ASX Small Caps Lunch Wrap: Which international fugitive has done Australia proud this week?

Meanwhile, in the board room at Qantas... Pic via Getty Images.

Local markets have been putting on quite a show this morning, as the market gained momentum ahead of the always-impactful National Accounts data from the Australian Bureau of Counting Things.

In the lead-up to the announcement, the benchmark climbed just shy of 1.0%, driven by market expectations that the economy had expanded by about 0.4 per cent for the quarter and 1.8 per cent over the past year.

But… that wasn’t the case. Economic growth came in at half that expectation, at just 0.2% over the three months to September 30 and 2.1% over the past year.

There was an immediate 6-point dip on the benchmark when the numbers landed, but as we rolled into lunchtime it seems to be correcting itself.

Elsewhere, there’s been some good, old-fashioned Aussie biffo in Canada this week, after a kangaroo got loose in Oshawa, about 65km east of Toronto.

The roo was being moved between local zoos, but made a break for it and managed to evade capture for four days, roaming free until it was spotted and reported by an eagle-eyed resident.

Local police descended on the area, and kept the wayward roo under surveillance while they tried to figure out the best way to catch it.

When officers called the experts for advice, they got the most Aussie advice ever – “just grab it by the tail, and hang on. We’ll be there shortly.”

“So in accordance with best practice by the handlers, the officers just actually grabbed it by the tail and they were able to safely keep her detained in the area,” Staff Sgt. Chris Boileau told reporters.

But, showing the kind of true grit that has made Australia the envy of the world for centuries, our jumpy little ambassador didn’t go down without a fight, reportedly leaving one Canadian cop requiring medical attention after being “punched in the face” by the roo during the take-down.

Australia 1, Canada 0.

TO MARKETS

The somewhat disappointing National Accounts data this morning gave local markets a small pause just before lunch, but with plenty of momentum behind it from some eager trading this morning, the ASX looks set to weather this little storm reasonably well.

But… there are signs that there’s some hard times ahead, mainly stemming from news that the nation’s household saving ratio has fallen to 1.3% in the September quarter.

The last time it got that low was in December 2007, when the GFC ruined Christmas for everyone by taking a hammer to the world’s economic kneecaps.

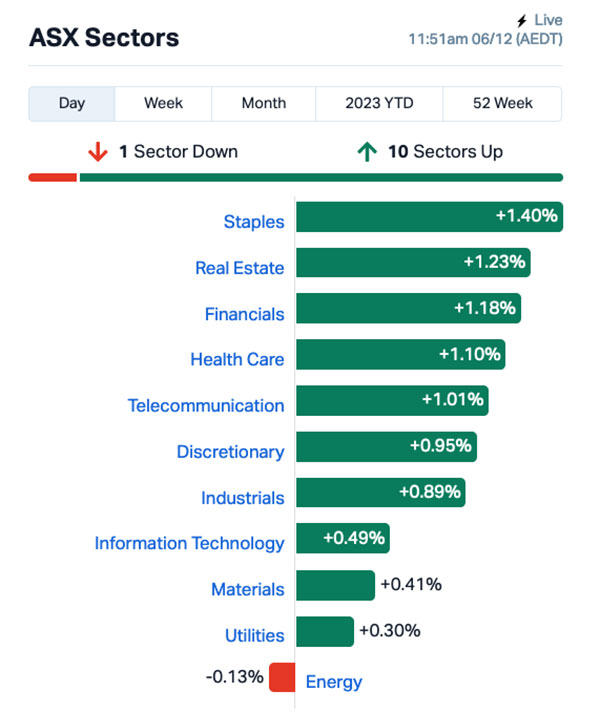

On the surprisingly resilient market this morning, though, most of the big action came via the Real Estate sector, with the big names like Charter Hall and Mirvac climbing nicely to help the sector add more than 1.2%.

Consumer Staples overtook Real Estate as the leader in a late surge just before lunch, and the rest of the sectors have largely been enjoying a morning on the right side of the ledger as well.

Except for Energy, that is – the sector has been a bit all over the place this morning, dealing with competing pressures from falling oil prices, a modest spike in uranium prices overnight and patchy news and updates from the smaller players.

That’s on the back of news that there’s been a sharp drop in coal and LNG exports out of Australia, which knocked a hole in the nation’s quarterly GDP growth that proved to be too difficult for the economy to overcome.

Another major disruption is coming via the fallout from the collapse of the $20 billion Origin Energy (ASX:ORG) deal earlier this week, after shareholders – in the form of our much-vaunted Super Funds – voted down the proposal for the Brookfield bid.

Up the fancy end of town, NIB Holdings (ASX:NHF) is tracking well this morning, stacking on close to +5% as the morning wore on, and Pilbara Minerals (ASX:PLS) is also making hay through the morning session, adding 4.6%.

NOT THE ASX

Wall Street delivered a mixed bag overnight, albeit one that was reasonably flat in either direction, after a fresh batch of US employment data gave the market cause to believe that the American economy is finally starting to cool off a little, sparking rumblings that the Fed could be looking at interest rate cuts as soon as March.

For those of you with a profound love of international data points, the numbers looked like this: US job openings slid to 8.73 million in October, down from 9.35 million openings in September.

That led to some pretty choppy action on Wall Street, and the S&P 500 fell by -0.06%, the blue chips Dow Jones index was down by -0.22%, while the tech-heavy Nasdaq rose by +0.31%.

In US stock news, Earlybird Eddy Sunarto reported this morning that Apple rose by over 2% to a four-month high, with its market cap topping the US$3 trillion mark once again.

Tesla closed 1.3% higher after reporting that insurance registrations for its cars in China continue to pick up, totalling 17,600 last week, up 5.4% from 16,700 the prior week.

Robinhood Markets surged over 10% after reporting that November crypto notional trading volumes were 75% above October levels.

Dell Technologies closed flat after Bloomberg reported that 58-year old founder Michael Dell is taking steps to donate Dell shares worth as much as US$1.74 billion.

US Treasuries meanwhile resumed their rally, with the benchmark 10-year yield plunging by 10bp (bond prices rise).

In Asia, Japan’s Nikkei is up 1.66% this morning, Shanghai markets are largely flat and Hong Kong’s Hang Seng is up 0.46% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 6 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap LNR Lanthanein Resources 0.013 117% 78,967,080 $6,729,453 DM1 Desert Metals 0.063 62% 1,695,853 $2,926,602 MPP Metro Performance Glass 0.135 29% 40,000 $19,464,699 CTO Citigold Corp Ltd 0.005 25% 250,000 $11,494,636 ME1 Melodiol Global Health 0.0025 25% 999,991 $9,225,840 TSL Titanium Sands Ltd 0.011 22% 116,696 $17,943,572 EVR Ev Resources Ltd 0.012 20% 2,425,000 $9,545,883 TON Triton Min Ltd 0.024 20% 457,805 $31,227,192 SRI Sipa Resources Ltd 0.025 19% 400,000 $4,791,321 NNL Nordicnickellimited 0.16 19% 82,500 $7,892,101 LIS Lisenergy 0.2 18% 264,077 $108,834,039 HRN Horizon Gold Ltd 0.335 18% 15,385 $41,279,378 IEC Intra Energy Corp 0.0035 17% 23,000 $4,982,345 MTL Mantle Minerals Ltd 0.0035 17% 3,418,572 $18,442,338 VAL Valor Resources Ltd 0.0035 17% 11,911,198 $11,620,004 VRC Volt Resources Ltd 0.007 17% 225,000 $24,780,640 GLE GLG Corp Ltd 0.185 16% 8,400 $11,856,000 AUZ Australian Mines Ltd 0.016 14% 1,063,574 $11,238,734 WMG Western Mines 0.375 14% 525,693 $22,046,160 ATS Australis Oil & Gas 0.017 13% 538,779 $19,002,983 CL8 Carly Holdings Ltd 0.017 13% 117,179 $4,025,556 MEU Marmota Limited 0.052 13% 4,095,483 $48,704,826 CMP Compumedics Limited 0.26 13% 11,700 $40,747,478 CXO Core Lithium 0.26 13% 17,366,462 $491,495,175 MEK Meeka Metals Limited 0.045 13% 150,000 $47,438,357

Lanthanein Resources (ASX:LNR) is way out in front of the rest of the market this morning, sailing towards a 100% gain on news that the company has inked a farm-in agreement that will see it earn up to a 70% interest in WA’s Lady Grey lithium project.

It’s a strategically important patch of land, some 360km east of Perth, which is literally over the fence from Covalent Lithium’s fully-operational Earl Grey Mine, which boasts a resource of 189Mt @1.53% Li2O at Mount Holland in the Forrestania Greenstone Belt.

“This transaction positions Lanthanein with a prospective lithium project in one of the most desired jurisdictions for lithium explorers in Western Australia,” Lanthanein technical director Brian Thomas said.

Lanthanein says it is looking to have the drills spinning on site in early 2024.

Desert Metals (ASX:DM1) is also doing well this morning, on news that the company has received commitments of $3.75 million through a heavily over-subscribed conditional share placement, with bids reportedly topping $6 million.

The $3.75 million is set to arrive via the issue of approximately 115.4 million fully paid ordinary shares at an issue price of $0.0325 a pop, with the money earmarked to drive drilling and exploration in Côte d’Ivoire and to continue exploration on the company’s Western Australian portfolio.

Earlier in the morning, the gainers list included the likes of 88 Energy (ASX:88E), which brought some momentum into the market on the heels of an options prospectus delivered after market close yesterday.

And Noble Helium (ASX:NHE) made back some of its losses from recent days, after releasing a clarification statement on drilling results from its North Rukwa Helium Project in Tanzania.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 6 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MCT Metalicity Limited 0.001 -50% 3,857,144 $8,502,172 ERW Errawarra Resources 0.091 -30% 4,913,489 $12,469,687 AUH Austchina Holdings 0.003 -25% 50,000 $8,311,535 BP8 BPH Global Ltd 0.0015 -25% 1,750,000 $3,231,126 KNM Kneomedia Limited 0.003 -25% 201,227 $6,133,085 NVQ Noviqtech Limited 0.003 -25% 2,437,328 $5,237,781 JPR Jupiter Energy 0.017 -23% 50,000 $27,947,266 LCL LCL Resources Ltd 0.017 -23% 11,879,990 $17,474,698 EG1 Evergreenlithium 0.155 -23% 73,093 $11,246,000 PHL Propell Holdings Ltd 0.015 -21% 9,100 $2,286,755 TGH Terragen 0.015 -21% 113,758 $7,012,541 SER Strategic Energy 0.012 -20% 12,007,164 $7,287,227 HRE Heavy Rare Earths 0.072 -20% 445,419 $5,443,914 GTG Genetic Technologies 0.002 -20% 989,000 $28,854,145 PPY Papyrus Australia 0.016 -20% 540,000 $9,853,852 SVG Savannah Goldfields 0.047 -19% 235,091 $11,625,533 BLY Boart Longyear 1.225 -18% 97 $439,441,815 OAK Oakridge 0.05 -17% 52,537 $1,055,965 ECT Env Clean Tech Ltd. 0.005 -17% 159,919 $17,085,331 ESR Estrella Res Ltd 0.005 -17% 17,229,969 $10,556,231 RIE Riedel Resources Ltd 0.005 -17% 12,817,169 $12,356,442 TAS Tasman Resources Ltd 0.005 -17% 149 $4,276,016 GBZ GBM Rsources Ltd 0.011 -15% 2,203,169 $8,064,184 A8G Australasian Metals 0.145 -15% 2,500 $8,860,484

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.