ASX Small Caps Lunch Wrap: Who’s been caught starting the War with the Machines this week?

I am telling you, Maureen.. the god-darned thing has been following me around all morning. I'm shooting it down, and you can't stop me!" Pic via Getty Images.

Local markets are on the up this morning, after the benchmark fired to a 1.02% lead in the opening moments of the session, where it appears to be holding reasonably steady, for now.

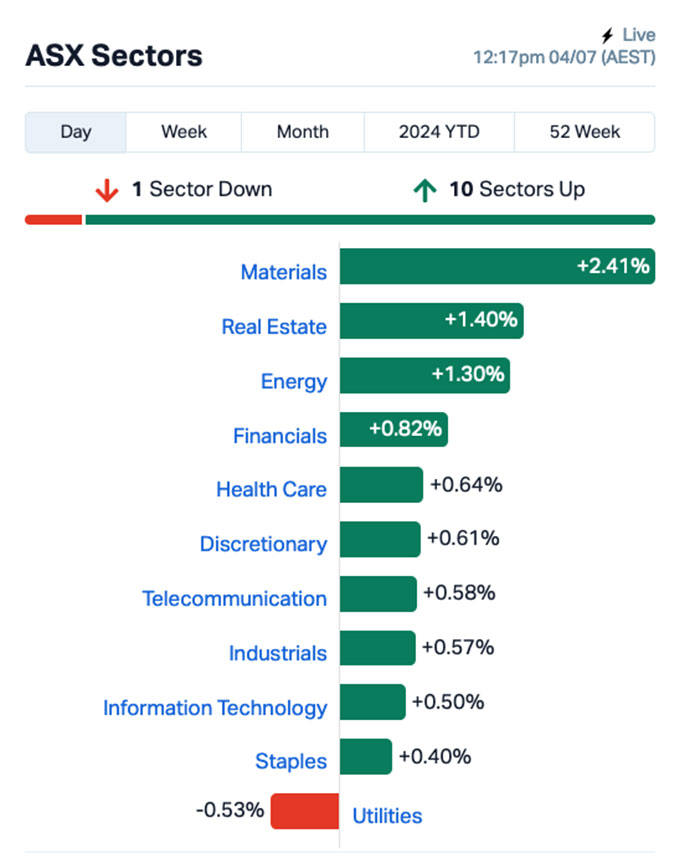

Every sector, with the stark exception of Utilities, is performing well – but the power supplier Mercury NZ is down more than 3.7% this morning, and that’s weighing heavily on the sector.

I’ll get into more detail on that shortly, but first – and I know that falling back on a Florida Man story is kinda like cheating, here – we’re off to the Humid Panhandle of America, where Florida Man has been flying his freak flag high once again.

Today, it’s 72-year-old Dennis Winn, who’s in trouble with the law after … *checks notes* … using his gun to blow a Walmart delivery drone out of the sky, because of course he did.

The drone was being used by a couple of Walmart employees who were performing mock deliveries with the unit out and about in the neighbourhood, in an attempt to drum up some business for the drone delivery service that Walmart now offers in some parts of the US.

When the pair pulled up outside Winn’s home in a quiet cul de sac, and started putting the drone through its paces to show local residents what it was capable of, they heard “a sound like a gunshot”.

Rounding the corner of the home, one of the employees saw an elderly man with a weapon pointed in the air, and the drone… well, let’s just say that the drone had seen better days.

An inspection of the craft showed about US$2,500 worth of damage to the drone’s payload system, and so police were called.

Under questioning, Winn stated that he saw the drone fly over his home, prompting him to retrieve his gun to fire at it, believing that it was being used to spy on him… because, of course he did.

Winn was arrested and charged with shooting at an aircraft, criminal mischief with damage over $1,000, and discharging a firearm on public or residential property – all of which I’m frankly astonished are still illegal in Florida.

No word on the condition of the drone, but I do fear that it will end up becoming a touchstone in the upcoming war against the machines – an electronic martyr, and a rallying cry for every weaponised fax machine and remote control toy that turns bad and rises up against humanity.

TO MARKETS

Local markets are up this morning, with the benchmark holding steady just above +1.0% for most of the morning, and all the sectors barrelling along nicely, except for Utilities, which most definitely is not.

The talk around town, though, is centred on yesterday’s report into the Australian Securities and Investments Commission – and the fallout that has been raining down since it landed.

I don’t have the time, nor space (or, frankly, the energy) to dive all the way into it – and the one man around here who could do it justice is battling pneumonia, because he is old and frail.

(Get well soon, Christian! Please…)

Anyway – the report into ASIC is not even remotely flattering, and there are now calls for the watchdog to be massively overhauled from the lumbering bureaucratic behemoth that it is, to a more nimble, streamlined operation that will actually do stuff.

As the ABC puts it: “ASIC’s ambit is too wide, its resourcing too low and its culture so bad that white collar crime has been allowed to go unchecked in Australia, for too long.”

The Senate report makes a few recommendations, but the take home message is one that says the organisation needs to be broken up, split out into two bodies – one regulator focussed on corporations, and another focussed on financial services.

Tellingly, the 20-month inquiry by the Senate Economics Committee found that ASIC currently has a track record of taking complaints, and filing them – with no further action taken on a large number of those complaints.

But when ASIC did take action, the report says, the outcomes “were often at odds with the scale of the offending”, and when criminal proceedings were instigated, few of them resulted in any penalties at all.

Make of that what you will.

A look at how the ASX sectors were performing shows this:

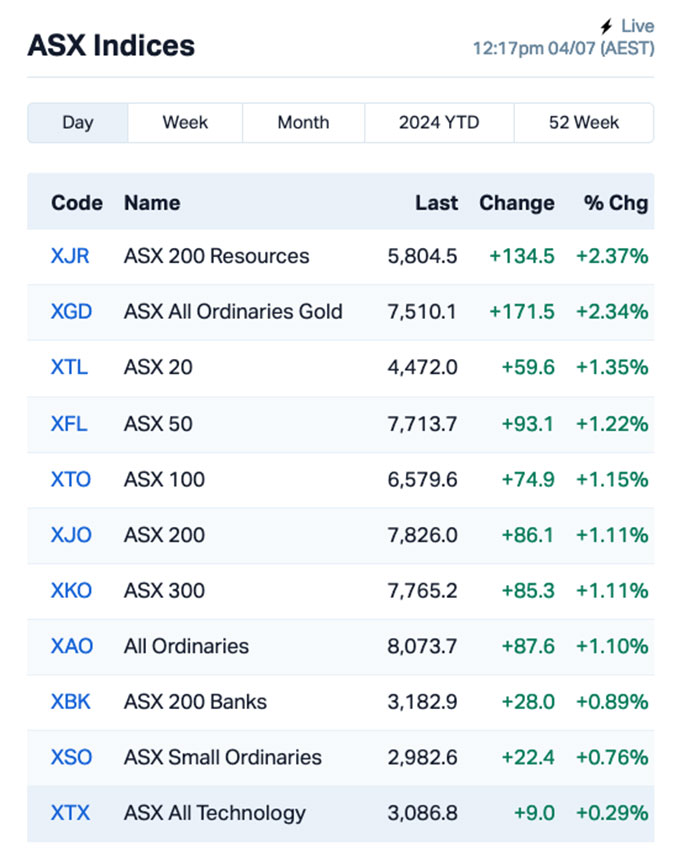

The ASX indices were doing this:

And I’ll get to the Small Caps winners shortly, once I’ve wrapped up what’s been happening offshore in the past day or so.

NOT THE ASX

It was a half day on Wall Street yesterday, with the market closing at lunch time to allow traders the opportunity to go home and fortify their dwellings against the onslaught of today’s 4th of July celebrations.

It is traditionally a celebration of America’s independence from Britain, which in recent years has resulted in heavy drinking, fireworks everywhere and an enormous spike in mass shootings.

Things should return to normal on Friday – but if you’ve been watching the headlines out of the US this week, there’s a non-zero chance that the next few days could be pretty bumpy in the US.

The half-day didn’t exactly set the world on fire for US markets – while the S&P (+0.51%) and Nasdaq (+0.88%) both managed modest rises, the Dow was fractionally below par for the session, down -0.06%.

In US stock news, Paramount Global was rising fast on rumours that a much-vaunted takeover could be back on, Tesla piled on another +6% and chipmaker Nvidia was up +4.5%.

European markets surged ahead of upcoming elections which have markets – and pretty much everyone else – very much on edge.

Among the Euro stocks, shipping giant Maersk was the standout, climbing 3.8% on news that it had withdrawn from sales talks with logistics firm DB Schenker, after what appears to be insurmountable integration hassles scuppered the deal.

In Asian markets, Japan’s Topix rode to an all-time high yesterday, riding a wave of optimism among the broader Asian market community. However, Japan’s Yen has slumped to a 38-year low against the U.S. dollar and fallen into a record-low chasm versus the euro.

That’s despite a weakening US dollar, too – the greenback is losing steam after a pair of reports spotlighted a contraction in the US services sector and a downturn in manufacturing.

Asian markets today are looking “okay” – Japan’s Nikkei is up +0.39%, the Hang Seng is +0.56% higher and Shanghai markets are up +0.20%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 04 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Change Volume Market Cap MHC Manhattan Corp Ltd 0.002 33.3 376,000 $4,405,470 HCD Hydrocarbon Dynamic 0.003 50.0 500,000 $1,617,165 EDE Eden Inv Ltd 0.002 33.3 1,027,832 $5,517,407 NGS NGS Ltd 0.004 33.3 1,001,000 $753,682 RLG Roolife Group Ltd 0.004 33.3 222,000 $2,347,145 OLY Olympio Metals Ltd 0.05 31.6 109,885 $3,248,106 AHK Ark Mines Limited 0.275 31.0 158,230 $11,643,747 RCR Rincon 0.14 27.3 9,073,280 $31,713,625 SNT Syntara Limited 0.028 27.3 1,856,005 $26,268,699 PVT Pivotal Metals Ltd 0.025 25.0 1,100,000 $14,082,366 AEV Avenira Limited 0.005 25.0 827,116 $9,396,136 ALR Altairminerals 0.005 25.0 97,889 $17,186,310 ATH Alterity Therap Ltd 0.005 25.0 130,192 $20,980,461 BYH Bryah Resources Ltd 0.005 25.0 20,000 $2,013,147 HLX Helix Resources 0.0025 25.0 1,228,166 $6,528,387 LCL LCL Resources Ltd 0.01 25.0 100,904 $7,719,024 1MC Morella Corporation 0.003 20.0 619,798 $15,446,999 MMM Marley Spoon Se 0.045 18.4 572,108 $4,473,527 FSG Field Solu Hldgs Ltd 0.026 18.2 33,105 $16,868,315

Avenira (ASX:AEV) was rising this morning, but the only recent news of note was the resignation of two directors, Mr Kevin Dundo and Ms Winnie Lai Hadad, who stepped down from the Board of Directors on 2 July 2024.

Similarly, Marley Spoon’s (ASX:MMM) news today was the result of a resignation as well, after CEO and Management Board Chairman Fabian Siegel departed on 26 June – by mutual agreement – after 10 years at the helm of the company.

On the downside of things this morning, eCargo (ASX:ECG) is in freefall after announcing yesterday that it’s looking to delist from the ASX.

West African Resources (ASX:WAF) was lower on news that it is gearing up for an equity raising, offering new shares at A$1.37 a pop, an 18% discount to the last traded price on Monday, 1 July 2024 which was $1.59.

Alice Queen (ASX:AQX) was down on news that Gage Resource Development has snapped up ~450 million ordinary shares at $0.008 which will raise a further ~$3.64 million for the company.

And Latitude 66 (ASX:LAT) is showing as a loss on our charts, but the story’s a little more complicated. The company, formerly known as DiscovEX Resources (ASX:DCX) has come back from a prolonged trading suspension, after a $4 million capital raising to fund exploration in Finland and Australia.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 04 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Change Volume Market Cap ECG Ecargo Hldg 0.008 -58 3,973,243 $11,689,750 RML Resolution Minerals 0.002 -33 2,706,096 $4,830,065 SIS Simble Solutions 0.002 -33 238,114 $2,260,352 1TT Thrive Tribe Tech 0.003 -25 4,628,471 $1,882,486 ODE Odessa Minerals Ltd 0.003 -25 4,400,000 $4,173,130 IVX Invion Ltd 0.004 -20 125,000 $33,022,661 NVQ Noviqtech Limited 0.034 -19 59,860 $6,322,876 LAT Latitude 66 Limited 0.165 -18 799,313 $28,523,215 BLU Blue Energy Limited 0.01 -17 2,754,127 $22,211,683 RIL Redivium Limited 0.0025 -17 14,864 $8,192,564 PGO Pacgold 0.092 -16 92,363 $9,255,998 ODA Orcoda Limited 0.13 -16 12,078 $26,219,346 ANR Anatara Ls Ltd 0.035 -15 37,444 $7,836,893 CL8 Carly Holdings Ltd 0.012 -14 180,339 $3,757,185 EXL Elixinol Wellness 0.003 -14 1,197,382 $4,624,138 MOM Moab Minerals Ltd 0.003 -14 163,737 $2,491,871 RR1 Reach Resources Ltd 0.013 -13 493,878 $13,116,470 WAF West African Res Ltd 1.38 -13 7,040,579 $1,634,171,685 AQX Alice Queen Ltd 0.007 -13 713,400 $5,527,921 ME1 Melodiol Glb Health 0.0035 -13 11,286,218 $921,849

ICYMI – AM EDITION

Indiana Resources (ASX:IDA) has wrapped up its combined reverse circulation and aircore drilling campaign at the Minos and Hopeful Hill prospect areas after drilling 16 holes for 1,638m.

At Minos, 5 drill holes were carried out to test the extension of high-grade gold mineralisation as well as a parallel structure at the northwest end, which was intersected in earlier campaigns.

Another three drill holes were drilled at Hopeful Hill, testing several areas of interest identified in late 2022.

Assay results are expected in August.

At Stockhead we tell it like it is. While Indiana Resources is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.