ASX Small Caps Lunch Wrap: Who’s spending big to fix his ailing Johnson this week?

If symptoms persist, see your doctor. Pic via Getty Images.

The ASX gave a lot of folks a bit of a heart attack this morning, sinking fast at open thanks to a sub-par perfmance from Wall Street overnight, and the usual Big Trouble in Even Bigger China rumblings that are really starting to get on my nerves.

The good news, though, is that things have improved and the benchmark is up into positive territory, hitting +0.2% by lunch.

But before I get into all that, there’s been something of a newsflash from the weird, weird world of tech billionaire Bryan Johnson, whose pursuit of looking and feeling younger has garnered international headlines since early this year.

That’s mostly because he’s been doing some clearly bizarre things to try to turn back the inexorable march of time, including harvesting the blood of his then-17-year-old son Talmage for plasma treatments.

Spoiler alert: it didn’t work.

Johnson shot to fame a few years back when, after offloading his payment processing company Braintree Payment Solutions to eBay for $1.25 billion in cash, and then diving headfirst into the world of bio-hacking.

Since then, he’s brought a “mind-reading” helmet to market (no, really…) but it’s his ongoing super-expensive quest to Benjamin Button himself back into nappies that’s brought him the most attention.

It’s also brought about quite an amazing transformation, from Normal Human:

…into this:

Sorry… this:

Easy mistake to make… the resemblance is uncanny.

After his intra-familial vampirism experiment failed to produce results, Johnson’s moved on to the next round of crazy-expensive quackery, this time focussing on his pee-pee in a bid to make it “younger”.

The so-called “penis rejuvenation therapy” is a fairly obvious play, as most men would likely attest, knowing that their own teenage experiments of “vigorously applying handfuls of lotion to the appendage 5-6 times a day” were, for the most part, effective – and a golden time in a young man’s life.

But Johnson’s not ‘young’ in age terms. He’s 45 years old, and – it would seem – starting to reach the time in his life where if his penis were to be called as a witness, the evidence it gave might not stand up in court. #IfYouKnowWhatIMean

So he’s shelling out somewhere between $150k – $300k to get his doodle to cease its infernal dangling, and – very thoughtfully – he’s sharing the experience with the world via Twitter (or X or whatever it’s called this week).

don’t get caught in an awkward conversation not knowing your nighttime erection avg.

the tech is built by UK co Adam Health. the device is simple, comfortable, and easy-to-use. they only have 100 available in this beta phase. QR code and link below:https://t.co/kjG0Yn0XKd https://t.co/pEqXA9ORNQ pic.twitter.com/gIyJQwtaO8

— Zero (@bryan_johnson) August 15, 2023

Now, I’m no expert, but I think any conversation about my nighttime erection average is going to be awkward, whether I know the precise number of them or not. But that’s probably just me.

Johnson says the treatment uses a process called “focused shockwave therapy”, which sounds an awful lot to me like a very expensive way of saying “sex toys”.

I have my doubts whether it’s going to work, and – given that quite a few things Johnson’s tried didn’t exactly work out – I’ll hit pause on making any judgments on whether his penis rejuvenation is successful… at least until I see the results with my own eyes.

… that came out wrong.

Perhaps Johnson should just take a leaf from the crew behind the Inverse Cramer ETF – surely living a life that’s the precise opposite of CNBC’s ratchet-jawed 1,000-year-old infant would be preferable to drinking your own son’s blood.

TO MARKETS

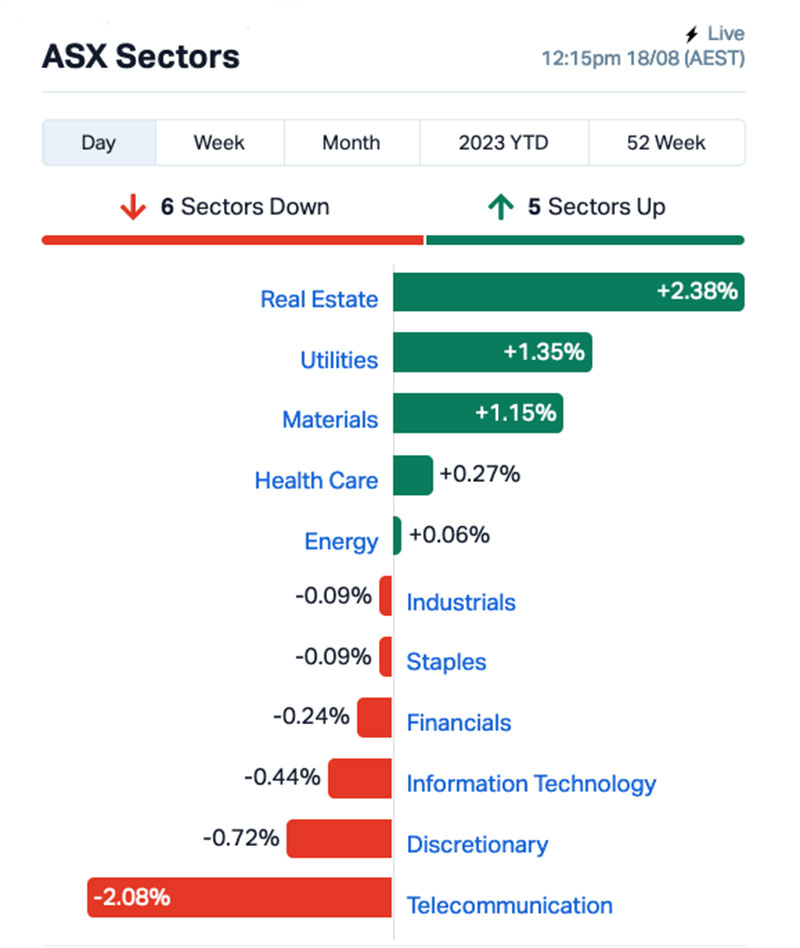

Local markets fell briefly this morning, but a rally from resources – particularly the goldies – and another surge in Real Estate have combined to bring a ray of sunshine to the ASX by lunchtime today.

The benchmark is up around 0.25% at the moment, thanks mostly to a 1.11% pump from the XGD All Ords Gold index, and a similar 1.03% bump on the broader XJD ASX 200 Resources list.

The Real Estate sector has continued its run of good form from yesterday, adding another 2.4% this morning as well.

An enormous chunk of Real Estate’s gains can be attributed to global integrated property group Goodman (ASX:GMG), a $42 billion market cap behemoth which has shot up 8.3% alone this morning.

That’s off the back of the company’s yearly report, which showed an operating profit of $1,78 billion (up 17% on FY22), driving a statutory profit of $1,56 billion.

NOT THE ASX

On Wall Street overnight, the S&P 500 tumbled further by -0.77%, blue chip Dow Jones by -0.84%, and tech heavy Nasdaq by -1.17% – mostly due to the now-familiar refrain of “it’s all China’s fault”.

That, and the increasing likelihood that the US Fed will cough up another rate rise hairball into the laps of the US mortgage-paying public sooner rather than later, as that nation continues to struggle against inflation, and the kind of generalised breakdown of polite society indicative of the crumbling of an empire.

Earlybird Eddy Sunarto reports that Moderna was the S&P 500’s best performer overnight, up by 7.4% after news that Jonathan Van-Tam, England’s former deputy chief medical officer, has taken a job as senior medical consultant at the vaccine giant.

Tech stocks meanwhile are still suffering as the bond rout sent yields to the highest levels since 2008. Meta and Tesla shed 3%, while Apple was down an iWatering -1.5%.

In Japan, the Nikkei is flattish at -0.07% as the nation pauses to recognise International International Day Day, when the global International Day committee members meet in Kyoto to set the global International Day calendar for the next 12 months by voting on which day each International Day should be held internationally.

When approached for comment, International Day chairman and Generic 90s trashbag Simon Day, said “I thought I told you to stop calling me” and hung up.

None of that is true.

In China, though, Shanghai’s markets are up (I know, right?!?) 0.40% despite mounting evidence that the country’s national economy is effectively running on empty, while in Hong Kong the Hang Seng is down 0.13% for reasons that haven’t been made clear.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 18 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap OXT Orexplore Technologies 0.098 113% 23,003,844 $4,768,553 AXP AXP Energy Ltd 0.002 33% 1,416,690 $8,737,021 CHK Cohiba Minerals 0.004 33% 2,399,009 $6,639,733 FTL Firetail Resources 0.15 30% 842,188 $11,068,750 XGL Xamble Group Limited 0.041 24% 13,156 $9,377,156 LLI Loyal Lithium Ltd 0.97 23% 4,203,801 $54,502,101 AN1 Anagenics Limited 0.022 22% 92,357 $6,581,159 BCB Bowen Coal Limited 0.1325 20% 14,926,172 $234,958,447 CZN Corazon Ltd 0.018 20% 720,630 $9,154,958 PNX PNX Metals Limited 0.003 20% 1,927,629 $13,451,562 RHT Resonance Health 0.077 18% 2,963,823 $29,955,379 4DS 4Ds Memory Limited 0.059 18% 15,773,175 $81,627,161 MFG Magellan Fin Grp Ltd 10.85 18% 1,915,653 $1,669,173,471 NES Nelson Resources. 0.007 17% 1,020,218 $3,681,566 OPN Openn Negotiation 0.014 17% 50,000 $13,400,156 RIE Riedel Resources Ltd 0.007 17% 1,049,587 $12,356,442 S3N Sensore Ltd 0.29 16% 2,500 $8,474,433 BUR Burley Minerals 0.155 15% 24,859 $13,675,062 SZL Sezzle Inc. 22 15% 32,178 $104,772,096 TAS Tasman Resources Ltd 0.008 14% 1,490,000 $4,988,685 AQS Aquis Ent Ltd 0.2 14% 442,746 $6,250,856 PR1 Pure Resources 0.295 13% 23,521 $6,669,002 PWN Parkway Corp Ltd 0.017 13% 16,836,519 $33,402,283 CNQ Clean Teq Water 0.405 13% 137,030 $20,835,569 G1A Galena Mining 0.135 13% 1,710,779 $90,308,242

Leading the Small Caps competition this morning is Orexplore Technologies (ASX:OXT), up more than 117% since revealing that the company has inked a $1.55 million deal with mining giant BHP.

The deal will see the deployment of Orexplore’s mobile field scanning installation and technology platform to BHP’s Carrapateena operation in South Australia, which is obviously huge news for the exploration tech minnow.

“This agreement further demonstrates increasing global demand for non-destructive, 3D information sourced rapidly from the field to inform decision processes, drive traditionally siloed collaboration around digital models, and create value within an operating mine,” Orexplore MD Brett Giroud said.

Next best is a surprise no-news boost for Firetail Resources (ASX:FTL), up more than 30% despite not telling the market a thing since 04 August, when Valor Resources (ASX:VAL) revealed that the Peruvian Ministry of Energy and Mines gave the go-ahead for drilling at Valor’s Picha copper poject in (obviously) Peru.

That was big news for Firetail, because it had already negotiated to buy the Picha project from Valor, which was announced to the market in late July. Valor hasn’t had any news today either, but it’s down 12.5%.

And in third place, Bowen Coking Coal (ASX:BCB) is up 27.3% this morning, also on no fresh news.

The last time we heard from Bowen was more than a week ago, when the company revealed that it had achieved its monthly goal of shipping four vessels in July 2023, exporting ~179 kilotonnes (Kt) of coal from its Bluff Mine (PCI) near Blackwater, and Broadmeadow East Pit (coking), part of the Company’s Burton Mine Complex near Moranbah.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 02 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CT1 Constellation Tech 0.002 -33% 100,005 $4,413,601 MTB Mount Burgess Mining 0.003 -25% 190,402 $4,062,587 GSM Golden State Mining 0.03 -25% 8,629,526 $7,643,531 SPT Splitit 0.05 -24% 5,878,678 $36,516,746 ELE Elmore Ltd 0.004 -20% 11,098,800 $6,996,919 A8G Australasian Metals 0.14 -18% 32,845 $8,860,484 SGC Sacgasco Ltd 0.005 -17% 824,833 $4,641,496 NHE Noble Helium 0.215 -16% 2,810,301 $50,586,759 AJQ Armour Energy Ltd 0.11 -15% 116,746 $13,405,615 HTG Harvest Tech Grp Ltd 0.029 -15% 945,955 $23,411,590 MNS Magnis Energy Tech 0.09 -14% 14,509,417 $123,847,306 CXU Cauldron Energy Ltd 0.006 -14% 250,961 $6,660,981 OSM Osmond Resources 0.13 -13% 5,714 $7,034,406 IMU Imugene Limited 0.0815 -13% 41,782,615 $603,765,676 BDX Bcal Diagnostics 0.135 -13% 184,875 $33,051,067 AL8 Alderan Resource Ltd 0.007 -13% 91,910 $4,933,557 BEX Bikeexchange Ltd 0.007 -13% 859,800 $9,513,201 BXN Bioxyne Ltd 0.014 -13% 54,683 $30,426,326 CCZ Castillo Copper Ltd 0.007 -13% 500,000 $10,396,043 DDT DataDot Technology 0.0035 -13% 406,543 $4,843,811 SPX Spenda Limited 0.007 -13% 187,663 $29,371,377 TOU Tlou Energy Ltd 0.028 -13% 2,400 $32,786,657 VAL Valor Resources Ltd 0.0035 -13% 11,250,000 $15,313,339 E33 East 33 Limited. 0.029 -12% 150,116 $17,129,927 MMC Mitre Mining 0.235 -11% 62,253 $10,132,302

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.