ASX Small Caps Lunch Wrap: Who’s feeling hungry for a MAMMOTH ball today?

"Stop busting my extinct balls." (Pic via Getty Images)

Meatball, that is. Actual woolly mammoth, that is.

Whatyoutalkin’boutWillis? It’s someone making a point, and we’ll get to it in a sec. But first, a word on the Aussie stock market performance – which, after all, is mainly what we’re here for and not big balls of meat.

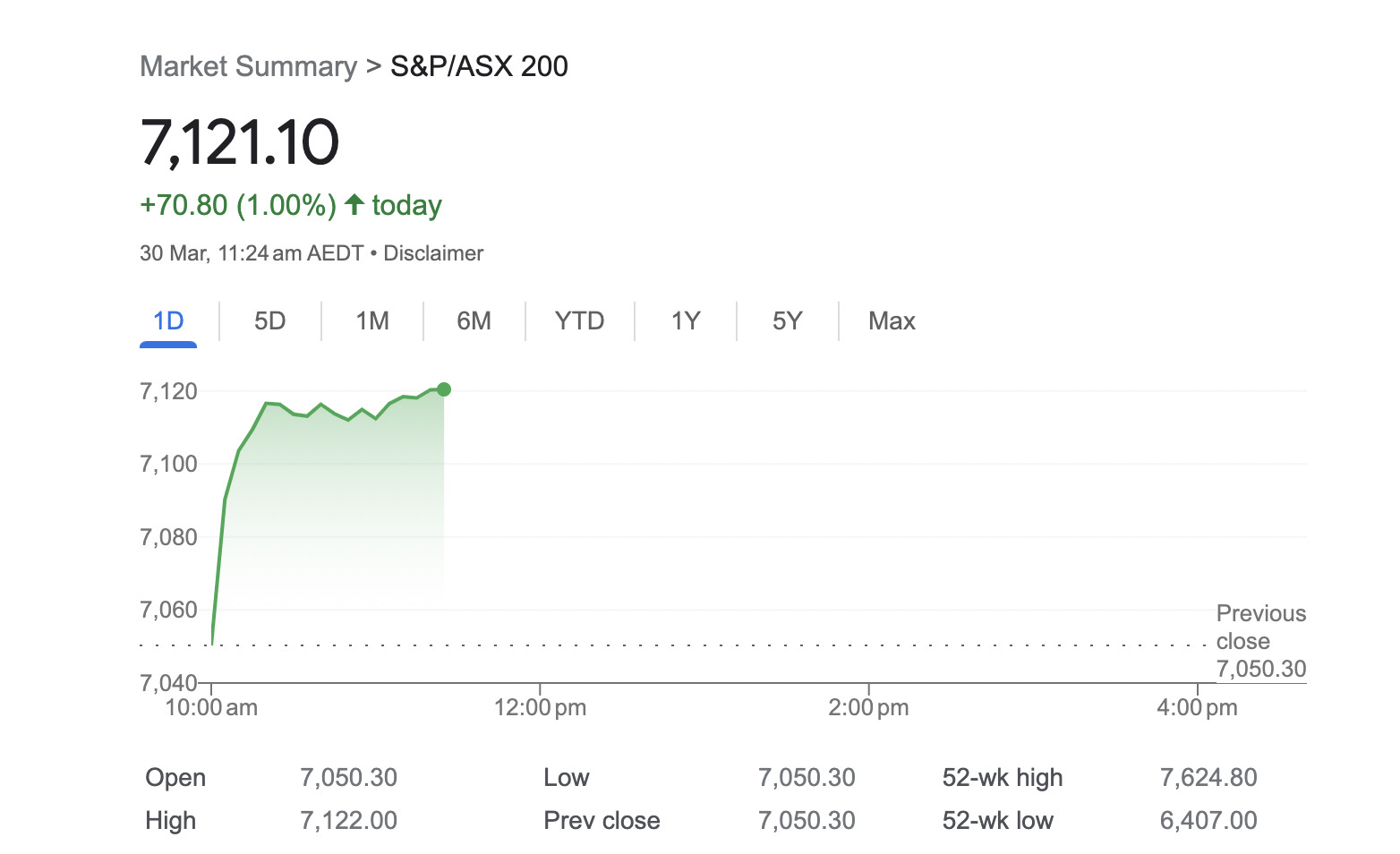

The ASX200 seems to be making a point, too, though. Or at least it was when it hit the ground running at opening time…

Acting as one giant sheep station then, local stocks performance has once again tracked that of Wall Street, with the major US indices all closing in the green based on… actually, we’ll get into that a bit further below. Let’s get the important mammoth balls news out of the way first.

A mammoth achievement

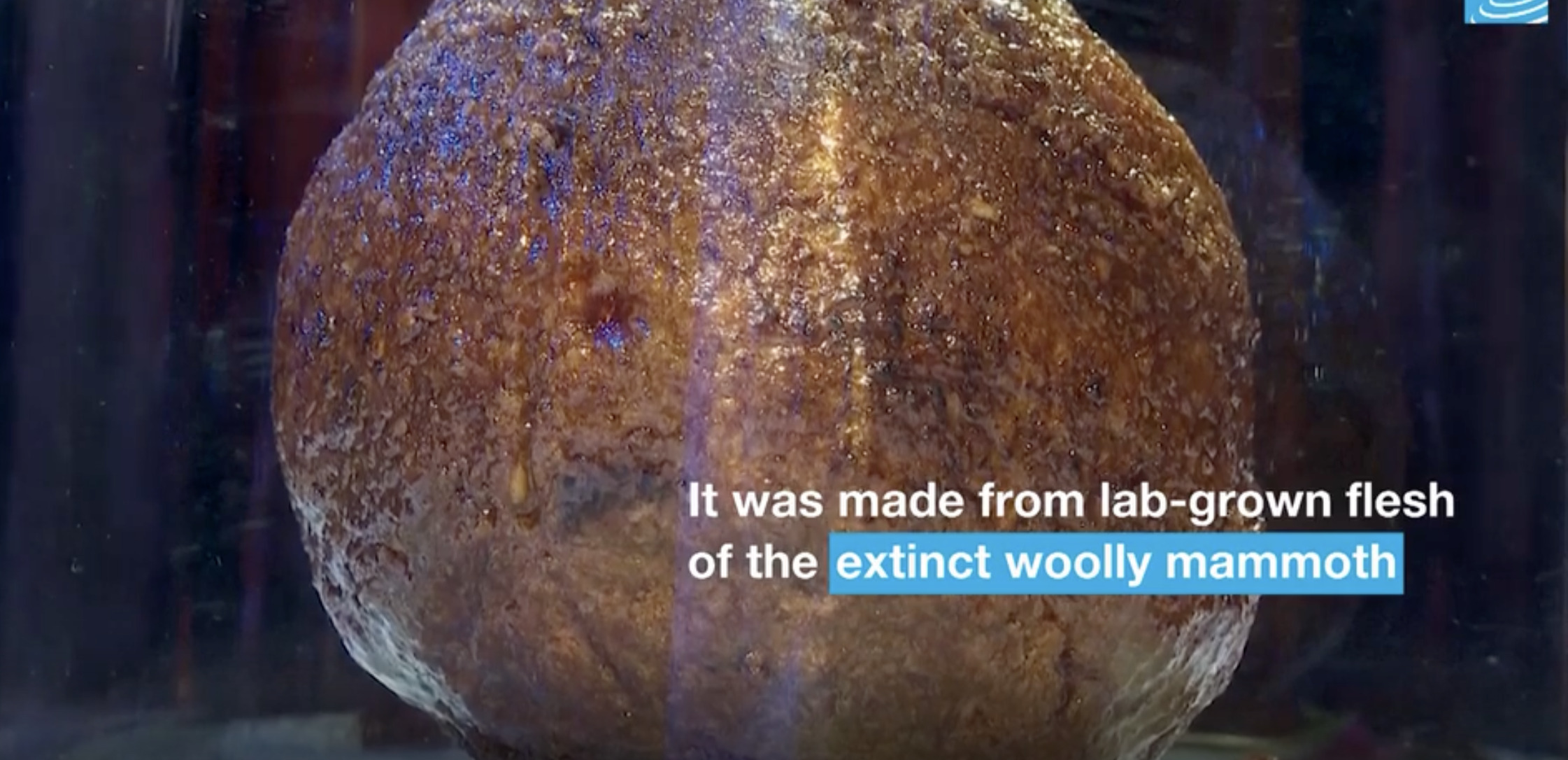

In fact, it’s just one ball – a giant meatball made partially from the “myoglobin” DNA of an extinct woolly mammoth as well as sheep cells and African elephant DNA, too.

Whetting your CAVEMAN-SIZED appetite is it? Here, take a gander…

Engineered by a bunch of Aussie food scientists at the cultured meat company Vow, the giant ball of moist, pungent flesh that looks like the Christmas pud from hell was unveiled this week at the Nemo science museum in the Netherlands.

Check out the video here on news.com.au and/or below on Reuters.

A giant meatball made from flesh cultivated using the DNA of an extinct woolly mammoth was unveiled at Nemo, a science museum in the Netherlands https://t.co/vl4Piqnlt8 1/4 pic.twitter.com/sI9drGPcQY

— Reuters Science News (@ReutersScience) March 29, 2023

Before revealing it to the museum’s onlookers, the scientists slow-cooked the mammoth ball in a very large oven and blowtorched the outside of it for an added touch of Heston Blumenthal-esque flare.

If you think the meal seems to be lacking a certain culinary balance, though – such as a shedload of spaghetti and a vat of Paul Newman’s bolognese sauce – that’s because it’s not actually a meal. Not one fit for humans at this point, anyway.

Vow’s point with it, the firm says, was to get people talking about cultured meat, referring to the process as a more sustainable alternative to the kind of meat you’re used to, which obviously requires the slaughtering of animals.

“We wanted to create something that was totally different from anything you can get now,” Vow co-founder Tim Noakesmith told Reuters news agency.

Achievement unlocked.

He added that an additional reason for choosing mammoth is that Vow’s scientists believe the giant creature’s extinction was caused by climate change.

“We face a similar fate if we don’t do things differently,” Noakesmith said.

The mammoth’s DNA sequence obtained by Vow had a few gaps, so sheep cells and African elephant DNA was inserted to complete it.

It was created “much like they do in the movie Jurassic Park”, said James Ryall, Vow’s chief scientific officer.

Righto, not sure that’s the most reassuring scientific reference, but guess it’s all pretty cool, nonetheless.

TO MARKETS

Checking back in with the ASX200, then and it’s looking reasonably tasty so far today. It’s currently up a full percentage point from this time yesterday where it was feeling decidedly undecided about matters, on the whole.

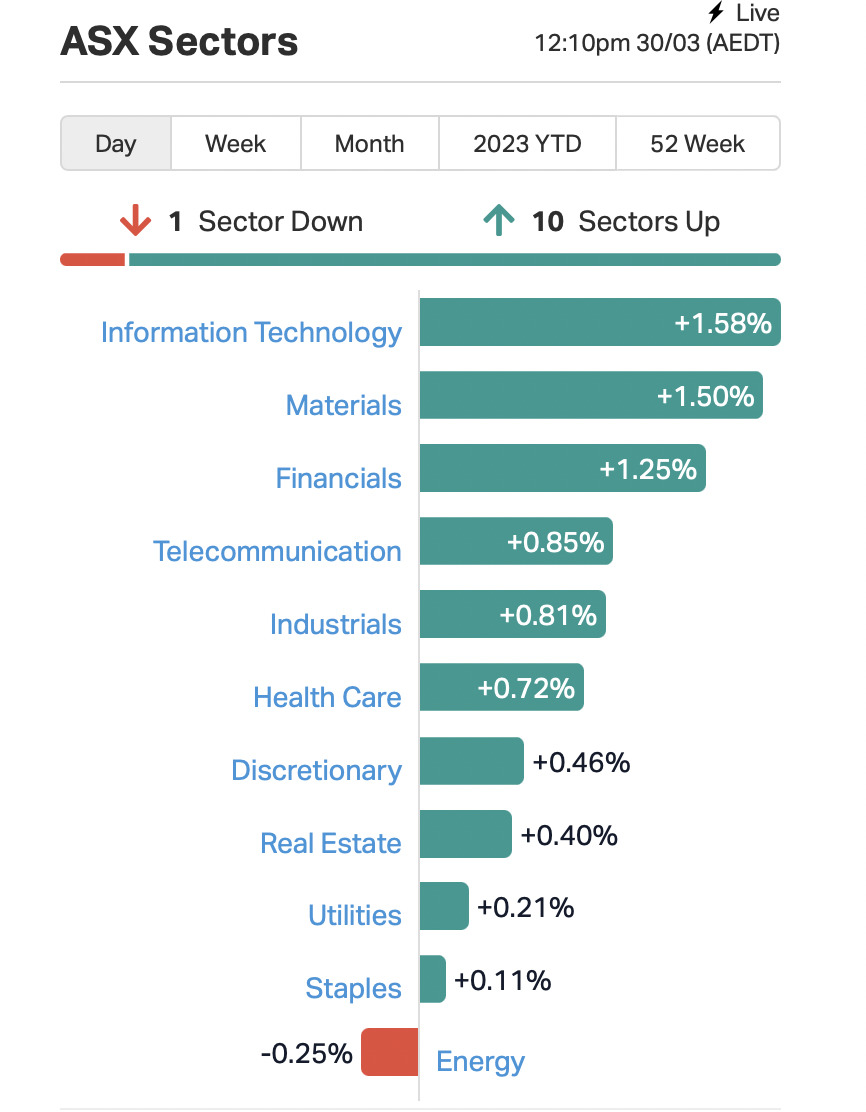

Drilling into sector specifics, here’s a chart…

Spoon-feeding you through that, then, we have IT, Materials and Financials well up today, with Energy as the only real lagger.

Zooming in further, here are some standouts we’re seeing so far today. Although this first one is an anomaly, given what we just said about the Energy sector lagging…

• Energy – Paladin Energy (ASX:PDN): +6.7% on no huge fresh news over the past few days that this columnist is spying.

• Materials – Alpha Hpa (ASX:A4N): +11.4%, again on no fresh news, although there may still be some basking glow on the reveal the Aussie company is entering into sapphire glass production with the Austrian HQed Ebner Group. Oh, and Macquarie just bought a nice chunk of it.

No time for (daily price) losers? Here’s one:

• Materials – RED 5 Ltd (ASX:RED): -5%, on no particular news of note.

NOT THE ASX

As mentioned above, Wall Street closed in the green overnight, and Stockhead’s early-to-bed, early-to-rise Eddy “Healthy, Wealthy and Wise” Sunarto has some reasons for that.

You should definitely head over to his Market Highlights for the full picture, but here’s something of a screen grab of his roundup:

“Aussie shares are set to rally, tracking stocks across Europe and Wall Street as concerns about stress in the banking sector eased further. At 7.30am AEDT, the April futures contract was pointing up by 0.7%.

“Overnight, the S&P 500 rose by 1.42%, the Nasdaq by 1.7%, while stock markets across Europe rallied by around 1.5%.

“Pretty much all US regional bank stocks climbed, and rate-sensitive tech stocks like Amazon and Apple led the session.”

Adding to that, over in China, at the time of writing, the Shanghai index is up 0.29%. “Among other advancers was Alibaba, which rose a further 1.7% a day after announcing its plan to break up the company and seek five potential IPOs,” noted Eddy.

In Japan, the Nikkei is -0.66%. And in Hong Kong, the Hang Seng is +0.24%.

Meanwhile, here’s a bit of lunchtime gossip for you. Albeit, possibly the most boring gossip you’ll hear today.

Apparently US Federal Reserve boss Jerome “Got the Financial World by its Mammoth Balls” Powell was overheard saying there will be one more interest rate hike this year. And that Gary Genlser fancies Elizabeth Warren (unsubstantiated), shh… pass it on.

Powell says one more rate hike over lunch. pic.twitter.com/iaJpFXSatR

— Sven Henrich (@NorthmanTrader) March 29, 2023

And in the Cryptoverse, Bitcoin continues to show remarkable resilience.

Well, is it remarkable? The thing has been steadily on the rise all year and is up about 72% over the past few months. Guess it is pretty startling, given all the regulatory mud being thrown the way of the crypto industry in the US this year.

For the morning roundup on daily price action crypto deets, head over to Mooners and Shakers.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 30 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap GGX Gas2Grid Limited 0.002 100% 7,500 $4,077,102 SIH Sihayo Gold Limited 0.002 100% 100,000 $6,102,128 AQX Alice Queen Ltd 0.0015 50% 1,880,000 $2,530,288 CCE Carnegie Cln Energy 0.0015 50% 10,686,348 $15,642,574 CLZ Classic Min Ltd 0.0015 50% 9,199,124 $2,437,440 WC1 West Cobar Metals 0.12 41% 2,920,118 $7,342,618 PYR Payright Limited 0.021 40% 41,283 $8,433,648 REE Rarex Limited 0.063 34% 8,580,802 $27,231,169 ADR Adherium Ltd 0.004 33% 150,192 $14,989,315 YPB YPB Group Ltd 0.004 33% 300,000 $1,857,747 GRV Greenvale Energy Ltd 0.125 30% 521,963 $40,893,768 PVT Pivotal Metals Ltd 0.038 27% 1,052,145 $14,234,313 KED Keypath Education 0.85 25% 3,930 $145,300,851 PUA Peak Minerals Ltd 0.005 25% 193,728 $4,165,506 ARR American Rare Earths 0.255 21% 9,089,697 $93,739,968 LIS Lisenergy limited 0.265 20% 426,233 $36,501,121 RFX Redflow Limited 0.27 20% 306,042 $40,436,856 KPO Kalina Power Limited 0.012 20% 2,314,083 $15,151,958 NZS New Zealand Coastal 0.003 20% 1,017,874 $4,135,025 RML Resolution Minerals 0.006 20% 400,000 $5,398,731 BVR Bellavista Resources 0.19 19% 297,181 $6,075,602 SOR Strategic Elements 0.13 18% 6,050,619 $49,162,678 RXH Rewardle Holding Ltd 0.02 18% 134,291 $8,947,465 CBE Cobre 0.135 17% 1,003,958 $31,939,424 COO Corum Group Limited 0.034 17% 250,026 $17,324,072

Some standouts for you:

• Alice Queen (ASX:AQX): +50% on news that the “advanced gold and copper explorer” has has its application approved for a QLD government critical minerals grant for the company’s Horn Island Project in Torres Strait. More details > here.

• West Cobar Metals (ASX:WC1): +41% on more positive high-grade REE clay mineralisation results at the company’s Salazar project 150km northeast of Esperance in Western Australia. Details > here, and in today’s Resources Top 5, here.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for March 30 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap SCU Stemcell United Ltd 0.005 -62% 30,715,773 $16,916,037 MCT Metalicity Limited 0.002 -33% 507,144 $10,513,618 BFC Beston Global Ltd 0.015 -32% 20,844,347 $43,935,032 MRR Minrex Resources Ltd 0.016 -30% 28,199,437 $24,951,953 TYM Tymlez Group 0.009 -25% 9,064,629 $13,106,344 SRJ SRJ Technologies 0.062 -23% 24,000 $7,570,814 CTO Citigold Corp Ltd 0.004 -20% 9,246 $14,168,295 OAU Ora Gold Limited 0.002 -20% 5,561,831 $9,842,313 PUR Pursuit Minerals 0.017 -15% 37,928,609 $23,745,017 M2M Mt Malcolm Mines 0.04 -15% 145,000 $2,926,972 MME Moneyme Limited 0.09 -14% 2,284,164 $29,740,959 SIO Simonds Grp Ltd 0.09 -14% 109,126 $37,790,177 AD1 AD1 Holdings Limited 0.006 -14% 175,677 $4,905,119 CPT Cipherpoint Limited 0.006 -14% 800,000 $8,005,717 DM1 Desert Metals 0.12 -14% 54,090 $10,155,751 GNM Great Northern 0.003 -14% 200,000 $5,981,678 JRV Jervois Global Ltd 0.0575 -14% 73,806,191 $139,310,485 AE1 Aerison 0.1 -13% 130,000 $37,195,311 ELT Elementos Limited 0.2 -13% 16,928 $40,969,664 REC Recharge Metals 0.14 -13% 50,250 $6,367,200 RCR Rincon 0.065 -12% 49,242 $5,011,698 DTZ Dotz Nano Ltd 0.19 -12% 100,375 $99,196,477 8IH 8I Holdings Ltd 0.023 -12% 5,062 $9,291,256 DUN Dundas Minerals 0.12 -11% 108,125 $6,404,974 CNJ Conico Ltd 0.008 -11% 50,200 $13,544,717

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.