ASX Small Caps Lunch Wrap: Who’s not finding mailed sausage sandwiches particularly choice?

Getty Images

Decent arvo to you. Because when Wall Street types pack up daily proceedings with smug looks on their faces, you can usually assume trading Down Under is bound to roll along pretty well, too.

Not an absolute given, of course, but it’s how things are playing out so far today. The ASX 200 opened the bowling with a full-pitched delivery just shaping away nicely from off stump. It began in the green, and is currently up about 0.14%.

In fact, over the past five days, the speed gun has clocked the ASX at +1.1% – and +5.38% over the past month. And that’s this site’s cricket-analogising quota reached for the day.

What else is up specifically, then? We’ll get to that with some sense of market pertinence (promise) below, but first we feel strangely compelled to tell you that the incidence of hotdog-related letterbox trolling is well up in the small community of Waiheke Island, just off Auckland.

Yeah, it’s a thing there, apparently. Although no one quite knows why.

According to a Newshub.co.nz article we just happened to stumble across, one particular resident of the 7,600+ population is “fed up” with dodgy-looking sausages in bread with tomato sauce being left in his letterbox. An occurrence that’s been happening “at least once a month” for the best part of a year.

There are suggestions “Snagatha Christie” needs to get on the case tout suite.

"It was at that point I realised we're dealing with quite a mass sausaging. It's just been a year of torment." https://t.co/Xt3CCpyVyJ

— Checkpoint (@CheckpointRNZ) January 23, 2023

“Jacob”, the snag-mail receiver interviewed for the article, is pretty pissed about it and initially felt he was the sole target of a completely weird, ongoing prank.

Either that, or occasional sausage-sizzle-facilitator Bunnings Warehouse has come up with the worst direct-mail teaser campaign of all time.

Turns out that Jacob’s not the sole victim here, though…

“It happened again and again, to the point where I messaged my friends thinking they were playing a joke on me,” he told the Kiwi news outlet. “And then all of them had photos of sausages in their letterboxes… that was when I knew it was a serious problem.

“It’s tearing my friend group apart, it’s tearing Waiheke apart, because we just don’t know who it is. It’s terrible.”

Meanwhile, Chris Hipkins, a baby-faced 40-something with a neatly parted haircut and an apparent “weakness for sausage rolls”, will be sworn in as NZ’s 41st PM tomorrow.

Sausage rolls… eh? A ground-meat-based Kiwi coincidence? Yeah.

Righto, moving on…

TO MARKETS

How’s the ASX 200 sizzling now, then? Er, actually, somewhat wrecking our initial assessment, it’s dipped a fraction (0.088%) since we began this roundup.

Still, our very own Eddy Sunarto was this morning predicting a decent rise for the Aussie benchmark today in his Market Highlights wrap – and that’s based on the “broad rally in New York”, he wrote. More of that, further below.

A quick look at the local sectors today tells us Real Estate (+1.08%) and Materials (+1.02%) are leading the way again, while Healthcare (-1.03%) is looking a bit poorly. Financials (-0.63%) are down, too.

Of some note today in unicorn-dwelling end of ASX town are the following:

• Breville Group Ltd (BRG): +7%

• Block Inc (SQ2): +6.3%

• LIFE360Inc (360): +6.42%

Not seeing a hell of a lot of news to attribute to these rises, other than announcements of upcoming dates for half-yearly results.

NOT THE ASX

Along with tech stocks surging late last week, overnight (AEDT) the auto giant Ford jumped 3%, Eddy noted. And that was after it announced 3,200 job cuts in Germany amid reports it might move its factory back to the US. Make America Work Again?

As Eddy also points out: “Spotify has also joined the Big Tech layoff party, announcing it will cut about 6% of its workforce.”

Looking at some of the major world indices, then, here’s a quick statistical summation:

US positivity continues – the S&P 500 closed +1.19%; Nasdaq +2.01% and the Dow Jones +0.76%.

Meanwhile plenty of Asian stock markets are still off celebrating the Chinese/Lunar new year. The Nikkei, though, like Wall Street and the ASX, is trading up: +1.28% at the time of writing.

Over in the UK? The FTSE was +0.18%.

In Europe, surmised Eddy, EU consumer confidence has improved from -22.2 in December to -20.9 in January.

European Central Bank (ECB) chief Christine Lagarde said that EU rates will need to continue rising at a “steady pace” in order to combat inflation.

Crypto… yeah, it’s travelling along quite well, generally toeing the line with other markets. Maybe one day it’ll be brave enough to do its own thing. But Bitcoin is trading above US$23k for now, and above its 200-day simple moving average.

So it’s in a decent spot, and there’s a groundswell of positivity that’s starting to become more and more dominant on Crypto Twitter, we’ve noticed.

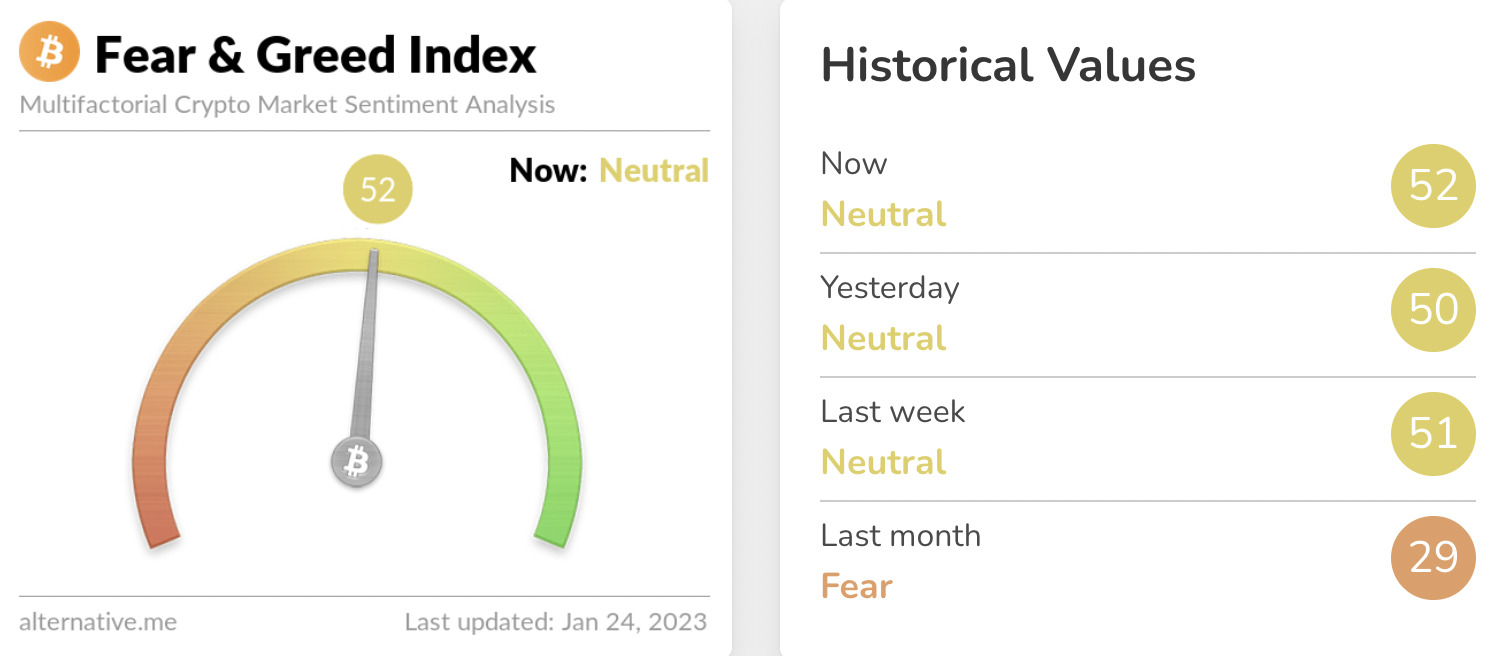

In fact, let’s just quickly check in with that market’s leading sentiment tracker – the Crypto Fear & Greed Index…

It’s actually switched “Neutral” just lately, which believe you me, is actually pretty damn positive compared with where it was wallowing in finger-nail-biting territory late last year.

As usual, you’ll find more info and updates on “magic internet money” over at Mooners and Shakers.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 24 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap GLV Global Oil & Gas 0.002 100% 4,700,822 $3,428,798 SPA Spacetalk Ltd 0.046 77% 2,591,460 $6,661,183 AMD Arrow Minerals 0.009 50% 61,342,428 $15,202,591 ANL Amani Gold Ltd 0.0015 50% 797,868 $24,693,441 WBE Whitebark Energy 0.0015 50% 3,086,302 $6,464,886 CCE Carnegie Cln Energy 0.002 33% 1,640,549 $23,463,861 GNM Great Northern 0.004 33% 960,000 $5,127,153 LML Lincoln Minerals 0.028 33% 4,992,822 $12,074,657 FHS Freehill Mining Ltd. 0.005 25% 1,247,604 $7,707,396 IS3 I Synergy Group Ltd 0.02 25% 247,632 $4,625,286 MRQ Mrg Metals Limited 0.005 25% 2,585,716 $7,943,675 SFG Seafarms Group Ltd 0.011 22% 1,162,380 $43,529,393 CMD Cassius Mining Ltd 0.03 20% 867,643 $10,212,323 EDE Eden Inv Ltd 0.006 20% 607,011 $13,656,369 GLA Gladiator Resources 0.024 20% 879,542 $10,683,398 SI6 SI6 Metals Limited 0.006 20% 100,000 $7,476,973 CDA Codan Limited 5.27 19% 1,314,830 $800,762,975 PHL Propell Holdings Ltd 0.038 19% 53,222 $3,396,263 PYC PYC Therapeutics 0.071 18% 1,573,086 $190,855,566 SMX Security Matters 0.23 18% 626,848 $32,742,749 LMLND Lincoln Minerals - Ordinary New 0.02 18% 2,349,002 $13,625,128 PXX Polarx Limited 0.027 17% 11,659,088 $31,117,779 AYT Austin Metals Ltd 0.007 17% 277,560 $6,095,248 AAU Antilles Gold Ltd 0.046 15% 6,457,155 $19,492,425 EQE Equus Mining Ltd 0.08 14% 50,099 $13,589,655

Some standouts from that mob:

• Spacetalk Ltd (ASX:SPA): This thing’s mooning today (+77%) on the back of an announcement of “$3.3m improvement in 2Q FY2023 free cash flow as compared to 1Q FY2021 (excludes proceeds of rights issue).”

It’s the first time the Aussie “software wearables” (smart watches and the like) company has had a positive quarterly cashflow since 3Q FY2021.

• Antilles Gold’s (ASX:AAU): Stealing this info from our mate Ruebs’ Top 10 at 10 column, which you probably should check out after you’re done here, if you haven’t already:

“Drilling has returned gold grades up to 190g/t from an outcropping oxide deposit at at Antilles Gold’s El Pilar concession in central Cuba. Highlights include 53.5m at 19.06g/t gold from 10m, including 16.4m at 41.64g/t.”

• Arrow Minerals (ASX:AMD): +50% on… a response to ASX price and volume queries. That’s all we’re seeing on this one.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for January 24 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AYI A1 Invest & Res Ltd 0.001 -50% 3,018,826 $36,843,893 NTL New Talisman Gold 0.002 -33% 2,046,767 $9,381,676 XST Xstate Resources 0.0015 -25% 1,500,001 $6,430,363 RON Ronin Resources 0.125 -22% 107,784 $4,639,695 PO3 Purifloh Ltd 0.21 -16% 40,000 $7,880,875 1AG Alterra Limited 0.012 -14% 44,918 $9,751,736 LNU Linius Tech Limited 0.003 -14% 33,366,757 $10,427,945 THR Thor Energy PLC 0.006 -14% 103,154 $10,187,190 NGS NGS Ltd 0.038 -14% 688,259 $6,525,528 BTE Botalaenergyltd 0.13 -13% 30,000 $7,997,500 GUL Gullewa Limited 0.052 -13% 12,037 $11,746,386 BUS Bubalus Resources 0.2 -13% 202,241 $6,220,620 ADX ADX Energy Ltd 0.007 -13% 3,578,722 $28,103,300 HHI Health House Int Ltd 0.007 -13% 140,438 $1,130,637 AHK Ark Mines Limited 0.175 -13% 15,027 $6,922,021 LER Leaf Res Ltd 0.021 -13% 1,994,448 $43,440,933 GTI Gratifii 0.015 -12% 839,235 $17,130,001 AUK Aumake Limited 0.004 -11% 66,193 $3,935,011 BAS Bass Oil Ltd 0.165 -11% 5,774,117 $49,564,695 POL Polymetals Resources 0.175 -10% 32,277 $8,810,625 AUA Audeara 0.081 -10% 65,520 $9,224,939 HMI Hiremii 0.045 -10% 170,800 $5,398,206 LYK Lykos Metals 0.09 -10% 110,555 $6,240,000 DXN DXN Limited 0.0045 -10% 136,363 $8,606,574 MOM Moab Minerals Ltd 0.009 -10% 61,876 $6,819,635

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.