ASX Small Caps Lunch Wrap: Who else really has the s**ts with airlines this week?

Fire crews battled for hours to get rid of the disastrous stench. Pic via Getty Images.

Local markets have opened lower this morning, partially because Wall Street could’ve just stayed in bed for all the help it’s offering, and partially because our dear, sweet Aussie Battler Dollar we all love so much is acting weird, and partially because China’s economy is – as is tradition – acting even weirder.

There’s also the looming spectre this morning of Australia’s June quarter GDP figures, due out later on today and sure to have some kind of impact on the market’s mood – but before we get too far into that business, there’s some Even More Important Stuff to discuss.

This morning, it’s time to talk airline disasters – which, ordinarily, would be a fantastic opportunity to sway abruptly outgoing Qantas (ASX:QAN) CEO Alan Joyce on the arse as he scampers for the exits with his $24 million golden parachute strapped to his back.

But, I won’t. He’s taken enough of a well-deserved kicking over the past couple of weeks, and revenge is a lot like the ‘lunch’ on a Sydney-Melbourne Qantas flight. Best served cold.

So today’s major news story will instead focus on an incident in the US that embodies the absolute living nightmare of airline travel.

As everyone who has ever had to fly anywhere will know, air travel is probably best described as the most evil of necessary evils.

Sandwiched into a metal tube with hundreds of strangers, with no avenue of escape for hours on end, even the simplest of minor irritants can quickly escalate into becoming the single worst thing in the world, ever.

A crying baby, for example, is a bit of a nuisance most of the time. However, when you’re buckled into a seat next to one for 14 hours, having your eardrums shattered and being unable to dispose of it because it’s “not yours”, it’s a catastrophe.

Stories abound of seemingly ordinary, well-balanced people losing their minds aboard aircraft – and, lucky for us, the advent of mobile phones with cameras means that we get to see a lot of these meltdowns as they unfold.

This recent example springs to mind, when Texas marketing executive Tiffany Gomas apparently became convinced that a person she was sitting near wasn’t human.

Heads-up – Ms Gomas has something of a potty mouth, so you’re gonna want to pop your headphones on if you’re at work.

However, all of the screaming baby / hallucinating Texas marketing execs in the world can’t compare to what took place on Delta airlines late last week, when a flight from Atlanta to Barcelona was forced to turn back because of a “biohazard issue”.

As one of the pilots explained to air traffic control mid-flight: “We had a passenger who had diarrhoea all the way through the airplane so they want us to come back to Atlanta.”

According to passengers on the flight, the unnamed culprit managed to fire out a foul-smelling trail, “dribbling down the aisle” the length of the Airbus 350 aircraft.

For reference, the Airbus 350 passenger aisle is at least 50 metres long. You can sit with that piece of information, like the passengers on that ill-fated flight sat with their mess.

It remains unclear what caused the passenger to have such a severe bout of intestinal distress, but given the state of the global airline industry at the moment – and yes, I’m looking directly at you, Mr Joyce – the outcome could be precisely the sort of wake up call that airlines in general need.

There’s no word on whether the captain took mercy on the passengers and dropped the oxygen masks, but one thing is very clear – if there’s a more definite way of telling an airline that it’s giving you the shits, I’m yet to see it.

TO MARKETS

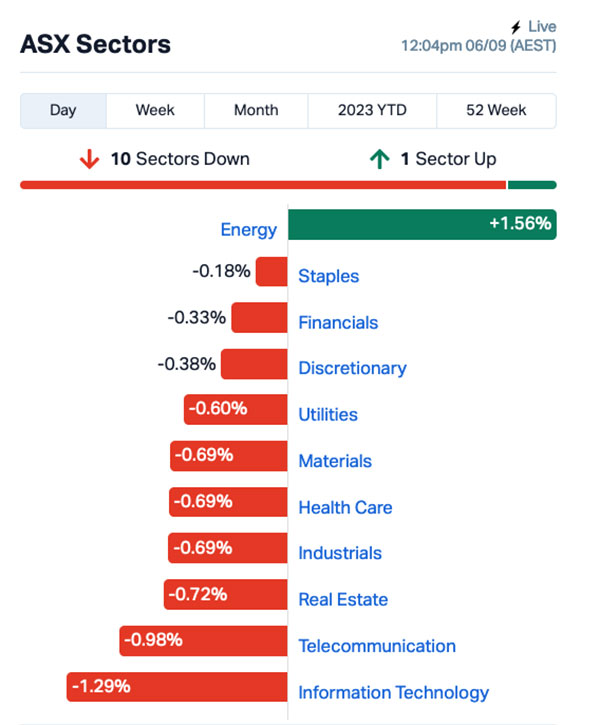

Local markets have fallen this morning, reaching lunchtime at a 0.6% deficit after everything except the Energy sector took a hefty blow to the back of the head.

As you can see, the ASX has taken something of a downturn this morning, despite interest rates remaining on hold.

I’m paraphrasing here, but the cheat-sheet version is this: The RBA decision yesterday was already priced-in, and yesterday’s Aussie dollar plunge has upset the broader market a bit more than we’d probably liked to have let on, hence the decline.

Energy’s the only sector doing well, and that’s most likely attributable to OPEC’s decision to continue a supply squeeze, which sent oil prices surging more than 1.0% overnight.

On top of that, the June quarter GDP figures arrived from the ABS this morning, revealing that while the economy expanded by 0.4% over the period from April to June (up by 2.1% over the year on a seasonally adjusted basis), there are some factors holding things back.

Decreased household spending has been a serious anchor on the economy as a whole, and that’s directly attributable to the astonishing $82.8 billion surge in mortgage interest payable during the year around the nation.

Discretionary household spending fell for the third quarter in a row, down 0.5%in the June quarter.

Interestingly, there’s talk this morning of a “per capita recession” – which is when the per person economic growth turns negative for two successive quarters, which happens in circumstances where the country’s economic growth it outpaced by population growth, which has surged since Covid stopped being a thing.

In stock news, energy company Deep Yellow (ASX:DYL) is the closest we’ve got to a Large Cap doing well today, rising more than 5% on no particular news.

However, losing tons of value this morning is mining mob Orora (ASX:ORA), down more than 17% after a prolonged break from trading, despite announcing that it’s picked up more than $1 billion from an institutional entitlement offer and a placement while it’s been taking a break from the trading floor.

NOT THE ASX

Wall Street pissed and moaned for about 7 hours yesterday, banked a nothing-burger result and wandered off to sulk overnight, leaving the S&P 500 down by 0.42%, blue chips Dow Jones off by 0.56%, and tech-heavy Nasdaq by 0.08% lower.

All American eyes were on the dynamic duo of oil prices and bond yields, apparently, after crude prices surged 1% following a meeting by OPEC+ members, during which Saudi Arabia and Russia agreed to prolong their supply cuts by another three months, because of course they did.

That news shoved US oil stocks higher, which in turn bumped US bond yields up 8bp, because what the world really doesn’t need right now is another oil price spike to layer on top of the rest of the uncertainty driving global market jitters.

Earlybird Eddy was up at the crack of dawn to look over US stock movements, and reports that Tesla led gains in megacaps, up almost 5%, while Airbnb popped 7% and Blackstone 3.5% after both stocks were included in the S&P 500 index.

United Airlines shares fell by 2.5% after the airlines grounded all US flights temporarily following a “systemwide technology issue” according to the Federal Aviation Administration, which could mean an AI-driven autopilot strike, but more likely just means that everyone’s luggage got sent to Denver again.

In Japan, The Nikkei is up 0.60% this morning on news that the Japanese government is giving serious thought to dissolving the Moonies, also known as The Family Federation for World Peace and Unification.

If you’re out of the loop on this one, the Moonies – named for its founding leader, the now long-dead Sun Myung Moon – is most widely known for its completely normal religious practice of holding massive weddings where couples are paired together by church leaders and married to each other, thousands at a time.

The issue that the Japanese government has with the group isn’t how unbelievably weird it is about the whole marriage thing. Nor does it have a particular problem with the long-standing reports that the group has a thing for “sex rituals”.

Those include a pre-marriage ceremony where the recently-introduced couples travel to spend seven days fasting, before hitting each other on the butt three times with a baseball bat to “cleanse them of their sins”.

It gets weirder than that, but it’s largely immaterial to the story – which is that the current ruling party of Japan has battling allegations of having “deep ties” to the Moonies, which obviously isn’t a good look.

It’s also a terrible image problem, considering that former PM Shinzo Abe, who was assassinated last year, was murdered by his assailant because of his alleged ties to the church.

So… yeah. That’s what’s happening in Japan right now.

Meanwhile, in China, the economy is running slow (again) and that’s causing headwinds for their local markets. Shanghai’s down 0.5% in early trade, and Hong Kong – still mopping out the foyer after the typhoon that blew through over the weekend – is down 1.0% this morning as well.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 06 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CCE Carnegie Clean Energy 0.002 100% 79,904,197 $15,642,574 LV1 Live Verdure Ltd 0.15 63% 388,609 $8,257,833 DXN DXN Limited 0.0015 50% 1,000,132 $1,723,340 VPR Volt Power Group 0.0015 50% 516,978 $10,716,208 AGD Austral Gold 0.034 42% 96,613 $14,695,472 ADS Adslot Ltd 0.004 33% 1,177 $9,799,853 EDE Eden Innovations 0.004 33% 120,012 $8,990,911 ELE Elmore Ltd 0.004 33% 4,891,375 $4,198,151 BOA Boadicea Resources 0.045 29% 624,227 $4,308,161 KGL KGL Resources Ltd 0.14 27% 41,861 $62,402,105 GES Genesis Resources 0.005 25% 40,150 $3,131,365 BUX Buxton Resources Ltd 0.195 22% 2,557,072 $27,404,571 AUE Aurum Resources 0.12 20% 51,985 $2,500,000 AMD Arrow Minerals 0.003 20% 731,666 $7,559,413 PUA Peak Minerals Ltd 0.003 20% 333,628 $2,603,442 SI6 SI6 Metals Limited 0.006 20% 4,898,240 $9,969,297 C29 C29Metalslimited 0.088 19% 522,681 $3,061,151 RNE Renu Energy Ltd 0.035 17% 507,372 $13,215,064 TAS Tasman Resources Ltd 0.007 17% 1,946,019 $4,276,016 APS Allup Silica Ltd 0.059 16% 359,776 $1,962,332 PBH Pointsbet Holdings 0.755 15% 2,292,677 $206,606,833 GMN Gold Mountain Ltd 0.008 14% 6,625 $15,883,550 MOB Mobilicom Ltd 0.008 14% 1,387,188 $9,286,737 TOY Toys R Us 0.008 14% 301,227 $6,460,426 GHY Gold Hydrogen 0.285 14% 6,879 $14,230,756

Leading the Small Caps race this morning is energy minnow Carnegie Clean Energy (ASX:CCE), which is showing a 100% bump on news that it’s inked a juicy contract with Ireland that will see its CETO wave energy tech installed there by mid-2025.

CCE says that its CETO Wave Energy Ireland (CWEI) subsidiary has been awarded a €3.75 million contract to build and operate a CETO wave energy converter at the Biscay Marine Energy Platform in the Basque Country, Spain and will deliver power to the grid.

In second place, Consumer Cyclical company Live Verdure (ASX:LV1), is up 63% this morning on news that it has snagged commitments for a $1.68 million placement from new and existing sophisticated shareholders.

The funds raised will be used for “new product development, fund working capital requirements for large retail partnerships and to further accelerate the Company’s growth through investment in sales, marketing, and inventory initiatives,” LV1 says.

In third place, Boadicea Resources (ASX:BOA) has added more than 28% pre-lunch on no news while a number of other goldies including Austral Gold (ASX:AGD) and Gold 50 (ASX:G50) are showing significant jumps on slim volume this morning as well.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 09 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CLE Cyclone Metals 0.001 -33% 117,500 $15,396,757 MTB Mount Burgess Mining 0.002 -33% 220,527 $3,046,940 AAU Antilles Gold Ltd 0.023 -21% 8,953,357 $17,119,660 GTG Genetic Technologies 0.002 -20% 56,111 $28,854,145 CNJ Conico Ltd 0.005 -17% 1,549,403 $9,420,570 ECT Environmental Clean Tech 0.005 -17% 31,635 $17,085,331 ROG Red Sky Energy 0.005 -17% 282,200 $31,813,363 ENR Encounter Resources 0.34 -16% 3,373,604 $160,187,941 BCT Bluechiip Limited 0.027 -16% 671,204 $22,837,455 XGL Xamble Group Limited 0.035 -15% 2,700 $11,650,406 CI1 Credit Intelligence 0.15 -14% 30,000 $14,612,353 NES Nelson Resources 0.006 -14% 700,126 $4,295,160 SKN Skin Elements Ltd 0.006 -14% 502,950 $3,986,403 LDR Lode Resources 0.125 -14% 18,000 $15,483,701 VBC Verbrec Limited 0.1 -13% 50,000 $25,469,760 LSR Lodestar Minerals 0.007 -13% 100,001 $14,867,179 NRX Noronex Limited 0.014 -13% 997,236 $6,052,828 ODE Odessa Minerals Ltd 0.007 -13% 3,422,249 $7,576,895 FTL Firetail Resources 0.105 -13% 1,168,490 $11,550,000 MRZ Mont Royal Resources 0.21 -13% 287,602 $19,750,784 ORA Orora Limited 2.9 -12% 20,189,559 $2,780,436,428 OXT Orexplore Technologies 0.046 -12% 484,061 $5,390,538 EXL Elixinol Wellness 0.008 -11% 156,244 $5,638,344 Z2U Zoom2Utechnologies 0.065 -11% 80,875 $10,219,246 DKM Duketon Mining 0.255 -11% 110 $34,795,715

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.