ASX Small Caps Lunch Wrap: Who else has a case of the ‘true marathon experiences’ today?

Getty Images

Got a touch of Mondayitis? We hear you. The ASX 200 doesn’t, though. It’s whistled its way up a very solid 0.22% today after opening in strong form. More on that in a sec…

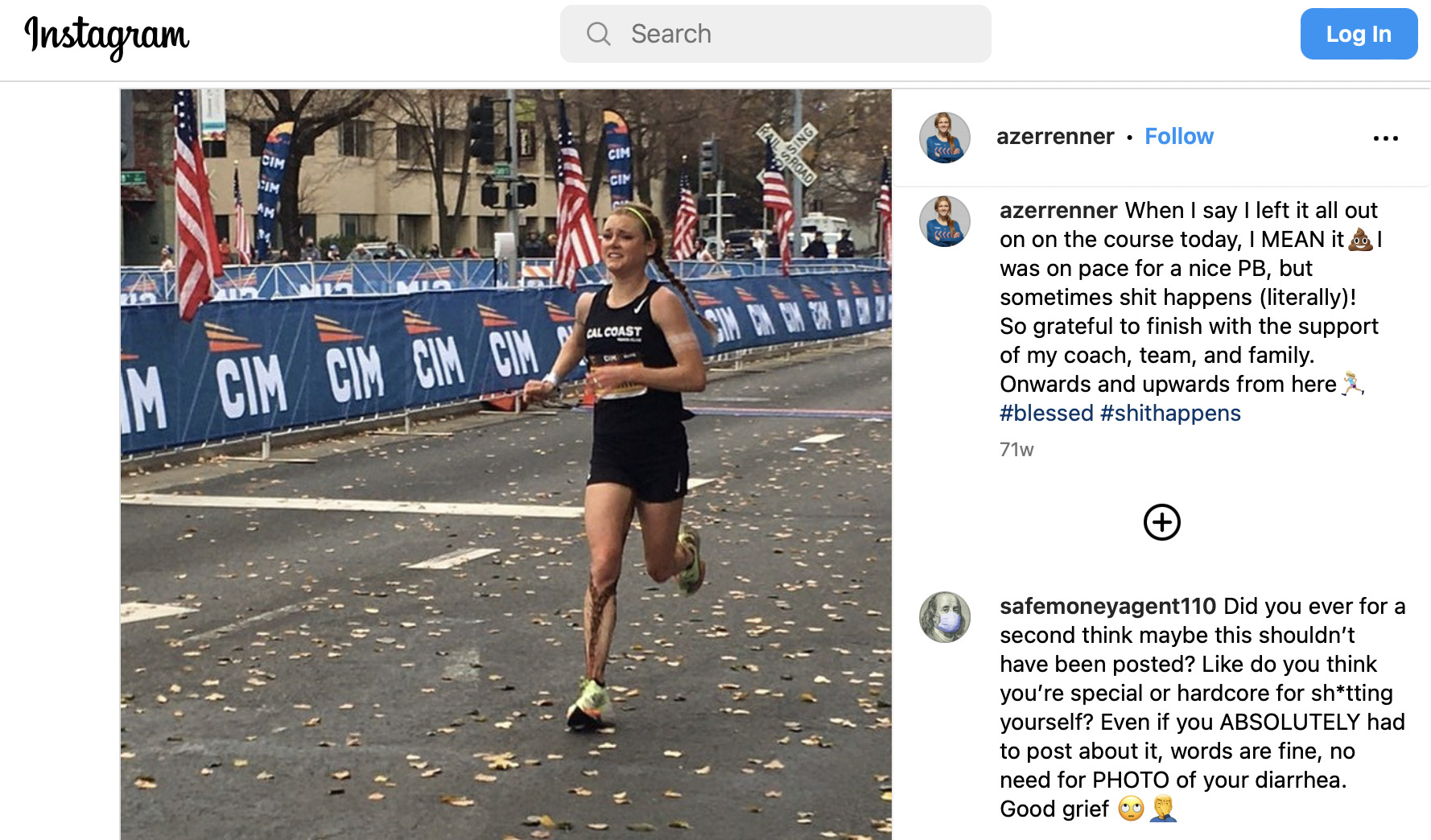

What’s not been so solid is the bowel movements of one extremely candid (some might say ridiculously over-sharing) American long-distance runner by the name of Addi Zerrenner.

Insider.com gains all the credit for getting their hands dirty on this one, but here’s the general gist…

Zerrenner, a 27-year-old elite marathon runner and Santa Barbara-based personal trainer, has revealed how she once shart her kecks three times during the California International Marathon after eating a crapload of mushroom pasta the night before.

Why reveal this at all and, indeed plaster a graphic picture of her crop-sprayed leg all over social media (see below, and apologies if you’re eating at the time of reading)?

It’s a matter of professional pride, seemingly.

“I’m finally having the true marathon experience,” she explained at the time. “This was probably my proudest finish ever.”

For further context, Zerrenner (which in German, by the way, literally means “The Runner”), has had issues with eating disorders in the past and told Insider that she’d worked hard to not care what people think about her appearance.

“I’m finally at a point in my life where the only thing I care about what people think of me is the internal,” she said.

Fair enough, although that’s probably enough of externalised internals for one day. Let’s see if the ASX has managed to avoid the runs while we’ve been bogged down writing this opening gambit…

TO MARKETS

The Aussie benchmark shelved the Metamucil it thought it might need a moment or two ago and is looking in decent shape presently, now up about 0.25% since its Friday close. Thankfully, the signs are decent for a “clean exit”.

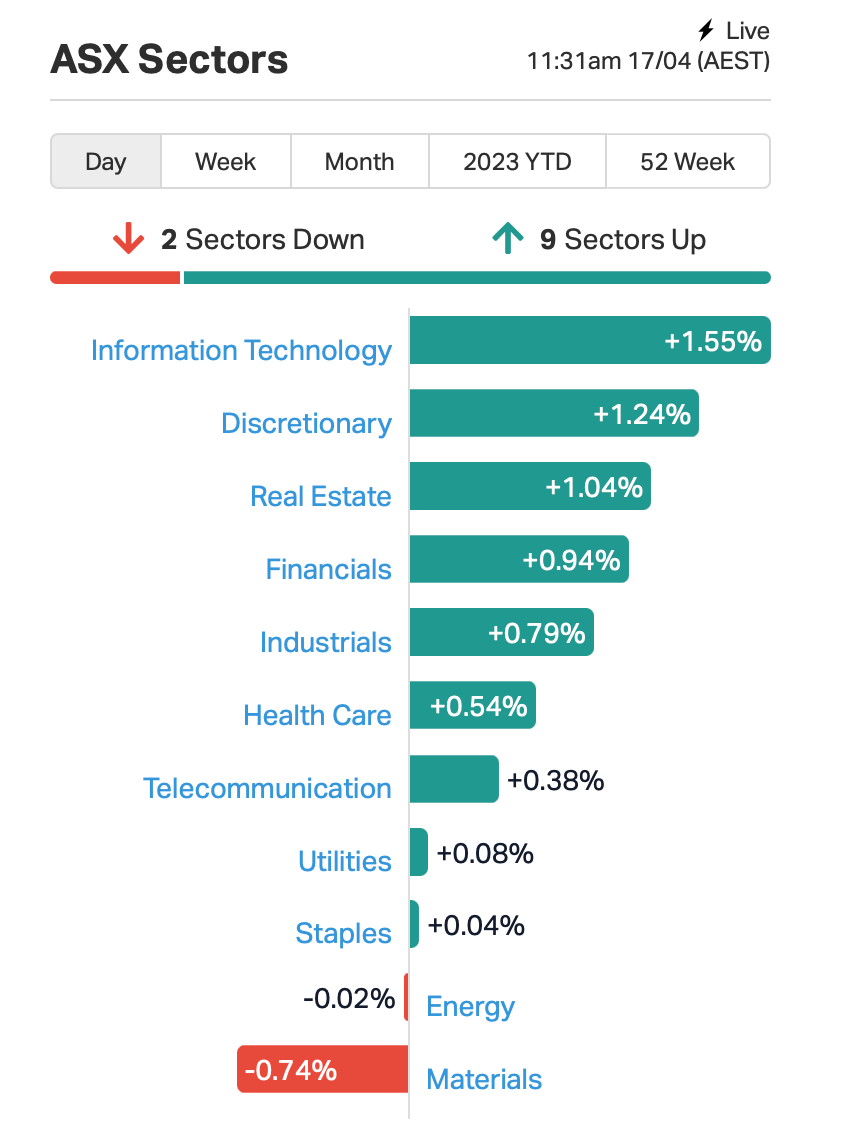

Digging into specifics a little, here’s the sector-based snapshot, per Market Index data:

Spoon-feeding you the highlights there, while increasing the word count of this article, we have InfoTech, Discretionary and Real Estate leading the way, with Materials the only downer of the day so far.

Meanwhile, we’re noticing one particular unicorn having a nice time of things, prancing about in a rainbow-soaked North American mine, with not a single hint of crap running down its hind legs.

Sayona Mining (ASX:SYA), currently up 6.4%, has some news. And that’s this – there’s been an announcement of a major resource expansion for the company’s Quebec-located Moblan lithium project – with Measured, Indicated and Inferred Resource of 51.4 million tonnes at 1.31% Li2O. It represents one of North America’s single largest lithium resources with flexibility for higher tonnage production to boot.

NOT THE ASX

As usual, let’s tap into the journalistic rounding-up prowess of macro markets guru Eddy “Early Doors” Sunarto, who correctly prophesied in his Market Highlights this morn that the ASX would indeed rise higher today.

And that was despite a flaccid end to markets over in the US the last time Wall Street traders finished high-fiving themselves for the day in an unconvincing manner.

As Eddy points out, US fat-cat banks (less so the skinny ones) have a few bragging rights at present, with JPMorgan Chase, Citigroup and Wells Fargo all beating earnings expectations in Q1.

At the same time, they’re giving off Negative Nellie vibes with JPMorgan still beating the recession drum and the others banging on about a commercial real estate pitfall.

Meanwhile, for some reason perhaps only she knows about, the US Treasury Secretary thinks the US economy is “strong” right now.

They HAVE to say that even if it's not true.

It's called keeping confidence up.

It's PR. You will never get a Treasury Secretary or Fed Chair to come straight out and say a severe recession is coming or even needed to get rid of inflation in this case.— Sven Henrich (@NorthmanTrader) April 14, 2023

Anyhoo, what about Bitcoin and crypto, you probably didn’t ask? Well, we’ll tell you anyway. Bull goose cryptocurrency Bitcoin (BTC) has dipped a fraction since we published our morning Mooners and Shakers roundup.

It’s still there or thereabouts near US$30k, however, while Ethereum has been looking pretty solid ever since its successful network upgrades last week. Plenty of Crypto Twittering analysts of varying degrees of professionalism, meanwhile, are spying potential for a run on the altcoins. (Altcoins? Basically, that’s every crypto that isn’t Bitcoin.)

$BTC.D is showing an HS reversal. This will likely cause a large alt pump in the coming days/weeks.$TOTAL & $BTC showing a breakout and likely a retest which will allow the HS to form on $BTC.D

This is bullish behavior in an uptrend. Nothing bear yet.#cryptocurrency #Bitcoin pic.twitter.com/FPC4i8szY9

— Roman (@Roman_Trading) April 17, 2023

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for April 17 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap POL Polymetals Resources 0.31 72% 1,476,123 $8,132,885 SFG Seafarms Group Ltd 0.007 40% 6,061,894 $24,182,996 ARE Argonaut Resources 0.002 33% 40,404,556 $9,542,807 BMG BMG Resources Ltd 0.016 33% 7,637,225 $4,631,900 TMB Tambourahmetals 0.12 29% 175,624 $3,830,912 LM1 Leeuwin Metals Ltd 0.39 28% 1,203,362 $12,288,448 ALA Arovella Therapeutic 0.097 23% 28,653,426 $59,688,258 FYI FYI Resources Ltd 0.1 20% 1,155,816 $30,404,360 A11 Atlantic Lithium 0.65 20% 967,977 $328,990,496 ELE Elmore Ltd 0.018 20% 1,308,306 $20,990,757 IEC Intra Energy Corp 0.006 20% 550,000 $3,528,908 SI6 SI6 Metals Limited 0.006 20% 1,576,222 $7,476,973 AR3 Austrare 0.735 19% 2,970,266 $59,024,962 GES Genesis Resources 0.007 17% 200,000 $4,697,048 LAU Lindsay Australia 1.225 17% 1,735,539 $318,575,130 SGI Stealth Global 0.115 15% 23,835 $9,970,000 AMT Allegra Orthopaedics 0.07 15% 75,000 $6,372,011 EG1 Evergreen Lithium 0.655 14% 2,407,590 $32,332,250 EML EML Payments Ltd 0.655 14% 4,660,406 $215,040,874 ID8 Identitii Limited 0.033 14% 30,541 $6,159,708 SRR Saramaresourcesltd 0.125 14% 149,424 $5,614,873 WKT Walkabout Resources 0.125 14% 188,765 $69,420,972 BEZ Besra Gold 0.225 13% 5,192,744 $70,772,378 BAT Battery Minerals Ltd 0.0045 13% 186,980 $11,740,969 THR Thor Energy PLC 0.0045 13% 410,526 $5,904,451

Some standouts…

• Polymetals Resources (ASX:POL); +72%: Polymetals has released its first batch of assay results for six drill holes out of its Phase 1 drilling of 21 holes at its newly gained Ag-Zn-Pb mine in NSW. And they’re talking up “high-grade mineralisation up to 13.9g/t gold, 2,020 g/t silver, 12% zinc and 17% lead”.

• Argonaut Resources (ASX:ARE); +33%: There are pegmatite intercepts happening. Some thick ones, from surface at Higginsville, WA. The drilling program there is targeting lithium, caesium, tantalum (LCT) pegmatites. The firm’s official announcement has more, here.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for April 17 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap BTC BTC Health Ltd 0.016 -36% 386,000 $7,046,159 PHL Propell Holdings Ltd 0.027 -33% 150,000 $4,814,221 TIG Tigers Realm Coal 0.009 -28% 7,694,880 $163,333,780 AMA AMA Group Limited 0.18 -27% 7,739,752 $262,902,203 ADR Adherium Ltd 0.003 -25% 151,316 $19,985,753 CLE Cyclone Metals 0.0015 -25% 415,920 $13,483,474 HCD Hydrocarbon Dynamic 0.013 -24% 754,743 $9,980,029 PVS Pivotal Systems 0.009 -22% 5,324,210 $1,850,483 CT1 Constellation Tech 0.004 -20% 47,740 $7,356,002 ROG Red Sky Energy 0.004 -20% 3,645,667 $26,511,136 PLG Pearlgullironlimited 0.033 -18% 66,559 $6,256,650 ADD Adavale Resource Ltd 0.015 -17% 1,008,200 $9,351,470 CTO Citigold Corp Ltd 0.005 -17% 516,481 $17,241,955 HPR High Peak Royalties 0.046 -16% 1,136 $11,492,602 KLI Killiresources 0.057 -15% 118,453 $2,249,525 TKL Traka Resources 0.006 -14% 5,560 $5,726,091 TYM Tymlez Group 0.006 -14% 2,607,300 $7,645,367 B4P Beforepay Group 0.43 -14% 7,870 $17,423,409 LDX Lumos Diagnostics 0.02 -13% 3,500,000 $6,288,662 5GG Pentanet 0.087 -13% 672,688 $29,581,071 CZN Corazon Ltd 0.014 -13% 175,000 $9,765,289 MRD Mount Ridley Mines 0.0035 -13% 973,829 $31,139,531 TAS Tasman Resources Ltd 0.007 -13% 220,000 $5,701,354 LME Limeade Inc 0.18 -12% 77,319 $52,622,116

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.