ASX Small Caps Lunch Wrap: Who else is having trouble believing their eyes this morning?

"Are your eyes deceiving you as well this morning?" Pic via Getty Images.

Australian markets have opened slightly higher this morning, after a weekend of solid self-reflection and bed rest, as per doctor’s orders… and there’s nothing quite like finding yourself sitting up in bed eating “Meal in a Can” straight out of the tin at two in the morning to help you realise that maybe – just maybe – you’re a teensy bit depressed.

Hardly surprising, given the stress the market’s been under recently, but it’s a brand new week, so fingers and toes are all crossed, and let’s hope for a better show than last week.

That’s not to say there’s not plenty to be concerned about, with Deutsche Bank the next on the list of “too big to fail” banks looking like it’s actually a “too big to carry” risk – more on that later.

For now, though, a quick word about the future of misinformation – and how it’s becoming increasingly difficult for a huge percentage of the population to figure out what’s real and what isn’t, thanks to the influence of AI.

Over the weekend, this image of Pope Francis stepping out in a very stylish puffer jacket hit the front page of reddit, and an enormous number of normally reasonably savvy folks were fooled by it.

AI-generated image of Pope Francis goes viral on social media. pic.twitter.com/ebfLK4F850

— Pop Base (@PopBase) March 25, 2023

To quote prominent Ghostbuster Dr. Raymond Stantz: “I tried to think of the most harmless thing. Something I loved from my childhood. Something that could never ever possibly destroy us.”

And thus, Mr StayPoped was born. Nice thinking, Ray…

To be fair, seeing the Pope dressed like he’s just dropped an absolutely banger of a tune and his on his way to collect a Grammy is quite amusing – but the more frightening aspect of it is that given how quickly the image spread over the weekend, portrayed as an actual image and not an AI creation, is proof that the genie is well and truly out of the bottle.

In the wake of that image going viral, Elliott Higgins – founder and creative director of investigative journalism outfit Bellingcat – threw the cat among the pigeons by firing up AI image creator Midjourney to make “pictures of Trump getting arrested while waiting for Trump’s arrest”.

— Eliot Higgins (@EliotHiggins) March 20, 2023

And the internet lost its mind.

In Higgins’ defence, they are genuinely funny images. The images of Donald Trump working out in a prison gym and playing basketball with fellow inmates in particular are top-shelf satire.

— Eliot Higgins (@EliotHiggins) March 21, 2023

The images earned Higgins a ban from the MidJourney AI platform, and – as intended – gave the world a couple of wry chuckles that it probably needs right now.

TO MARKETS

Local markets opened higher this morning, despite deepening concern for the banking sector as Deutsche Bank tumbled 8.5%, setting off fresh concerns for global banking.

Despite that, the benchmark climbed as high as +0.5% in early trade, but on the way into lunch time, it’s settled around +0.25% as a decline in Energy stocks weighs on the market.

The Energy sector is down 1.56% this morning, and Materials is pretty much flat, leaving Utilities (+1.74%) and Real Estate (+1.30%) to do most of the heavy lifting.

Meanwhile, the banking sector is doing its level best to whistle nonchalantly like nothing’s the matter, adding +0.14% this morning, despite news from the US that suggests there is – potentially – a lot more trouble brewing.

The award for Most Problematic Revelation this morning goes to Latitude Financial (ASX:LFS), which picked this morning to tell the world that the hack that “possibly involved 300,000 of its customers” is much, much worse than that.

Hackers have made off with 7.9 million Australian and New Zealand driver licence numbers, 3.2 million of which had been provided to the company within the past 10 years.

On top of that, some 53,000 passport numbers have been pinched as well.

Oh… and another 6.1 million records containing names, addresses and dates of birth dating back to at least 2005 were also taken.

It is nothing short of a complete and utter disaster, leaving millions of customers in danger of identity theft and fraud.

For what it’s worth, Latitude says it’ll cover the cost of having hacked identification documents replaced. Oh, and they’re really, really sorry.

Latitude is down 3.3% for the day, but – unbelievably – is still up 1.3% for the month.

If you’ve been affected by the hack, the company says you should contact IDCARE on 1800 595 160 using the referral code “LAT23” for advice about how to prevent fraud and identity theft.

NOT THE ASX

Stateside, all the talk at the moment is about the banking crisis, and some alarming data from the US suggests that things are actually pretty dire among the small and mid-sized US banks – if the quantity of emergency funds being tapped via the US Fed is any indication.

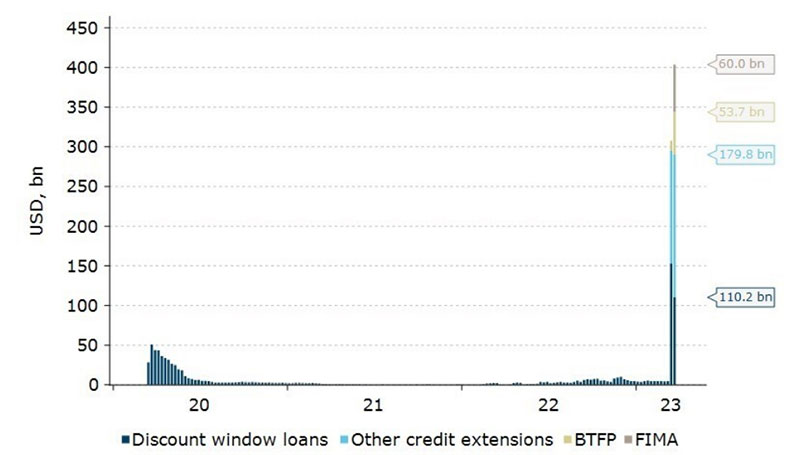

The ANZ published this chart this morning, which is about as clear an indication as you could ask for that things aren’t really going to plan. See the bit where there’s a massive spike? Yeah… that’s the bad bit.

Even with all that in mind, as Earlybird Eddy Sunarto reported this morning, you could be forgiven for wondering if all rational thought has gone flying out the window, after shares of Silvergate Capital rose 52% on rumours the failed crypto friendly bank may be able to sell some of its technology assets like the Diem stablecoin technology at reasonable prices.

In Japan, the Nikkei is doing its best to build some momentum, up 0.15% despite days of national speculation over a gift from Japanese PM Fumio Kishida made to Ukrainian president Volodymyr Zelensky during a surprise visit to Kyiv, which appeared to be an enormous box of Japanese ‘cheesy poof’ style snacks.

【速報】岸田文雄さん、ゼレンスキーにうまい棒を差し入れwww https://t.co/XpXuPGYIut

焼き鳥味か pic.twitter.com/iNZ05X6Ecm— なる (@nalltama) March 21, 2023

It turned out that the box actually contained a large, ceremonial rice scoop – a traditional gift that is said to bring good luck and victory in battle.

No doubt shares in Japanese Cheesy Poofs are set to tumble as a result.

In China, markets have opened lower, with Shanghai down 0.12% and the Hang Seng down 0.32% in very early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 27 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| WBE | Whitebark Energy | 0.002 | 100% | 1,150,000 | $6,464,886 |

| IPD | Impedimed Limited | 0.0955 | 62% | 22,152,324 | $105,354,230 |

| ALO | Alloggio Group | 0.28 | 47% | 2,696,470 | $22,490,348 |

| SRY | Story-I Limited | 0.011 | 38% | 7,726,474 | $3,011,239 |

| DXN | DXN Limited | 0.004 | 33% | 3,000,491 | $5,163,945 |

| OJC | The Original Juice | 0.13 | 30% | 66,203 | $23,669,079 |

| EX1 | Exopharm Limited | 0.014 | 22% | 1,384,204 | $1,807,901 |

| LNU | Linius Tech Limited | 0.003 | 20% | 10,216,753 | $8,074,366 |

| GRL | Godolphin Resources | 0.076 | 20% | 494,820 | $7,516,460 |

| ROC | Rocketboots | 0.1125 | 20% | 187,500 | $2,984,500 |

| HIL | Hills Ltd | 0.029 | 20% | 33,482 | $6,376,234 |

| NNL | Nordic Nickel | 0.33 | 18% | 12,318 | $16,368,801 |

| GO2 | Thego2People | 0.014 | 17% | 100,000 | $5,213,881 |

| LRL | Labyrinth Resources | 0.014 | 17% | 37,142 | $11,513,848 |

| BYH | Bryah Resources Ltd | 0.022 | 16% | 65,886 | $5,343,816 |

| GSN | Great Southern | 0.0205 | 14% | 384,119 | $11,943,126 |

| NRZ | Neurizer Ltd | 0.083 | 14% | 1,011,901 | $83,692,932 |

| EQS | Equity Story Group | 0.06 | 13% | 75,000 | $1,955,159 |

| EOL | Energy One Limited | 3.9 | 13% | 2,913 | $103,582,089 |

| CHR | Charger Metals | 0.27 | 13% | 157,787 | $10,491,448 |

| NIM | Nimy Resources | 0.225 | 13% | 120,254 | $13,553,760 |

| SFG | Seafarms Group Ltd | 0.009 | 13% | 3,028,651 | $38,692,793 |

| THR | Thor Energy PLC | 0.0045 | 13% | 353,719 | $5,912,451 |

| GBR | Greatbould Resources | 0.0975 | 12% | 7,335,911 | $39,059,952 |

| POD | Podium Minerals | 0.095 | 12% | 50,777 | $28,607,508 |

In Small Caps news, the clear winner for Monday morning is Impedimed (ASX:IPD), soaring 62.7% on news that the US National Comprehensive Cancer Network (NCCN) released a new set of guidelines, which include the use of bioimpedance spectroscopy as an objective measurement tool to identify early signs of lymphoedema for the first time.

It’s big news for Impedimed as the company currently holds the only FDA-cleared BIS technology for the assessment of lymphoedema, which managing director and CEO of ImpediMed Richard Valencia says is a “major validating moment for the company”.

“The authors of the NCCN Guidelines are world leaders in global cancer care driven by sound clinical evidence and patients’ best interests. Their recommendations are highly influential for clinicians, patients, policymakers, and insurance companies,” he continued.

“We will take the information in these updated NCCN Guidelines and immediately integrate it into our reimbursement strategy to expand coverage of SOZO testing for lymphoedema. Our near-term focus remains leveraging our strong clinical evidence, market position, and now these guidelines to drive growth and adoption of our solution for breast cancer-related lymphoedema.”

Next on the ladder is Alloggio Group (ASX:ALO), which has announced it’s entered into a Scheme Implementation Deed (SID) with Next Capital, which would see the latter acquire 100% of ALO shares at $0.30 a pop. ALO is currently 47% higher at $0.28 per share.

And lastly, Apple re-seller Story-i (ASX:SRY) is back in business on the bourse after fulfilling all of its requirements to be relisted following a sin-binning by the ASX in October.

The list of recommendations to get the company back up to code was more than 4.5 pages long, but the ASX seems happy enough that the recommendations have all been met, and it’s back to trading and it’s already 37.5% higher.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for March 27 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.001 | -50% | 9,158,972 | $31,285,147 |

| KEY | KEY Petroleum | 0.001 | -33% | 400,996 | $2,951,892 |

| AMD | Arrow Minerals | 0.003 | -25% | 3,015,779 | $11,633,242 |

| CLZ | Classic Min Ltd | 0.0015 | -25% | 11,705,089 | $3,675,564 |

| MGG | Mogul Games Grp Ltd | 0.0015 | -25% | 1,000 | $6,526,882 |

| CT1 | Constellation Tech | 0.004 | -20% | 800 | $7,356,002 |

| RDN | Raiden Resources Ltd | 0.004 | -20% | 2,291,262 | $8,272,912 |

| AJQ | Armour Energy Ltd | 0.004 | -20% | 11,658,830 | $11,659,524 |

| SRR | Sarama Resources | 0.099 | -18% | 294,694 | $4,499,278 |

| ERL | Empire Resources | 0.005 | -17% | 253,332 | $6,677,610 |

| BEZ | Besragoldinc | 0.135 | -16% | 5,615,218 | $56,617,902 |

| CTN | Catalina Resources | 0.006 | -14% | 214,650 | $8,669,408 |

| HCD | Hydrocarbon Dynamic | 0.012 | -14% | 599,083 | $8,218,847 |

| OPA | Optima Technology | 0.024 | -14% | 11,458 | $6,957,323 |

| WSR | Westar Resources | 0.03 | -14% | 446,976 | $2,829,484 |

| GML | Gateway Mining | 0.038 | -14% | 41,000 | $11,718,676 |

| WIA | WIA Gold Limited | 0.038 | -14% | 667,348 | $25,181,986 |

| HXL | Hexima | 0.013 | -13% | 7,998 | $2,505,594 |

| CG1 | Carbonxt Group | 0.047 | -12% | 153,191 | $14,728,490 |

| DXB | Dimerix Ltd | 0.115 | -12% | 743,693 | $41,713,577 |

| BOC | Bougainville Copper | 0.31 | -11% | 30,032 | $140,371,875 |

| AM7 | Arcadia Minerals | 0.195 | -11% | 5,231 | $10,273,536 |

| HAL | Halo Technologies | 0.16 | -11% | 1,500 | $23,309,138 |

| VN8 | Vonex Limited. | 0.04 | -11% | 92,872 | $16,282,288 |

| CHK | Cohiba Min Ltd | 0.004 | -11% | 197 | $7,979,599 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.