ASX Small Caps Lunch Wrap: Who’s spent 5 years and $10.4m not giving herpes to fish?

Despite ongoing government delays, Queensland man Darren McArdle has made a headstart on giving herpes to as many carp as he can catch. Pic via Getty Images.

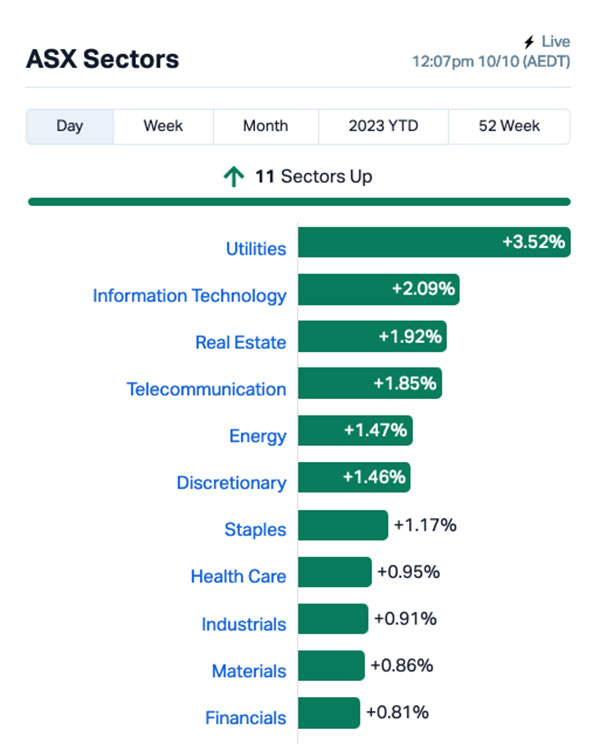

The ASX 200 benchmark is up at lunchtime today, 1.1% better off than it was when the markets opened today thanks to a surge in Utilities of more than 3.3%.

A huge chunk of that is down to news that the ACCC has given the green light to the proposed acquisition of Origin Energy (ASX:ORG) by the Brookfield Asset Management/MidOcean Energy consortium.

I’ll dig into that, and some other stuff, in a minute or two, but first there’s some good news for the wild invasive carp population in Australia, after yet another delay to government plans to give all of the fish a fatal dose of herpes.

No, that’s not a typo – Australia, with its long and glorious history of completely ballsing-up biological warfare on pests, is at it again.

We’ve had two stabs at wiping out the introduced rabbit population – myxomatosis in the 1950s, and the calicivirus in the mid-1990s, which were highly effective in the short term, but left a handful of unaffected animals still alive.

And, since rabbits are well known for their ability to “breed like rabbits”, there’s now millions of them hopping about, rooting like lunatics and slowly rebuilding their numbers before an inevitable armed uprising to topple humankind once and for all.

It also goes without saying that the introduction of cane toads has been a miserable disaster as well, with the godless warty abominations spreading further south by the day, poisoning anything that tries to eat them as they go.

So the idea of giving a fatal variant of herpes to the invasive carp that are clogging up the nation’s waterways seems like it was a profoundly stupid notion to start with, and has been beset with setbacks several times already.

First mooted in 2016, the federal government announced it wanted to spend a cool $15.2m on the National Carp Control Plan with the aim of releasing the virus in 2018, hoping to turn Australia’s aquatic ecosystem into a fishy version of Schoolies Week on the Gold Coast where pretty much everyone goes home with a special gift in a special place.

The deadline for that went sailing by, and in October 2018 the government announced that there would be a 12-month extension to the timeline.

A mere 15 months into the 12-month extension, the Fisheries Research and Development Corporation finally delivered its first report, which basically said “yeah, we should probably wait before sending people out to infect the fish with herpes”.

Six months later, the government acknowledged the delay and blamed it on Covid-19, which first kicked off in Australia at the same time the initial (and very overdue) report was tabled.

A year ago, a plan was delivered – which by the looks of things has landed on someone’s desk with a thud, to be summarily ignored for another year or so, which brings us to now.

Five years after it was meant to start, federal and state government ministers have taken bold and decisive action by announcing that nothing is going to happen until more research is done.

$10.4 million has been spent so far, and not a single case of deadly cold sores has been delivered. Amazing.

TO MARKETS

THe morning’s big market news is the proposed acquisition of Origin Energy by Brookfield Asset Management and MidOcean Energy consortium getting the All Clear from the ACCC, meaning the deal is set to move to the next step: shareholder approval.

Approval of the acquisition, worth around $18.7 billion, was something of a line-ball for the ACCC, which notes that while it was “not satisfied that the proposed acquisition would not be likely to substantially lessen competition”, it eventually said yes because the acquisition “is likely to result in public benefits that would outweigh the likely public detriments.”

The short-term result is Origin Energy hitting a 5-year high, jumping 4.64% to $9.21 per share – helping to push the Utilities sector way out in front of the rest of the market, which is also doing pretty well.

Up the top end of town, the big gainers include a gaggle of miners such as Chalice Mining (ASX:CHN), up more than 10% so far and giving shareholders a welcome reprieve from the bloodletting they’ve endured since Chalice started tanking at the end of April.

Azure Minerals (ASX:AZS) is also on the rise today, up 4.9% this morning and Sayona Mining (ASX:SYA) is also performing well, up 5.9% before lunch.

NOT THE ASX

In the US overnight, Wall Street banked a somewhat pedestrian round of gains, as the the S&P 500 rose by +0.63%, the blue chips Dow Jones index was up by +0.59%, and the tech-heavy Nasdaq lifted by +0.24%.

Earlybird Eddy reports that US stocks were boosted after remarks from Fed Vice Chair Philip Jefferson who said Fed officials should “proceed carefully” after the recent surge in bond yields.

Earlier in the day, Fed Bank of Dallas President Lorie Logan also said the recent surge in bond yields meant the Fed might not need to tighten again.

To stock news, US energy companies like Exxon Mobil led as US crude futures briefly topped US$87 a barrel.

Defence stocks like Northrop Grumman and Lockheed Martin also surged the most since March 2020 as war rages.

Meanwhile, travel stocks like Delta and American Airlines, as well as British Airways and Air France, all fell.

“Against this backdrop, we continue to prefer fixed income to equities,” said Solita Marcelli of UBS Global Wealth Management.

“We see a better risk-reward profile for fixed income, and we recommend investors consider buying high-quality bonds in the 5-10-year maturity range.”

In Japan, the Nikkei is up more than 2.0% this morning despite nearly 900 people being “officially” struck down with food poisoning after eating at a “nagashi somen” restaurant in Tsubata, Ishikawa Prefecture.

Nagashi somen involves a long, bamboo trough filled with running water – much like a lengthy urinal at a poorly-planned music festival – from which diners do their best to use chopsticks to snag small portions of noodles as they go whizzing by.

22 of those affected required hospitalisation, and the restaurant owners have since determined water quality was to blame, after staff were “unable to check on the water quality this year due to damage caused by heavy rains in mid-July”. The eatery has since been closed.

In Shanghai, markets are up 0.24% while in Hong Kong, the Hang Seng is apparently up 1.19% this morning, or non-operational according to other sources.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 10 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MOB Mobilicom Ltd 0.01 43% 6,161,665 $9,286,737 TAL Talius Group Limited 0.01 43% 6,190,143 $16,002,975 ROO Roots Sustainable 0.007 40% 10,801,603 $761,195 GCM Green Critical Minerals 0.008 33% 2,498,489 $6,819,510 HCD Hydrocarbon Dynamic 0.008 33% 141,988 $3,897,995 NGL Nightingale Intelligence 0.065 30% 112,967 $5,106,451 CZR CZR Resources Ltd 0.175 30% 202,803 $31,824,177 LML Lincoln Minerals 0.009 29% 15,137,590 $9,944,983 PR1 Pure Resources 0.2 25% 447,404 $4,104,001 AEV Avenira Limited 0.011 22% 2,930,972 $15,570,065 GML Gateway Mining 0.03 20% 78,000 $6,658,339 SFG Seafarms Group Ltd 0.006 20% 5,000 $24,182,996 SPX Spenda Limited 0.013 18% 7,916,643 $40,449,559 A11 Atlantic Lithium 0.47 18% 1,294,733 $244,896,664 ST1 Spirit Technology 0.062 17% 1,426,429 $38,987,049 TSL Titanium Sands Ltd 0.007 17% 1,510,908 $10,630,828 FAL Falcon Metals 0.15 15% 26,452 $23,010,000 BRN Brainchip Ltd 0.195 15% 19,346,811 $301,759,885 NET Netlinkz Limited 0.008 14% 3,061,759 $24,923,699 PRX Prodigy Gold NL 0.008 14% 625,000 $12,257,755 ALV Alvomin 0.16 14% 15,289 $10,709,456 AGD Austral Gold 0.025 14% 200,331 $13,470,850 NNL Nordic Nickel 0.175 13% 13,560 $9,061,301 TKM Trek Metals Ltd 0.0315 13% 951,778 $13,835,362 NVO Novo Resources Corp 0.225 13% 847,627 $7,500,000

CZR Resources (ASX:CZR) is leading the Small Caps race at lunch, up 29.6% on news that the company’s Definitive Feasibility Study (DFS) on its Robe Mesa iron ore project in the Pilbara shows it is “set to generate exceptional financial returns”.

The main talking points of the announcement include increased ore reserves at the project, from 8.2Mt in the pre-feasibility study (PFS), to 33.4Mt and production rates have increased from 2Mtpa in the PFS to 3.5-5Mtpa in the DFS.

“Outstanding metallurgical testwork results have also confirmed the high quality of Robe Mesa iron ore and the ability to substitute Robe Mesa for well-known products, such as Rio Tinto’s Robe River Fines and FMG Super Special Fines and Blended Fines,” the company says.

Meanwhile, Pure Resources (ASX:PR1) rose on news that it has staked 13.5km2 of exploration claims in the Crystal Mountain Pegmatite District, Colorado, covering three historical, artisanal mines including the Kings Canyon, Debbie Doll and Buckhorn mines.

And Atlantic Lithium (ASX:A11) has added more than 17% this morning on news that its plan to deliver Ghana’s first lithium mine has been helped along by a government decision to allow the diversion of two transmission lines that run across planned mining areas within the Mankessim prospecting licence.

“The diversion of the transmission lines that traverse the proposed project site forms an important part of the mine plan and the company’s preparations towards shovel readiness at Ewoyaa,” A11 CEO Keith Muller said.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 10 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CCE Carnegie Clean Energy 0.001 -50% 500,000 $31,285,147 FAU First Au Ltd 0.002 -33% 1,396,660 $4,355,980 AXP AXP Energy Ltd 0.0015 -25% 106,265 $11,649,361 CCO The Calmer Co 0.003 -25% 2,500,010 $3,268,477 MXC MGC Pharmaceuticals 0.0015 -25% 500,500 $8,855,936 LVT Livetiles Limited 0.007 -22% 9,281,632 $10,593,996 FGL Frugl Group Limited 0.011 -21% 382,922 $13,384,868 PHL Propell Holdings Ltd 0.011 -21% 1,413,141 $1,684,977 ASQ Australian Silica 0.036 -20% 185,497 $12,674,717 LSA Lachlan Star Ltd 0.008 -20% 3,116,765 $13,190,127 RGS Regeneus Ltd 0.005 -17% 10,131 $1,838,621 AGR Aguia Res Ltd 0.016 -16% 1,065,036 $8,898,403 MEG Megado Minerals Ltd 0.028 -15% 1,271,565 $8,397,033 CUS Coppersearchlimited 0.17 -15% 116,300 $16,481,588 EXT Excite Technology 0.006 -14% 50,000 $8,464,692 G50 Gold50 0.12 -14% 4,165 $14,980,100 AL8 Alderan Resource Ltd 0.013 -13% 4,119,885 $9,250,420 DC2 DC Two 0.02 -13% 10,000 $3,006,470 BUY Bounty Oil & Gas NL 0.007 -13% 140,006 $10,964,008 ETR Entyr Limited 0.007 -13% 270,284 $15,864,831 GGE Grand Gulf Energy 0.007 -13% 22,000 $14,934,288 HNR Hannans Ltd 0.007 -13% 67,307 $21,796,838 INP Incentiapay Ltd 0.007 -13% 713,433 $10,120,509 KCC Kincora Copper 0.029 -12% 57,752 $5,287,493 YOW Yowie Group 0.03 -12% 3,000 $7,431,309

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.