ASX Small Caps Lunch Wrap: Who is really, definitely probably dead maybe this week?

Robin and Scott liked to take turns playing with the autopsy tools on days when things were 'a bit quiet' at work. Pic via Getty Images.

Local markets were up this morning, and it’s a raft of positive news pretty much across the board, thanks to a big lead-in from overseas markets today.

Wall Street was up, Nvidia has officially knocked Apple off its perch as the second-largest publicly traded company, Canada dropped its official cash rate 25 basis points… no wonder we were all smiling this morning.

I’ll get into the details of that shortly, but first to a story from Lincoln, Nebraska, where city officials have confirmed that a woman they thought was dead, but who was still alive, is now actually dead.

For real, this time.

The confusion started when an ambulance was called to Butherus-Maser & Love Funeral Home, and when paramedics arrived to find staff doing the last thing you’d expect them to be doing while at work – frantically performing CPR on a dead woman.

That woman was 74-year-old Constance Glantz, who had been taken to the funeral home after staff at the nursing home where she was being looked after declared her dead on the morning of Monday 04 June.

So, you can probably imagine the shock that staff at the funeral home got when old lady Glantz started showing signs of life. She was rushed by ambulance to a local hospital, where doctors examined her and confirmed that she was very much alive. Briefly, anyway.

Shortly after arriving at hospital, Constance died – again, depending on how you look at it.

Lancaster County Sheriff Chief Deputy Ben Houchin appeared before the media to confirm, rather ominously in my view, Constance really was dead this time.

Local officials are investigating the bizarre mix-up, and have ordered an autopsy – partially, I assume, to be absolutely rock-solid on the topic of whether or not Constance had, in fact, passed away.

My hope for Constance is that the autopsy doesn’t reveal that she died in the most horrible way possible: during an autopsy.

TO MARKETS

Local markets are up today, and it’s one of those lovely rare lunchtimes where the bourse is a sea of lovely green.

“How green?” I hear you ask… well, it’s greener than the surly green garbage creature that haunted my nightmares as a child, after my dad mistakenly let me fall asleep in front of the TV while Sesame Street was on and irreversibly warped my tiny little mind.

A loaf of bread, a container of milk, and a stick of butter… a loaf of bread, a container of milk, and a stick of butter…

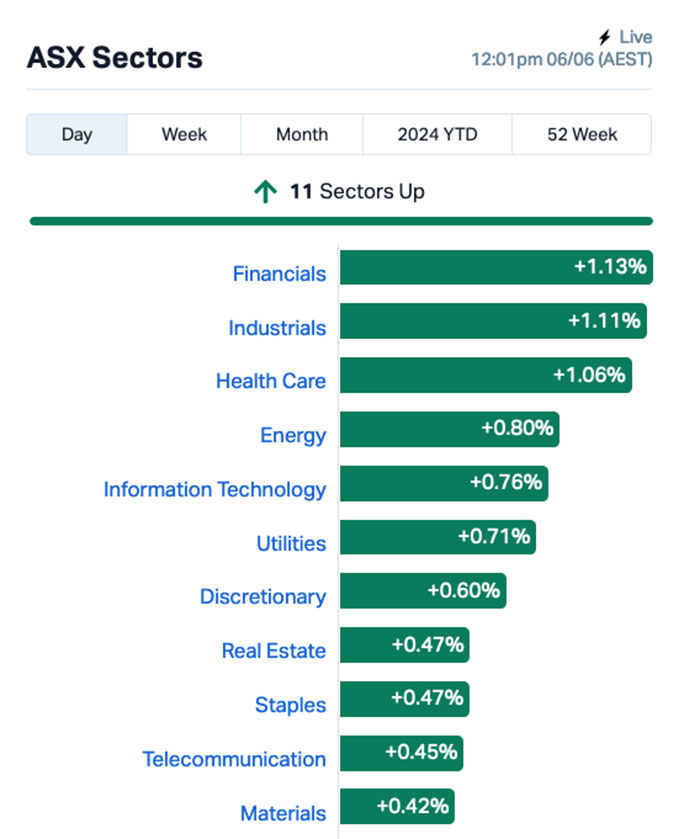

The market sectors look like this:

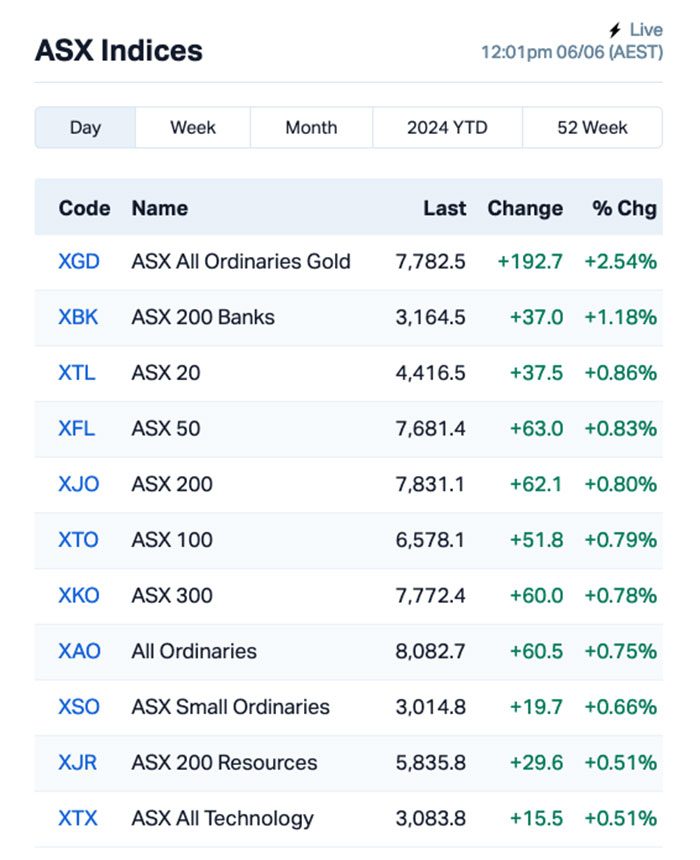

The ASX indices look like this:

And, as you can see, today is an excellent day to be a goldie, with that slice of the market soaring through +2.5% in a few short hours this morning.

Among the big winners was Coronado Global Resources (ASX:CRN) – and while I haven’t had the chance to look through the chairman’s comments to the company’s AGM this morning, I’m assuming it was very positive as the company’s risen through +5.3% this morning so far.

Part of the market’s buoyant mood this morning stems from our friends in Canada, that lovely part of America where everyone talks funny and there aren’t that many guns.

The good news from Canada is that central bankers there have blinked, lowering the nation’s official cash rate 25 basis points to 4.75%, which many have taken as a sign that it’s the first of any dominos set to fall in the global interest rate pain saga.

Word on the street is that the European Central Bank is gearing up to do the same later on today, after inflation across the Eurozone fell from an alarming 10% to the ECB’s 2% target over the course of recent months.

RBA Governor Michele Bullock, eager to get in the good times, appeared before Senate Estimates yesterday to tell those gormless idiots in Canberra that she’s not afraid to hike rates again later this year if she has to, which probably isn’t what Australian borrowers wanted to hear.

But, tough luck. Bullock’s got a job to do, and by golly she’s gonna give that one, solitary economic lever at her disposal a proper workout if she wants to.

And I’m not gonna stand in her way… would you?

NOT THE ASX

Lots of news to briefly touch on from overseas this morning, so let’s start with the usual: Wall Street rallied to new records once again on the back of tech stocks.

The S&P 500 rose by +1.18%, its 25th record high this year. The blue chips Dow Jones index was up by +0.25%, and the tech-heavy Nasdaq surged by +1.96%.

Earlybird Eddy reported that Nvidia Corp rose by +5% to yet another record high, as it became the second most valuable company in the world with its market cap surpassing Apple’s to top US$3 trillion for the first time.

The other big chipmaker, ASML Holding, which is traded in Amsterdam, rose +8% to become Europe’s second-biggest listed company, overtaking LVMH, with a market cap of EUR380 billion.

Microsoft, with a market cap of US$3.15 trillion, sill remains the world’s most valuable company after its shares climbed +2% last night.

“In addition to a strategic allocation to the tech sector, we see a particular opportunity in small-cap stocks supported by the beginning of the Fed’s easing cycle,” Lolita Marcelli at UBS Global Wealth Management told Bloomberg.

Alphabet (Google) rose +1% after appointing Anat Ashkenazi, an executive from Eli Lilly & Co., as its new chief financial officer. She will succeed Ruth Porat, who had previously announced her intention to transition from the role.

Even Boeing had a decent run, adding +0.65% after launching its space taxi, carrying NASA astronauts, despite a known hydrogen leak buried deep within the spacecraft. It’s currently on course to rendezvous with the International Space Station later today, our time (and their time, which is Space Time).

Discount store Dollar Tree fell after -5% after announcing that it was deciding what to do with its struggling Family Dollar division. Options on the table include selling it, or spinning it off into a separate company, or marking it down by 95% because everything must go!

In Asian market news, Japan’s Nikkei is up +1.12%.

In Hong Kong, the Hang Seng is up +0.40% (which is basically trading flat for that volatile market) and Shanghai markets are being all Shanghai again, going their own way and dropping -0.32%.

If you’re trying to do business with either South Korea or Stockholm markets today, you’re gonna need to wait, because they’re on holidays, the lucky buggers.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 06 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap FTL Firetail Resources 0.096 109% 15,055,849 $6,849,656 MRD Mount Ridley Mines 0.0015 50% 4,220,843 $7,784,883 OSX Osteopore Limited 0.08 48% 28,098,477 $6,134,562 SMN Structural Monitor. 0.47 38% 350,344 $46,513,770 TD1 Tali Digital Limited 0.002 33% 2,000,851 $4,942,733 VPR Volt Power Group 0.002 33% 2,460,155 $16,074,312 ADD Adavale Resource Ltd 0.005 25% 976,000 $4,161,061 ATH Alterity Therap Ltd 0.005 25% 2,091,214 $20,980,461 ESR Estrella Res Ltd 0.005 25% 812,000 $7,037,487 PUR Pursuit Minerals 0.005 25% 2,020,313 $11,775,886 RML Resolution Minerals 0.0025 25% 82,599 $3,220,044 BEO Beonic Ltd 0.027 23% 135,990 $9,338,889 GED Golden Deeps 0.049 23% 450,000 $4,620,894 1MC Morella Corporation 0.003 20% 1,363,079 $15,446,999 AHN Athena Resources 0.003 20% 167,600 $2,676,169 AOA Ausmon Resorces 0.003 20% 918,988 $2,647,498 NRZ Neurizer Ltd 0.006 20% 17,639,660 $9,512,153 PKO Peako Limited 0.006 20% 83,333 $2,635,424 BVR Bellavistaresources 0.19 19% 49,157 $12,555,056 IDT IDT Australia Ltd 0.12 17% 845,831 $35,945,805 TMX Terrain Minerals 0.0035 17% 82,244 $4,295,012 VFX Visionflex Group Ltd 0.007 17% 95,714 $8,501,947 8VI 8Vi Holdings Limited 0.069 15% 15,000 $2,514,685 AD1 AD1 Holdings Limited 0.008 14% 81,882 $6,290,539 ADY Admiralty Resources. 0.008 14% 392,456 $11,406,318

Jumping early on Thursday morning was Firetail Resources (ASX:FTL) on news that the company is set to acquire up to 80% of the York Harbour copper-zinc-silver project in Newfoundland, Canada via a staged earn-in agreement.

So far, the company says, only shallow exploration down to 300m has been previously completed, with historical exploration limited to two key areas, the old York Harbour mine and the Number 4 Pond target.

The best of those results include 29.0m at 5.25% Cu, 9g/t Ag from 147m, and 24.3m at 2.77% Cu 9.3% Zn, 18g/t Ag from 93m.

Osteopore (ASX:OSX) was back in the news after revealing that its $18.7 million partnership with Singapore’s NDCS and A*STAR to develop next-generation dental implants has reached “significant milestones”.

The milestones include the successful development of a 3D-printed technology, which the company says “can combine patented biological additives and polymer compounds for dental implants that have the potential to accelerate bone healing”.

Structural Monitoring Systems (ASX:SMN) rose quickly after reporting a forecast FY2024 annual revenue of $28.38m, which the company says represents year on year growth of 27%, building on revenue growth of 43% in FY2023.

And Top End Energy (ASX:TEE) made moves through the morning session, after announcing that it has been given a formal Ministerial grant of Exploration Permit, which the company says is the culmination of a multiple year application and approval process encompassing native title holder agreement and NT Ministerial approvals.

The permit the first EP to be granted in the NT since 2015, and sets TEE up for rapid deployment of a planned exploration program, looking for natural gas. The company is also in the process of finalising a deal for three additional granted permits from Hancock.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 06 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AUK Aumake Limited 0.002 -33% 20,000 $5,743,220 AXP AXP Energy Ltd 0.001 -33% 17,819,750 $8,737,021 IEC Intra Energy Corp 0.002 -33% 719,995 $5,072,345 CCO The Calmer Co Int 0.009 -31% 14,203,685 $17,949,372 CUS Coppersearchlimited 0.105 -28% 1,145,302 $13,381,384 AVE Avecho Biotech Ltd 0.003 -25% 1,007,159 $12,677,188 ICU Investor Centre Ltd 0.003 -25% 2,565,010 $1,218,045 MHC Manhattan Corp Ltd 0.0015 -25% 1,587,778 $5,873,960 SKN Skin Elements Ltd 0.003 -25% 341,633 $2,357,944 TAR Taruga Minerals 0.006 -25% 8,610,673 $5,648,214 TIG Tigers Realm Coal 0.003 -25% 725,000 $52,266,809 GTG Genetic Technologies 0.099 -21% 775,271 $16,527,156 H2G Greenhy2 Limited 0.008 -20% 3,035,381 $5,981,842 SHP South Harz Potash 0.008 -20% 6,718,666 $8,271,850 BCM Brazilian Critical 0.018 -18% 250,167 $18,276,267 TGH Terragen 0.014 -18% 171,280 $6,274,379 WLD Wellard Limited 0.019 -17% 833,806 $12,218,757 ADG Adelong Gold Limited 0.005 -17% 8,175,357 $6,707,934 TTI Traffic Technologies 0.005 -17% 5,563,623 $5,546,989 HNG Hancock & Gore Ltd 0.3 -15% 20,005 $106,374,130 CTQ Careteq Limited 0.011 -15% 1,251,022 $3,062,115 HPC Thehydration 0.011 -15% 572,719 $3,963,870 SKC Skycity Ent Grp Ltd 1.36 -15% 1,578,182 $1,220,129,360 AMD Arrow Minerals 0.003 -14% 605,075 $35,487,778 BFC Beston Global Ltd 0.003 -14% 36,828 $6,989,664

ICYMI – AM EDITION

Many Peaks Minerals (ASX:MPK) has raised $5.2m through a strongly supported private placement to accelerate exploration at its Odienné and Ferké gold projects in Cote d’Ivoire.

Maronan Metals (ASX:MMA) has restarted exploration drilling at its namesake silver-lead, copper-gold project in the Cloncurry region in northwest Queensland.

The 7000-10,000m diamond drilling program is focused primarily on growing the indicated resource within the near surface Starter Zone to facilitate the release of advanced mining studies later in the year.

It will do so by growing the silver-lead resources on the Eastern Horizon following the thickened, high-grade zones down-plunge; infill the high-grade trend identified on the Western Horizon to upgrade local areas from inferred to indicated; and test shallow extensions to Eastern Horizon silver-lead mineralisation.

At Stockhead, we tell it like it is. While Many Peaks Minerals and Maronan Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.