ASX Small Caps Lunch Wrap: Whose world record attempt fell dismally short last week?

Pic via Getty Images.

Local markets were up this morning, tracking the winning parts of Wall Street higher, with our local Telcos and Consumer Discretionary leading a solid morning’s work.

The ASX 200 jumped early to a 45-point gain, and it’s managed to hold its ground through to lunchtime to be up close to +0.80%.

I’ll get into that in a moment, but first – a rapid apology. This will definitely be something of a “how much do I hate the NBN right now” Lunch Wrap, as I’m battling the dodgiest of internet connections today.

But before we get too deep into today’s markets, I’ve got a rather sad story from the United States, where a group had gathered in the mid-summer heat on the 4th of July in downtown Washington DC with plans to set a new world record.

The record they were chasing? The World’s Largest Human Ice Cream Cone – which is one of those classically stupid records in the Guinness book that will almost certainly baffle scholars of human history for centuries to come.

The rules were, as you’d expect, pretty simple: A big group of people had to assemble, throw on ponchos to represent part of a massive ice cream cone, and then stand still in formation while someone snapped photographic proof that the deed had been done.

Getting it to happen, however, was another story. Organisers say that the previous record of 478 people was in very real danger of being smashed out of the park, after more than 700 people had responded to the call-out online.

The previous record, for anyone interested, was set by Nestle Ice Cream Business Unit (China) in Qingdao, Shandong, China, on 18 December 2019 – so it must be legit.

Anyway, the effort in DC was – in case you hadn’t already guessed – a total disaster.

For starters, organisers were hard pressed getting people to pop on a plastic poncho and stand in the sun in the middle of summer, but even when they did manage to get what looked like enough people on board with the idea, the city authorities threw a spanner in the works.

City officials demanded that the lift used to take a picture – an official requirement of the record is that a good, clear (and I’m guessing publishable) image is taken as proof – needed to be moved from its planned position to a new one.

The problem being that the new position a) had trees in the way, blocking the photographer, and b) the photo, even once it was taken, showed the ice cream cone ‘upside down’, which Guinness officials deemed no bueno.

And so, with participants wandering away to get out of having to stand in the sun wrapped head to toe in a hot plastic poncho, and all efforts to get a decent photo of those who stuck around all but scuttled, organisers were dismayed to learn that official adjudicators said “nope” to it being declared a new record.

At least one participant needed help from paramedics as the heat got too much, and the official photograph – as seen above – makes it impossible to accurately count how many people were gathered to suffer heat exhaustion while looking nothing at all like any ice cream cone I’ve ever seen.

And so, the assembled blancmange of humanity that had failed were left to dissipate back to their ordinary little lives, with the words of the attempt’s official adjudicator ringing in their ears.

“But it was still a valiant attempt,” Sarah Casson, an official adjudicator for Guinness World Records, said.

Small comforts, indeed, for those who struggled – and failed – to set a really dumb record.

TO MARKETS

Local markets have lifted today, with the benchmark putting on a solid show to be up by around +0.80% as we head towards lunch.

The bulk of the heavy lifting has come via the Telcos and Consumer Discretionary this morning, courtesy of heavyweights including Telstra, which has added more than +2.3%, off the back of reports that the company is gearing up to jack up its mobile plan prices to consumers by between $2 and $4 a month.

On the Consumer Discretionary side of things, there’s some movement among the big names in gambling, with Aristocrat and The Lottery both poking their noses past +1.6% today.

On the boring data side of the broadsheet this morning, the sour news is that consumer sentiment is mired deep in the bog, after the Westpac–Melbourne Institute Consumer Sentiment Index dipped 1.1% to 82.7 in July.

It basically measures the mood of consumers, and any significant dip means we’ve got a collective case of the grumps – and we are grumpier now than we were in June.

But there was a ray of good news today, with our normally puny Aussie dollar hitting a solid high against the Japanese Yen, which – in a perfect world – would set the stage for increased spending on fancy Japanese imports, which in turn tends to have a deflationary effect on the local economy.

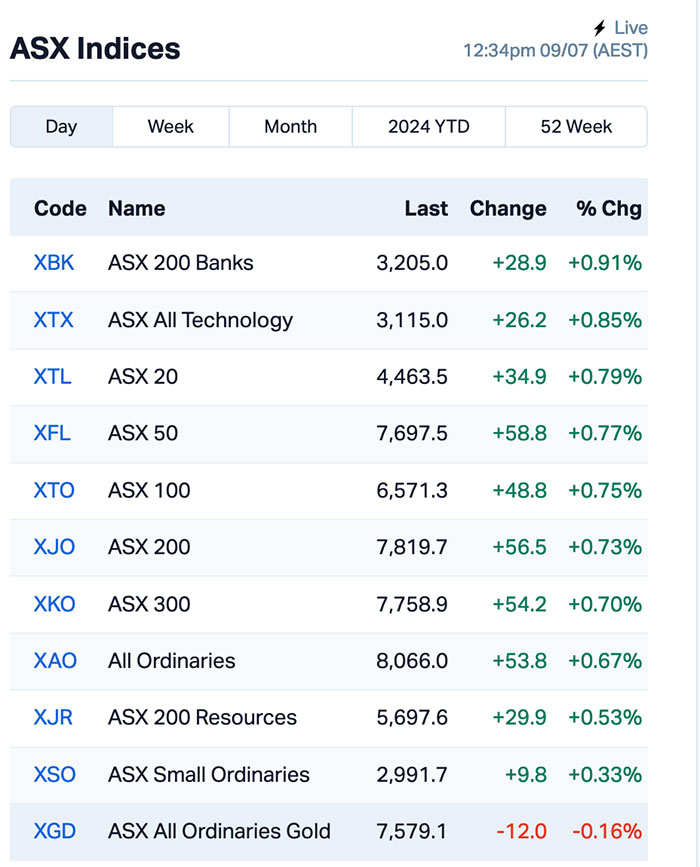

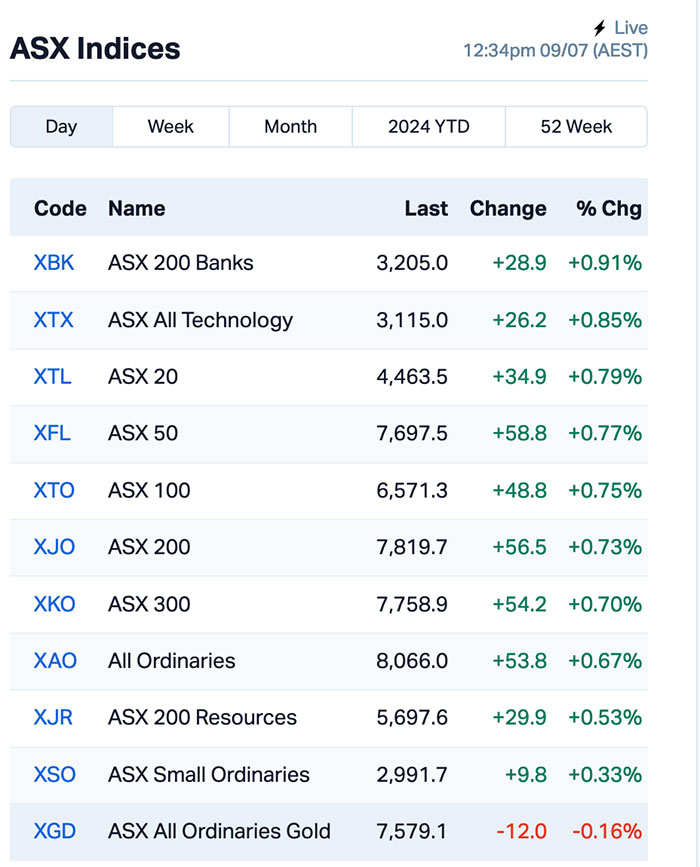

A quick look at the sectors shows things looking like this:

And the indices look a bit like this:

And I’m about to throw my laptop and router in the bin… but let’s press on.

NOT THE ASX

In New York overnight the trade was tepid, but the records kept falling – the S&P 500 added 0.1% and the Nasdaq Composite climbed 0.3%, both extending a run of record closes.

But the blue chip Dow Jones Industrial Average obviously missed the memo, and thus the party, so it fell -0.1% – a harsh lesson in paying attention to your inbox.

In company news, Apple (AAPL) added 0.7% for a new closing market cap a smidge off US$3.49trn.

Next door, literally, and in hot pursuit is Nvidia (NVDA), which added a lazy 2%, inching toward the world’s largest company by market cap at US$3.15trn.

Corning soared past +11% on news of demand for fibre optics driven by the AI boom, while tech companies Super Micro Computers and Intel both piled on more than +6.0% through the session.

In Asian markets this morning, things are looking a little mixed, with Japan’s Nikkei up +1.38%, Shanghai basically flat at around +0.09 and Hong Kong’s Hang Seng retreating by -0.28%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 09 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap TKL Traka Resources 0.002 100% 498,000 $1,750,659 KLI Killiresources 0.078 81% 28,048,065 $5,169,621 LSR Lodestar Minerals 0.0015 50% 1,000,000 $2,023,397 SLM Solismineralsltd 0.115 34% 779,384 $6,618,050 MOM Moab Minerals Ltd 0.004 33% 763,043 $2,135,889 PGO Pacgold 0.17 31% 273,122 $10,938,907 LYK Lykosmetalslimited 0.03 30% 451,764 $4,332,178 AHN Athena Resources 0.0025 25% 203,926 $2,140,935 ATH Alterity Therap Ltd 0.005 25% 125,000 $20,980,461 MCL Mighty Craft Ltd 0.005 25% 1,119,506 $1,475,637 ME1 Melodiol Glb Health 0.0025 25% 1,035,060 $612,527 TAS Tasman Resources Ltd 0.005 25% 155,850 $2,850,677 YPB YPB Group Ltd 0.0025 25% 5,295,384 $4,615,923 FG1 Flynngold 0.026 24% 51,923 $5,345,439 AMD Arrow Minerals 0.003 20% 5,422,411 $26,348,413 AML Aeon Metals Ltd. 0.006 20% 165,833 $5,482,003 AVE Avecho Biotech Ltd 0.003 20% 451,640 $7,923,243 CTN Catalina Resources 0.003 20% 1,333,649 $3,096,217 GMN Gold Mountain Ltd 0.003 20% 643,521 $7,944,359 IS3 I Synergy Group Ltd 0.006 20% 95,000 $1,770,402 PIL Peppermint Inv Ltd 0.012 20% 7,717,199 $21,213,583 COD Coda Minerals Ltd 0.125 19% 330,838 $18,355,579 FBM Future Battery 0.033 18% 1,227,610 $18,543,726 HT8 Harris Technology Gl 0.014 17% 740,344 $3,589,626 IPB IPB Petroleum Ltd 0.007 17% 4,684,368 $4,238,418

Killi Resources (ASX:KLI) was killin’ it on Tuesday morning, sailing high and tight on news of assays from surface rock chip sampling which returned high-grade gold and copper results at the Kaa target, within the 100% owned Mt Rawdon West Project in Queensland.

Killi is reporting one very high-grade sample which came back from the lab at 238g/t Au, 2.1% Cu & 513g/t Ag, which the company says it believes is representative of the surface outcrop of a mineralised structure.

Base and precious metals exploration company Lykos Metals (ASX:LYK) was up on news that the National Assembly of Republic of Srpska has voted to adopt an updated Law on Geological Exploration, which opens the door for the company to immediately seek the re-award of the Sockovac license, as well as size expansion from its previous 17km2 to 50km2 area.

And Solis Minerals (ASX:SLM) was rising on Tuesday after surface grab samples from the Cinto project came back from the lab sporting assays up to 7.14% Cu with mineralisation mapped over a 200m x 100m area in historical workings associated with significant alteration and structural deformation.

The company has signed an access agreement with local Carumbraya community at the Cinto project and initiated systematic mapping and sampling of outcropping copper mineralisation.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 09 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CLZ Classic Min Ltd 0.001 -50% 19,005,133 $1,616,730 PRX Prodigy Gold NL 0.002 -33% 20,000 $6,353,323 AAU Antilles Gold Ltd 0.003 -25% 70,192 $3,986,140 EXL Elixinol Wellness 0.003 -25% 3,563 $5,284,729 ALR Altairminerals 0.004 -20% 1,050,052 $21,482,888 BXN Bioxyne Ltd 0.004 -20% 310,520 $10,233,227 HLX Helix Resources 0.002 -20% 1,641,209 $8,160,484 LPD Lepidico Ltd 0.0025 -17% 415,587 $25,767,358 MEI Meteoric Resources 0.13 -16% 18,382,388 $308,468,576 CTQ Careteq Limited 0.012 -14% 270,411 $3,319,662 PAB Patrys Limited 0.006 -14% 41,502 $14,402,131 M2M Mtmalcolmminesnl 0.031 -14% 4,553,521 $6,632,122 EV1 Evolutionenergy 0.025 -14% 121,901 $8,827,100 AL3 Aml3D 0.16 -14% 9,615,660 $69,763,321 T88 Taitonresources 0.13 -13% 86,061 $8,066,182 VMM Viridismining 0.915 -13% 811,879 $67,437,675 BNL Blue Star Helium Ltd 0.007 -13% 314,487 $15,559,082 MEM Memphasys Ltd 0.007 -13% 5,390,102 $11,061,985 SBR Sabre Resources 0.014 -13% 118,107 $6,287,391 SPX Spenda Limited 0.007 -13% 149,151 $34,595,662 SRN Surefire Rescs NL 0.007 -13% 331,073 $15,890,463 TYX Tyranna Res Ltd 0.007 -13% 803,161 $26,303,403 MOZG Cbnd 8% 09-24 3M Qet 0.801 -12% 148 $13,245,037 EGR Ecograf Limited 0.115 -12% 10,860 $59,024,136 CTO Citigold Corp Ltd 0.004 -11% 77,627 $13,500,000

IN CASE YOU MISSED IT – AM EDITION

Astute Metals’ (ASX:ASE) rock chip sampling has returned high-grade assays topping up at 4150ppm lithium over a 1.4km north-south trend north of hole RMRC002. This extends the prospective lithium horizon at the Red Mountain project and is indicative of its potential scale.

Meteoric Resources’ (ASX:MEI) scoping study for the Caldeira ionic adsorption clay-hosted rare earths project in Brazil has outlined costs of just US$7/kg REE during the first five years of production. This is based on a 5Mtpa throughput and mine life and 20 years though the 619Mt resource means that’s plenty of room for both mine life and production increases.

At Stockhead, we tell it like it is. While Astute Metals and Meteoric Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.