ASX Small Caps Lunch Wrap: Who’s making some pretty outrageous predictions for 2023?

News

News

“And so this is Christmas and what have you done? Another year over and a new one’s just begun”….

Happy Xmas (War is Over), first released in 1971 by John Lennon (and to be technical Yoko Ono, Plastic Ono band & Harlem Community Choir), can certainly make you reflect on the year gone by and what is in store for the next one.

Well, according to Saxo, 2023 is shaping up to be a BIG one with the online trading platform today releasing its 10 Outrageous Predictions for 2023.

Landing in my inbox this morning, the release on the predictions says they focus on “a series of unlikely but underappreciated events, which if they were to occur, would send shockwaves across the financial markets as well as political and popular cultures.

Saxo said the predictions are a “thought experiment in considering the full extent of what is possible, even if not necessarily probable” and occassionally, they even come true.

The company recently released its ‘Outrageous predictions that weren’t so outrageous’ , correctly predicting the UK’s exit from the European union.

So just what are the Top 10 outrageous predictions for 2023?

“This year’s Outrageous Predictions argue that any belief in a return to the disinflationary pre-pandemic dynamic is impossible because we have entered into a global war economy, with every major power across the world now scrambling to shore up their national security

on all fronts – whether in an actual military sense, or due to profound supply-chain, energy and even financial insecurities that have been laid bare by the pandemic experience and Russia’s invasion of Ukraine,” Saxo CIO Steen Jakobsen said.

Indeed.

Anyway…

Australian markets were lower in their mid-week morning session, tracking losses on Wall Street overnight, where the S&P 500 fell 1.4%, the Nasdaq was down 2% lower and the Dow Jones fell 1%.

That’s spooking investors who appear to be heeding warnings from bank chiefs of a potential US recession in 2023. And yesterday, at its last meeting for 2022, the RBA raised the cash rate by 25bps to 3.1%. The central bank has raised rates eight times from a record low of 0.1% in early May as it works to put the inflation genie back in the bottle.

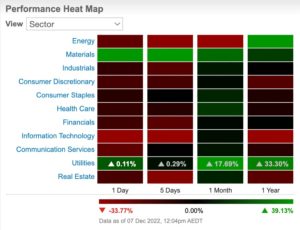

By 1pm AEDT the S&P/ASX 200 had fallen 0.80%. All sectors were in the red except Utilities which was up 0.19% and Materials which was up 0.11%. Leading the laggards was the IT sector, down 2.52% followed by Energy 1.65%.

Making headlines is the Queensland government’s controversial new coal royalties scheme, forecast to generate four times as much money as originally estimated. Queensland Treasurer Cameron Dick is set to announce today (he hasn’t done it yet at time of writing) a 286% in the projected revenue haul from the government’s coal royalty hike, with the estimated figure jumping from $765m to $2.95 billion.

Here are the best performing ASX small cap stocks for December 6 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| PMT | Patriot Battery Metals | 1.16 | 93% | 2,650,113 | $4,200,000 |

| OXX | Octanex Ltd | 0.004 | 33% | 286,555 | $776,933 |

| MIO | Macarthur Minerals | 0.185 | 23% | 121,551 | $24,848,023 |

| BDG | Black Dragon Gold | 0.049 | 23% | 117,003 | $8,026,802 |

| RML | Resolution Minerals | 0.009 | 20% | 330,339 | $8,023,096 |

| GCR | Golden Cross | 0.006 | 20% | 88,966 | $5,486,281 |

| RAN | Range International | 0.006 | 20% | 1 | $4,696,452 |

| CMX | Chemx Materials | 0.19 | 19% | 23,502 | $7,498,580 |

| GLH | Global Health Ltd | 0.26 | 18% | 8,158 | $12,760,744 |

| POD | Podium Minerals | 0.13 | 18% | 256,016 | $37,021,482 |

| SPX | Spenda Limited | 0.011 | 16% | 6,398,703 | $30,701,060 |

| N1H | N1 Holdings Ltd | 0.195 | 15% | 5,800 | $14,969,447 |

| PCL | Pancontinental Energy | 0.008 | 14% | 5,257,244 | $52,879,560 |

| SFG | Seafarms Group Ltd | 0.008 | 14% | 746,928 | $33,856,194 |

| TAS | Tasman Resources Ltd | 0.008 | 14% | 257,203 | $4,698,068 |

| BAS | Bass Oil Ltd | 0.07 | 13% | 6,611,752 | $16,610,871 |

| CMG | Critical MineralGroup | 0.22 | 13% | 50,668 | $5,954,437 |

| KNG | Kingsland Minerals | 0.18 | 13% | 216,975 | $4,114,374 |

| FAU | First Au Ltd | 0.0045 | 13% | 2,799,367 | $3,807,973 |

| MRD | Mount Ridley Mines | 0.0045 | 13% | 2,244,553 | $27,746,019 |

| RDS | Redstone Resources | 0.009 | 13% | 137,150 | $5,894,659 |

| ASQ | Australian Silica | 0.065 | 12% | 330,206 | $16,336,302 |

| E2M | E2 Metals | 0.19 | 12% | 72,455 | $33,852,495 |

| FRX | Flexiroam Limited | 0.038 | 12% | 29,469 | $21,825,051 |

| MMA | Maronan Metals | 0.295 | 11% | 80,000 | $19,875,003 |

Heads, shoulders, daylight and streets ahead of everyone this morning is freshly dual-listed lithium explorer Patriot Battery Metals (ASX:PMT).

It raised $4,200,000 at an issue price of $0.60 per CDI. This morning, those shareholders were enjoying near 100pc returns as PMT shot to $1.16 just before the lunch bell.

Patriot owns 214sqkm of prime spod exploration ground including the Corvette discovery, a 50km trend littered with spodumene outcrop it hopes could be the next major North American lithium discovery.

Among the leadership team is a modern lithium legend – Ken Brinsden.

He is famed not only for helping turn Pilbara Minerals (ASX:PLS) from a penny dreadful into a $15 billion lithium giant, but also for driving the development of its Battery Material Exchange auction platform to uncover the true market value of Australian lithium concentrate.

Spenda (ASX:SPX) has announced that, following completion of a recent pilot program, Carpet Court has committed to integrate the Spenda Platform into its standard operating environment across all its member stores, with target integration by April 2023.

The retail flooring company has a growing network of 205 franchised stores in every Australian state and territory. SPX said payments processed via its platform increase productivity and create efficiencies for both individual member stores and Carpet Court’s National Support Centre by automatically allocating and reconciling payments in the accounts payable ledger and accounts receivable ledger of the store and NSC, respectively.

Here are the most-worst performing ASX small cap stocks for December 6 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AO1 | Assetowl Limited | 0.001 | -50% | 350,000 | $3,144,260 |

| MEB | Medibio Limited | 0.001 | -50% | 210,972 | $6,641,188 |

| MGTDB | Magnetite Mines | 0.63 | -26% | 243,155 | $64,460,252 |

| MTL | Mantle Minerals Ltd | 0.003 | -25% | 584,263 | $21,382,420 |

| BIO | Biome Australia Ltd | 0.065 | -19% | 110,000 | $12,844,025 |

| COY | Coppermoly Limited | 0.009 | -18% | 211,270 | $24,133,526 |

| LYK | Lykosmetalslimited | 0.1 | -17% | 13,099 | $7,488,000 |

| GLV | Global Oil & Gas | 0.0025 | -17% | 1,446,611 | $6,857,567 |

| NES | Nelson Resources. | 0.006 | -14% | 300,010 | $4,120,160 |

| LAW | Lawfinance Ltd | 0.065 | -13% | 273,376 | $4,790,074 |

| BGL | Bellevue Gold Ltd | 1.05 | -13% | 8,342,716 | $1,267,508,098 |

| KTG | K-Tig Limited | 0.1 | -13% | 60,077 | $20,827,795 |

| REM | Remsense Technologies | 0.135 | -13% | 27,000 | $5,651,544 |

| ADY | Admiralty Resources | 0.007 | -13% | 192,100 | $10,428,633 |

| MCT | Metalicity Limited | 0.0035 | -13% | 20,000 | $13,968,157 |

| NZS | New Zealand Coastal | 0.0035 | -13% | 1,008,292 | $4,508,020 |

| OPL | Opyl Limited | 0.035 | -13% | 15,001 | $2,175,415 |

| EOF | Ecofibre Limited | 0.25 | -12% | 160,000 | $99,526,147 |

| ARD | Argent Minerals | 0.015 | -12% | 600,000 | $19,928,392 |

| DW8DD | DW8 Limited | 0.03 | -12% | 811,651 | $3,808,062 |

| W2V | Way2Vatltd | 0.03 | -12% | 416,702 | $6,046,703 |

| AXP | AXP Energy Ltd | 0.004 | -11% | 217,476 | $26,211,063 |

| CXU | Cauldron Energy Ltd | 0.008 | -11% | 421,111 | $5,467,899 |

| HXG | Hexagon Energy | 0.016 | -11% | 858,111 | $9,232,486 |