ASX Small Caps Lunch Wrap: Who else has been taking a few shortcuts this week?

"The race to the nearest taxi stand, shortly after the start of the 2023 Mexico City Marathon". Pic via Getty Images.

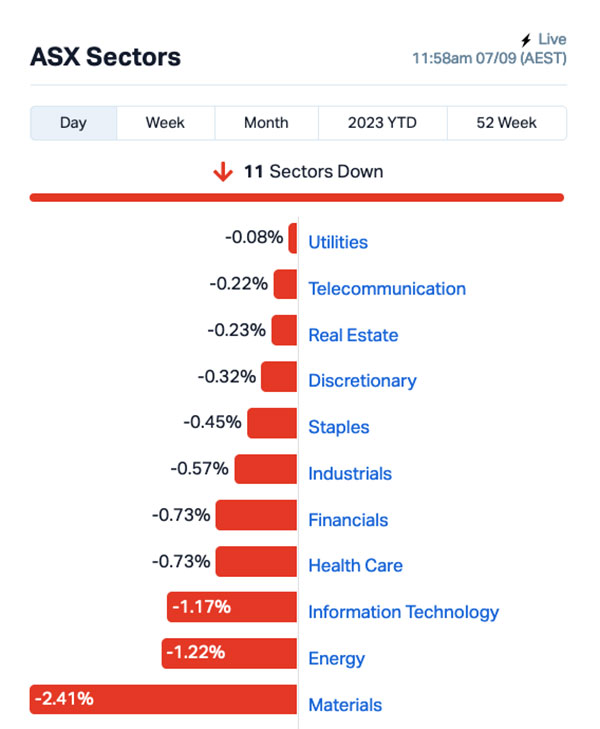

Local markets are down today, shedding about 1.0% throughout the morning on the heels of a less-than-stellar performance on Wall Street overnight.

Materials has been hardest hit, and at the time of writing, there’s not a single sector posting a gain.

I’ll explain it all shortly, but before I do, it’s time to about taking shortcuts.

It’s a very broad topic that could mean anything from, for example, rocking up to work 15-20 minutes late every morning because you have trouble sleeping at night, or knocking off work two months early because “everyone’s being mean to me, even though I’m the CEO of a major airline”.

Boo hoo.

For today, however, I’m talking about taking shortcuts in the world of sport – specifically marathon running, which as everyone knows, is for lunatics.

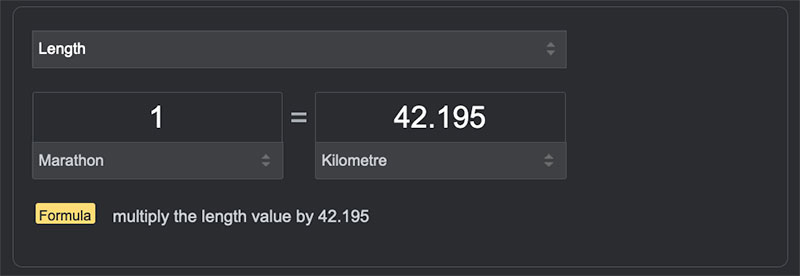

Marathons are, on just about every possible level, bonkers. Just the length of the race alone is ridiculous – 42.195km… a distance that I have been known to complain about having to drive to get somewhere, let alone run.

It seems like an oddly-specific distance, but it’s completely accurate. I know this because I had to look it up on Google to find it out.

Luckily for me, Google not only had the answer, but also provided this extremely handy formula, so that I would remember it the next time I have to write about a marathon race.

Reminds me of the time I uttered the words “Hey Google… show me something stupid” to that weird electronic home invasion device my kids bought me, and my entire life flashed before my eyes.

But I digress.

This year’s running of a 42.195km race through Mexico City took place on 27 August, and was remarkable for one incredible statistic: Of the roughly 30,000 crazy people who took part in the event, more than 36% of them have been disqualified for cheating.

Race officials have binned around 11,000 runners from the official results, after they missed at least one of the checkpoints placed at 5km intervals around the course.

Not only that, but thousands of runners are accused of using cars and/or public transport to whisk themselves along in a manner that the Mexico City Sports Institute said “demonstrated an unsportsmanlike attitude”.

It’s not the first time in the history of the Mexico City Marathon that huge numbers of runners have been DQ’d – in 2017, more than 6,000 were done for cheating, and the following year, despite an evident crackdown on making sure people weren’t simply hopping into a taxi, more than 3,000 were bounced from the results.

Two people who apparently didn’t cheat were the eventual winners: Kenyan Celestine Chepchirchir was the women’s champion in 2:27:17, and Bolivian runner Héctor Garibay Flores won the men’s marathon in a course-record 2:8:23, breaking the previous mark by more than two minutes.

TO MARKETS

Local markets are having a rough time today, with the benchmark landing at -1.0% at lunchtime and the sector board showing redder than the faces of thousands of Mexican marathon cheats.

Utilities is faring the best of the bunch, hovering around almost-break-even but still below the high water mark, while InfoTech, Energy and especially the Materials sector have taken an absolute bath.

It would be easy to blame the market’s soggy droop this morning on a pathetically weak lead-in from Wall Street (because it’s true… Wall Street was next to useless last night), but there’s one spectre hanging over the market today that will cause more than a couple of teary eyes in Aussie finance today.

At 1:05pm today, Dr Phillip “Keepin’ it on the down” Lowe fronted up before the press pack to deliver his final public address as head honcho of the Reserve Bank of Australia.

It’s the end of an era for the RBA – Lowe’s been there ever since he started as a clerical worker right around the time that Jesus was killing all the dinosaurs.

That clerical role clearly wasn’t particularly taxing, as it allowed Lowe to complete a commerce degree from the University of NSW, which he achieved with first-class Honours, and pocketed the university medal to boot.

Barely breaking stride, Lowe parlayed that into a PhD in Hiking Interest Rates from the Massachusetts Institute of Technology, joining a list of alumni that includes former US Fed Chair Ben Bernanke, former UN Secretary General Kofi Annan, and Second Dude on the Moon, Buzz Aldrin.

In 2004, Lowe made the leap to middle management, earning the title Assistant RBA Governor (financial systems), before moving to the Economic desk five years later.

In 2012, Lowe was deputised and, as all good Number 2s do, he bided his time before striking while the iron was hot, seizing control of the RBA in 2016 and holding the Chairmanship in his vice-like grip for seven long years.

He will mostly be remembered for his exceptionally conservative taste in ties, his unique sense of humour and “pranking” the entire Aussie home-owning population regarding when’s a good time to get a $1 million loan, and the fact that his post-RBA career plans are something of a mystery.

However, I have it on good authority that he will, at the end of his final public appearance, be completely absorbed by a malevolent red ball of pure fiscal stimulus, and will ascend to the heavens to become Earth’s second sun, and fulfil his dream of turning our world into “that one from the beginning of Star Wars”.

Just like that.

Also up the fancy end of town, there are a couple of Large Caps doing pretty well today, including Liontown Resources (ASX:LTR) which has popped 8% this morning on news that Albermarle has delivered its “best and final” offer at $3.00 a share.

It’s subject to a bunch of conditions (none of them out of the ordinary) so it looks like Albermarle’s takeover is pretty much a done deal.

Also climbing this morning is Chalice Mining (ASX:CHN), which is up 5% this morning because – and I’m just calling it like I see it, here – it couldn’t possibly have gotten much worse after the 42.5% rogering Chalice has taken since last Tuesday.

NOT THE ASX

As you may have noticed, Wall Street didn’t do so well last night, after “stronger than expected data” made everyone in America nervous again.

For the sake of being thorough, the data was US services data – but, let’s be honest… US investors are going mental every time they hear someone even whisper the word “spreadsheet” at the moment, so it could have been just about anything.

“Growth stocks have been pricing in the idea that inflation has been well anchored and that the Fed’s going to cut. If that idea no longer holds they’re going to be vulnerable,” Patrick Kaser, portfolio manager at Brandywine Global, explained to Reuters.

The end result was that the S&P 500 was down by -0.7%, blue chips Dow Jones by -0.57% and tech heavy Nasdaq by -1.06%.

Earlybird Eddy reports that most megacaps declined with Apple down by -3.6%, while Nvidia, Tesla and Amazon fell by around -1% each.

Lockheed Martin tumbled -5% after the company trimmed its F-35 jet delivery outlook. Mining giant Albemarle also slid -5% on concerns about lithium demand from top consumer China.

In Japan, the Nikkei is subdued and down 0.12% on news that the recent shutdown of the nation’s Toyota factories wasn’t the result of a sneaky, hostile takeover by Chinese automaker DongFeng, but was actually caused by an “insufficient disk space” error on the company’s IT system.

That resulted in, as everyone who’s ever tried to run Adobe Photoshop on a Mac that’s more than a week old will know, a prolonged bout of the Dreaded Spinning Beachball, which in turn meant that the company’s workers forgot how to bolt stuff together.

Markets are lower in China as well, with Shanghai falling 0.30% while Hong Kong’s Hang Seng is down 0.76%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 07 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap LPM Lithium Plus 0.395 41% 7,326,074 $18,476,696 CXU Cauldron Energy Ltd 0.009 29% 13,164,076 $6,660,981 KLI Killi Resources 0.057 24% 1,522,954 $2,740,453 ELS Elsight Ltd 0.38 23% 910,829 $46,599,070 MRI My Rewards International 0.011 22% 148,880 $3,839,704 NSM Northstaw 0.055 22% 16,000 $5,405,715 JCS Jcurve Solutions 0.04 21% 200,287 $10,835,333 ODE Odessa Minerals Ltd 0.009 20% 27,052,795 $7,103,339 TMG Trigg Minerals Ltd 0.018 20% 30,000 $3,020,769 NAE New Age Exploration 0.006 20% 1,568,447 $7,179,495 RML Resolution Minerals 0.006 20% 82,500 $6,286,459 MEL Metgasco Ltd 0.013 18% 193,435 $11,702,754 LRL Labyrinth Resources 0.007 17% 325,502 $7,125,262 OAR OAR Resources Ltd 0.007 17% 1,440,459 $15,678,814 DAL Dalaroo Metals 0.05 16% 250,274 $2,230,625 BCT Bluechiip Limited 0.03 15% 1,033,863 $18,555,432 EMP Emperor Energy Ltd 0.015 15% 19,070 $3,495,212 CCA Change Financial Ltd 0.062 15% 180,000 $33,893,715 AL8 Alderan Resource Ltd 0.008 14% 250,000 $4,316,863 BUY Bounty Oil & Gas NL 0.008 14% 8,110,344 $9,593,507 GMN Gold Mountain Ltd 0.008 14% 265,255 $15,883,550 NRX Noronex Limited 0.016 14% 478,125 $5,296,225 SPX Spenda Limited 0.008 14% 11,808,049 $25,699,955 TOY Toys R Us 0.008 14% 241,913 $6,460,426 C7A Clara Resources 0.025 14% 82,250 $4,158,859

In local Small Caps news, Lithium Plus Minerals (ASX:LPM) is out in front of the pack at lunchtime, climbing ~43% on news that the first completed diamond hole (BYLDD019) at the Lei Prospect has intersected 127m of strongly mineralised pegmatite from 609m (with a true width of ~60m), with assays pending.

LPM says the find represents “one of the largest mineralised intersections ever recorded from the Bynoe pegmatite field”, putting the Lei pegmatite in company with Core Lithium’s (ASX: CXO) previously reported world-class 119m intercept at the BP33 deposit.

Killi Resources (ASX:KLI) has delivered a pre-lunch jump of 26%, on news of high-grade copper up to 7.2% Cu and gold 12.4g/t Au at surface from rock chip samples from the Baloo prospect within the company’s 100% owned Mt Rawdon West project, Queensland.

Killi says 12 of the 26 rock chip samples collected have returned assays greater than 1% Cu, including 7.2% Cu and 27.2g/t Ag, 4.2% Cu, 1.16g/t Au, 75.8g/t Ag, 1 % Pb and 0.3 % Zn, and 4.5% Cu, 0.09g/t Au and 83.7g/t Ag.

Elsight (ASX:ELS) has jumped 22.5% so far today after the US Federal Aviation Administration (FAA) has granted the Halo enabled Airobotics Optimus-1EX system a Type Certificate, that will allow flight operations over people and infrastructure without the need for case-by-case waivers.

Elsight and its project partner Airobotics have been working on getting the Optimus-1EX drone certified for four years, the company says, leaving Elsight CEO Yoav Amitai delighted at the result.

“We warmly congratulate Airobotics for this achievement,” Amitai said. “This is a major step forward for the drone industry in general. Completing the long-complicated process to achieve the first non-air carrier drone Type Certification by the FAA shows that the regulators are coming to the position that drones are a part of the future.”

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 07 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap T92 Terra Uranium 0.1 -33% 1,050,875 $7,740,774 M4M Macro Metals Limited 0.003 -25% 700,000 $7,948,311 DTM Dart Mining NL 0.024 -21% 372,000 $5,254,760 RNX Renegade Exploration 0.009 -18% 200,000 $10,484,362 NOU Noumi Limited 0.15 -17% 86,930 $49,879,677 HLX Helix Resources 0.005 -17% 500,136 $13,938,875 LNU Linius Tech Limited 0.0025 -17% 8,655 $12,689,372 TIG Tigers Realm Coal 0.005 -17% 300,000 $78,400,214 THR Thor Energy PLC 0.032 -16% 328,148 $5,545,291 AHI Advanced Health 0.21 -14% 280,901 $53,337,472 1MC Morella Corporation 0.006 -14% 797,529 $42,970,590 CNJ Conico Ltd 0.006 -14% 228,571 $10,990,665 IEC Intra Energy Corp 0.006 -14% 1,924,182 $11,345,471 CMO Cosmo Metals 0.061 -13% 115,000 $2,428,767 NMR Native Mineral Res 0.041 -13% 1,137,370 $8,224,778 ATH Alterity Therap Ltd 0.007 -13% 15,123 $19,519,181 VAL Valor Resources Ltd 0.0035 -13% 1,656,579 $15,313,339 CDX Cardiex Limited 0.14 -13% 269,450 $22,989,364 ZNO Zoono Group Ltd 0.038 -12% 346,276 $8,166,890 E33 East 33 Limited 0.023 -12% 166,799 $13,496,306 GGE Grand Gulf Energy 0.008 -11% 65,100 $16,801,075 PIL Peppermint Inv Ltd 0.008 -11% 4,844,902 $18,340,712 RNE Renu Energy Ltd 0.032 -11% 9,265 $15,858,076 GAL Galileo Mining Ltd 0.315 -10% 583,843 $69,168,724 MCM Mc Mining Ltd 0.135 -10% 539 $59,949,780

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.