ASX Small Caps Lunch Wrap: Who else fell short of their goals this weekend?

doink. Pic via Getty Images.

Local markets have ticked down this morning, after another mediocre performance on Wall Street on Friday set the ASX 200 Futures index pointing down by 0.3% before the markets opened today.

At present, that’s pretty much where we’re at, with the Small Ordinaries index outperforming the rest of the market – but I’ll get into the details of that shortly.

Because at the top of this morning’s Big List of Things to Talk About is, of course, football – a topic on the minds of many Australians after this weekend’s final games of the 2023 Women’s World Cup.

But I have neither the time nor the inclination to rehash the words of the trillions of suddenly-all-knowing armchair experts who would like to know why coach Tony Gustavsson bothered putting so much effort into building a squad with obvious depth, but sent the same clearly exhausted 11 onto the field on Saturday.

Because that sort of talk is not only pointlessly devisive, but it also goes against the nature of football itself, as it’s deservedly world-famous for bringing the global community together in a celebration of sportspersonship and camaraderie.

Take, for instance, the now-legendary clash between El Salvador and Honduras in 1969, where a qualifier for the following year’s World Cup brought the two countries together to the point that there was an actual four-day military confrontation.

And more recently, there’s this past weekend’s example from Edmonton, Canada when the ‘Canada World Peace Soccer Tournament’ had to be postponed because of 400-person brawl.

The event, put together by local man “Captain Abdull”, is an annual tournament featuring teams representing Mexico, Namibia, Somalia, Congo, Brazil, El Salvador, Gambia, and Burundi – using football to “promote community, appreciation, love, and peace”.

However, this year’s event failed to live up to its name, or its stated intent, leaving one person hospitalised and one of the match venues awash with officers from Edmonton’s city police tactical unit.

Apparently, the conflict kicked off between two sets of supporters of the same team, when pro-government supporters of Eritrea clashed with anti-government supporters, in a fight that at one stage had spectators attacking each other with sticks.

The rest of the tournament was postponed until this coming weekend, which will likely attract a large precautionary police presence, especially at the upcoming match between the Canada World Peace Team and the city’s own police team on Sunday.

TO MARKETS

Local markets dipped this morning, delivering a lacklustre -0.23% by lunchtime in the wake of another round of the ongoing and super-boring combo of ‘Wall Street weakness’ and ‘China’s slow implosion’.

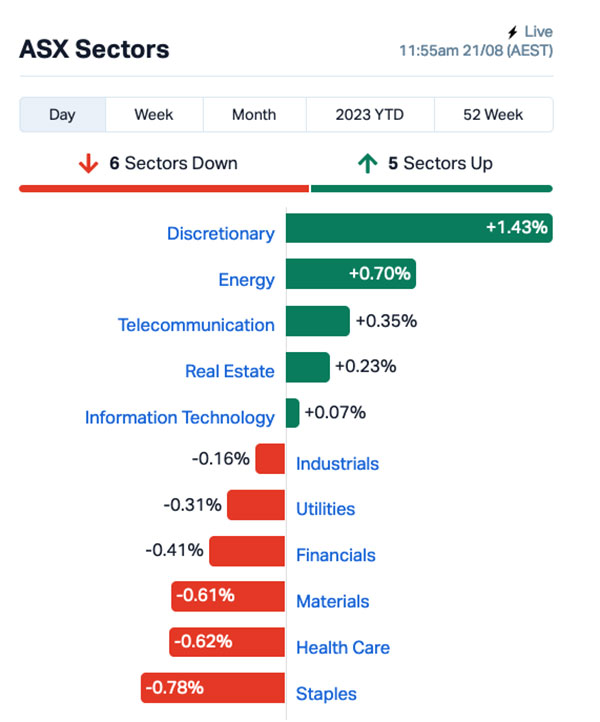

The end result locally was a mixed performance across the sectors, with Consumer Discretionary doing reasonably well out in front, and Consumer Staples lagging way down the bottom of the ladder.

There’s a push on from the XTX All Ords Tech index this morning, which – along with the XSO Small Ords index – is significantly outperforming the market this morning, up 0.36% so far.

That’s largely attributable to the likes of Audinate (ASX:AD8) piling on 16.5% this morning after revealing the company has increased revenue 40% on FY22 to US$46.7 million ($69.7 million), delivering gross profit of US$33.4 million, up 34.4% on a gross margin of 72.1%.

And consumer electronics mob Breville (ASX:BRG) has soared 14.9% this morning, on news that the company has managed to solve the global energy crisis once and for all, by achieving sustainable nuclear fusion in the centre of a disastrously hot cheese and tomato toastie.

NOT THE ASX

A flat session on Wall Street on Friday left US indices in a fairly unremarkable position, with the Dow and the S&P 500 both down less than 0.1%, while the tech-heavy Nasdaq dipped 0.2%.

US investors are “largely keeping to the sidelines”, Earlybird Eddy explained this morning, ahead of famous market-tanker Jerome Powell’s speech at the annual Jackson Hole bankers dronefest later this week.

In US stock news, a number of mega-cap tech stocks slumped for a third straight week, however Nvidia rose 0.5% post-market Friday after raising its current quarter revenue guidance by 50%.

In Japan, the Nikkei is up 0.4% this morning, despite the country battling a gruesome heatwave that has seen temperatures soaring well into the 30s for several weeks, leaving hundreds of citizens hospitalised and many more seeking new and novel ways to beat the heat.

That includes, of course, the extremely Japanese pursuit of heat-beating tech, including fan-forced cooling jackets and this amazing piece of in-car cooling tech for a very specific part of the body.

It’s being marketed on shopping site AliExpress as the “Universal Extension Hose for Air Conditioner” – and it’s pretty much just a hose that is designed to run directly from an air-con vent directly into the nether-regions to help cool the whole of your body.

Probably the best part of this is that it is an earnest application (ie, a shameless rip-off) of a joke invention which grabbed a fair bit of attention last year, thanks to this guy:

Just the ticket for having ice-cold nards while dying of heat stroke, it could be yours for the low, low price of 1,900 yen.

Meanwhile in China, the PBOC has cut its one-year loan prime rate for the second time in three months, as it battles to get the economy un-stalled. The one-year loan prime rate was cut by 10 basis points from 3.55% to 3.45%, but the five-year loan prime rate remained unchanged at 4.2%.

Shanghai markets have reacted by doing pretty much nothing at all, while Hong Kong’s Hang Seng has dipped 0.5% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 02 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap NMR Native Mineral Res 0.05 100% 1,346,797 $3,674,122 CCE Carnegie Cln Energy 0.0015 50% 4,290,083 $15,642,574 WGR Western Gold Resources 0.057 43% 1,656,917 $3,709,916 CHK Cohiba Min Ltd 0.004 33% 574,997 $6,639,733 MTH Mithril Resources 0.002 33% 51,962 $5,053,207 SCL Schrole Group Ltd 0.25 25% 200 $7,133,517 MRD Mount Ridley Mines 0.0025 25% 5,303,279 $15,569,766 ROO Roots Sustainable 0.005 25% 162,062 $554,889 1ST 1St Group Ltd 0.011 22% 18,191,202 $12,752,921 PIL Peppermint Inv Ltd 0.011 22% 2,206,758 $18,340,712 AGR Aguia Res Ltd 0.023 21% 430,000 $8,243,231 MBK Metal Bank Ltd 0.04 18% 35,000 $9,400,508 FTL Firetail Resources 0.175 17% 755,782 $14,437,500 LSA Lachlan Star Ltd 0.0105 17% 854,999 $11,871,114 SIO Simonds Grp Ltd 0.175 17% 201,393 $53,985,968 ECT Env Clean Tech Ltd 0.007 17% 326,381 $14,859,663 MTB Mount Burgess Mining 0.0035 17% 501,429 $3,046,940 OAR OAR Resources Ltd 0.007 17% 5,812,021 $15,678,814 SKN Skin Elements Ltd 0.007 17% 200,000 $3,416,917 AD8 Audinate Group Ltd 11.97 16% 677,319 $797,754,766 NAG Nagambie Resources 0.037 16% 5,000 $18,615,242 CMG Critical Mineral Group 0.265 15% 15,908 $7,023,182 ASR Asra Minerals Ltd 0.008 14% 66,870 $10,082,710 BRG Breville Group Ltd 26.37 14% 1,146,465 $3,305,388,600 DTC Damstra Holdings 0.13 13% 313,733 $29,644,432

There’s a pretty clear winner this morning among the Small Caps, thanks to Native Mineral Resources (ASX:NMR) jamming a 124% gain on the company receiving commitments under a placement to sophisticated and institutional investors to raise $640,913 by the issue of 21,363,767 fully paid ordinary share at $0.03 a pop.

That news comes on the heels of the company’s announcement last week that it has acquired 51% of the highly prospective McLaughlin Lake lithium project in the Oxford Lake region of Manitoba, Canada.

Meanwhile, Western Gold Resources (ASX:WGR) has spiked 37.5% this morning on news that it’s set to acquire Euro Future Metals, which holds exploration permit applications over three high grade prospects – the Holmtjarn REE, Loberget Graphite and Rullbo Graphite Projects – in Sweden.

“The Holmtjarn, Loberget and Rullbo Projects strongly complement our critical minerals portfolio, and we look forward to working with our in-country technical experts as well as new stakeholders,” WGR managing director Warren Thorne said.

“We believe Sweden’s REE and Graphite potential is still to be unlocked, and that these Projects can assist making Europe self-sufficient in battery minerals.”

And in third place is 1ST Group (ASX:1ST), up 22.2% on news that the company has bagged an initial purchase order from WA Primary Health Alliance (WAPHA) for $1.1m, for the imminent implementation of Visionflex’s clinical telehealth technology across an initial 75 Commonwealth-funded Residential Aged Care Facilities (RACF) in Western Australia.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 02 August [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CLE Cyclone Metals 0.001 -50% 797,865 20,529,010 MCT Metalicity Limited 0.001 -50% 44,867 7,472,172 MXC MGC Pharmaceuticals 0.002 -33% 3,662,822 11,677,079 VPR Volt Power Group 0.001 -33% 10 16,074,312 IRE IRESS Limited 7.02 -30% 5,264,711 1,866,026,845 MEB Medibio Limited 0.0015 -25% 3,013,100 12,201,488 SIH Sihayo Gold Limited 0.0015 -25% 1,000,000 24,408,512 IBG Ironbark Zinc Ltd 0.008 -20% 894,963 14,667,843 ALV Alvomin 0.2 -18% 1,023,911 18,210,832 HLX Helix Resources 0.005 -17% 3,656,812 13,938,875 M4M Macro Metals Limited 0.0025 -17% 224,534 5,961,233 FLN Freelancer Ltd 0.21 -16% 306,790 112,728,721 AMM Armada Metals 0.022 -15% 18,000 1,782,770 NIM Nimy Resources 0.125 -15% 1,951 10,467,729 CNJ Conico Ltd 0.006 -14% 630,449 10,990,665 DOU Douugh Limited 0.006 -14% 25,812 7,398,827 RDS Redstone Resources 0.006 -14% 563,153 6,099,649 TIG Tigers Realm Coal 0.006 -14% 700,171 91,466,917 VAL Valor Resources Ltd 0.003 -14% 9,356 13,399,172 EGY Energy Tech Ltd 0.043 -14% 22,967 16,882,992 BAT Battery Minerals Ltd 0.084 -13% 591,097 11,601,636 SPT Splitit 0.047 -13% 1,926,342 29,877,338 1MC Morella Corporation 0.007 -13% 74,315 48,788,644 DC2 Dctwo 0.028 -13% 25,000 4,182,915 PKO Peako Limited 0.007 -13% 312,120 3,765,852

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.