ASX Small Caps Lunch Wrap: Who’s been sunk by a poopy one-star review this week?

Mmmmm... so pungent. Pic via Getty Images.

Well, would ya look at that? Local markets are up this morning, with the ASX 200 benchmark higher by 33 points just moments after kick-off, and continuing to climb throughout the early portion of the session.

Why? Well… that’d be because there was a rally on Wall Street.

“Again?” I hear you ask, the incredulity in your outraged voices reaching fever pitch, as the dawning realisation that we are seemingly utterly beholden to whatever malarkey is going on in New York while we’re asleep.

“Yup… again,” says I, the resignation of realising that I’m about to spend another 90 minutes of my life coming up with a new and exciting way to tell you the same news I’ve told you at least 100 times before.

It was another record-setting session, though, so… there’s that. But this time, it’s the Dow that’s breaking records, crossing out an all-time high to finish on 40,954.48 points. What a time to be alive.

I’ll go into more detail about it all shorty, but first, to a remarkable story from the wild, wild world of Amazon businesses, which tells the story of one small “mom and pop” operation in the US that has been brought undone by a poop-filled, one-star review that won’t go away.

The company is Beau & Belle Littles, and it sells a fairly wide range of clothes and accessories for babies – including, apparently, nappies designed to be worn by kids when they go swimming.

However, according to the company, a mix-up in Amazon’s returns warehouse in 2020 has been the catalyst for the business’ poor performance, after it sparked a scathing one-star review.

The problem began when, according to the business owners, Amazon’s return centre didn’t adequately check a product that had been sent back by a consumer, and simply re-labelled it and sent it out as ‘brand new’.

That was a major issue, because the product was a) a nappy, and b) was most definitely in “used condition”, arriving at its new owners house complete with visible skidmarks.

The new owner was justifiably outraged, left a blistering review on the company’s page, and went about their day. The problem for the retailer was that more than 100 shoppers quickly “liked” the review, which in turn told Amazon’s algorithm that it was important enough to take pride of place on the Beau & Belle Littles page.

For years the review was there for all to see – despite being no fault of the business owners, who reportedly went out of their way to make amends to the outraged shopper, and who say they repeatedly asked Amazon to take the review down.

Store owners Paul and Rachelle Baron told media recently that they were, at the time, in the process of ramping up the business by “executing a plan to triple their annual sales to $3 million in 2020” – but, that’s been all but sunk by a stinky stain on their shop’s reputation, which has left them more than half a million dollars in debt.

That review, however, has finally been removed – most likely after receiving significant media attention this week – but two questions still linger…

First of all, how is it that a company is able to deliver three sets of guitar strings, four cases of soft drinks and a personal massage device (that has turned out to be really difficult to explain) to my door in under 12 hours, but took four years to remove a powerfully pungent one-star review from a small business when it wasn’t their fault in the first place.

But, most important of all – who in their right mind thought it was cool to mail a dirty nappy back to Amazon?

That one’s a mystery for the ages.

TO MARKETS

Local markets were up this morning, jumping out of the gate all vibrant and happy, shooting a +0.5% rainbow out of its butt like a happy little unicorn, setting the mood for a positive morning on the ASX.

That good feeling has intensified throughout the morning, and by lunchtime the ASX 200 has added 0.8%, largely thanks to surges from… oh. It’s InfoTech and the goldies again.

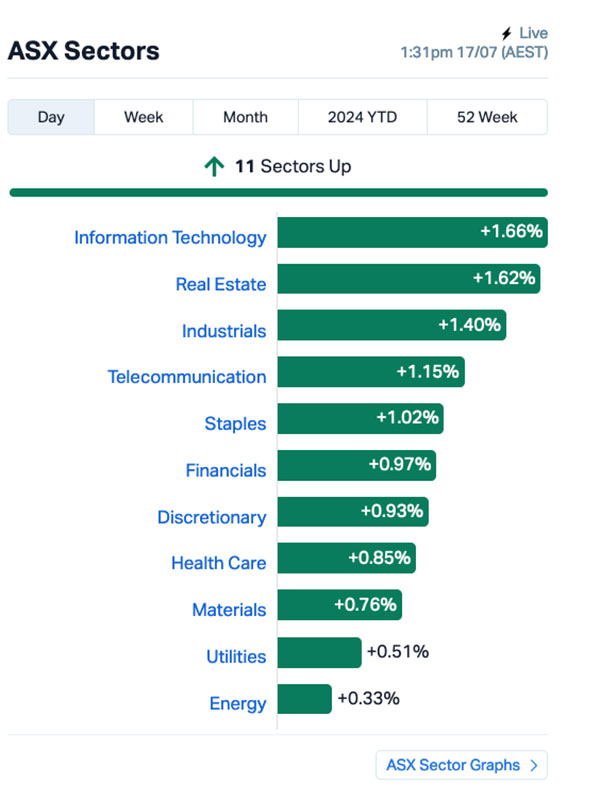

For what it’s worth, every market sector is in the green this morning, and the chart looks like this:

The push among the techies is most likely due to yet another strong showing on Wall Street overnight, with local big guns WiseTech Global (ASX:WTC) and Life360 (ASX:360) leading the charge, with gains of 4.18% and 2.87% respectively.

Among the Resources heavyweights, James Hardie (ASX:JHX) was up 4.64%, Northern Star Resources (ASX:NST) added 4.48% and there’s a lengthy list of companies well into the Billion Dollar Club that are better off by more than 2.0% this morning.

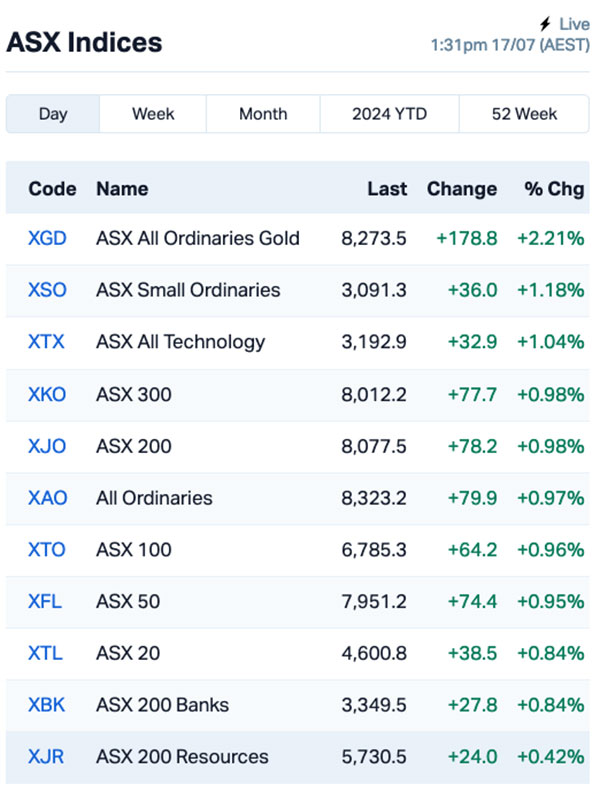

The ASX indices look like this:

As you can see, the goldies are caning it again this morning, after spot gold rose 1.9% overnight to hit $US2,468.57 per ounce.

That helped Gold Corporation, aka ASX:PMGOLD to add 2.06%, while PM Albanese fell to 33% in the latest Resolve poll, and PM Dawn hasn’t had a hit since Looking Through Patient Eyes reached No 6 on the Billboard Top 100 in 1993.

NOT THE ASX

On Wall Street overnight, the Dow closed up by 1.9% to hit an all-time record high, while the S&P 500 advanced 0.6% and the Nasdaq Composite was 0.2% better off.

Frankly, it’s about time the stuffy old Dow Jones Index got into the record books again – it’s been a lengthy stretch of records for the S&P and the Nasdaq recently, and the Dow just hasn’t been keeping up.

I like to think of the Dow anthropomorphically, as one of the old men from Trading Places who sits in an overstuffed burnt-cherry red armchair in a private men’s club in New York, harrumphing gently from behind a tattered copy of the Wall Street Journal from 1996, wondering aloud to anyone who’ll listen with questions like “What’s an Eminem?”, and “Whatever happened to that guy with the great voice? KD someone… is he still going?”

Anyway – Wall Street was higher because of some US data that investors thought was great. US retail sales data for June showed results that were stronger than expected, which has been taken as yet another tick in the “Surely the Fed will cut rates soon” box.

US Small Caps were also on the menu again, with the barely-mentioned before this past week Russell Index – the US Small Caps index – pushing through its fifth consecutive 1%-plus session overnight.

In US stock news, Bank of America (BofA) and Morgan Stanley both ended the day with gains.

Despite BofA’s quarterly profit declining, it still exceeded estimates. Meanwhile, Morgan Stanley’s profit surged, signalling a potential resurgence in investment banking for both firms.

Amazon was up slightly as the commerce giant launched Prime Day, its annual two-day promotional event. Prime Day, which started nine years ago, was created to showcase the value of a Prime membership by providing special deals and benefits for members.

In Asian markets today, things are mixed and not at all fabulous. Hong Kong and Tokyo are flat, while Shanghai markets are down 0.48% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 17 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap LRL Labyrinth Resources 0.016 220.0 29,003,144 $5,937,719 XGL Xamble Group Limited 0.03 50.0 238,022 $5,923,142 AUK Aumake Limited 0.003 50.0 1,787,291 $3,828,814 PRX Prodigy Gold NL 0.003 50.0 1,465,653 $4,235,549 RML Resolution Minerals 0.003 50.0 200,000 $3,220,044 TD1 Tali Digital Limited 0.0015 50.0 10,000 $3,295,156 ATH Alterity Therap Ltd 0.007 40.0 105,790,972 $26,225,577 WNR Wingara Ag Ltd 0.011 37.5 75,558 $1,404,340 DOU Douugh Limited 0.004 33.3 198,436 $3,246,207 GCM Green Critical Min 0.004 33.3 126,250 $4,159,755 OAR OAR Resources Ltd 0.002 33.3 100,000 $4,833,150 PKO Peako Limited 0.004 33.3 1,434,160 $1,581,254 ADN Andromeda Metals Ltd 0.022 29.4 24,618,904 $52,874,606 HLX Helix Resources 0.0025 25.0 8,889,041 $6,528,387 LPD Lepidico Ltd 0.0025 25.0 600,000 $17,178,239 RNE Renu Energy Ltd 0.005 25.0 1,128,587 $2,904,536 SIH Sihayo Gold Limited 0.0025 25.0 487,000 $24,408,512 REZ Resourc & En Grp Ltd 0.017 21.4 1,447,093 $9,052,948 EVG Evion Group NL 0.022 16% 161,112 $6,592,301 PVT Pivotal Metals Ltd 0.022 16% 90,909 $13,378,247 C29 C29 Metals 0.11 16% 569,018 $13,269,713 CSX Cleanspace Holdings 0.3 15% 38,506 $20,113,533 ADC ACDC Metals 0.06 15% 330,481 $2,580,370 1AE Aurora Energy Metals 0.091 15% 707,872 $14,146,035 AAU Antilles Gold Ltd 0.004 14% 1,003,000 $3,487,872

The clear winner for Wednesday morning was Labyrinth Resources (ASX:LRL), flying through 220% on news that the company is set to acquire 100% of Distilled Analytics – which owns the Vivien Gold Project – and a 12-month option (commencing on completion of the Distilled acquisition) to acquire Sand Queen’s 49% interest in Comet Vale for $3m in cash, which would take LRL’s ownership of Comet Vale to 100%.

TALi Digital (ASX:TD1) was up after delivering a quarterly this morning that it has sold its 10% holding in Healthcarelink Group for $35,000, has kept cash burn to a minimal $0.1 million and is “actively exploring M&A opportunities to foster growth and enhance shareholder value”.

Alterity Therapeutics (ASX:ATH) climbed on news of positive interim data from the ATH434-202 open-label Phase 2 clinical trial in patients with multiple system atrophy (MSA), which has been shown preclinically to reduce α-synuclein pathology and preserve neuronal function by restoring normal iron balance in the brain.

Peako (ASX:PKO) was up this morning on the back of some housekeeping news, including the resignation of Geoff Albers, who will be replaced on the board by Gernot Abl who has been nominated to be non-executive chairman, at the conclusion of a non-renounceable 2 for 3 rights Issue at $0.003 per share.

And Andromeda Metals (ASX:ADN) was up, thanks to news of a binding with Traxys Europe for the sale and purchase of Andromeda’s kaolin products for the first 5 years of production, which the company says has helped it to meet the required support needed for its expanded Stage 1A+ production and further progress towards a final investment decision.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 17 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap EDE Eden Inv Ltd 0.001 -50.0 50,000 $7,427,417 JTL Jayex Technology Ltd 0.001 -50.0 587,965 $562,557 SI6 SI6 Metals Limited 0.002 -33.3 2,799,998 $7,106,578 AX8 Accelerate Resources 0.015 -31.8 8,944,320 $13,656,587 BEZ Besragoldinc 0.068 -31.3 3,536,555 $41,391,990 CAQ CAQ Holdings Ltd 0.011 -31.3 758,000 $11,484,580 ITM Itech Minerals Ltd 0.079 -21.0 839,054 $12,228,356 MTL Mantle Minerals Ltd 0.002 -20.0 11,000 $15,493,615 ROG Red Sky Energy. 0.004 -20.0 500,000 $27,111,136 DRO Droneshield Limited 1.64 -18.8 51,734,472 $1,540,351,788 SRH Saferoads Holdings 0.041 -18.0 150,000 $2,185,270 SNS Sensen Networks Ltd 0.033 -17.5 278,462 $31,116,350 ADG Adelong Gold Limited 0.005 -16.7 118,140 $6,707,934 ICG Inca Minerals Ltd 0.005 -16.7 3,150,107 $4,863,219 ICR Intelicare Holdings 0.022 -15.4 124,484 $7,565,991 NWC New World Resources 0.028 -15.2 11,011,319 $93,575,297 BNL Blue Star Helium Ltd 0.006 -14.3 1,856,679 $13,614,197 OVT Ovanti Limited 0.006 -14.3 2,119,783 $8,680,738 TMK TMK Energy Limited 0.003 -14.3 3,027,616 $24,225,642 TMX Terrain Minerals 0.003 -14.3 6,758,503 $5,010,847 TM1 Terra Metals Limited 0.067 -14.1 6,813,957 $28,421,538 ODA Orcoda Limited 0.155 -13.9 82,372 $30,448,272 GRV Greenvale Energy Ltd 0.032 -13.5 255,185 $16,972,969 LPM Lithium Plus 0.13 -13.3 192,614 $19,851,000 BMM Balkanminingandmin 0.074 -12.9 4,690 $6,038,444

IN CASE YOU MISSED IT – AM EDITION

The gold and base metals explorer has been awarded an allocation $960,000 of exploration credits for the 2024/25 income year under the Federal Government’s Junior Minerals Exploration Incentive (JMEI).

The JMEI encourages investment in greenfields minerals exploration companies by allocating tax credits to qualifying companies to give up some of their tax losses for distribution to eligible investors. In early CY 2024, Cosmo announced the intention to acquire the Kanowna Gold Project (KGP) adjacent to the 7Moz Kanowna Belle gold mine near Kalgoorlie.

The company is also active in the underexplored Yamarna Belt in the Eastern Goldfields region which is considered highly prospective for copper-nickel-cobalt and platinum group elements.

DeSoto says two geophysical contractors are completing surveys at its Spectrum Rare Earth Elements (REE) and base metals project and Fenton gold project in the NT.

Back in May, the company inked an agreement to earn-in to the highly prospective Spectrum project in the Pine Creek minerals district where historic uranium-focused drilling at Spectrum was completed before REEs were recognised as a valuable critical minerals opportunity.

At Fenton, the project contains a 55km-long strike of the Fenton Shear Zone (FSZ), similar in strike and parallel to the prolific Pine Creek Shear Zone (PCSZ) which contains about 17Moz of recorded gold deposits.

Now DES reports that geophysical surveys to follow-up the Vesper and Fenton South AEM anomalies ahead of its planned 2024 drilling programs are progressing well. Zonge Engineering has completed three loops of the ground FLEM (Fixed Loop ElectroMagnetic) survey at Fenton South and are now working at the Spectrum project area.

In addition, gravity geophysical contractor Atlas Geophysics was mobilised to site on 11th July to commence a high resolution 125m by 250m spaced ground gravity survey over Fenton South, and Spectrum projects Vesper and Quantum. The Fenton South area has now been completed and both teams are now working at the Spectrum project area.

The gravity survey is expected to be completed within 7-10 days and the FLEM approximately 3 weeks with the IP survey to follow.

Greenvale Energy has re-engaged the University of Jordan (UofJ) to undertake the liquefaction Testwork Program 5 on samples from its Alpha torbanite project in Queensland.

Test Program 5 is designed to examine the issues raised in Test Program 4 by Technix, whose aim was to determine the potential of the Alpha project to produce a premiumgrade C170 bitumen product.

Unfortunately, the analysis of bulk samples revealed that, while the shale extract from Alpha could be used for manufacturing standard or modified types of bitumen, it did not meet the stringent specifications required to deliver a premium C170 bitumen product. The main issues identified were the viscosity of product and the lack of elasticity.

“Following consultation with the University of Jordan, we have been able to design a low-cost Test Program 5 that we believe should give us a more definitive picture of the forward pathway for Alpha,” GRV CEO Mark Turner said.

“With the benefit of the findings delivered to us by Technix, the experts at the UoJ have been able to design a test program that will address the key issues of viscosity and elasticity – and could potentially lead to an important breakthrough for the project.”

If the Test Program 5 is deemed successful in achieving viscosity and penetration in the desired ranges, the company will move on to Test Program 6, where the individual ply’s will be tested – Torbanite (LT) on its own as well as L1 & L2 Cannelite on their own.

A bulk sample will then be prepared under the optimum conditions and sent to Technix for product analysis and identification.

At Stockhead, we tell it like it is. While Cosmo Metals, Greenvale Energy and DeSoto Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.