several years with this order taking cumulative orders on this project to over $1.0 million”.

Nimy Resources (ASX:NIM) has hit into a 10m interval of volcanic massive sulphide, or VMS, from its first RC drill hole at its Mons VMS project. Mons is in the Forrestania nickel belt west of Kalgoorlie where IGO’s (ASX:IGO) nickel operations are located. It raised just over $1m for exploration that’s currently running its finger over a previous 5m @ 0.73% nickel, 0.53% copper, 0.06 % cobalt and 0.55g/t PGE’s from 102m anomaly it discovered at the Masson prospect – and has a diamond drill ready to spin to drill beneath the two RC pre-collars it just completed.

One of Waratah Minerals (ASX:WTM)’s substantial holders, Farjoy, has increased its stake in the junior from 5.08% to 7.49%, injecting almost $1.5m – as a maiden RC drilling campaign continues at the Spur project. It put in $232,000 as part of a $5m placement that WTM is using to accelerate drilling at its Spur gold-copper project – and has just thrown in another $1.2m-odd purchase for 4 million shares. It’s been a good month for the stock price so far, with results from another six holes from the current drill program consistently hitting shallow, high-grade gold mineralisation – up to 9.33g/t Au with 0.38% Cu.

Thursday 15 August, 2024

Artemis Resources (ASX:ARV) was up on news that high grade gold has been reported in veins at Titan prospect with abundant visible gold at surface, with the prospect tracked over 700m and remaining open. Early rock chip assays have come in strong, with three samples providing results that exceeded the testing equipment’s 10,000g/t upper limit. The company says that gold that it has already picked up at the site has been smelted into a 10.4oz bar, and that the site is just 2km from its existing Carlow project which boasts an MRE of 374,000oz Au.

Nex Metals Exploration (ASX:NME) was continuing on from its decent day yesterday, when it announced that drilling has re-commenced at its highly prospective Yundamindra Gold Project. Nex followed that up with news today that a new chief executive has been appointed, with Maki Petkovski taking the helm as of 15 August, 2024.

Latin Resources (ASX:LRS) was soaring on news that the company and its giant Salinas lithium project in Brazil is set to be acquired by mining giant Pilbara Minerals (ASX:PLS), in a deal worth around $580 million. Pilbara is offering the equivalent of ~$0.20 a share, to be delivered as 0.07 PLS shares, a premium of 57% on the LRS 10-day VWAP.

Lightning Minerals (ASX:L1M) was up on Latin Resources’ news. L1M has expanded its lithium tenure in Brazil by snapping up the Esperança project which is just 5km away from its recently acquired Caraíbas and Sidrônio lithium projects in Minas Gerais, Brazil. The company’s stock rise today may have something to do with Pilbara Minerals’ buyout of LRS, since L1M’s tenements are along trend from its lithium deposits, including the more than 70Mt Colina.

The option agreement to purchase allows for identification of drill targets prior to the potential full acquisition. Current exploration work will carry over to the new Esperança project, which includes ground recon, rock chip and soil sampling.

Emerging lithium-ion battery recycler Redivium (ASX:RIL) has been boosted by news that the company has started trading on the Frankfurt stock exchange, with the dual-listing undertaken to support the company’s strategy to broaden its investor base outside Australia.

Volt Resources (ASX:VRC) was up on news that it’s planning a $500,000 capital raise via Convertible Note to professional and sophisticated investors, after the company’s successful push to reduce cash burn from $9,528,000 during FY23 to $4,610,000 in FY24.

Lachlan Star (ASX:LSA) made gains on news of a wide disseminated copper sulphide system discovery at the Basin Creek Prospect, part of the Junee project in NSW, following comprehensive relogging of half-a-century-old diamond drill core. The company says it has uncovered historical high-grade intercepts including 21.3m @ 4.51% copper from 41.1m, and 3.1m at 5.50% copper from 59.4m.

Kalina Power (ASX:KPO) was up on news of the execution of important tolling MOUs with natural gas producers for its project development portfolio of Alberta based power plants incorporating CO2 capture and sequestration. The volumes set out under the MOUs represents 40,000 GJ per day and is sufficient to supply the requirements of KDP’s first ~170 MW project of ~ 36,300 GJs per day.

Litchfield Minerals (ASX:LMS) gained on on news that drilling at the Silver King project area in West Arunta has intersected massive base metal sulphides, with intercepts of 17m at 2.47% Pb, 1.06% Zn, 15.7 g/t Ag from 49m, including 3m at 11.84% Pb, 5.62% Zn, 0.1% Cu, 57.1 g/t Ag from 51m among the highlights.

Perpetual Resources (ASX:PEC) was on the winner’s list on news that initial drill results from its Raptor project confirm that exceptionally high TREO grades persist at depth, with “a significant weighting towards the higher-value Neodymium-Praseodymium (Nd+Pr) rare earth oxides”. Standout intercepts include 12m at 4,601ppm TREO (23% Nd+Pr), and 7m at 4,240ppm TREO (23% Nd+Pr) – both from surface.

And, OncoSil Medical’s (ASX:OSL) surged 20% as its device has been successfully used to treat its first commercial patient at Memorial Hospital in Istanbul, where the patient’s pancreatic tumour was successfully removed. The patient, initially diagnosed with locally advanced pancreatic cancer that was deemed inoperable, received OncoSil treatment alongside chemotherapy. The OncoSil treatment uses a specialised device to deliver targeted radiation directly to pancreatic tumours, helping to shrink them and improve their operability.

Friday 16 August, 2024

A2 Milk (ASX:A2M) jumped almost 5% after telling investors that it has settled a long-standing dispute with Synlait Milk (ASX:SM1), allowing it to start producing its own infant formula. The deal, which involves a $22.6 million payment, ends an exclusivity agreement and resolves their complex relationship, where Synlait previously supplied most of A2 Milk’s formula.

Miramar Resources (ASX:M2R) announced the commencement of the maiden drilling campaign within the Company’s 100%-owned Bangemall Project portfolio in the Gascoyne region of WA, co-funded through the WA Government’s Exploration Incentive Scheme (EIS) to test several airborne +/- ground EM anomalies at Mount Vernon and Trouble Bore highlighted by Miramar’s exploration programs.

Poseidon Nickel (ASX:POS) was climbing after the company refiled news of gold mineralisation, “very similar to nearby gold mines including Kanowna Belle and Gordon Sirdar”, at the company’s Black Swan prospect in the WA Goldfields. Poseidon refiled the announcement after it tripped over the rules around announcing visual gold during early exploration while showing off some of the 52 gold nuggets with a combined weight of 17.9g the company has picked up.

Elixir Energy (ASX:EXR) was also up Friday after delivering an update on its Daydream-2 program in the 100%-owned Grandis Project in Queensland’s Taroom Trough. Elixir says the flow test of the Lorelle Sandstone post stimulation is complete, with work moving on to the stimulation of the 5 upper zones. Lorelle Sandstone flows gas at stabilised flow rates of 2.1 and 2.5 MMSCFPD, which is approaching requirements for the entire project to clear the modelled pre-production economic hurdle

Larvotto Resources (ASX:LRV) was up on China’s news. Targeting first ore in 2026, LRV’s Hillgrove gold-antimony project in NSW has a maiden 606,00oz AuEq reserve, yet it’s the antimony that could really be the economic kicker, with 39,000t of the material.

Priced conservatively at US$15,000/t and including the gold endowment, the project is expected to have a capex of $73m and an NPV8 of $157m, according to a PFS.

At spot prices though, the NPV8 sits at $383m and an eye-whopping IRR of 114%. Those numbers are huge, and China’s export restriction announcement could see antimony prices spike considerably.

Adriatic Metals (ASX:ADT) was up no news, but the company did announce earlier a fatality at its Rupice deposit, part of its 65,000tpa Ag and 90,000tpa Zn Vares silver-zinc mine in Bosnia and Herzegovina, when an employee of a local Bosnian sub-contractor’s vehicle overturned. The incident didn’t occur near any mining operations but ADT secured the mine for 24 hours just in case.

It follows a tumultuous time for Adriatic, which saw its CEO and MD Paul Cronin resign, stepping down and returning to Australia ‘for family reasons’. He was replaced by interim CEO Laura Tyler who yesterday said ADT was ‘deeply saddened’ by the ‘tragic incident’.

Hard rock lithium explorer Patriot Battery Metals (ASX:PMT) was up on recent news. PMT is trundling along with exploration of the 80.1 Mt at 1.44% Li2O indicated resource at its Shaakichiuwaanaan (formerly Corvette) project in Canada. It’s just hired Alex Eastwood as a senior mining executive to help drive commercialisation efforts downstream. Eastwood is a Pilbara Minerals (ASX:PLS) alumni, rejoining his former-coworker and PMT MD Ken Brinsden.

Wildcat Resources (ASX:WC8) is up almost 20% this week as it continues to prove up its Tabba Tabba lithium project in the Pilbara, which is surrounded by the world-class 414Mt Pilgangoora and 259Mt Wodgina hard rock lithium mines. It’s Leia deposit continues to bring in the hits, with 67m at 1.9% Li2O, including 46m at 2.5% registered to the market on August 5.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.