ASX Small Caps Lunch Wrap: Who else is a level six life form with illuminated mind today?

Getty Images

Aussie markets are in a decent mood so far today, even if Wall Street is having a bet each way with the SPX up and the tech-heavy Nasdaq slightly hungover.

Pfft, tech stocks, eh? Often hard to know what you’re gonna get from that box of chocolates.

Which, incidentally, is how the Maroochydore Magistrates Court must be feeling about one Joey Myer today. As reported by news.com.au, the failed political candidate and convicted child abuser was booted from court after a “rant filled with bogus legal jargon” in which he identified as a “sovereign living man”.

Er, righto. For context, Myer was found guilty by a jury in 2021 of 11 counts of indecently treating a child under 16 and one count of rape. As the report details, he has since been acquitted on appeal of the rape charge, and the QLD Court of Appeal has reserved his decision on Myer’s appeal in respect of the other charges. He pled not guilty to all the charges during the trial.

Per the news.com.au report: going by the name “Jarreau”, he declared: “I won’t be needing any legal advice” before denying his identity.

“I’m not Mr Myer,” Myer said.

“Joey Myer is the birth certificate, I am not Joey Myer, and I appear by way of divine appearance occupying the office of executor for the estate of Joey Myer.

“This is a certified copy of Joey Myer brought before this maritime vessel that is Maroochydore Magistrates Court.

“I am Jarreau, I am a sovereign living man, level six life form with illuminated mind.”

Honestly, this sovereign citizen movement is the best thing that’s happened to news for decades. And policing. Earlier this week we saw a couple of soveriegn gronks pull the “you’re out of your jurisdiction” card on highway police and the highlights included:

– demanding to know one cop’s badge number (reply: “Don’t have one – it’s not America, mate”)

– claiming all police force ABN numbers “are registered in Norfolk Island” and

– telling police they “should be out catching pedophiles” (reply: “I just had a look and you are one. You’re on the Child Protection Register mate.”)

Endless entertainment. Much like the ASX, really. Here are today’s highlights.

TO MARKETS

It was a “what’s the story, morning glory?” opening for the ASX 200 this morning, with a steady rise to where it sits now with +1.11% gain.

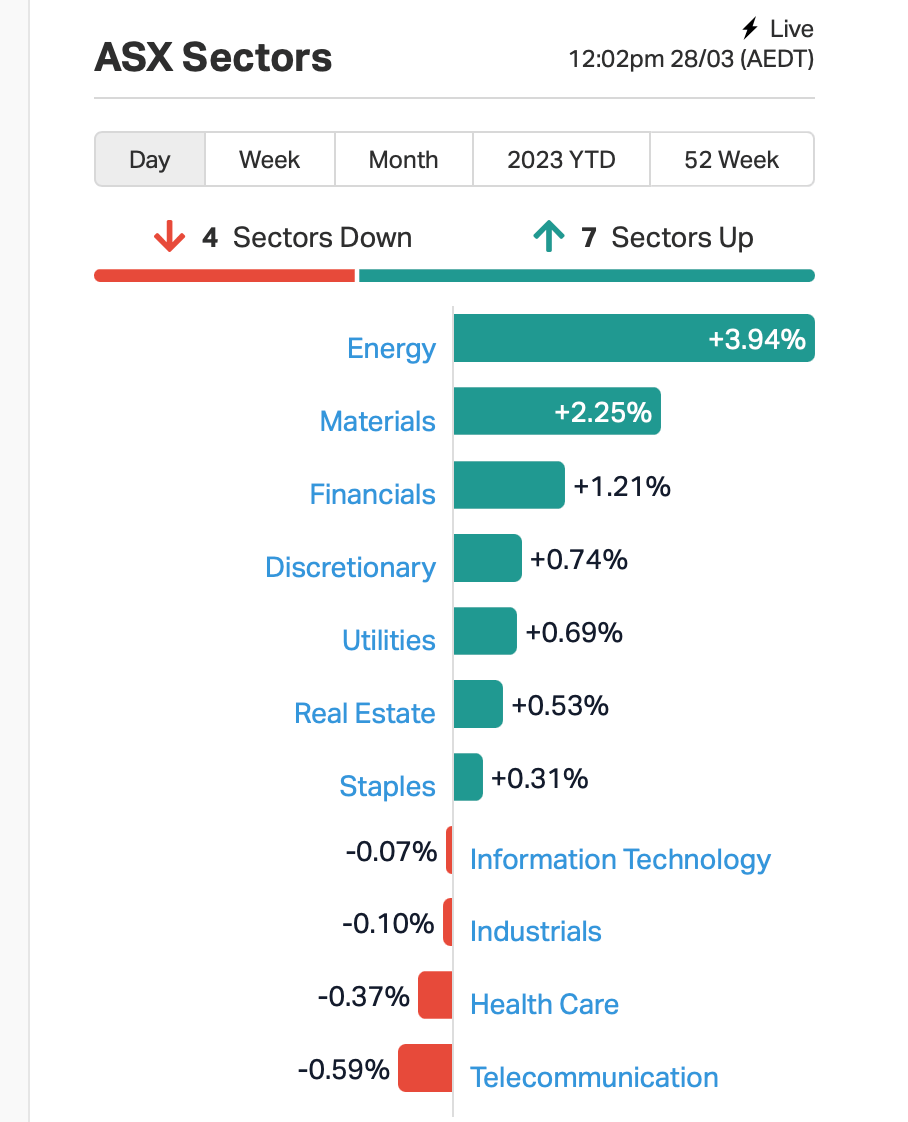

In terms of specific sectors, here’s how those are currently tracking, too (below). On a daily timeframe at least then, we have Energy and Materials = winning; Telcos and Healthcare = losing.

We know you like your small caps, but indulge us on some slightly larger ones for half a minute, because there’s a bit catching our eye there.

Notably, the $15.8bn market capped Mineral Resources (ASX:MIN) with an energetic 66% gain at the time of writing. There’s no specific news we can see that’s given it its frisson, other than an application for quotation of securities the other day, which is hardly worth the mention we just gave it. Nevertheless.

The $11.87bn valued Pilbara Minerals (ASX:PLS) meanwhile is likely up a near 24% on this positive narrative – a deal with leading mining tech player Plotlogic to trial OreSense at the world’s largest hard rock lithium operation, the Pilgangoora project in Western Australia.

This will reportedly improve identification and delineation of ore and waste materials and lead to increased production of lithium at the mine.

These two daily winners stand in stark contrast to fellow Basic Materials stocks Core Lithium (ASX:CXO) -23%; and Paladin Energy (ASX:PDN) -21%… as well as Healthcare sector daily loser Imugene Ltd (ASX:IMU) sinking -48%.

NOT THE ASX

The big news out of the US of A overnight, as reported by Stockhead’s very own, non-fungible Eddy Sunarto in his always must-read Market Highlights roundup, was the news that First Citizens Bank has bought up a large portion of imploded bank SVB.

The FDIC retains the remaining SVB securities and assets, writes Eddy, who also notes that US stocks have been bolstered by this as well as the fact a “5% rebound in crude oil prices sent US energy shares higher following a volatile few weeks for crude caught up in the banking storm”.

Nevertheless, the tech-heavy Nasdaq still settled around -0.47% at Wall Street close, while the S&P 500 climbed 0.16%.

Over in China, at the time of writing, the Shanghai index is up 0.13%. In Japan, the Nikkei is +0.14%. Hong Kong – the Hang Seng is +0.75%… nope it just moved… +0.74%.

Crypto… the world of magic internet money is known for being all over the shop, and it certainly dipped overnight on the news that a US regulator (no, not the SEC for a change) – the commodity-tastic CFTC – is suing the world’s biggest cryptocurrency exchange Binance.

It’s all part of a broader crackdown on the industry in the US right now. On the whole it seems concerning, but leading crypto Bitcoin has been on a rising narrative all year, enjoying some glow as a potential safe-haven asset amid the crumbling American banking situation, a la gold.

Can that sustain? Some experts have a few interesting takes here. And for the latest price movements across the wild west of finance, read this morning’s Mooners & Shakers.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 28 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap LTR Liontown Resources 2.41 58% 75,103,797 $3,352,643,315 TD1 Tali Digital Limited 0.003 50% 161,009 $6,530,311 GTG Genetic Technologies 0.004 33% 200,000 $34,624,974 MRD Mount Ridley Mines 0.004 33% 3,285,714 $23,354,649 NRZ Neurizer Ltd 0.115 32% 3,387,088 $99,743,631 UMG United Malt Group 4.515 31% 3,334,571 $1,029,176,224 CHR Charger Metals 0.315 26% 326,630 $10,928,592 CT1 Constellation Tech 0.005 25% 3,500,697 $5,884,801 EMU EMU NL 0.0025 25% 1,370,377 $2,900,043 LLI Loyal Lithium Ltd 0.26 24% 136,234 $12,492,900 FRS Forrestania Resources 0.1 23% 795,067 $4,932,196 MXC MGC Pharmaceuticals 0.011 22% 2,004,826 $25,798,026 CY5 Cygnus Metals Ltd 0.225 22% 650,066 $34,016,729 AUH Austchina Holdings 0.006 20% 2,626,615 $10,389,418 BYH Bryah Resources Ltd 0.024 20% 460,961 $5,625,069 PNX PNX Metals Limited 0.003 20% 496,666 $13,451,562 AQC Auspaccoal Ltd 0.11 20% 4,030,209 $31,952,608 CXO Core Lithium 0.9225 18% 27,052,695 $1,446,913,099 MDX Mindax Limited 0.13 18% 2,568,312 $219,236,455 TRT Todd River Res Ltd 0.013 18% 749,550 $6,935,733 PMT Patriot Battery Metals 1.415 18% 4,434,219 $296,897,388 CUS Copper Search 0.27 17% 4,583 $12,142,826 AMD Arrow Minerals 0.0035 17% 965,000 $8,724,932 PGY Pilot Energy Ltd 0.014 17% 764,665 $9,671,132 YPB YPB Group Ltd 0.0035 17% 5,486,598 $1,857,747

Standouts…

• Liontown Resources (ASX:LTR): +58%. Hear the Liontown folk roar. Or something like that. Because they’ve rejected an indicative proposal from Ablemarle Corporation that would have seen the latter acquire all of the LTR shares at a price of $2.50 each.

“The Liontown Board and its advisers carefully considered the Indicative Proposal and unanimously determined that it substantially undervalues Liontown, and therefore is not in the best interests of shareholders,” reads a Liontown statement today via the ASX. Moving on, then…

• United Malt Group (ASX:UMG): The fourth largest commercial maltster globally, making many a hard-earned-thirst quencher unassumingly happy, is up 31%. News? It’s entered into a Process Deed after an Indicative Proposal from Malteries Soufflet, which is French, and the largest commercial maltster in Europe. More details: here.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for March 28 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap HXL Hexima 0.009 -40% 655,000 $2,505,594 AVW Avira Resources Ltd 0.002 -33% 1,000,000 $6,401,370 CCE Carnegie Cln Energy 0.001 -33% 2,800,584 $23,463,861 KCN Kingsgate Consolidated 1.5 -25% 5,254,996 $444,854,111 CXU Cauldron Energy Ltd 0.006 -25% 3,002,498 $7,452,544 SIH Sihayo Gold Limited 0.0015 -25% 11,973,173 $12,204,256 FTC Fintech Chain Ltd 0.02 -23% 266,811 $16,920,009 M4M Macro Metals Limited 0.004 -20% 31,000 $9,785,389 VKA Viking Mines Ltd 0.01 -17% 1,866,472 $12,303,101 TOU Tlou Energy Ltd 0.031 -16% 750,314 $30,736,481 LYK Lykosmetalslimited 0.059 -16% 163,037 $4,368,000 SAN Sagalio Energy Ltd 0.011 -15% 187,238 $2,660,582 BAT Battery Minerals Ltd 0.003 -14% 399 $10,273,348 CTN Catalina Resources 0.006 -14% 132,840 $8,669,408 GNM Great Northern 0.003 -14% 300,000 $5,981,678 ZNO Zoono Group Ltd 0.061 -14% 613,076 $11,940,999 EPX Ept Global Limited 0.025 -14% 286,958 $11,222,884 ODM Odin Metals Limited 0.019 -14% 126,167 $16,480,686 REM Remsense Technologies 0.07 -14% 429,242 $2,953,387 AZI Altamin Limited 0.064 -14% 41,501 $28,987,040 PNC Pioneer Credit Ltd 0.335 -13% 7,000 $43,098,476 BMR Ballymore Resources 0.135 -13% 344,475 $14,929,206 SRJ SRJ Technologies 0.068 -13% 100,000 $7,381,544 AVM Advance Metals Ltd 0.007 -13% 45,528 $4,656,353 IPD Impedimed Limited 0.11 -12% 13,031,841 $223,208,114

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.