ASX Small Caps Weekly Wrap: Chinese stimulus delivers a bumper week for Materials

I genuinely have no idea what animal this is. Pic: Getty Images

- The ASX 200 barely broke even this week, up just 0.25pc

- Stimulus in China sent Materials soaring, up nearly 10pc for the week

- Who won the Small Caps race? Read on to find out…

It’s Friday afternoon, and you know what that means… a mad scramble to look back over the results for this week and try to make sense of what’s been happening.

Luckily, it’s blindingly obvious what’s happened, because the market’s come in flat as a tack for the week, with a massive bright spot in the Materials sector, courtesy of China announcing massive stimulus efforts, in a bid to defibrillate their economy before it’s too late.

Early in the week, word spread that China’s central bank is going to force-feed 1 trillion yuan into the gaping maw of the Chinese economic system, which many took as a sign that the country’s formerly inexhaustible hunger for raw materials – especially our iron ore – might be about to ramp back up.

Then yesterday, during a very serious monthly gathering of China’s 24-person Politburo, President Xi Jinping called publicly for the government to “spend! spend! spend!” in support of the stimulus package by the bank.

The already red-hot Resources sector on the ASX didn’t specifically need another kick up the bum – but it didn’t hurt, and that’s left Materials up by nearly 10% for the week, with some of the Really Big Guns stacking on enormous gains.

Fortescue added more than 15% for the week… South32 gained 14.8%, BHP was up 11.3%, while Rio Tinto added 11.1%. Those are big numbers for some of the biggest companies on the bourse.

I had a bit more to say on the topic of stimulus, however I got a phone call about 10 minutes ago from a remarkably pretty lady-friend, asking me out for dinner tonight – so both my ability and my desire to write anything more this afternoon have vanished… as shall I in about 60 seconds.

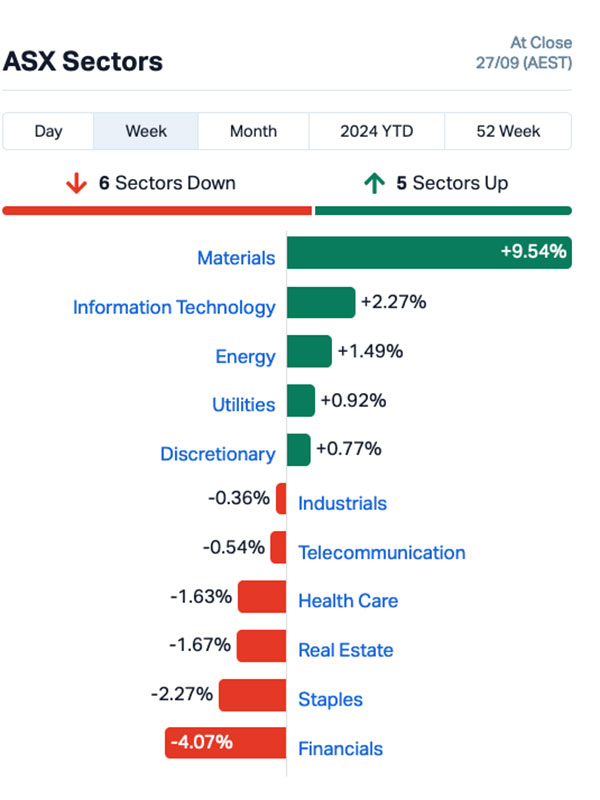

WHAT THE SECTORS DID

Here’s what the market sectors looked like by the end of play on Friday:

Leaving aside the surge for Materials, the rest of the market was – let’s be honest – a bit crap.

There weren’t really any massive standout stories to be gleaned from these charts – which is to say that I didn’t spot any, but that’s far from an exhaustive yardstick… if I missed something, my email address isn’t hard to find – and it’s been a while since anyone’s bothered to hassle me about stuff.

It’s worth noting that the banks took a beating this week, probably because the RBA didn’t budge on rates again – but, given how interminably tedious any and all talk of interest rates is right now, you’ll have to forgive me for outright refusing to write any more than that about it this arvo.

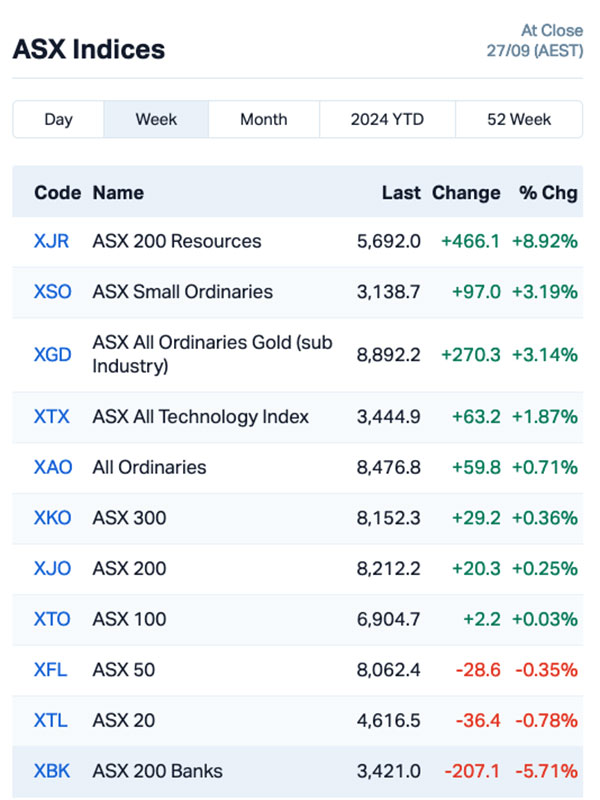

Here’s how the sub-sectors and ASX indices landed at the end of the week.

HOW THE WEEK SHOOK OUT

Monday 23 September, 2024

Media company Motio (ASX:MXO) was up after delivering an investor update to the market, drawing attention to the company’s performance in FY24. Motio says that it has managed to bring in a 27% rise in revenue to $8.367 million on a gross margin of 72%, with the company guidance for FY25 coming in at a 10%-15% increase on pcp, targeting between $9.2 million to $9.6 million.

Mithril Silver and Gold (ASX:MTH) was rising, most likely on the back of Friday’s report that the company has hit a fantastic intercept at its Copalquin project in Mexico. The company says the drill result has come back at a breathtaking 7m grading 144g/t gold and 1162g/t silver, with that intercept from a down-hole depth of just 18m forming part of a broader 33m intersection at 31.8g/t gold and 274g/t silver from surface.

Lachlan Fold Belt explorer, Golden Deeps (ASX:GED), has made another splash after news broke about an 80m-thick high-grade copper intersection from its Havilah project, which sent the share price nuclear.

It dipped on news of a subsequent $1.78m capital raising, yet shares are back up today after announcing a bigger 92m sulphide hit that extends the Hazelbrook copper zone at Havilah. Copper grades of up to 3.6% were discovered using a handheld pXRF reader, and while those visual readings are no substitute for lab analysed confirmation of grades, they bode well for future exploration work. The intersection of another thick zone of sulphide mineralisation in [hole] HVD004, including patches of copper sulphides, extends the Hazelbrook mineralised zone 200m to the northeast of the 80m sulphide intersection in HVD003.

Avecho (ASX:AVE) rose after delivering a not-exactly-stellar half-year financial report this morning, showing that the company has experienced a revenue drop of 30% for the period to $312,187, which the company says is “mainly attributable to a decrease in Vital ET sales made to Ashland during the period”. However, Research and development tax incentive and other income increased by 80% to $725,182 – and the company currently has net assets of $4,216,535, including cash and cash equivalents of $4,838,410.

Emperor Energy (ASX:EMP) was up on news that it has received firm commitments to raise $1.25 million in an institutional placement, at an issue price of $0.007 per share with Nero Resources Fund, Perennial Value Management and Regal Funds Management set to become substantial shareholders. The company has also appointed Argonaut as a strategic financial advisor to assist with progressing the Judith Gas Field Project.

New Age Exploration (ASX:NAE)’s early exploration drilling at its Wagyu gold project in WA’s Pilbara is gaining attention as the junior plans to drill ~4300m as part of a Phase 2 program that’s continuing to test high-priority targets, including potential ‘Hemi-style’ intrusive systems just 9km along strike from De Grey Mining’s (ASX:DEG) ~10.5Moz Hemi gold deposit.

The AC drilling is testing additional gold targets that were identified from geophysics surveys and are following up on Phase 1 geological observations. Phase 1 itself was completed between July and September across gold targets on the eastern side of the project with >7640m drilled across 156 holes, which are currently being assayed for gold and multi-elements, with expected by the end of the month.

Laramide Resources (ASX:LAM) was also rising, but today’s news of a change of Director’s interest most likely wasn’t the cause. Last week, the company revealed first assays from its Long Pocket infill drilling progrem, which returned strong uranium mineralisation at shallow depths. Significant intersections included 10m @ 606ppm U3O8 from 6m depth, including 2m @ 1,726ppm U3O8 from 11m, and 8m @ 1,770ppm U3O8 from 16m depth, including 4m @ 3,128ppm U3O8 from 17m.

Tuesday 24 September, 2024

Element 25 (ASX:E25) was up on exciting news that it has been selected for award negotiations for a US$166 million grant from the US Department of Energy (DoE) under the Battery Materials Processing Grant Program. The funding will support the construction of Element’s proposed battery-grade high-purity manganese sulphate monohydrate (HPMSM) facility in Louisiana, USA, and the funding is additional to the US$115 million already committed by offtake partners General Motors and Stellantis.

Recent diamond drilling has confirmed a thick zone of antimony copper mineralisation at West Cobar Metals’ (ASX:WC1) Bulla Park project. The drilling supports further confidence of a large antimony copper system at Bulla Park, alongside previous drilling results that include 33m at 0.47% Cu and 0.15% Sb from 229m.

Clover Corp (ASX:CLV) was up despite delivering an annual report this morning that showed a total revenue of $62.2 million which was in line with guidance, but also marked a decline from the previous year’s $79.9 million. Clover also reported that net profit after tax (NPAT) also saw a significant drop, falling to $1.5 million from $6.2 million in FY23.

E&P Financial Group (ASX:EP1) rose after the company dropped a grab-bag of announcements, first informing the market that it has finalised a $12.5 million conditional placement of 125,000 convertible notes at a face value of $100 per note, mandatorily convertible into fully paid ordinary shares at a conversion price of $0.52, together with free-attaching options to wholesale investors. That was quickly followed by news that the company has officially requested to voluntarily de-list from the ASX, subject to the results of an extraordinary General Meeting, which was announced immediately after the second announcement, at which shareholders will also vote on a proposed an off-market equal access buy-back for up to $25,000,000.

After receiving a $10.7m exploration grant in June for its Cowboy State Mine rare earths project in Wyoming – touted as potentially one of the largest REE deposits on the planet – American Rare Earths (ASX:ARR) has been backed by the US govt’s Export-Import Bank (EXIM) to the tune of up to US$456m.

The Cowboy State Mine has an enormous 2.34 BILLION tonne JORC resource, with 7.48Mt total rare earth oxides (TREO) with a basketful of high-priced magnet metals such as neodymium and praseodymium.In a letter of intent from EXIM, the outlined debt-funding package will go towards the construction and execution of the project’s mining area at Halleck Creek and covers all initial capex that was outlined in a scoping study earlier this year.

EXIM Bank made the offer based on the preliminary information submitted regarding expected US exports and US jobs to be created through the CSM project and indicated a repayment tenor of 15 years under EXIM’s Make More In America Initiative.

A 190m-long antimony intercept had West Cobar Metals (ASX:WC1) shares flying as diamond drilling confirms a thick zone of antimony-copper mineralisation at Bulla Park with structural control from a major WSW trending fault.

The explorer says the find provides further confidence of a large antimony-copper system with strong economics, with antimony up around the US$22,700/t mark and red metal prices recovering up to ~US$9,300/t. Additional drilling is being planned to prove up a maiden antimony copper mineral resource estimate at Bulla Park.

Earlier, Poseidon Nickel (ASX:POS) was up after it reported finding several gold anomalies extending over multiple soil traverses (between 400m to 800m) following reconnaissance soil sampling at its Black Swan project. The company also said a coherent gold anomaly has been defined (up to 54ppb Au) that is 1.4km by 1km in size and remains open to the south at its Wilson’s prospect.

Wednesday 25 September, 2024

ReNu Energy (ASX:RNE) doubled up (from $0.001 to $0.002) on news that it has entered into a binding Grant Deed with the Tasmanian Government for the award of up to $8 million of funding for its Tasmanian green hydrogen project, to be paid on delivery of green hydrogen to customers.

Western Gold Resources (ASX:WGR) was up after the company published a positive Scoping Study for its Gold Duke project in Western Australia, noting that the study has only assessed the economics based on mining 51% of the current published 2.9Mt at 2.07g/t for 234,000oz gold mineral resource of Gold Duke.

Lodestar Minerals (ASX:LSR) was up on news that test drilling at its Ned’s Creek site has been completed, and data from two drillholes at the Ned’s Creek project in Western Australia is due from the lab imminently. Lodestar recently completed placing of the Rights Issue shortfall, with exploration at Ned’s and inaugural Aircore drill testing on gold anomalies at Coolgardie West set to kick off shortly.

Ecofibre (ASX:EOF) was up on news that it has completed an agreement with Under Armour for the supply of NEOLAST yarns to Under Armour’s nominated knitting mills, including the purchase of associated manufacturing equipment. The initial term of the supply agreement is three years, with an expected annual revenue at full production of US$6.0 million.

Si6 Metals (ASX:SI6) announced plans to undertake a non-renounceable rights issue of one (1) fully paid ordinary share in the capital of the company for every two (2) shares held by eligible shareholders at an issue price of $0.001 per share (pre-consolidation) or $0.02, with funds raised to go towards exploration programs at the Lithium Valley (lithium), Pimento (rare earth elements) and Monument (gold) projects and for general working capital purposes.

Earlier, Great Boulder Resources (ASX:GBR) revealed that infill and extensional RC drilling at its Mulga Bill project has intersected more extremely high gold grades, extending the resource and adding thickness and grade to existing lodes. Highlights include 5m @ 43.13/t Au from 185m, including 2m @ 102.80/t Au from 186m, and 5m @ 40.61g/t Au from 256m, including 1m @ 194.50g/t Au from 258m.

In a strategic move to expand its niobium exploration tenure in Brazil, Power Minerals (ASX:PNN) has inked an option agreement to acquire the Tântalo project in Paraiba state.

It resides south of the company’s Nióbio project and adjacent to Summit Minerals (ASX:SUM) Equador niobium project, where it has seen recent success of its own. Power will make a non-refundable payment of $50,000 and carry out a 60-day due diligence period.

PNN says the acquisition would represent a major, material expansion of Power’s niobium, tantalum, REE and lithium-prospective ground position in Paraiba state, Brazil, and reinforces its position as a South American-focused explorer and developer.

$30 million capped Labyrinth Resources (ASX:LRL) was up again, with a whole bunch of executive movements bringing investors onside. Monday’s close of the deal to acquire the Vivien mine, famously worked over by Ramelius Resources, came alongside a host of management and board changes.

Alex Hewlett and Kelvin Flynn are now on the board. Their list of credits between them include Spectrum Metals, Silver Lake Resources, MinRes, Delta Lithium and Wildcat Resources, the latter where the two worked on the transformational Tabba Tabba lithium deal. Charles Hughes has flown in as CEO. A former Bellevue, Northern Star and Saracen man, the geo has led the drilling teams at Delta’s Mt Ida lithium and gold projects over the past three years.

It comes as the company reloads for a fresh assault on the gold potential at Comet Vale and Vivien, with a share consolidation upcoming and ~$2m entitlement offer in the works.

And, cancer cell therapy drug developer Chimeric Therapeutics (ASX:CHM) has struck an alliance with a US blood bank that will enable access to ‘fresher’ blood cells for its proposed immune therapies. Chimeric’s collaboration is with the Los Angeles-based Achieve Clinics, which cryopreserves product collected from apheresis: the process of dividing blood into its components of red and white blood cells, platelets and plasma.

Chimeric is now recruiting gastrointestinal cancer patients in the US for a phase I/II trial of its CHM CDH-17, “the world’s first cadherin 17- directed CAR-T cell therapy.”

Thursday 26 September, 2024

Catalina Resources (ASX:CTN) was up after it delivered its annual report, which is 73 pages long. The rump of the info is that the company is progressing re-permitting to re-commence direct shipping ore project at the Nelson Bay River Iron project, along with gearing up for diamond drilling program at its Lachlan Fold Belt project.

Additionally, aircore drilling totalling 25 holes for 1,593 metres has been completed at its Laverton project, returning anomalous gold and REE results up to 2.42g/t Au and 1m @ 16,426ppm TREO.

Alterity Therapeutics (ASX:ATH) was up by quite a lot, well ahead of it delivering its Annual Report this afternoon, which I haven’t read because it is 149 pages long and I only have one set of eyes. Let’s assume it was great news, and move on.

Bastion Minerals (ASX:BMO) was up after announcing that it has secured the services of Canadian Northwest Territories geological experts Aurora Geoscience to prepare an exploration plan to follow up historical work and gain a better understanding of a “large >520m long mineralised quartz vein” identified by previous owners Mariner Mines, during previous exploration that intersected grades up to 18.4% Cu.

Rincon Resources (ASX:RCR) was up on news that it is about to kick off a major new soil sampling program over several tenement areas at Laverton, where the company holds a land package of over 150 km2 within the highly endowed gold district.

Vital Metals (ASX:VML) was on the winner’s list, but the announcement today is just notice of the upcoming AGM – and the price movement was from $0.0020 to $0.0025.

Gladiator Resources (ASX:GLA) was rising sharply on news of a high-grade uranium find at the Mkuju Uranium Project, located in southern Tanzania, where drilling has confirmed six mineralised intervals including 7.1 metres averaging 1,963ppm eU3O81, from 63.1 metres depth.

Earlier in the day, Western Mines Group (ASX:WMG) was up after announcing assay results for three Phase 3 RC drilling holes at Mulga Tank, which show “broad zones of nickel sulphide mineralisation – elevated Ni and S coincident with highly anomalous Cu and PGE”. The intercepts include 188m at 0.28% Ni, 129ppm Co, 57ppm Cu, 23ppb Pt+Pd from 112m S:Ni 1.1.

Titomic (ASX:TTT) was rising this morning on news that it has sold its first D623 cold spray system to an Australian client, United Industrial Solutions, a specialist in coatings and corrosion mitigation for the resource sector, for $174,000. Titomic says the system’s primary application will be “the deposition of corrosion-resistant coatings on critical oil and gas assets, primarily in Western Australia”.

Arika Resources (ASX:ARI) – formerly known as Metalicity – was up on news that assays received from a further 9 holes at the Pennyweight Point prospect within the Yundamindra gold project, have returned “further exceptional results”, such as 30m @ 2.36 g/t Au from 64m, and 23m @ 2.84 g/t Au from 53m. Arika currently holds an 80% stake in the project, alongside 20% stakeholder Nex Metals (ASX:NME).

Premier1 Lithium (ASX:PLC) – formerly known as SensOre – was rising early after releasing the results of a strategic review of all exploration assets for their gold and copper potential based on all available historical exploration data. The company says the review has identified “significant untapped potential within the Yalgoo project area” in WA’s Murchison region, where historical drilling has revealed “numerous high-grade gold intercepts at near surface that have been largely untouched since the 1990s”.

Friday 27 September, 2024

Douugh (ASX:DOU) – the company named after the sound of Homer Simpson falling down a well – was charging hard on news that it has signed a binding agreement to acquire US B2B fintech services platform R-DBX, in a deal that the company says will provide it with a stable positive income stream which in 2023 generated $1.1 million. Douugh has also secured $1 million in working capital via a loan from US-based Relentless Fintech Partners.

4D Medical (ASX:4DX) was up on news that it has signed a comprehensive distribution agreement with Philips, to help the company establish a transformative commercialisation pathway in the United States. Under the terms of the deal, Philips will have exclusive distribution rights to the 4DMedical suite of products with US government customers and non-exclusive rights with all other US customers.

Black Canyon (ASX:BCA) has been boosted by news that drilling has intersected high grade manganese at the W2 prospect at Wandanya, 80km south of the Woodie Woodie Mine in WA. The company says that Portable XRF (pXRF) analysis indicates grade ranges of between 15% to 55% Mn, but – arguably more importantly – the geology of the find “expands the scope to explore for additional high-grade mineralisation along strike where the company has mapped 1.75km of intermittent high grade outcropping manganese”.

Nyrada (ASX:NYR), a drug development company specialising in novel small molecule therapeutics, was climbing on news of the successful completion of a dog toxicology study for its lead candidate, NYR-BI03. The study provided continuing data to support safety and tolerability of the drug, and Nyrada says it is on track to commence first in-human Phase I clinical trial for NYR-BI03 in late CY2024.

Cobalt Blue (ASX:COB) was up on yesterday’s annual report. After booking a $30m impairment to the value of its assets earlier this year and facing oversupply in the cobalt market, COB had a pretty severe drop in share price of 67% in the last year.

An annual report released yesterday has started to lift spirits – and the stock price again – after stating concentrated commitments to its corporate governance and making significant strides in its operations.

This includes the initiation of the Kwinana Cobalt Refinery Study and the commencement of engineering work by Tetra-Tech, while also partnering with Iwatani Corp for potential collaboration on the refinery and its Broken Hill project.

Nothing brewing lately with Loyal Lithium (ASX:LLI) and the last announcement to the market was about partnering with McGill University to access a C$1m research grant to advance its lithium projects in Canada.

It’s got a field program underway at its flagship Trieste project in Quebec’s prolific James Bay lithium district where 10 geo’s are are conducting field prospecting and are due to wrap up the program today. They’ve been concentrating on five resistivity trends across an extensive 22km stretch that align with all six known spodumene-bearing pegmatite dyke outcrops within the project area that showed up to 2.2% Li2O near surface.

Polymetals Resources (ASX:POL) continues to skyrocket after receiving an upgraded ~$30m funding in a loan facility and offtake agreement with long term partner UK-based commodities trader Ocean Partners for its Endeavour base metals mine in mid-September.

The mine developer remains on track to restart Endeavour which comes in with a pre-tax NPV8% of $414m, IRR of a whopping 345% and free cash flow of $609m over the 10-year mine plan with an average annual EBITDA of $89m over the first five years.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.