ASX Small Caps Lunch Wrap: Who’s been arrested for chasing their dreams this week?

Pic via Getty Images.

After last week’s return to volatile, fever-dream trading, it’s a big welcome back to yet another meek Monday morning in ASX-Aussieland, from All of Us* here at Stockhead.

(*Not Bevis, he is always grumpy on Mondays.)

(**And Tues-Fri.)

So, markets here are lower, the ASX200 has trotted backwards by circa 0.25% ahead of lunch. Wall Street indices did in fact achieve some unconvincing gains on the Friday night-in-New York/Saturday morning-in-Sydney session.

Before we set the scene for that, however, there’s the small matter of some entirely unrelated news, which is so joyously preposterous it’s brought an enormous smile to the hearts of literally tens of people.

Hence, I’ve got no choice but to bring it to your attention – because the US Coast Guard has arrested a man for trying to run from Florida to London.

That fella’s name is Ray “Reza” Baluchi, a self-proclaimed “extreme athlete” with a penchant for punishing his body in the name of sport. Or mental illness. Or it could just be a pain kink. I’m really not sure at this point.

Baluchi is something of an extreme running sensation, kind of. He’s had a crack at several massive journeys on foot, including a 14,000 mile run in March of this year.

He didn’t finish that run for two reasons, which will tell you a lot about what kind of guy we’re dealing with here.

Firstly, he wanted to make that run barefoot, because of course he did, leading to the second reason he didn’t make it.

On Day 2 of that effort, he cut his foot open on a piece of glass – which would have stopped a reasonable human being. But not Baluchi.

He ran – bleeding – until he found a tyre repair workshop by the side of the road, where he spent a considerable amount of time trying to superglue the wound shut.

The latest in his long list of rampant lunacy goes as follows: US Coast Guard officials say they were patrolling the seas off the coast of Florida when they encountered Baluchi on August 26, about 70 nautical miles east of Tybee Island, Georgia.

The Coast Guard was out and about because there was an enormous hurricane on the way to the region, so they were pretty surprised to find Baluchi way out to sea.

They were even more surprised when they asked him what he was doing out there, and he quite calmly told them that he was trying to run from the US to London, in a gigantic home-made buoyant hamster wheel, which he called a ‘hydropod’, but most rational people would call a ‘ guaranteed deathtrap’.

Rather than waste hours of my life trying to explain what it looked like, watch this and see for yourself.

Here’s the thing… when the coast guard pulled alongside Baluchi and what they called a “Hamster Wheel of Doom”, they already knew who he was – because he’s tried several times to head out to sea in similar contraptions, and failed miserably every time.

So, figuring that he’s his own worst enemy, they ordered Baluchi to abandon this latest effort and return to shore in an effort to save his life, however Baluchi’s response to being plucked from the ocean yet again was – as they say in the classics – massively disproportionate.

I’ll let the court documents of the case tell the story, in their delightfully understated way.

“Officers informed Baluchi that he needed to disembark the vessel onto their small boat since they were terminating his voyage due to it being manifestly unsafe,” they say.

“Baluchi replied that he was armed with a 12-inch knife and would attempt to commit suicide should the USCG officers attempt to remove him from the vessel.”

Long story short, they managed to get Baluchi into the boat and back to shore, where it looks like he’ll be able to live according to his mantra once more.

“My message is… no matter how many times you fail, you can do it,” Baluchi said – wise words from a man facing up to five years in prison for gross stupidity.

TO MARKETS

At home, the ASX200 benchmark has fallen -2% already in September leaving a mere +1.6% in the bank for the hard yakka of the YTD.

At lunchtime today, though, things are pretty much flat for the benchmark, which is down by a grand total of 3.3 points (-0.05%) at midday.

As Christian noted this morning, the ASX200 lives and dies by four big local banks and a handful of mega-miner stocks, and frankly they’ve not had a blistering run lately, and largely struggled for traction throughout 2023.

That weakness was also amplified last week as a few of the BHP-and-friends went ex-dividend, sucking the little positive momentum from the crowded panic room.

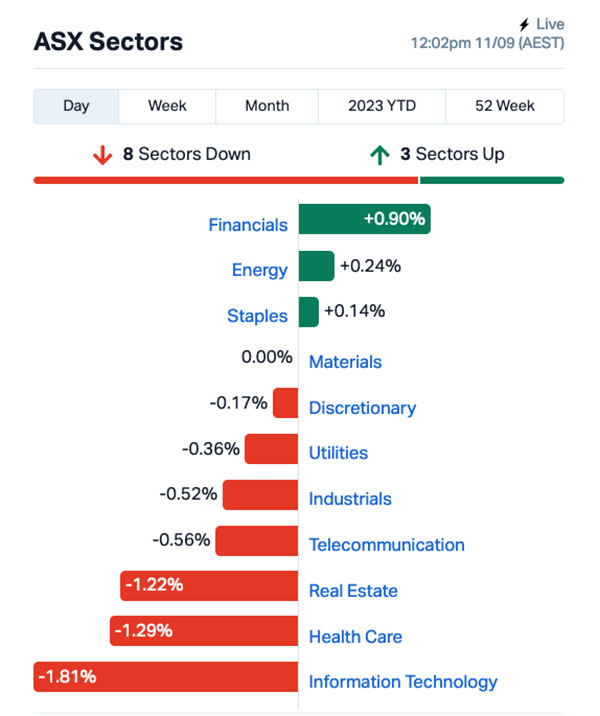

However, it’s the Financials sector keeping the benchmark from sinking this morning, out in front of the market by around 1.0%, offsetting the dragging weight of another struggle-day for InfoTech, which is around 1.7% lower.

Up in the fancy seats, large capper Genesis Minerals (ASX:GMD) has added 5.4% this morning on news of multiple high-grade drill results confirming its Gwalia underground mine as “a world class gold system with an endowment of 5,600oz per vertical metre”.

But on the wrong side of the large cap ledger, it’s a Monday of shame for the usually steely bunch at Sims Metal Management (ASX:SGM), where the share price has collapsed circa 15% after management predicted a deflating ‘breakeven’ for Q1 earnings as the pants remain around the ankles of steel demand.

NOT THE ASX

As mentioned, uncertainty and self-doubt reemerged across most major markets last week.

The EU is scared of what Christine Lagarde and her minions at the ECB might do this week and Wall St is sleepless again over the unending rate-rise bias of the US Federal Reserve and its apparent impotence vs inflation, as well as similar fears over China’s economic trajectory.

Lower-than-expected US initial jobless claims revivified the phobias around faster-paced rate hikes, leaving investors alone with their fraught fears about the Fed’s next moves.

As of Friday, Wall St was still booking a pause in September, but now there’s a greater-than-40% probability of a rate hike in November.

In the previous session, Wall Street’s S&P 500 and the tech-heavy Nasdaq Composite found about +0.1%, but lost -1.3% and -2% for the week.

The Dow Jones Industrial Average closed the week circa -0.8% lower, after adding +0.2% on Friday.

Earlybird Eddy reports that Apple stocks steadied ahead of its iPhone 15 release later this week, and a potential response regarding Chinese moves to ban iPhone use within the government.

Additionally, meme stock Gamestop was also down 6% after it was revealed that the US SEC was investigating the video game retailer’s chairman, Ryan Cohen – possibly for cheating at Donkey Kong.

To US economic news, consumer credit in the US increased by US$10.4 billion in July vs an expected US$16 billion, the second-smallest monthly increase since November 2020.

Looking ahead this week, the US will release the all-crucial CPI data on Wednesday (US time), and back home, the ABS will publish the unemployment rate on Thursday.

In Japan, the Nikkei is down 0.2% this morning, as the nation struggles to come to grips with the news that a proposed casino resort – the first official casino for Japan – is going to be delayed.

It’s slated to be constructed on an artificial island near Osaka, which itself has been constructed to house the 2025 World Expo – a tragically weird event where nations from all over the globe set up shop in huge barns to tell the rest of the world how great they are.

It is perhaps the most cheerfully pointless exercise of modern international trade, which costs bajillions of dollars to put on but is apparently excellent for the local economy and fun for the whole family.

Once the planet has been sufficiently Expo’d, the barns are to be torn down and replaced with a casino, but that’s not going to happen now until at least 2030, frustrating the notoriously punt-happy Japanese populace and leaving them forced to continue to lose money in smoky Yakuza-controlled gambling dens.

This, of course, carries a terrible risk for everyone involved, on the basis that the moment either a woman, or a white-skinned man, gets into the slightest trouble, there are faint tremors throughout the space-time continuum.

Those, in turn, inevitably summon Steven Seagal from whatever Burger King bathroom he’s currently haunting, to punish everyone in the room in a feebly asthmatic display of mediocre fat-guy martial arts.

In China, Shanghai markets are up 0.47%, while in Hong Kong the Hang Seng has fallen 1.35%, reflecting the sheer confusion Steven Seagal causes every time he begrudgingly leaves the house to show the world that he has mastered the art of pushing complicit stooges onto the floor.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 11 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap EDE Eden Inv Ltd 0.003 50% 3,677,585 $6,727,274 NXMR Nexus Minerals Ltd 0.003 50% 175,067 $130,181 CTQ Careteq Limited 0.03 43% 855,417 $4,664,580 NVO Novo Resources Corp 0.275 38% 660,858 $7,500,000 AXP AXP Energy Ltd 0.002 33% 3,315,000 $8,737,021 DXN DXN Limited 0.002 33% 29,179,187 $2,585,010 MTH Mithril Resources 0.002 33% 1,500,050 $5,053,207 OMX Orangeminerals 0.04 33% 10,000 $1,490,021 CNW Cirrus Net Hold Ltd 0.054 32% 24,293,668 $38,130,262 AVE Avecho Biotech Ltd 0.005 25% 8,595,908 $10,793,168 DCX Discovex Res Ltd 0.0025 25% 1,000,000 $6,605,136 GTG Genetic Technologies 0.0025 25% 4,782,528 $23,083,316 MXC Mgc Pharmaceuticals 0.0025 25% 670,364 $8,855,936 KLI Killiresources 0.065 23% 586,331 $3,157,478 SRT Strata Investment 0.19 23% 62,000 $26,260,654 MOB Mobilicom Ltd 0.0085 21% 4,010,525 $9,286,737 ACM Aus Critical Mineral 0.435 21% 2,199,029 $10,703,250 ODE Odessa Minerals Ltd 0.018 20% 54,548,784 $14,206,677 AX8 Accelerate Resources 0.025 19% 507,280 $7,992,637 BIT Biotron Limited 0.039 18% 10,311,929 $29,764,182 LV1 Live Verdure Ltd 0.245 17% 289,500 $18,849,402 AOA Ausmon Resorces 0.0035 17% 1,000,000 $2,907,868 ICN Icon Energy Limited 0.007 17% 668,712 $4,608,082 LSR Lodestar Minerals 0.007 17% 125,215 $12,125,384 MTB Mount Burgess Mining 0.0035 17% 3,000,000 $3,046,940

Topping the Small Caps charts this morning is Cirrus Networks (ASX:CNW), which has zoomed 30.5% higher on news that it’s entered into a Scheme Implementation Deed under which it is proposed Atturra will acquire 100% of Cirrus for $0.053 per share.

That jump was enough to push CNW’s trading price to… yup, $0.053 per share.

In second place today, Australian Critical Minerals (ASX:ACM) has popped 25% on no fresh news. The company remains the most exciting of the year’s IPOs, however, riding the latest lithium surge this morning to clock in at +125% since it made its debut in early July.

Tambourah Metals (ASX:TMB) is up a shade over 23% this morning, also on no apparent news.

Live Verdure (ASX:LV1) is continuing its climb today, adding another 9.5% to last week’s outstanding effort, while Odessa Minerals (ASX:ODE) is also enjoying a continuation of last week’s success, up 13.3% today.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 11 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CLE Cyclone Metals 0.001 -50% 1,014,094 $20,529,010 MEB Medibio Limited 0.001 -50% 1,439,115 $12,201,488 ERD Eroad Limited 0.705 -34% 43,292 $120,984,925 XTC Xantippe Res Ltd 0.001 -33% 1,103,999 $26,292,008 TYM Tymlez Group 0.003 -25% 225,000 $4,952,781 SRR Saramaresourcesltd 0.022 -24% 269,999 $1,631,343 TZL TZ Limited 0.017 -23% 100 $5,648,679 PIL Peppermint Inv Ltd 0.007 -22% 69,498 $18,340,712 TOE Toro Energy Limited 0.0095 -21% 31,650,274 $52,306,652 MRI Myrewardsinternation 0.012 -20% 628,088 $6,399,507 RCE Recce Pharmaceutical 0.52 -20% 365,076 $115,865,302 ELE Elmore Ltd 0.004 -20% 1,788,523 $6,996,919 RMX Red Mount Min Ltd 0.004 -20% 1,443,726 $12,621,755 FTC Fintech Chain Ltd 0.013 -19% 170,266 $10,412,313 CLU Cluey Ltd 0.099 -18% 71,095 $24,193,628 CBR Carbon Revolution 0.12 -17% 794,281 $30,762,113 WC8 Wildcat Resources 0.295 -17% 12,187,214 $236,294,235 TTT Titomic Limited 0.015 -17% 151,603 $15,581,595 ME1 Melodiol Glb Health 0.005 -17% 3,464,557 $17,683,922 MEL Metgasco Ltd 0.01 -17% 2,774,354 $12,766,641 AFL Af Legal Group Ltd 0.165 -15% 58,514 $15,319,477 CAV Carnavale Resources 0.006 -14% 50,587,854 $23,334,862 CHK Cohiba Min Ltd 0.003 -14% 2,385,699 $7,746,355 RC1 Redcastle Resources 0.012 -14% 45,000 $4,000,978 RIE Riedel Resources Ltd 0.006 -14% 4,000,000 $14,415,849

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.