ASX Small Caps Lunch Wrap: Whose head’s gonna roll over this week’s Chinese blunder?

Yep... we thought exactly the same thing when we saw it, too. Pic via Getty Images.

Local markets are up and down like a bare bum in the back of a kombi, as the ASX 200 benchmark struggles to decide which way it’s going to lie for the day.

I do this a lot – not because I like to, but because I have to – but it’s all US Fed Chair Jerome Powell’s fault again. Well… mostly. A bit. But he’s definitely involved – and I’ll explain why in a moment.

But first, we’re off to China, where internet users are somewhat bemused by the proposed design of a train station in the city of Nanjing.

That’s because it looks like a massive sanitary pad.

The building’s design, which has already (by some astonishing miracle) been approved by local authorities, is supposed to be representative of the plum blossoms (not a euphemism, don’t be gross) that the city is famous for.

But it is 100% a massive feminine hygiene product. Seriously, just look at it – it’s even got huge wings on the sides so that commuters will stay dry, even when the station’s under a heavier than normal load.

(But still play volleyball and juggle kids/career.)

According to the BBC, construction on the enormous Maxi-Pad is due to begin in the first half of 2024, with the city on the hook for an eye-watering $4.2 billion to erect it.

Whether the design will survive the test of time, and usher in a new period of Chinese architecture remains to be seen.

And I’m gonna stop there because I’ve written, by my count, about 12 more jokes for this story, and not a single one of them is publishable because I’m an appalling human being… sometimes.

TO MARKETS

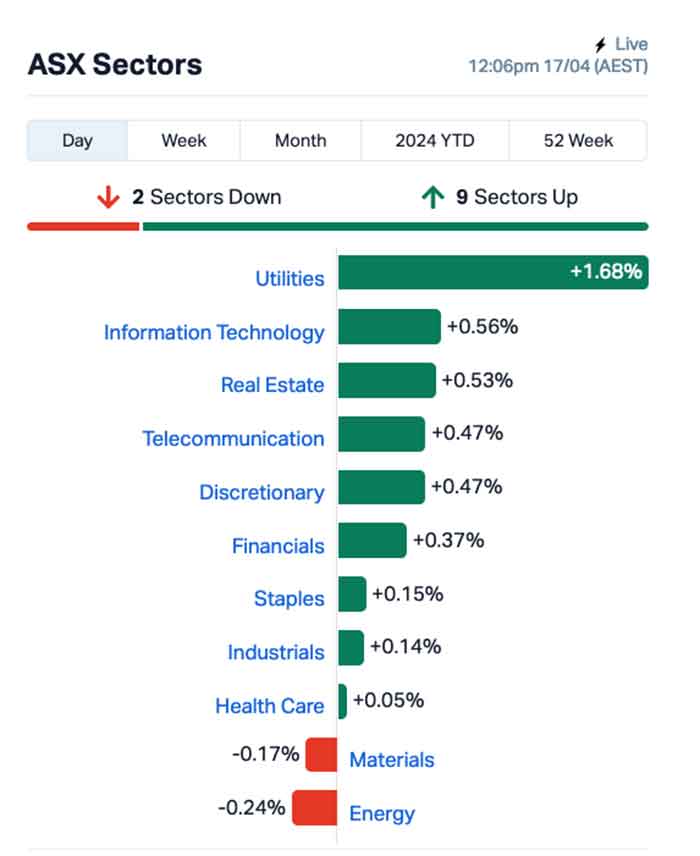

So, anyway… the ASX is really volatile this morning, whipsawing between good and ugly throughout the early morning trade, with Utilities offering the best performance among the sectors by quite a considerable margin.

The sector has some big names to thank for that, namely AGL Energy (ASX:AGL), which is up +4.7% and Origin Energy (ASX:ORG) adding +1.7% throughout the morning.

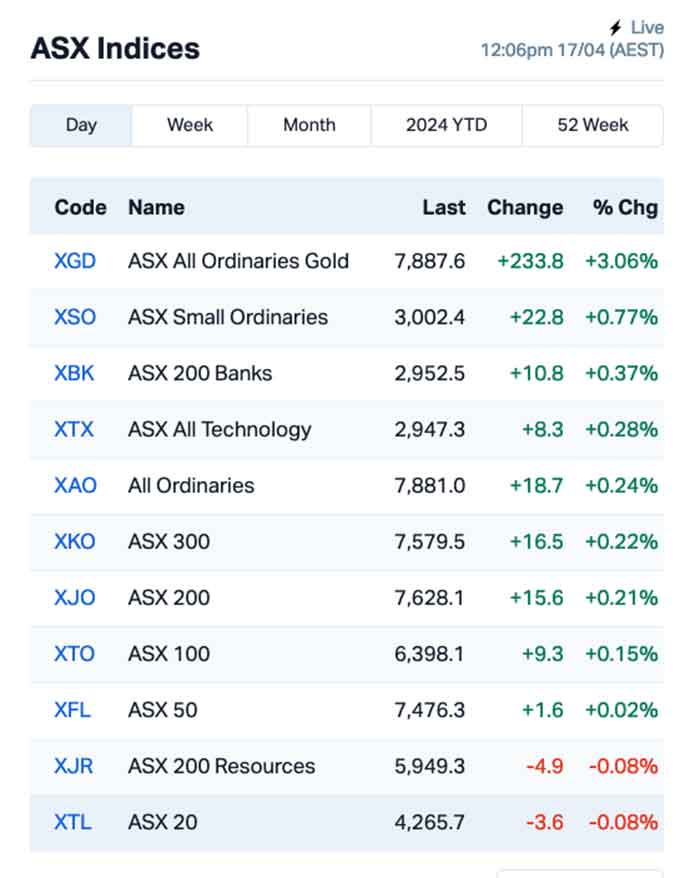

But, as is often the case when the markets are a bit on the nose, the goldies are making some serious hay, with the ASX XGD All Ords Gold index up a thumping +3.06%, on a combination of the ever-increasing price of the precious metal, and it’s safe haven status whenever Jerome Powell opens his mouth in front of a microphone.

It’s also due to Evolution Mining’s (ASX:EVN) rapid rise this morning, with the company hitting $8.5 billion in market cap, courtesy of an +11% hike to $4.285 per share today.

Evolution revealed that drilling from underground at Ernest Henry and Mungari (Kundana) has returned “exciting assay results in close proximity to infrastructure and current mine plans”, leading the company to pre-emptively suggest an upgrade to the projects’ mineral resource is on the cards.

The pick of the intercepts are 40.4m (33.0m etw) grading 0.64g/t gold and 1.14% copper from 434.0m from Ernie Junior, and an astonishing 0.26m (0.26m etw) grading 420g/t gold from 385.8m down-dip and along strike of the Genesis orebody at Kundana.

NOT THE ASX

Wall Street turned in a mixed bag overnight, after US Fed Chief Jerome Powell used an event in Washington overnight to point out the lack of progress made on inflation after the rapid decline seen at the end of last year.

As with all of Powell’s out-loud ponderings on this topic in recent times, New York investors heard his words, and stormed the exits, leaving the S&P 500 down by -0.21%, the blue chips Dow Jones index up by +0.17%, and the tech-heavy Nasdaq off by -0.12%.

For those really dedicated Powell-watchers, here’s what he said.

“The recent data have clearly not given us greater confidence, and instead indicate that is likely to take longer than expected to achieve that confidence,” he said, adding that if inflation persists, the Fed will keep rates steady for “as long as needed.”

Clearly, that’s not what the rate-sensitive US market wants to hear at the moment, and that’s why everyone’s all gloomy and morose.

In US stock news, investors digested more bank results. Bank of America fell -3.5% after Q1 profit dropped 18% year on year. Morgan Stanley rose +2.5% as Q1 results topped expectations.

Johnson & Johnson fell -2% after reporting a revenue miss, while United Airlines jumped more than +5% after the bell as the airliner posted Q1 results that beat analysts’ forecasts.

And, just because I’m finding this too fascinating not to stare at it, Donald Trump’s social media thing is still leaking value, dropping 12% on Monday and another 14% yesterday.

Why? Well… Monday saw the company – already pretty much in freefall – take the really weird step of announcing what amounts to a stock dilution, through the potential sale of 146.1m shares, including 114.8m shares owned by the former president, plus an additional 21.5m shares that could be sold upon the exercise of certain warrants issued when the company went public.

On Tuesday, the company announced plans to launch a streaming platform, outlining that the content it will offer will be – in no particular order – news networks, religious channels, “family-friendly” films and “other content that has been cancelled, is at risk of cancellation, or is being suppressed on other platforms and services”.

So if you’re in the market for a reality TV show about a disgraced mega-church preacher’s efforts to rebuild his flock before the clock runs down and he’s fired out a cannon into the sun, that’s where you’ll find it.

In Asian market news, both the Nikkei (-0.12) and the Hang Seng (-0.17%) are marginally lower in early trade, but Shanghai markets are bucking the global trend again, rising 0.95%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 17 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

CODE COMPANY PRICE % TODAY VOLUME MARKET CAP FRE Firebrickpharma 0.078 53% 6,678,944 $9,126,284 IEC Intra Energy Corp 0.002 33% 575,000 $2,536,172 MEG Megado Minerals Ltd 0.013 30% 318,437 $2,544,556 EMH European Metals Hldg 0.415 26% 153,859 $40,787,372 BUR Burleyminerals 0.059 26% 575,106 $4,901,948 AMD Arrow Minerals 0.005 25% 4,200,576 $37,918,825 MKL Mighty Kingdom Ltd 0.005 25% 6,298,013 $2,645,066 OAR OAR Resources Ltd 0.0025 25% 284,907 $6,306,622 RML Resolution Minerals 0.0025 25% 250,000 $3,219,994 RR1 Reach Resources Ltd 0.0025 25% 206,565 $7,380,040 NXM Nexus Minerals Ltd 0.074 21% 293,222 $23,732,668 DRO Droneshield Limited 1.135 20% 12,682,268 $582,595,912 FZR Fitzroy River Corp 0.15 20% 38,662 $13,494,281 ADD Adavale Resource Ltd 0.006 20% 1,110,000 $5,079,898 LPD Lepidico Ltd 0.003 20% 18,781,277 $19,095,770 GAS State GAS Limited 0.125 19% 135,355 $28,793,813 HIO Hawsons Iron Ltd 0.046 18% 2,701,668 $35,843,771 CMX Chemxmaterials 0.049 17% 69,858 $4,841,789 AQX Alice Queen Ltd 0.007 17% 300,000 $4,145,940 BNL Blue Star Helium Ltd 0.007 17% 7,659,143 $11,653,592 SI6 SI6 Metals Limited 0.0035 17% 5,562,376 $7,106,578 TMK TMK Energy Limited 0.0035 17% 504,500 $20,267,144 BCT Bluechiip Limited 0.008 14% 69,487 $7,705,368 RTG RTG Mining Inc. 0.032 14% 311,111 $30,383,766 TMX Terrain Minerals 0.004 14% 225,000 $5,010,847

The big mover on Wednesday was Firebrick Pharma (ASX:FRE), after it announced that its Nasodine nasal spray was being launched in the United States. The company pointed out that the spray will be marketed in the US “for ‘nasal hygiene’ without any therapeutic claims”, bypassing the need for the spray to receive FDA approval. It was up close to +100% in early trade.

Burley Minerals (ASX:BUR) was moving on up on news of a $1.8m capital raise consists of a combination of a share placement and share purchase plan, consisting of a $1.3m placement at $0.05 per share to existing shareholders representing a 6% premium to the last closing price.

Mighty Kingdom (ASX:MKL) inched up on news that the company has completed the retail shortfall bookbuild for the retail component of its 5 for 1 pro-rata accelerated renounceable entitlement offer, announced on 15 March 2024, with the company revealing that the offer has raised gross proceeds of approximately $6.25 million.

And DroneShield (ASX:DRO) was up on news that the NATO Support and Procurement Agency (NSPA) has approved the first Counter-small UAS (C-UAS) procurement framework agreement in NATO history, signed through COBBS BELUX BV, DroneShield’s in-country Belgium and Luxembourg partner for an initial three-year agreement with extension options. Plus, there’s a couple of wars on, apparently.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 17 April [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap HAS Hastings 0.002 -60% 1,900,980 $307,590 OSX Osteopore Limited 0.13 -57% 197,908 $3,098,607 DUB Dubber Corp Ltd 0.065 -52% 14,247,410 $77,144,481 FG1 Flynngold 0.009 -40% 138,144 $1,231,057 ZNO Zoono Group Ltd 0.06 -26% 24,384 $17,307,869 WMG Western Mines 0.25 -22% 657,170 $24,026,618 88E 88 Energy Ltd 0.004 -20% 20,598,743 $125,620,313 ASV Assetvisonco 0.013 -19% 23,875 $11,613,385 ASM Ausstratmaterials 1.18 -18% 741,198 $240,180,454 MX1 Micro-X Limited 0.099 -18% 1,210,236 $62,258,445 ADY Admiralty Resources. 0.005 -17% 26,200 $9,776,844 LYN Lycaonresources 0.245 -16% 1,047,853 $12,776,313 XPN Xpon Technologies 0.0145 -15% 333,199 $5,161,339 ADG Adelong Gold Limited 0.003 -14% 49,582 $3,081,711 AEV Avenira Limited 0.006 -14% 526,409 $16,443,238 ASR Asra Minerals Ltd 0.006 -14% 242,051 $11,647,970 SHO Sportshero Ltd 0.006 -14% 1,581 $4,324,830 WSR Westar Resources 0.013 -13% 1,800,439 $2,780,363 1MC Morella Corporation 0.0035 -13% 324,102 $24,715,198 BLU Blue Energy Limited 0.014 -13% 601,567 $29,615,578 FGL Frugl Group Limited 0.007 -13% 1,312,500 $11,918,197 MEL Metgasco Ltd 0.007 -13% 345,777 $8,511,094 NAE New Age Exploration 0.0035 -13% 163,540 $7,175,596 FAL Falconmetalsltd 0.145 -12% 41,291 $29,205,000 GPR Geopacific Resources 0.022 -12% 816,835 $20,542,934

ICYMI – AM EDITION

Uvre (ASX:UVA) plans to recommence field activity at its East Canyon uranium project in southeastern Utah next week to follow up on highly encouraging results from mapping and sampling work carried out in 2023.

Field activity, which will seek to rank prospects for the next phase of drilling, will focus on the Loya Ray target where 3D interpretation has indicated potential strike prospectivity of up to 3.6km along flat lying stratigraphy close to the regional NE Shay Fault.

Loya Ray also has the largest surface uranium anomalism defined by the company’s radiometric survey, has been the subject of historical small-scale open pit mining, and has recent surface rock chip samples returning grades of up to 0.3% U3O8 and 2.59% vanadium pentoxide.

East Canyon has identified 19 prospects and over 30 mapped occurrences of uranium minerals mapped out over +17km of uranium-vanadium prospective strike.

At Stockhead, we tell it like it is. While Uvre is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.