ASX Small Caps Lunch Wrap: Who’s going to be eating his dinner through a tube this week?

Via Getty

Local markets have risen, with the overnight US consumer inflation read hotter-than-hoped-for, but unlikely to turn the hand of the Federal Reserve monetary policy crew.

Local investors are working their rings out this morning in an effort to get the benchmark to stay on the happy side of break-even. And what do you know – it’s paid off (just a bit) to the tune of +0.2% in the first hour of trade.

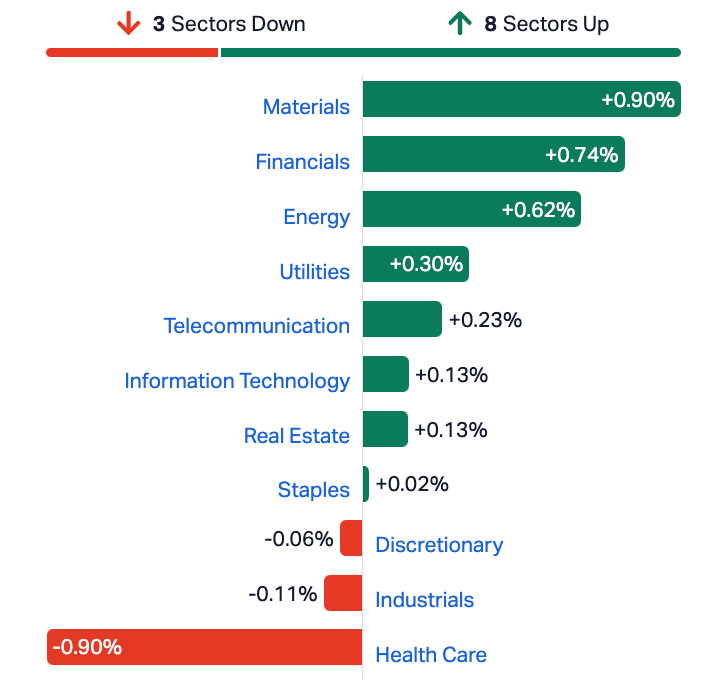

It’s mostly thanks to strong-ish performances among Materials and Energy stocks, but it’s all a little up-in-the-air in the wake of a very mixed lead-in from Wall Street overnight.

We’ll get to the important stuff shortly, but first there’s an outstanding highlight from New York Fashion Week that absolutely must get the attention it deserves.

Fashion – or so-called ‘high fashion’ (read “unwearable clothes that cost ridiculous sums of money, paraded by alien stick insects”) – is arguably one of the dumbest things in the world.

It’s a baffling industry, because it quite clearly doesn’t deserve to be able to take itself as seriously as it does. Which is why when something like the New York Fashion Show is in town, and someone does something to knock the lot of it down a peg or two, it’s cause for celebration.

The “hero” of the story is apparently a Youtube prankster by the name of Fred Beyer, who is apparently a bit famous and made a name for himself doing stupid sh-t, because that’s what passes for entertainment these days.

But I’ve gotta hand it to Beyer, if only because he had the balls to hit the catwalk in the middle of a runway show to make a pretty solid point about how ridiculous the whole scene really is.

Beyer managed to model his own creation – some boardshorts, a shower cap and a see-through bin bag – for an unreasonably lengthy period of time before someone realised that he wasn’t supposed to be there.

He was met with a pretty hearty response by a very enthusiastic security guard:

YouTube

prankster Fred Beyer wears a TRASH BAG as he crashes New York Fashion

Week catwalk, but no one even bats an eyelid until he’s tackled by

security pic.twitter.com/NJjEvWjLLK&md

ash; Anny (@anny25717503) September 13, 2023

In the wake of the incident, the security guard has been offered a spot on the New York Giants roster as an offensive tight end (that’s a real NFL position, btw) – and YouTube prankster Beyer is getting used to eating his meals through a… tube.

TO MARKETS

Local shares have made some morning progress on this fine Thursday in Sydney. The benchmark ASX200 (XJO) index has bagged a neat 0.3% of green, despite some mixed US leads and better-than-expected local jobs data.

The big ends of the market have gone to work – the heavyweight iron ore miners led the charge, Fortescue Metals recouping much of Wednesday’s red blood cells, up by almost +2.5%, while and Rio Tinto added +1.3%.

But are they RBA-dial-turning jobs numbers?

The local economy added 64.9k jobs in August vs. the 25k expected, while the unemployment rate remained stable at 3.7% due to a significant increase in the participation rate to 67% from 66.7%.

Prior to this morning’s Bureau of Stats release, the rates market was betting on just 5bp of RBA rate hikes into year-end.

The sharp snapback this month from July’s weakened and holiday-hit data had the ABS saying:

“The large increase in employment in August came after a small drop in July, around the school holiday period. Looking over the past two months, the average employment growth was around 32,000 people per month, which is similar to the average growth over the past year.”

On the central bank, IG Markets’ analyst and friend of the show, Tony Sycamore answered:

“Stepping back from the month-to-month volatility, its clear the labour market remains extremely tight despite the 400bp of rate hikes the RBA has delivered, and today’s set of numbers won’t give the RBA the breathing room it might have been hoping for to end its rate hiking cycle.”

“We continue to think the chance of a November rate hike is underpriced, which would be the final rate RBA rate hike taking its official cash rate to 4.35%.

Aussie consumer’s inflation expectations have apparently hit a five-month low. I wouldn’t get excited, that base is as low as you can go.

NOT THE ASX

Overnight, things were a little mixed on Wall Street, after the bean counters and data crunchers did some serious spreadsheeting to reveal that inflation has surged to 3.7% on a yearly basis in August from 3.2% in July.

That means that the likelihood of the US getting stung with another rate rise next week has increased somewhat, giving Wall Street another round of the jitters.

In turn, that put a decent slab of performance anxiety into the market, and once the smoke had cleared, the S&P 500 rose by +0.12%, blue chip Dow Jones fell by -0.2%, and the tech-heavy Nasdaq was up by +0.29%.

Earlybird Eddy reported that US government bond yields edged lower after the report release, suggesting that the market expects the Fed to hold.

“This latest US CPI data is unlikely to move the needle on the Fed’s highly anticipated move to hold rates steady at their meeting next week – which has already been priced-in by financial markets,” said Nigel Green of the deVere Group.

“But the uptick in inflation gives the US central bank extra reason to be hawkish moving forward. As such, we also expect the Fed will start to prepare the market for a rate increase at its November meeting.”

In US stock news, mega-cap growth stocks Tesla (TSLA), Meta (META), Microsoft (MSFT) and Amazon (AMZN) all gained between 1% to 3%. Apple (APPL) fell for a second day, post iPhone 15 reveal.

American Airlines dipped 6% after downgrading its Q3 profit outlook due to higher fuel costs and a US$230 million payment in retroactive salary for its pilots.

3M also dropped 6% after the company’s CFO warned of a “slow growth environment.”

Meanwhile in Japan, the Nikkei is higher on news that the Kumamoto City Board of Education is planning a new strategy to help lure children back to the classroom, after it was revealed that the number of kids not showing up to school had doubled since 2018, to around 2,760.

The reason for kids refusing to go to school, the board says, is because they’re suffering from social anxiety, which leaves the unable to cope in a classroom setting and the cure for that, the board says, is to issue the kids with robots that will go to school for them.

The robots are said to be capable of going to class for the children, remotely controlled by the students who can use the robots’ cameras, microphones, and speakers so that the students controlling them from home can see and hear what’s going on in the classroom.

No word on when the student robots will be rolled out, but I’ll be extremely disappointed if these kids haven’t figured out a way to arm them with lasers and use their new metal friends to take over the school – or, at the very least, put a stop to any playground bullying by firing off a few rounds (pew pew pew) and reducing their tormentors to small piles of ash.

In China, Shanghai markets are flat, while in Hong Kong the Hang Seng is down 0.4%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 13 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap NXMR Nexus Minerals Ltd 0.003 200% 92,791 $65,091 MTL Mantle Minerals Ltd 0.0015 50% 17,470,129 $6,147,446 MXC Mgc Pharmaceuticals 0.0025 25% 32,193 $8,855,936 T92 Terrauraniumlimited 0.13 24% 185,314 $5,418,542 LGM Legacy Minerals 0.19 23% 13,329 $8,343,258 MEL Metgasco Ltd 0.011 22% 661,435 $9,574,981 LNU Linius Tech Limited 0.003 20% 1,115,961 $10,574,477 TSL Titanium Sands Ltd 0.006 20% 810,227 $8,859,024 AMN Agrimin Ltd 0.22 19% 48,641 $53,345,210 RRR Revolverresources 0.135 17% 44,444 $13,380,147 92E 92Energy 0.31 17% 1,306,555 $28,189,402 SRJ SRJ Technologies 0.07 17% 115,842 $7,844,385 CNJ Conico Ltd 0.007 17% 3,815,405 $9,420,570 CRB Carbine Resources 0.007 17% 500,000 $3,310,427 FRB Firebird Metals 0.15 15% 78,701 $9,499,750 DEV Devex Resources Ltd 0.39 15% 1,783,648 $126,064,716 NAE New Age Exploration 0.008 14% 5,675,988 $10,051,292 SI6 SI6 Metals Limited 0.008 14% 3,620,716 $13,957,016 AGE Alligator Energy 0.065 14% 27,182,389 $188,437,380 BMO Bastion Minerals 0.025 14% 45,000 $3,813,133 PEN Peninsula Energy Ltd 0.1 14% 25,898,223 $110,620,400 TOR Torque Met 0.3 13% 1,316,522 $25,714,815 BMN Bannerman Energy Ltd 2.67 13% 649,529 $355,205,158 FG1 Flynngold 0.08 13% 11,940,866 $9,683,164 ARR American Rare Earths 0.135 13% 604,158 $53,570,796

Moving early this morning is Flynn Gold (ASX:FG1), on news that the company has hit some proper high-grade gold at the historical Golden Ridge project in Tasmania.

The numbers are fabulous – we’re talking highlights like 4m at 23.7g/t gold including 0.5m at 170g/t from ~20m.

Semiconductor stock Archer Materials (ASX:AXE) says its foundry partner in the Netherlands validated its advanced biochip gFET design by manufacturing the chips using whole four-inch wafer semiconductor fabrication processes.

Key highlights:

- The new gFET design, to detect multiple disease samples at once, was fabricated at a commercial scale foundry.

- The validation of the new advanced gFET device design and whole wafer run in a commercial foundry represents a critical milestone in the commercialisation pathway for Archer’s biochip.

- Archer now intends to integrate more functionality on the biochip and optimise the device size and geometry to build advanced sensing regions.

- The biochip designs and devices form the basis of intellectual property that is 100% owned by Archer.

Bastion Minerals (ASX:BMO) was also performing nicely early in the session, continuing its upward trajectory of the past couple of days since dropping news of the successful completion of a placement to raise approximately $546,000 before costs.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 13 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MTH Mithril Resources 0.001 -50% 280,000 $6,737,609 MEB Medibio Limited 0.001 -33% 200,000 $9,151,116 BFC Beston Global Ltd 0.005 -29% 43,054,769 $13,979,328 KEY KEY Petroleum 0.0015 -25% 1,999,990 $3,935,856 TD1 Tali Digital Limited 0.0015 -25% 100,067 $6,590,311 TEM Tempest Minerals 0.009 -25% 8,287,291 $6,136,602 HVY Heavymineralslimited 0.1 -20% 569,872 $5,291,907 GTG Genetic Technologies 0.002 -20% 30,000 $28,854,145 MRD Mount Ridley Mines 0.002 -20% 305,960 $19,462,207 PNX PNX Metals Limited 0.002 -20% 199,999 $13,451,562 KNB Koonenberrygold 0.041 -18% 1 $3,787,822 RNE Renu Energy Ltd 0.03 -17% 536,947 $15,858,076 EDE Eden Inv Ltd 0.0025 -17% 12,400,900 $10,090,911 TRE Toubaniresourcesinc 0.11 -15% 113,140 $15,278,750 RCE Recce Pharmaceutical 0.495 -15% 594,198 $103,617,508 A3D Aurora Labs Limited 0.024 -14% 532,082 $6,882,626 CHK Cohiba Min Ltd 0.003 -14% 2,434,802 $7,746,355 IMI Infinitymining 0.12 -14% 25,674 $10,871,194 M4M Macro Metals Limited 0.003 -14% 1,558,335 $6,954,772 RLG Roolife Group Ltd 0.012 -14% 300,000 $10,087,814 MGA Metalsgrovemining 0.1 -13% 50,000 $4,278,058 ADS Adslot Ltd. 0.0035 -13% 450,000 $13,066,471 BUY Bounty Oil & Gas NL 0.007 -13% 6,610,575 $10,964,008 KPO Kalina Power Limited 0.007 -13% 209 $12,121,566 8VI 8Vi Holdings Limited 0.115 -12% 300 $5,448,485

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.