ASX Small Caps Lunch Wrap: Who said a final farewell to floppy disks this week?

Pic via Getty Images

Local markets have opened lower this morning, with the Resources sector dragging the market lower this morning after last week’s hopeful rise in iron ore prices turned out to be short-lived.

Early doors today, the benchmark was down by 0.35% and that’s about where it looked destined to stay all morning.

I’ll get into the details of that in a moment, but first – there’s some news from Japan, which will be bittersweet for the older geeks among us, who remember the olden days of computing when it was all pretty much DIY, and the world was run on floppy disks.

For those of you too young to remember, information used to be saved on things called “floppy disks”, which were tiny little circles of metal with laughably small capacity to store documents and programs.

They frequently failed because they frequently got physically damaged – leaving them carelessly near even a moderately powerful speaker, for instance, would corrupt them. And when the size of programs like games started to blossom out of control, it wasn’t unusual to purchase a game (in an actual box, from a shop you had to walk into and speak to someone… the horror!) and find out that just to install it was an hour-long process of shuffling up to 12 different disks into your disk drive, and hope like hell they all worked.

Oh, and if you lived in a house with even slightly dodgy wiring, the entire process could be derailed by any change in available current – I can vividly remember being halfway through installing a not-quite-kosher copy of the original Doom on my PC, only to have it fail because the washing machine at the other end of the house changed cycles, and spiked the electrical current through the house.

The ’80s and ’90s were a wild, wild time. Each of the 3.5-inch drives could hold a maximum of 1.44 Mb of information.

If you wanted to replicate the storage of a 32Gb thumb drive of today using floppy disks, you’d need more than 22,000 of them, and a decent-sized station wagon to haul them around.

Anyway… sanity came to the PC market in the form of CD Drives – and data stored on CDs became the norm. Then came DVD drives, and then all of a sudden (it seems), USB flash memory drives arrived and there was basically no need for floppy drives at all.

Except in Japan, where they were required by law in some instances – and if there’s a nation on the planet that thrives because of its slavish adherence to pointless bureaucracy, it’s that one.

However, Japan’s Digital Minister Taro Kono announced recently that his war on floppy disks has officially been won, after he went on a bureaucratic rampage through the bowels of Japan’s laws and regulations, seeking and destroying the thousands of elderly regulations that required citizens to provide certain information on 3.5-inch floppy disks, in order to have it processed.

It’s a milestone for the famously change-resistant nation, with the populace split between people applauding the move, and those who yearn for the good old days.

Taro Kono is, however, unapologetic – and has already announced the next item on his hit list – the fax machine… paving the way for an eventual, and inevitable, robot uprising as he goes after increasingly “smart” technology.

TO MARKETS

Local markets have opened lower, despite a decent lead-in from Wall Street’s Friday session that saw indices there reaching new record highs, again.

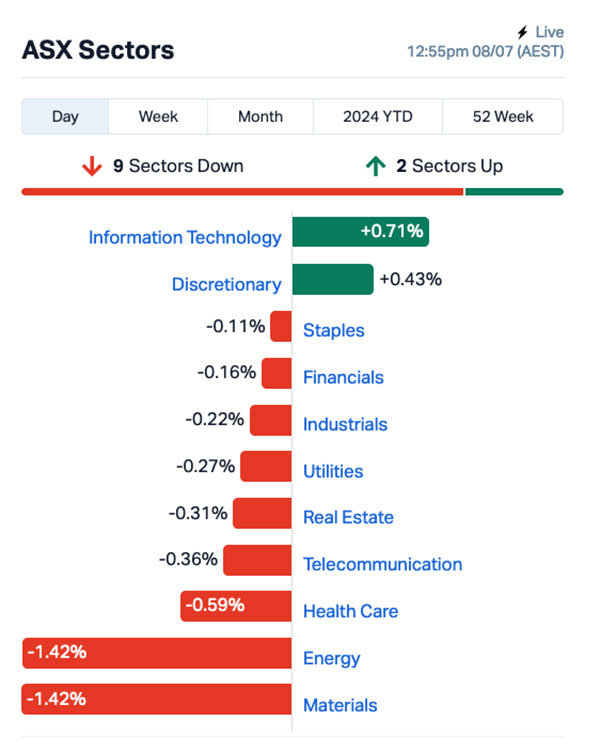

The ASX 200 benchmark fell -0.35% in early trade this morning, falling further to -0.42% on the way into the lunch break, with a solid jump in InfoTech stocks more than offset by big falls among Energy and Materials shares.

A quick look at the sectors shows this:

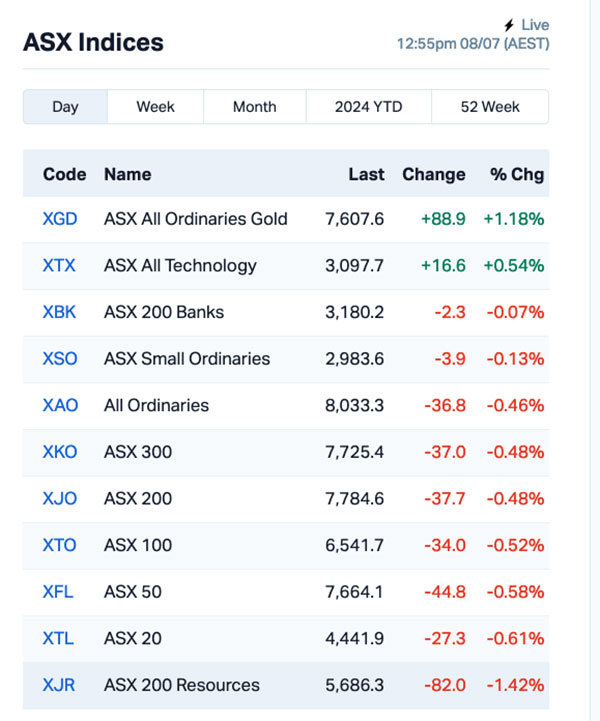

While the ASX indices look like this:

And you can see that while the goldies are doing pretty well, the rest of the resources mob are losing quite a bit of ground today, which is being blamed on the short-lived nature of last week’s iron ore price spike.

The rising fortunes of the goldies has a lot to do with how things are going in the United States, where falling US Treasury yields and a weakening Greenback are providing a boost for the precious metal.

There’s a well-established inverse relationship between US Treasury yields and gold prices, so investors are following the script as things soften for the US economy.

On the Energy side of the equation, a dip in oil prices since Friday would explain why some of the Large Caps are off this morning, while the bigger coal diggers are giving back some of the recent gains made off the back of the ongoing fire crisis at Anglo’s Grosvenor coal mine in Queensland.

Word from there is that the company believes that it has now sealed the last of the major oxygen ingress points, with the hope that the fire will be starved and die out in short order.

Anglo has guaranteed pay for the mine workers to the end of August, but all bets are off after that as no one is quite sure what the future holds for the site.

It’s the second major fire incident for the mine in the past 4-5 years, and the last time something like this happened, it was closed for more than two years while remediation work was underway.

NOT THE ASX

Wall Street came back from a day-and-a-half of 4th of July celebrations with a bit of vigour in its step, closing out Friday’s session with more record highs, as the S&P rose +0.5% to 5,567, the Dow added +0.2% and the Nasdaq added +1% to close at 18,352.

In US stock news, Tesla rose more than +2% – ending an extraordinary week +27% higher – while Apple also added +2% to hit yet anther all-time high.

Meta was the best mover among the Wall Street monsters, up +5.8%.

US Treasury notes were down, with the 2 Year yield at 4.60% and the 10 Year yield at 4.28%.

In Europe, sh-t’s gone weird. There’s really no other way to describe it, as the results of the French run-off election overnight are, frankly, a monstrous shock.

Marine Le Pen’s far-right National Rally looked to be home and hosed, and unbackable favourites to take the election – but a massive gamble by incumbent leader Emmanuel Macron to climb into bed with the far-left has paid off.

Macron’s now-broad left coalition has handed the far right a hugely unlikely win, coming in first with 182 seats and pushing Le Pen’s far-right party into third place, scuttling an expected lurch to the right for France and leaving the country facing an unpredictable future.

C’est ouf, indeed.

So… we can expect things in Europe to be a little bumpy for a while, and the same from Britain as they get used to having a new Prime Minister after the smiling humanoid Keir Starmer takes time off from starring in The Lego Movie franchise to have a crack at leading a nation.

In Asian markets this morning, Japan’s Nikkei is unusually flat, the Hang Seng is down -1.25% and Shanghai markets are tracking lower, down -0.55% before lunch.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 08 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Change Volume Market Cap RXM Rex Minerals Limited 0.448 62.7 15,306,651 $211,172,959 REM Remsensetechnologies 0.034 41.7 1,776,045 $3,956,632 T3D 333D Limited 0.007 40.0 740,126 $597,225 LVH Livehire Limited 0.017 30.8 1,508,890 $4,804,773 SRL Sunrise 0.530 29.3 54,348 $36,993,274 ME1 Melodiol Glb Health 0.003 25.0 1,505,093 $460,924 POS Poseidon Nick Ltd 0.005 25.0 20,800 $14,854,139 AYA Artryalimited 0.295 22.9 18,677 $18,888,958 SGQ St George Min Ltd 0.032 20.8 3,551,632 $26,196,321 APL Associate Global 0.120 20.0 242,000 $5,649,243 BLU Blue Energy Limited 0.012 20.0 806,844 $18,509,736 GMN Gold Mountain Ltd 0.003 20.0 4,220,033 $7,944,359 ENR Encounter Resources 0.870 19.2 5,338,055 $329,104,479 EWC Energy World Corpor. 0.013 18.2 182,426 $33,868,134 JPR Jupiter Energy 0.030 20.0 300,000 $31,841,305

Rex Minerals (ASX:RXM) was the early flyer on Monday morning, no news that it’s entered a scheme implementation deed that will see MACH Metals Australia buy the entire company for $0.47 per Rex share – which is a huge premium of 79% to Rex’s 30-day VWAP2 and 98% to the 90-day VWAP, valuing the company at $393 million.

Gold Mountain (ASX:GMN) was also moving quickly on Monday, on news that the company has received assays from regional stream sediment sampling with widespread anomalies that cover a total area of approximately 80km2, signallingpotential for ultra-high grade hard rock monazite hosted REE-Nb-U-Sc mineralisation at its Down Under project.

Robotic technology company FBR (ASX:FBR) was up on news that its its first next-generation Hadrian X construction robot has arrived in the United States, where it will be transported to a facility in Fort Myers, Florida to undergo testing.

And Bastion Minerals (ASX:BMO) was up early on news that soil sampling has defined elevated lithium to 120 ppm north of the post–tectonic granite (Agl) identified in government mapping, along with elevated tantalum (to 18 ppm), rubidium (to 234 ppm), tin (to 13 ppm) and cerium (to 115 ppm) occur in the south of the soil grid, at its 100% owned Split Rock Dam project in WA.

Encounter Resources (ASX:ENR) was up this morning on news that fresh assays from 200m east of other recently reported results have returned additional shallow, high-grade niobium-REE mineralisation including:

- 46m @ 3.1% Nb2O5 from 60m to EOH including 4m @ 6.4% Nb2O5 from 84m

- 18m @ 3.2% Nb2O5 from 76m including 2m @ 17.0% Nb2O5 from 76m

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 08 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Change Volume Market Cap LSR Lodestar Minerals 0.001 -33.3 1,473,224 $3,035,096 TD1 Tali Digital Limited 0.001 -33.3 117,000 $4,942,733 ERL Empire Resources 0.003 -25.0 1,500,000 $5,935,653 ODE Odessa Minerals Ltd 0.003 -25.0 1,118,766 $4,173,130 RIL Redivium Limited 0.003 -25.0 92,281 $10,923,419 OVT Ovanti Limited 0.009 -25.0 13,073,077 $14,881,266 NRZ Neurizer Ltd 0.010 -23.1 7,263,208 $24,731,598 DTR Dateline Resources 0.007 -22.2 6,807,647 $13,117,923 MVL Marvel Gold Limited 0.007 -22.2 4,347 $7,774,116 PNM Pacific Nickel Mines 0.024 -20.0 790,542 $12,547,593 ATH Alterity Therap Ltd 0.004 -20.0 160,017 $26,225,577 HLX Helix Resources 0.002 -20.0 2,852 $8,160,484 PNX PNX Metals Limited 0.004 -20.0 165,000 $29,851,074 PUA Peak Minerals Ltd 0.004 -20.0 1,849,041 $5,206,883 NVA Nova Minerals Ltd 0.198 -19.4 73,812 $52,688,936 TTT Titomic Limited 0.105 -19.2 14,415,938 $131,382,661 LMS Litchfield Minerals 0.130 -18.8 415,838 $4,410,000 1MCDA Morella Corporation 0.050 -16.7 193,689 $14,829,119

IN CASE YOU MISSED IT – AM EDITION

The clean compressor company has appointed a new executive chairman in Steven Apedaile to drive market cap growth incentives with SIX targeting $250 Million by December 2026.

Apedaile was originally appointed as a director on 16 April 2021 and has served as non-executive chairman since 8 November 2021.

He has 30+ years experience spanning management advice, risk analysis, strategic planning, public listings, forensic accounting, M&A, and general business advice.

“With our robust project pipeline and current market cap of approximately $25 million, we are targeting 4 times growth within the next 12 months,” Apedaile said.

“The next 6 months are particularly exciting as we transform into a mass production company, poised to generate high revenue and profit for our shareholders.”

Cosmo has completed a 4,915m drill program at its Kanowna Gold Project (KGP) in WA, comprising nine RC holes (1,764m) and 42 aircore holes (3,151m).

The programs were designed to follow up historical drill intercepts such as 18m at 5.3g/t Au and 10m at 4.7g/t Au from the Don Álvaro prospect.

Assays are pending and MD James Merrillees says the company has intersected host rocks and alteration styles which support its targeting model.

“Cosmo’s technical team is being assisted by input from Dr Gerard Tripp, a geologist with well recognised expertise at Kanowna Belle, and this collaboration has helped to develop the compelling targets at the KGP which we have started testing with the recently completed program as we assess outstanding historical drill intersections through ‘fresh eyes’,” he said.

“With assay results from the nine-hole RC program to come as well as the aircore drilling to support targeting, the company is well placed to unlock the potential of the KGP.”

The company has received A$773,335 refundable tax offset for eligible research and development (R&D) activities for the 2023 financial year at its North Stanmore Heavy Rare Earth Element (REE) project in WA.

The company says the funds maintain its cash position and provides flexibility to further progress North Stanmore development activities. With further eligible R&D activities undertaken at North Stanmore during the 2024 financial year, Victory also anticipates being able to claim further tax offsets in the coming financial year.

Sovereign Metals has commenced trading on the OTCQX under the ticker symbol SVMLF.

The OTCQX is the highest market tier of OTC Markets on which over 12,000 US and global securities trade.

The company previously traded on the OTC Pink Market and has been upgraded to the OTCQX as it meets high financial standards, follows best-practice corporate governance and has demonstrated compliance with applicable securities laws.

Trading on OTCQX began on 5 July 2024 and will enhance the visibility and accessibility of Sovereign – and its Kasiya rutile-graphite project in Malawi – to US investors.

Kasiya has the potential to be the world’s largest, lowest-cost producer of rutile, which is the purest form of titanium feedstock, and a long-term secure source of graphite supply outside of China. And the US Department of Energy has designated both titanium and graphite as critical minerals due to national security concerns. China currently dominates the global supply of both minerals.

The company has announced a 2 for 3 renounceable rights issue offer of new shares in Dateline at an issue price of $0.006 per to raise gross proceeds of up to approximately $5.8 million.

The funds raised will be used to fund further exploration at the company’s Colosseum gold and rare earths project, and to complete a mine planning study in relation to the Colosseum project. Dateline will also use the proceeds to reduce outstanding debt; and for general working capital.

At Stockhead, we tell it like it is. While Cosmo Metals, Victory Metals, Sovereign Metals, Dateline Resources and Sprintex are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.