ASX Small Caps Lunch Wrap: Who didn’t think this new format through properly this week?

Pic via Getty Images

Local markets are up this morning, bouncing back from a dour Monday to put a positive spin on what is normally the weirdest day of the week: Tuesday.

In case you missed the memo yesterday, we’re streamlining things here so the usual “oh wow, isn’t that amusing” news story you might have been expecting isn’t here – which, incidentally, has left me without a hook to hang my headlines on. I’ll think of something, though.

I look forward to your angry emails about the missing news stories – but before you dislocate a knuckle or two bashing out a missive to illustrate your displeasure that there’s no crazy monkey story for lunchtime, do read on… because here’s what’s happening on the markets.

TO MARKETS

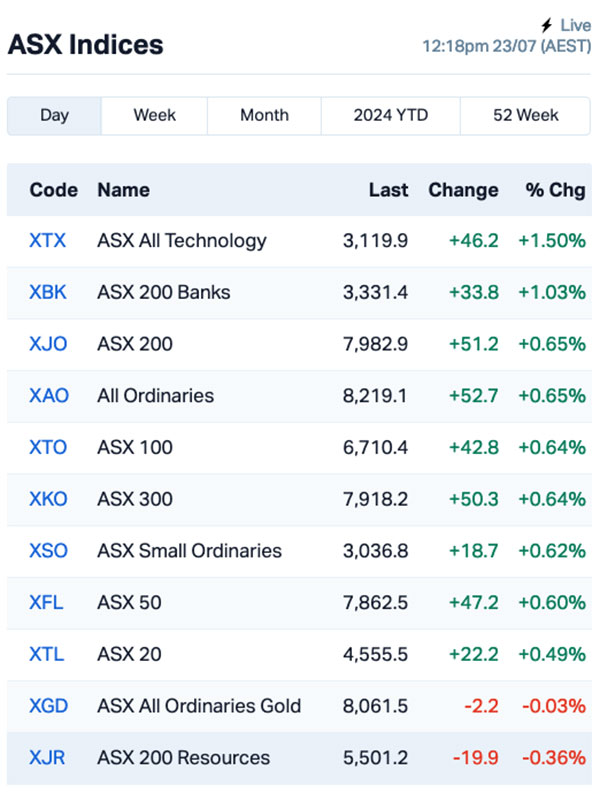

The ASX took off with a 0.4% gain straight out of the gate this morning, mostly because Wall Street did a much better job of not losing ground overnight.

That turnaround for New York added some much needed buoyancy to the ASX before lunch, but for local investors there was still a sizeable chunk of Energy sector ballast to deal with – but I’ll get to that in a minute.

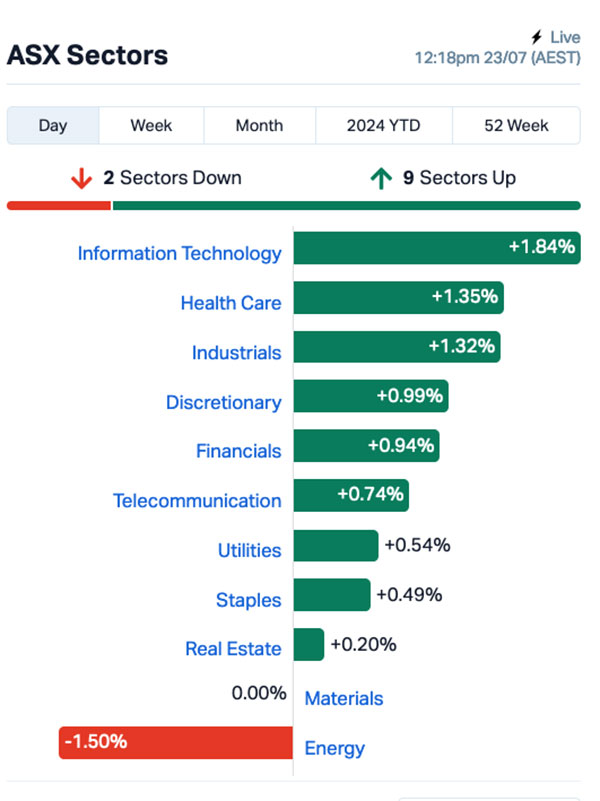

Here’s what the sectors looked like at lunchtime in the eastern states today:

The lead this morning was taken by local tech stocks, which are currently pretty much at the mercy of whatever’s happening in the US, where last week’s late sell-off drove the local techies down yesterday, and last night’s rally re-lit the local spark.

Up in the fancy seats in tech, some of the big names were charting rather well, including Nuix, which popped better than 6.0%. Wisetech, meanwhile, was up more than 2.0% and Iress gained 2.7%.

Health Care was also performing well, with a bunch of the heavy hitters up over 1.0%. Telix was the standout, putting on 2.0% prior to sandwich time.

The Energy sector continued to be a concern, though, with the losses there led by a 3.0% sell off for Woodside, after the company’s quarterly report included news of a 4% increase in the cost of its Scarborough Energy Project, which Woodside now says is going to cost $12.5 billion, with the first LNG cargo not due until 2026.

And the banks were doing well, taking out second prize in the ASX indices beauty contest, which – if my Monopoly memory hasn’t failed me – entitles them to collect $10.

The headline news of the day is arguably the laying of charges against four individuals who ASIC has accused of running a highly illegal “pump and dump” scheme, which – for those who don’t know – involves buying a bunch of cheap stock, pumping up the price and then selling it off at a hefty profit.

ASIC has recently come under fire for not really having the teeth to investigate alleged nefarious activity, but there was some insight from the watchdog’s media release today that explained how the sleuthing behind today’s charges played out.

“ASIC alleges that in an organised operation the defendants formed a private group on the Telegram app where they discussed and selected penny stocks to announce to the public Telegram group named the ‘ASX Pump and Dump Group.’”.

Oh.

Moving on… it looks like the writing is on the wall for Mighty Craft (ASX:MCL), after yesterday’s string of announcements that culminated in trading the company being suspended, and administrators called in.

Mighty Craft had been exploring merger options in the lead up to yesterday’s suspension, but it seems that’s all fallen through. Its share price had fallen to $0.005 a pop, despite the recent sale of some assets, including the sale of The Hills Distillery (aka 78 Degrees) for $5.2 million at the start of June.

NOT THE ASX

There was a rally on Wall Street overnight, which saw the S&P 500 climb by 1.08%. The blue chips Dow Jones index rose a more modest 0.32%, and the tech-heavy Nasdaq led the way on a 1.58% gain.

Tech stocks, which had been having a hard time in New York last week, were back in a big way, as Eddy Sunarto reported this morning.

“Nvidia spearheaded the tech comeback after suffering significant losses last week, up by 4.76% last night.

“Chip maker ASML also climbed by 2.5%, while semiconductor manufacturer TSMC saw a rise of over 2%.

“Tesla gained 5.15%, and Alphabet rose 2.26% with both companies set to report their quarterly results later today.”

Thank you Eddy.

As with the local market, Wall Street is gearing up for quarterlies, and the current best guess is that it’s going to be four of the “magnificent seven” companies – Nvidia, Amazon, Meta, and Alphabet – which are expected to be among the top 5 contributors to this season’s earnings.

It’s a safe bet that Crowdstrike is unlikely to be greeted with much enthusiasm this week, though, after Friday’s disastrous outage that took an enormous number of big names offline for hours.

Crowdstrike’s price took an 11% hit on Friday, and another 13% gutpunch last night as traders assessed the prospects of multiple lawsuits.

In Asian market news this morning, things are mixed but not outrageous. Japan’s Nikkei is up slightly, adding 0.3% – however, the Hang Seng is down 0.17 and Shanghai’s down evn further, off by 0.5% in early trade.

And if you’re wondering why there’s no action on the Egyptian stock exchange today, it’s because they’re having a day off to celebrate Revolution Day – although whether that’s to remember one they’ve already had, or to plan for the next one, remains unclear.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 23 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap DEL Delorean Corporation 0.09 91.5 12,546,059 $10,138,883 ME1 Melodiol Glb Health 0.0045 50.0 58,158,817 $1,102,750 AYM Australia United Min 0.003 50.0 799,907 $3,685,155 MHC Manhattan Corp Ltd 0.0015 0.0 65,000 $4,405,470 RML Resolution Minerals 0.003 50.0 250,000 $3,220,044 QHL Quickstep Holdings 0.39 34.5 1,050,632 $20,800,602 AUK Aumake Limited 0.0075 25.0 22,229,576 $11,486,441 SPX Spenda Limited 0.01 25.0 6,417,397 $34,595,662 SPR Spartan Resources 1.21 21.6 12,265,732 $1,101,323,597 AEV Avenira Limited 0.006 20.0 9,358,282 $11,745,170 EVR Ev Resources Ltd 0.006 20.0 800,000 $6,856,357 LRL Labyrinth Resources 0.013 18.2 1,478,487 $13,062,981 CMD Cassius Mining Ltd 0.007 16.7 92,500 $3,252,027 DMG Dragon Mountain Gold 0.007 16.7 200,141 $2,368,030 MVL Marvel Gold Limited 0.007 16.7 918,284 $5,182,744 RFT Rectifier Technolog 0.007 16.7 307,142 $8,291,904 VML Vital Metals Limited 0.0035 16.7 41,614 $17,685,201 SWP Swoop Holdings Ltd 0.225 15.4 124,955 $40,600,743 FTZ Fertoz Ltd 0.03 15.4 176,001 $6,506,471 RBD Restaurant Brands NZ 2.93 14.9 1,421 $318,134,234 Code Name Price % Change Volume Market Cap DEL Delorean Corporation 0.09 91.5 12,546,059 $10,138,883 ME1 Melodiol Glb Health 0.0045 50.0 58,158,817 $1,102,750 AYM Australia United Min 0.003 50.0 799,907 $3,685,155 MHC Manhattan Corp Ltd 0.0015 0.0 65,000 $4,405,470 RML Resolution Minerals 0.003 50.0 250,000 $3,220,044 QHL Quickstep Holdings 0.39 34.5 1,050,632 $20,800,602 AUK Aumake Limited 0.0075 25.0 22,229,576 $11,486,441 SPX Spenda Limited 0.01 25.0 6,417,397 $34,595,662 SPR Spartan Resources 1.21 21.6 12,265,732 $1,101,323,597 AEV Avenira Limited 0.006 20.0 9,358,282 $11,745,170 EVR Ev Resources Ltd 0.006 20.0 800,000 $6,856,357 LRL Labyrinth Resources 0.013 18.2 1,478,487 $13,062,981 CMD Cassius Mining Ltd 0.007 16.7 92,500 $3,252,027 DMG Dragon Mountain Gold 0.007 16.7 200,141 $2,368,030 MVL Marvel Gold Limited 0.007 16.7 918,284 $5,182,744 RFT Rectifier Technolog 0.007 16.7 307,142 $8,291,904 VML Vital Metals Limited 0.0035 16.7 41,614 $17,685,201 SWP Swoop Holdings Ltd 0.225 15.4 124,955 $40,600,743 FTZ Fertoz Ltd 0.03 15.4 176,001 $6,506,471 RBD Restaurant Brands NZ 2.93 14.9 1,421 $318,134,234

Delorean (ASX:DEL) was leading the way at lunchtime, gaining ground after issuing guidance for its FY24 results, announcing unaudited revenue for the year of between $27m and $28m, a record NPAT and targeting an eventual EBITDA of between $4.5 million and $5.1 million.

Melodiol Global Health (ASX:ME1) was also off to a flying start, after announcing a $12 million cash asset sale to bolster its bank account. The company has signed a non-binding LOI with Canadian-based Nacerna Life Sciences to sell its Mernova production facility and land in Nova Scotia, with two earn-out provisions totalling $2.2m which are payable to Melodiol on completion of each earn out provisions.

Resolution Minerals (ASX:RML) released its quarterly report this morning, revealing that it spent $49,000 on exploration activities in the June quarter, leaving the company with $239,000 in the bank.

Quickstep Holdings (ASX:QHL) was rising on news via a business update, with the company revealing that restructuring activity, announced to the market in June 2024, has been successfully completed, and a number of key business strands, including work on the C-130 and F35 aircraft, have been planned out. The company also highlighted record drone production output in Q4 FY24 from the Company’s Geelong facility.

EV Resources (ASX:EVR) was up on yesterday’s news that surface rock chip samples of up to 71% Cu and 874g/t Ag demonstrated previously unknown copper and precious metals potential at the Khartoum project in northern Queensland, with the company reporting that the high-grade copper values include 10.9% Cu, 9.11% Cu, 8.6% Cu and 4.16% Cu.

And Vital Metals (ASX:VML) was up on news that it has received assays from the final 24 drill holes completed in its 2023 resource definition exploratory work at its Tardiff prospect, with the program continuing to return shallow high grades including 53.5m at 1.5% TREO from 6.7m incl. 1.8m at 8% TREO within 15.8m at 2.6% TREO, and 27.45m at 1.5% TREO from 4.55m incl. 2m at 6.3% TREO.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 23 July [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AXL Axel Ree Limited 0.12 -40.0 5,974,815 $14,883,775 MTL Mantle Minerals Ltd 0.002 -33.3 5,725,000 $18,592,338 YPB YPB Group Ltd 0.002 -33.3 2,003,236 $6,923,884 JAY Jayride Group 0.007 -22.2 735,647 $2,126,782 RCL Readcloud 0.091 -20.9 838,189 $16,813,518 AZI Altamin Limited 0.031 -20.5 250,000 $17,115,112 MSG Mcs Services Limited 0.004 -20.0 839,000 $990,498 VFX Visionflex Group Ltd 0.004 -20.0 58 $7,500,000 ODY Odyssey Gold Ltd 0.015 -16.7 1,972,073 $16,179,680 AVE Avecho Biotech Ltd 0.0025 -16.7 10,000 $9,507,891 LPD Lepidico Ltd 0.0025 -16.7 348,259 $25,767,358 NRZ Neurizer Ltd 0.005 -16.7 6,003,920 $11,414,584 ODE Odessa Minerals Ltd 0.0025 -16.7 454 $3,129,848 PFE Panteraminerals 0.031 -16.2 273,692 $14,023,988 BDG Black Dragon Gold 0.017 -15.0 300,000 $5,350,354 KLI Killiresources 0.1275 -15.0 1,877,801 $18,033,561 NWM Norwest Minerals 0.029 -14.7 1,161,469 $13,196,063 AMD Arrow Minerals 0.003 -14.3 44,201,958 $36,887,778 PGD Peregrine Gold 0.185 -14.0 84,558 $14,593,861 GRV Greenvale Energy Ltd 0.031 -13.9 316,444 $16,514,240

ICYMI – AM EDITION

Great Southern Mining (ASX:GSN) plans to restart drilling at its Duketon gold project in Western Australia. This will focus on the Golden Boulder prospect – amongst others – that has over 50 historical workings over a 3km stretch.

GTI Energy (ASX:GTR) is now fully licenced and authorised to carry out its next phase of drilling, which is focused on expanding and upgrading the current 5.71Mlb uranium resource at its Lo Herma project in Wyoming’s prolific Powder River Basin.

Miramar Resources (ASX:M2R) has closed its non-renounceable rights issue after eligible shareholders subscribed for 197.39 million shares priced at 1.8c each to raise $1.58m.

Proceeds from the rights issue will be use primarily for upcoming exploration programs at the wholly-owned Bangemall nickel-copper-cobalt-PGE project in WA’s Gascoyne region and the 80%-owned Gidji joint venture project near Kalgoorlie.

The company also secured $450,000 in Federal government Junior Minerals Exploration Incentive (JMEI) scheme credits in relation to its greenfield mineral exploration that will be distributed to shareholders in proportion to their investments.

The JMEI scheme encourages investment in exploration companies that carry out greenfield mineral exploration in Australia, by allowing these companies to give up a portion of their tax losses for potential distribution to eligible investor.

QEM (ASX:QEM) has demonstrated its ESG credentials by completing its first year of offsetting unavoidable greenhouse gas emissions at its world-class Julia Creek vanadium project in Queensland.

At Stockhead, we tell it like it is. While Great Southern Mining, GTI Energy, Miramar Resources and QEM are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.