ASX Small Caps Lunch Wrap: Who else is feeling a little threatened today?

Getty Images

Afternoon. How are we shaping up today in ASX Small Caps Town? A little iffy, perhaps, given the mixed bag Wall Street left on our doorstep overnight.

The ASX 200 session opened okay, though – a 0.14% steady-as-she-goes greeting with a growing-bad-mood-masking upwards inflection.

We’ll explore a little further into this roundup about where it’s at and how it (and crypto) is looking like it might take a bit of a daily dip.

But first, if you think various markets’ recent good form is feeling threatened, there have also been a few, strangely unsettling things afoot in spaces some of us share with members of the animal kingdom.

We’ll begin with the lighter of three freakish occurences this week…

An identity-thieving bastard of a fish

We’ve read this Techspot story three times now, and we’re still scratching our heads about it. A Japanese bloke’s pet fish has been able to essentially steal his identity and cause his credit card to drain 500 yen. Which is only about $5, but still.

It’s something to do with an experiment the man, clearly a massive gaming geek with too much time to spare, was conducting on his fish using his Switch console.

He wanted to see if his finned friend could complete a Pokémon video game by using motion-tracking software linked to a “grid populated with controller inputs” that could manipulate actions in the game.

Or something. Here’s a video.

Anyway, it took the fish something like 1,144 hours to complete the game, but while the fella wasn’t looking, the game crashed and the Nintendo eShop came up instead. The whole thing was being recorded via webcam, and therefore exposed the man’s credit card details.

Nice of the watching thieves to only nick $5 worth, I guess. Nintendo apparently was quick to refund. Guess this sort of stuff happens all the time in Japan.

Animal Farm – finally coming true?

Meanwhile, in slightly more Orwellian-style animal-uprising news, an about-to-be-slaughtered pig has apparently killed a 61-year-old butcher in Hong Kong with a 15-inch meat cleaver.

While over in “Toto, We’re Back in Kansas”, a dog has shot a hunter with a rifle. That one was an accident, though. Or WAS it?

“A canine belonging to the owner of the pickup stepped on the rifle causing the weapon to discharge,” the Summer County Sheriff’s office said. “The fired round struck the passenger who died of his injuries on scene.”

Still, we’ll take a few animal-related mishaps/deaths over any iRobot-style insurgence, thanks very much…

https://twitter.com/alancarroII/status/1617582060755128321

Courtesy of that potentially job-threatening AI ChatGPT thing…

TO MARKETS

How’s the ASX 200 feeling right now, then? Yeah, the flat white never arrived, the Aussie stonks benchmark is slumped in its chair and some gloom (-0.37%) has potentially set in for the arvo.

Stockhead’s editor stepped in for an extremely organic and informative non AI-based Market Highlights wrap, which we’ll vaguely summarise and not really do justice to in a sec.

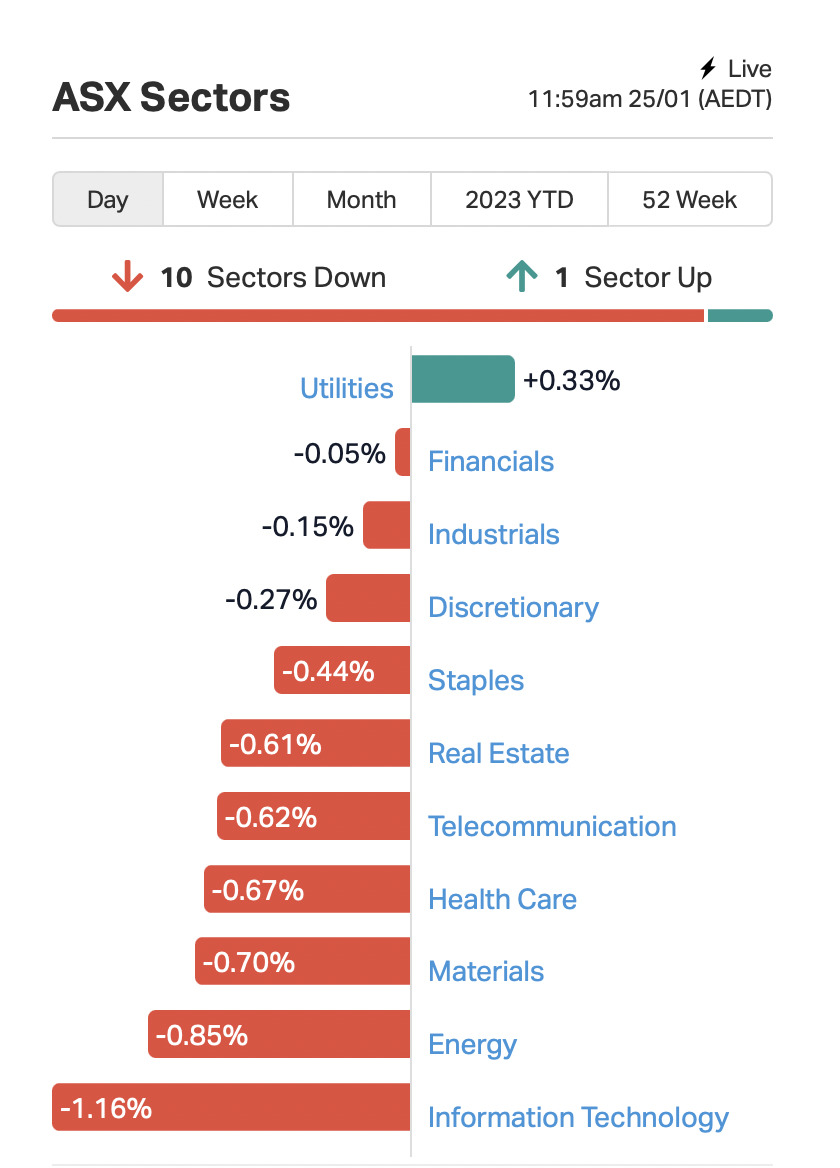

A very quick look at the leading and lagging ASX sectors today paints a bit of a picture. And not the best picture at that. Here you are, with thanks to marketindex.com.au:

A solid-looking tower, that. Pity it’s mostly red. At least utility players are still faring okay so far today.

Looking around, then, for some other scraps of intra-day positivity, we land on a sole unicorn. And as painful as that sounds, it’s at least a short story of rainbow-like upside for Accent Group (ASX:AX1).

The footwear company has a spring in its step, up 9.14% at the time of key tapping. And that can apparently be put down to some positive trading update info the firm has released.

Yeah, they’re bigging themselves up to investors here, but why not, eh? Here are some stats, in their words:

“Total Sales (including TAF franchisees) for the 27 weeks ended 1 January of $825 million were up 39%, and up around 33% excluding the impact of week 27.

“Reported earnings before interest and tax (EBIT)2 for H1 FY23 are expected to be in a range of $90 million to $92 million. The Company estimates that the impact of week 273 was around $36 million in sales, and around $10 million in marginal EBIT contribution.”

NOT THE ASX

“The ASX is heading for a bit of a glitch this morning as far as 2023 goes, with SPI Futures pointing to a -0.13% drop after a mixed session on US markets overnight,” Farquhar prophesised earlier.

(His soothsaying powers have proven correct, as the Aussie benchmark is now down half a percentage point so far today. That’s why he gets the not-as-much-as-other-editors bucks.)

It’s not all bad over in the US, though, he pointed out, though with “S&P500 earnings grinding on” – 65% of the 72 companies reporting so far beating consensus. Google and Amazon, however, dropped 2.09% and 1.23%.

Also down was the NYSE itself, which broke for a while, in a Solana-style outage that caused Gary Gensler and co over at the SEC to stop fretting about their XRP legal case for a bit and investigate.

And if parts of that sentence mean little to you, then that means crypto means little to you. Fair enough, and each to their own.

Mooners and Shakers has you partly covered on what’s happening in that sector today, though, if you change your mind. Spoiler: it’s run into a bit of a wall at present, too, very much taking its directional cues from Wall Street trading.

Bitcoin has actually dipped a little further since we published that morning roundup, and is changing hands for about US$22,600. The whole crypto market cap is now down close to 3% over 24 hours. Probably had to happen, as it’s all been on a bit of a tear these past handful of days.

As for some of the world’s leading indices, a quick statistical look:

The S&P500 closed 0.07% down, while the tech-stock-heavy Nasdaq drooped by 0.27%.

The Dow Jones was at least travelling okay at close (+0.31%), and Japan’s Nikkei is moving along okay (+0.11%), while over in London, the FTSE was down 0.35%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 25 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap LML Lincoln Minerals 0.07 100% 20,700,076 $20,124,429 SKY SKY Metals Ltd 0.08 60% 10,731,224 $18,839,174 WBE Whitebark Energy 0.0015 50% 748,500 $6,464,886 ARE Argonaut Resources 0.002 33% 3,150,000 $9,542,807 GLV Global Oil & Gas 0.002 33% 3,600,996 $5,143,196 WFL Wellfully Limited 0.02 33% 24,545 $5,867,223 AQX Alice Queen Ltd 0.0025 25% 3,056,888 $4,400,500 M8S M8 Sustainable 0.01 25% 3,947,577 $3,927,268 ASN Anson Resources Ltd 0.2325 22% 16,508,577 $223,868,435 JNO Juno 0.125 19% 136,940 $14,244,090 SCN Scorpion Minerals 0.089 19% 785,369 $25,927,964 OKR Okapi Resources 0.195 18% 2,800,511 $24,310,852 JPR Jupiter Energy 0.026 18% 50,000 $27,056,703 HFY Hubify Ltd 0.035 17% 63,715 $14,884,089 BMG BMG Resources Ltd 0.015 15% 371,351 $5,017,892 ICR Intelicare Holdings 0.023 15% 500,000 $4,178,308 UNT Unith Ltd 0.031 15% 1,585,823 $20,108,584 ADX ADX Energy Ltd 0.008 14% 97,500 $24,590,388 RAG Ragnar Metals Ltd 0.016 14% 1,349,073 $5,308,588 OAK Oakridge 0.12 14% 31 $1,805,546 LMLND Lincoln Minerals - Ordinary New 0.026 13% 12,318,328 $18,433,997 ASP Aspermont Limited 0.0225 13% 50,316 $48,621,743 M24 Mamba Exploration 0.225 13% 151,424 $8,435,001 RCW Rightcrowd 0.045 13% 106,948 $10,490,450 FOD The Food Revolution 0.036 13% 2,355,600 $30,296,374

A couple of standout intraday performers:

• Lincoln Minerals: (ASX:LML): +100%. The graphite explorer is going from strength to strength after its return to ASX-based trading five days ago. Why? It might have something to do with an extension of takeover offer from QGL. But Reubs knows way more than we can possibly take a stab at – he’ll tell you over here as he delves into lithium.

Oh, and while we’re at it, let’s nab some other thoughts from Reuben regarding another eye-catcher today…

• Sky Metals (ASX:SKY) is up 60% at the time of writing, on the back of “hitting thick, widespread rare earths at the historical Doradilla tin-tungsten project in NSW”.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for January 25 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap LBY Laybuy Group Holding 0.04 -33% 11,995,398 $15,451,812 INP Incentiapay Ltd 0.006 -25% 414,822 $10,120,509 MTL Mantle Minerals Ltd 0.0015 -25% 222,248 $10,691,210 XST Xstate Resources 0.0015 -25% 10,186,333 $6,430,363 CLE Cyclone Metals 0.0025 -17% 770,666 $18,350,211 MM1 Midasmineralsltd 0.165 -15% 121,215 $11,140,694 FTL Firetail Resources 0.12 -14% 67,500 $9,100,000 AU1 The Agency Group Aus 0.026 -13% 13,000 $12,857,298 DRO Droneshield Limited 0.365 -13% 5,310,762 $189,437,634 SRX Sierra Rutile 0.2 -13% 9,225,364 $97,574,383 OPN Oppenneg 0.069 -13% 355,241 $11,631,811 NES Nelson Resources. 0.007 -13% 2,000,000 $4,708,755 CMP Compumedics Limited 0.175 -13% 301,496 $35,432,590 MZZ Matador Mining Ltd 0.105 -13% 1,043,681 $37,826,260 GLA Gladiator Resources 0.022 -12% 548,499 $13,354,248 SBM St Barbara Limited 0.785 -12% 11,885,040 $726,722,064 FOS FOS Capital Ltd 0.19 -12% 30,000 $4,473,320 CLU Cluey Ltd 0.4 -11% 45,987 $62,226,105 AMD Arrow Minerals 0.008 -11% 7,696,763 $22,803,886 AXP AXP Energy Ltd 0.004 -11% 3,185,726 $26,211,063 BAT Battery Minerals Ltd 0.004 -11% 3,306,982 $13,208,591 NAE New Age Exploration 0.008 -11% 4,490,278 $12,923,090 SSH Sshgroupltd 0.165 -11% 166,666 $7,993,129 AON Apollo Minerals Ltd 0.045 -10% 162,000 $24,113,618 FRM Farm Pride Foods 0.09 -10% 14,146 $5,518,018

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.