ASX Small Caps Lunch Wrap: Whose eight-year world record dream has gone up in smoke this week?

French protestors have taken to the streets to set as many fires as possible, to send those English Guinness bastards a message. Pic via Getty Images.

Local markets are probably best described as “up… but definitely could be doing better”, following a morning that’s seen a solid enough showing from the Banks, Tech and Small Caps sectors to move the benchmark +0.36%.

The short version of this morning’s qualified success: a smattering of great results from a few market heavyweights, and a gentle-yet-positive set of numbers out of New York while most of us were still tucked up in bed overnight.

I’ll give you the details on that shortly, but before I do, there is news from the exciting world of matchstick sculptures, where one man’s dream to break a world record looks like it’s been a colossal waste of time.

Eight long, boring years ago, French dude Richard Plaud started on his weird dream to set a new, official world record, by building the tallest-ever model of the Eiffel Tower out of matchsticks.

However, after dedicating a huge chunk of his life to creating what is, clearly, a masterpiece, the people from the Guiness Book of Records have dealt Plaud an incredibly cruel blow – his record is unlikely to be recognised, because he’s used the wrong kind of matchsticks.

According to Plaud, he has painstakingly constructed his 7.2-meter tall model of France’s most famous phallic symbol, using nothing more than 700,000 matchsticks, and enough glue to render even the hardiest of teenagers comatose at the back of a classroom.

As this video shows, the result is clearly very impressive…

View this post on Instagram

But, the Guinness people have made it clear that just because it’s pretty, doesn’t mean it’s going to win.

As Plaud puts it, he started his project in much the same way as everybody else whose lives have reached a certain level of pointlessness, and he started buying boxes of matches from the supermarket and painstakingly removing the sulphur-laden heads from each one before using them on his model.

As you can probably imagine, the idea of manually removing the heads of more than 700,000 matchsticks wasn’t an appealing one – and so Plaud approached a local manufacturer and negotiated the purchase of matchsticks without the flammable heads.

Which is a very smart move, except for the fact that it’s apparently outside of the rules that govern this particular endeavour.

The Guinness people have since pointed out that the guidelines governing any record attempt in this category are clear, and include two highly pertinent rules:

- The matches used must be available commercially. Proof of this must be provided as evidence.

- The matchsticks must not be cut, disassembled or distorted beyond its recognition as matchsticks.

“As the matchsticks were not commercially available, and were not recognised as matchsticks the attempt has been disqualified,” the official word from Guinness says.

To suggest that Plaud, and by extension the whole of France, is outraged would be doing a disservice to the very notion of Angry French People – which is saying a lot, considering the number one sporting endeavour in Paris has been, for many years, the gentle art of rioting and setting things on fire in the streets.

Plaud might not need to lead his countrymen on a rampage through the streets, though. Mark McKinley, director of Guinness’ central records services, has indicated that the company’s record assessment team is willing to take another look at the model, and “see what can be done”.

In the meantime, Plaud’s left with a gigantic flammable model of the Big Paris Pee-Pee, and I will be hugely disappointed if it doesn’t get burnt in protest when Guiness upholds its original ruling.

TO MARKETS

At lunchtime today, the benchmark is up slightly after a couple of big names delivered very positive news to the ASX, and Wall Street offered a bit of a tailwind for local investors to make use of.

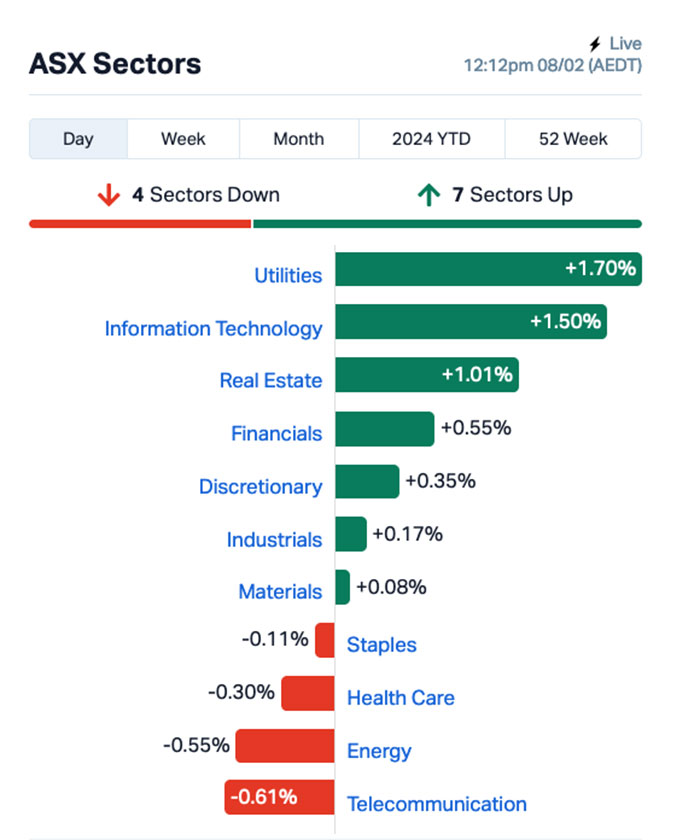

The sector outlook is broadly positive, with a decent run for Utilities that has lifted it nearly 2.0% this morning, and InfoTech has continued its wild ride, swinging wildly and currently up around +1.5% for the day.

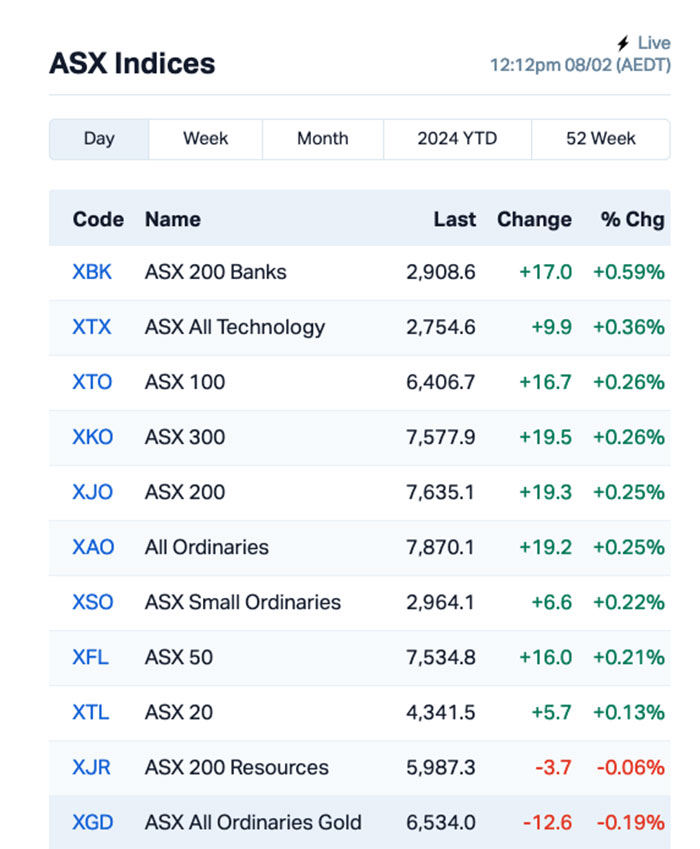

At a more granular level, the landscape becomes a bit clearer. The big banks are leading the way with the XBK ASX 200 Banks index in front on +0.86%, while the All Tech index is around 0.5% higher and the mighty Small Ordinaries pushing 0.36% higher as well.

The big players out in front early this morning included gas giant AGL Energy (ASX:AGL), which added more than 11.5% after banking a very solid half-year result.

AGL says that the boost to its bottom line has left underlying profit after tax at $399 million, $312 million higher than the prior half, thanks to “increased plant availability”, “benefits of portfolio flexibility”, and “more stable market conditions compared to the prior half”.

And, of course, “the impact of higher wholesale electricity pricing from prior periods” played a not-insignificant part in the company’s success as well.

News Corp (ASX:NWS) – to which Stockhead is attached, and as such to whom about 60% of my professional allegiance belongs – also banked a solid Q2 result that saw the company haul in revenue of $2.59 billion, a 3% increase compared to $2.52 billion in the prior year, driven by growth at the Digital Real Estate Services, Dow Jones and Book Publishing segments. News is currently trading about 5.5% better than it was last night.

NOT THE ASX

Overnight, Wall Street did okay. The S&P 500 rose by +0.82%, hitting a new record high – but that’s happening a lot at the moment, and we’re all a little jaded – while the blue chips Dow Jones index was up by +0.40%, and the tech-heavy Nasdaq lifted by +0.95%.

The big stock news from the US was Snapchat, which crashed by -35% after missing top and bottom lines forecasts, and a disappointing guidance as the market for saucy selfies and hilariously poorly-written social posts withers in the face of AI-generated porn and a general disdain for other humans among the platform’s users.

The AI splurge continued for chipmaker Nvidia. It’s climbed +2.75% ahead of its Q4 earnings, and those brave, brave souls at Morgan Stanley who had a price target for Nvidia set at $US603 have spotted that it’s already trading around $100 higher than that, so they’ve gone out on a limb and adjusted their target to $750 a share.

Utter madness, but that’s the world we’re living in.

Ford Motor jumped 6% after reporting quarterly loss due to the restructuring of the vehicle manufacturer’s overseas operations, but said sales grew, which is nice.

And Alibaba slumped by almost 6% after missing quarterly revenue target, but announced that it was increasing its share buyback program by US$25 billion – but I bet they could probably find knock-off company shares listed much cheaper on their retail platform.

Meanwhile, the auction of US 10-year notes gave investors some encouragement after the US government managed to sell a record $US42 billion, Earlybird Eddy reported this morning.

In Asian market news, Japan’s Nikkei is up 0.83%, Shanghai markets are up 0.59% but Hong Kong’s Hang Seng is down 0.7% for some reason. It’s probably weather-related – I hear it’s quite humid there this time of year.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 08 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Company Price % Volume MARKET CAP AXN Alliance Nickel Ltd 0.044 47% 6,311,949 $21,775,188 ARN Aldoro Resources 0.125 34% 146,557 $12,520,008 DXNDA DXN Limited 0.02 33% 25,161 $2,773,340 KGD Kula Gold Limited 0.012 33% 4,158,055 $3,808,907 SGA Sarytogan 0.215 30% 409,563 $12,696,735 ME1 Melodiol Glb Health 0.016 23% 4,563,891 $3,664,307 CCM Cadoux Limited 0.062 22% 278,563 $18,692,397 KBC Keybridge Capital 0.06 20% 33,505 $10,366,892 GCM Green Critical Min 0.006 20% 314,156 $5,682,925 HOR Horseshoe Metals Ltd 0.006 20% 361,000 $3,232,393 LNR Lanthanein Resources 0.006 20% 2,261,790 $6,449,060 MHC Manhattan Corp Ltd 0.0035 17% 100,006 $8,810,939 MM1 Midasmineralsltd 0.1 16% 290,224 $7,460,263 SLM Solismineralsltd 0.145 16% 91,000 $9,811,094 AL8 Alderan Resource Ltd 0.004 14% 60,000 $3,874,015 EFE Eastern Resources 0.008 14% 727,000 $8,693,625 REE Rarex Limited 0.016 14% 437,103 $9,567,412 GRE Greentechmetals 0.24 14% 281,773 $17,656,795 ZNO Zoono Group Ltd 0.049 14% 43,261 $8,688,604 CYP Cynata Therapeutics 0.165 14% 154,121 $26,046,609 EWC Energy World Corpor. 0.017 13% 126,841 $46,183,819 WEC White Energy Company 0.045 13% 15,667 $4,529,413 VFX Visionflex Group Ltd 0.009 13% 199,244 $11,335,930 YAR Yari Minerals Ltd 0.009 13% 110,000 $3,858,863 AGL AGL Energy Limited. 8.965 12% 5,047,076 $5,368,522,919

Alliance Nickel (ASX:AXN) is leading the charge this morning, on news that it’s signed a non-binding term sheet with Samsung – yes, that Samsung – for the future offtake of battery grade nickel and cobalt sulphate products from the NiWest Nickel-Cobalt Project in Western Australia.

Sarytogan Graphite (ASX:SGA) is making headway today after announcing that the first batch of coincell batteries has been produced using the company’s Uncoated Spherical Purified Graphite, which the company says have been outperforming many synthetic graphite anodes that are currently used in electric vehicles.

Aldoro Resources (ASX:ARN) rose more than 34% before lunch, after telling the market it had traced intermittent intrusive dyke bearing pyrochlore (a niobium containing mineral) over 200m and at widths of up to 1m, out along the southwest margin of the Kameelburg carbonatite.

Junior goldie Kula Gold (ASX:KGD) was climbing as well, up 33% in early trade on news that it had pinned down two new gold prospects at the Marvel Loch project near Southern Cross, one of WA’s better gold fields – namely, the new Stingray gold and lithium prospect and the Boomerang gold prospect, the latter identified in drilling for kaolin three years ago in a hit of 1m at 2.6g/t from 54m.

Lanthanein Resources (ASX:LNR) was moving higher early door, after saying that an extensive soil sampling programme across its entire 77km2 granted tenement on the Forrestania Greenstone Belt has kicked off, directly adjacent to Covalent Lithium’s (SQM & Wesfarmers) Earl Grey Mine, 189Mt @1.53% Li2O.

And Chimeric Therapeutics (ASX:CHM) made early progress after it announced that the first patient in the ADVENT-AML Phase 1B clinical trial in Acute Myeloid Leukemia (AML) has received treatment with CHM 0201 in combination with Azacitidine and Venetoclax.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 08 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Company Price % Volume MARKET CAP MTB Mount Burgess Mining 0.002 -33% 142,142 $3,134,440 MRD Mount Ridley Mines 0.0015 -25% 500,000 $15,569,766 NTM Nt Minerals Limited 0.006 -25% 120,369 $6,879,223 AMT Allegra Medical 0.023 -23% 1,000 $3,588,331 HT8 Harris Technology Gl 0.014 -22% 54,288 $5,384,439 NYR Nyrada Inc. 0.02 -20% 200,000 $3,900,218 ADG Adelong Gold Limited 0.004 -20% 12,500 $3,498,278 WNR Wingara Ag Ltd 0.019 -17% 110,311 $4,037,478 PLN Pioneer Lithium 0.125 -17% 24,000 $4,263,750 CAG Caperangeltd 0.135 -16% 5,000 $15,185,328 AJX Alexium Int Group 0.011 -15% 76,065 $8,595,740 SCT Scout Security Ltd 0.011 -15% 185,926 $3,021,556 M24 Mamba Exploration 0.045 -15% 1,017,677 $3,396,361 ECG Ecargo Hldg 0.04 -15% 123 $28,916,750 AN1 Anagenics Limited 0.012 -14% 3,578,333 $5,302,890 BUY Bounty Oil & Gas NL 0.006 -14% 7,200 $10,489,507 NUC Nuchev Limited 0.16 -14% 300 $15,615,347 POS Poseidon Nick Ltd 0.007 -13% 1,760,907 $29,708,278 TMG Trigg Minerals Ltd 0.007 -13% 100,000 $2,998,050 UNT Unith Ltd 0.014 -13% 12,240,801 $14,411,427 MPA Mad Paws 0.105 -13% 12,000 $43,273,187 NGX Ngxlimited 0.14 -13% 37,061 $14,497,894 NHE Nobleheliumlimited 0.105 -13% 1,042,794 $43,928,611 BMG BMG Resources Ltd 0.015 -12% 7,476,924 $10,774,552 ARE Argonaut Resources 0.115 -12% 1,266,149 $24,678,604

ICYMI – AM Edition

Future Metals (ASX:FME) is celebrating the successful completion of a non-renounceable entitlement issue announced late last year, which has brought in $3.3 million and will see CPS Capital Group take up an aggregate of 94,903,361 New Shares and 47,451,680 New Options in accordance with its underwriting agreement.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.