ASX Small Caps Lunch Wrap: Who sunk their career with a Bondi Torpedo this week?

"Dr Stevens? Yeah... it's me... I've had that dream again... can you squeeze me in for an appointment today? It's... urgent." Pic via Getty Images.

Local market futures were pointing slightly higher this morning, thanks to a positive (if slightly mediocre) effort from Wall Street overnight.

When the doors opened on the ASX this morning, the benchmark squibbed out a +0.35% gain on the way to lunch, with most sectors doing pretty well, Consumer Discretionary losing ground slightly and the Telcos crapping the bed.

I’ll get into the details of that shortly, but first – we’re off to Germany, where one political candidate has had their career implode in what can only be described as an absolute sh-tshow of the highest order.

Things reportedly came unstuck for Free Democratic Party (FDP) candidate for the district of Ostalb, Martin Neumaier, when video footage purportedly showing him ‘being intimate’ with a number of items in a public bathroom surfaced on social media.

The footage appears to show Neumaier enjoying the company of several urinals and a toilet seat, before moving his attention to what is presumably a used toilet brush, by kissing and licking it.

You could be forgiven for wondering whether there was a way out of the mess for Neumaier, as the video footage is pretty damning – and, if I’m being honest, stomach-churning and more than a little bit concerning.

Social media users were, predictably, outraged – but there were a few that rose to Neumaier’s defence. They, however, were largely silenced as more and more videos turned up. And that’s where things got bad.

Obviously, I’m not going to share the videos here, because I’m 100% certain that they’re so far beyond the boundaries of good taste that it would take the hardiest of dead-behind-the-eyes internet veterans to be able to un-see them.

But, if you’re keen to see a promising German political candidate detonating his career with the absolutely show-stopper to cap them all, the footage of him singing a Nazi-era German national anthem, with a dunny brush up his jaxxy and sporting a definitely-not-chocolate moustache that can best be described as a “Sh.tler”, a quick search on X (formery known as Twitter) will bring you your heart’s desire.

Don’t say you weren’t warned. It’s repulsive, and arguably one of the most polarising campaign efforts you’re ever likely to see – which is saying a lot for a nation whose pornography quite frequently starts with two stout women putting a tarp down to protect the carpet before the stars of the show are led in to get their freak on.

And, of course, this comes with a (hopefully unnecessary) warning – if you are going to go looking for the videos, don’t do it at work, because they are 100% NSFW material.

Doing so will almost certainly result in an “urgent meeting request”, and you’ll find yourself across the desk from Andrew from HR, glowering – or, even worse, winking – at you from over the top of your personnel file.

TO MARKETS

Local markets opened higher on Wednesday morning, following Wall Street’s overnight bump that gave the ASX 200 enough momentum to be +0.25% higher after the first hour of business.

There’s not a terribly huge amount happening in the headlines this morning, as most of the media pundits seem to be obsessing over whether we’re able to blame a deadly turbulence incident on a Singapore airlines flight on climate change.

Consensus seems to be “yes – provided you believe climate change is real. If you don’t believe it’s real, the turbulence is evidence of witchcraft and how heavier-than-air flight is an affront to the majesty of God himself.”

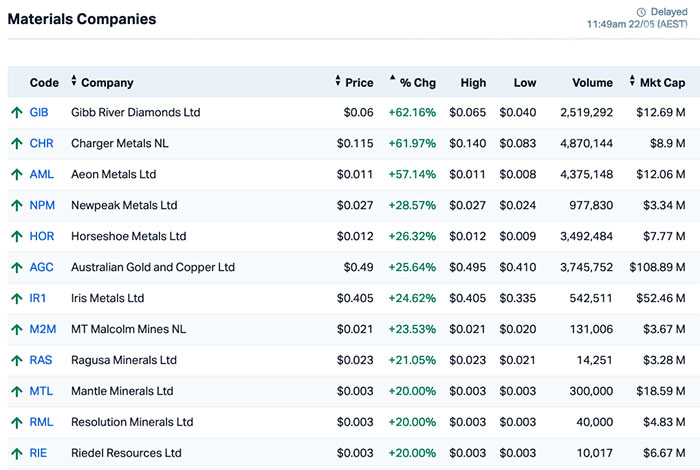

A look at how the ASX is travelling at lunchtime puts Materials and Industrials out in front for the morning, with a healthy scattering of diggers and explorers moving +20% or better in this morning’s action on the bourse.

Overall the sectors look like this:

A more granular look at the ASX indices looks like this:

And a deeper dive into what’s happening among the often mercurial Materials sector will give you an idea of how hot things are running in that market sector this morning.

Up the expensive end of town, a swag of large caps were reporting some sizeable gains, chief among them Telix Pharmaceuticals.

The company released news on Tuesday of the successful completion of CUPID, a first-in-human Phase I dose escalation study of TLX592 in patients with advanced prostate cancer.

That was followed by an investor briefing Wednesday morning from the CEO, and the company’s shares were up +7.5% since market open.

Also flying high (sorry…) Wednesday morning was Webjet, up more than +10.0% after the company announced pre-market that it had delivered an underlying FY24 EBITDA of $188.1 million, an increase of 40% over FY23.

Resolute Mining was also surging Wednesday morning, up around +8.0% on no particular news, other than gold’s seemingly inexorable march towards the US$2,500/oz mark this week.

Technology One continued its climb from Tuesday’s half-year results announcement that casually mentioned that HY profits are up 17%.

And Alumina was up again on Wednesday, announcing that there’s an amendment to the previously announced Scheme Implementation Deed for Alcoa’s 100% takeover of Alumina – the change essentially meaning that CITIC, Alumina’s second largest shareholder, will receive a small portion of its consideration under the transaction in the form of Alcoa non-voting convertible series A preferred stock instead of Alcoa CDIs, in order to meet regulatory requirements in the US.

NOT THE ASX

Overnight, the S&P 500 rose by +0.25% to its all-time high, the blue chips Dow Jones index was up by +0.17%, and the tech-heavy Nasdaq lifted by +0.22% to yet another new record.

Earlybird Eddy Sunarto reported this morning that US traders are eagerly awaiting Nvidia’s quarterly results later tonight, a highly anticipated report seen as a major catalyst that could drive a stock market rally.

The bar is set pretty high for Nvidia. Its shares have already jumped over 90% this year after tripling in 2023.

Analysts expect Nvidia to report around 240% of revenue growth for Q3 to US$24.6bn. Most of this (more than US$21 billion) is expected to come from sales of advanced chips the company is selling to Google, OpenAI, Microsoft, Meta etc,

In other US stock news, Tesla popped almost +7% after the company unveiled new details about its plan to develop electric semi trucks.

“We’re building a factory in Nevada that is being ramped in 2026 for customer deliveries, and ramping to eventual target capacity to 50,000 units a year,” said Tesla exec, Dan Priestley.

Trump Media & Technology, the company behind Truth Social, dropped -9% after reporting a Q1 operating loss of US$327.6 million, way more than the US$210k loss they had last year.

To cryptos, Etherium surged another 4% after yesterday’s 17% rally amid rumours that the US SEC might approve ether ETFs this week. Trading platforms like Coinbase and Robinhood also saw a boost to their share prices from the buzz.

Closer to home, the Reserve Bank of NZ (RBNZ) is set to hand down its rates decision later today. The central bank is expected to keep the benchmark rate steady at 5.50%.

In Asian markets this morning, Malaysia, Singapore and Thailand’s exchanges are all closed for a holiday, but the rest of the region is open for business.

Japan’s Nikkei is making hard work of Wednesday morning, down -0.51% while Hong Kong’s Hang Seng is up +0.60% and Shanghai markets have improved by +0.22% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 22 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CHR Charger Metals 0.115 62% 4,870,144 $5,496,838 GIB Gibb River Diamonds 0.059 59% 1,970,022 $7,825,849 MTH Mithril Resources 0.315 58% 6,662,928 $16,915,244 AML Aeon Metals Ltd. 0.011 57% 4,375,148 $7,674,804 ME1 Melodiol Glb Health 0.003 50% 1,415,014 $1,426,974 NPM Newpeak Metals 0.027 29% 977,830 $2,595,986 HOR Horseshoe Metals Ltd 0.012 26% 3,492,484 $6,153,897 IR1 Irismetals 0.405 25% 533,625 $42,098,869 M2M Mtmalcolmminesnl 0.021 24% 131,006 $2,974,586 AGC AGC Ltd 0.475 22% 3,611,546 $86,666,667 RAS Ragusa Minerals Ltd 0.023 21% 14,251 $2,709,377 LTP Ltr Pharma Limited 0.47 21% 394,348 $27,458,140 VBS Vectus Biosystems 0.15 20% 182,639 $6,651,170 MEL Metgasco Ltd 0.006 20% 194,444 $6,164,434 MTL Mantle Minerals Ltd 0.003 20% 300,000 $15,493,615 RIE Riedel Resources Ltd 0.003 20% 10,017 $5,559,589 RML Resolution Minerals 0.003 20% 40,000 $4,025,055 APL Associate Global 0.125 19% 30,000 $5,931,705 AS2 Askarimetalslimited 0.07 19% 2,531,057 $5,763,763 FIN FIN Resources Ltd 0.013 18% 2,264,850 $7,141,956 KP2 Kore Potash PLC 0.02 18% 1,558,785 $11,190,497 KRM Kingsrose Mining Ltd 0.055 17% 14,089,410 $35,368,746 OCT Octava Minerals 0.049 17% 10,263 $1,882,125 ALY Alchemy Resource Ltd 0.007 17% 370,000 $7,068,458 VML Vital Metals Limited 0.0035 17% 775,516 $17,685,201

Wednesday morning’s big winner was Charger Metals (ASX:CHR), up 62% by lunchtime on news that the company has defined new lithium and niobium soil anomalies at the Lake Johnston project in WA, which the company is running as a JV with mining giant Rio Tinto (ASX:RIO).

Gibb River Diamonds (ASX:GIB) was also up, moving more than +50% on Tuesday’s news that the company has secured mining leases M04/475, M04/476 and M04/477 which are the three key licences at the heart of developing the Ellendale Diamond Project, 140km east of Derby in the West Kimberley region of Western Australia.

Silver explorer Mithril Resources (ASX:MTH) was reinstated to the market after hours last night, following a lengthy absence from trading as the company worked towards meeting ASX requirements required to lift a trading suspension.

Mithril recently held an AGM to ratify its recent financing efforts, which raised ~A$5m, and a share consolidation, and hit the market floor running on Wednesday to jump as high as +50% in brisk trade.

Aeon Metals (ASX:AML) announced on Wednesday that the Traditional Owners, the Waanyi PBC and Waanyi People, have agreed terms for a new Cultural Heritage Protection Agreement (CHPA) which will enable Aeon to recommence activities at Walford Creek, with execution of the documentation to occur “in due course”.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 22 May [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MRD Mount Ridley Mines 0.001 -50% 21,249,995 $15,569,766 PKO Peako Limited 0.003 -40% 102,000 $2,635,424 CNJ Conico Ltd 0.001 -33% 265,255 $2,707,643 IEC Intra Energy Corp 0.002 -33% 1,350,294 $5,072,345 INP Incentiapay Ltd 0.004 -33% 5,194 $7,463,580 PRX Prodigy Gold NL 0.002 -33% 22,776 $6,041,322 SHP South Harz Potash 0.013 -32% 6,833,754 $15,716,514 CGR Cgnresourceslimited 0.225 -27% 1,701,150 $28,141,239 88E 88 Energy Ltd 0.003 -25% 36,545,983 $115,570,688 CTN Catalina Resources 0.003 -25% 270,456 $4,953,948 EXL Elixinol Wellness 0.004 -20% 237,022 $6,505,370 H2G Greenhy2 Limited 0.008 -20% 951,852 $5,141,842 HLX Helix Resources 0.004 -20% 39,933,228 $15,487,635 MHC Manhattan Corp Ltd 0.002 -20% 2,339,982 $7,342,449 OSL Oncosil Medical 0.004 -20% 358,566 $16,660,548 DGR DGR Global Ltd 0.013 -19% 183,538 $16,699,096 HAL Halo Technologies 0.073 -18% 15,500 $11,448,639 FXG Felix Gold Limited 0.055 -18% 666,492 $13,883,413 EOF Ecofibre Limited 0.058 -17% 10,993 $26,521,173 ATH Alterity Therap Ltd 0.005 -17% 383,200 $31,470,692 AYT Austin Metals Ltd 0.005 -17% 15,000 $7,945,148 BUY Bounty Oil & Gas NL 0.005 -17% 112,543 $8,991,006 SBW Shekel Brainweigh 0.052 -16% 63,897 $13,068,716 LGM Legacy Minerals 0.24 -16% 881,003 $30,054,674 RAG Ragnar Metals Ltd 0.017 -15% 9,060,727 $9,479,619

ICYMI – AM EDITION

Frontier Energy (ASX:FHE) continues to progress its debt financing process for the Waroona project with key appointments and contracts for procurement of capital items well advanced.

The process is moving swiftly through Phase Two with the recent appointment of Aurecon as the independent technical engineer and the appointment of legal counsel for the lenders.

FHE remains on track to receive binding credit approved terms from the preferred banking syndicate during July.

Blue Star Helium (ASX:BNL) has successfully drilled, cased and cemented the intermediate hole section of the State 16 SWSE 3054 development well at its Galactica helium project in Las Animas County, Colorado.

The intermediate hole section of the well was drilled to ~338.32m and a mandatory cement bond log (CBL) is expected to run shortly.

Upon successful testing at State 16 SWSE 3054, the well be ready to be tied-in to production facilities.

Australian Mines (ASX:AUZ) has discovered multiple tin, tantalum, and lithium anomalies at the Resende lithium project in Minas Gerais, Brazil.

The highest assay results returned tin, tantalum, and lithium at 1180, 56, 38ppm and 769, 65, 51ppm, comparing favourably to regional results which returned less than the lower detection limits of 5, 10, 10ppm.

AUZ now plans to embark on a comprehensive grid soil sampling program to identify potential future drilling targets.

At Stockhead, we tell it like it is. While Frontier Energy, Blue Star Helium and Australian Mines are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.