ASX Small Caps Lunch Wrap: Which would-be stripper pinched herself a Kia this week?

Apparently it's not okay to steal a car to go land a job as a stripper in Indianapolis. Who knew? Pic via Getty Images.

It’s a much nicer day on the ASX today, which has left the benchmark in a reasonably happy +0.64% position as the whistle blows and we down tools for a lunch break.

It’s largely down to a rebound for InfoTech stocks this morning, well-supported by some fine news out of the Materials sector that has a number of the smaller players making decent headway in a market littered with worries and woes.

But first, a short news story caught my eye this morning, as it illustrates one of two things – either it’s a searing indictment on how the cost of living is driving desperate Americans to do increasingly desperate things to get by… or, it’s a story of legitimate, outright stupidity.

I’ll let you decide.

This tale takes place in Muncie, Indiana – a moderately pleasant city that lies about 50 miles from the state capital of Indianapolis.

It’s home to a number of fabulous attractions, such as the National Model Aviation Museum, a park with some swings, and RDI Motors, one of Muncie’s finest used car yards.

It’s at that car yard that this story takes place, after an aspiring young adult entertainer (allegedly) pinched a 2013 Kia Optima off the lot, to drive to the Big Smoke for an audition at a strip club.

The plan was a simple as could be:

- Turn up at the car yard.

- Express interest in a car and obtain the keys

- Distract the sales person long enough to drive off in the car.

- Land a lucrative job taking your clothes off for desperate weirdos.

And that’s precisely how the lark unfolded, when 20-year-old Kasia Shelton – with help from a friend with a mobile phone continually ringing the office to keep the sales staff distracted – made off with the car and drove to Indianapolis.

Things came unstuck for a couple of reasons. Firstly, Indiana police have access to an enormous network of cameras, all tied to a numberplate recognition system, so they were able to track the vehicle pretty much from the moment they were called.

They also had a pretty good idea who had stolen the car, as Ms Shelton had expressed interest in a different Kia shortly before stealing the one she drove away in – and had very helpfully provided her name and address via the company’s website.

When police caught up with Ms Shelton, she was confused about being in trouble, as she had “brought the car back”. However, the bad news for her is that “dumping the car, with the keys in it, in a parking lot next to the dealership, where it was promptly stolen again” isn’t the same as “returning it to the dealership”.

Her argument that she couldn’t be arrested for stealing the car because it was no longer in her possession when police arrived also fell on deaf ears.

No word on whether she landed the stripper gig in Indianapolis, but it’s a sure bet that she’s gonna miss the first day of work – and possibly the next 2.5 years – if she’s found guilty by the local court.

TO MARKETS

Local markets have lifted this morning, following a handsome rally on Wall Street overnight that appears to have put local investors in a pretty good mood.

Plus, there’s been a swag of decent news among a number of companies this morning as well, which I’ll get into more detail about shortly.

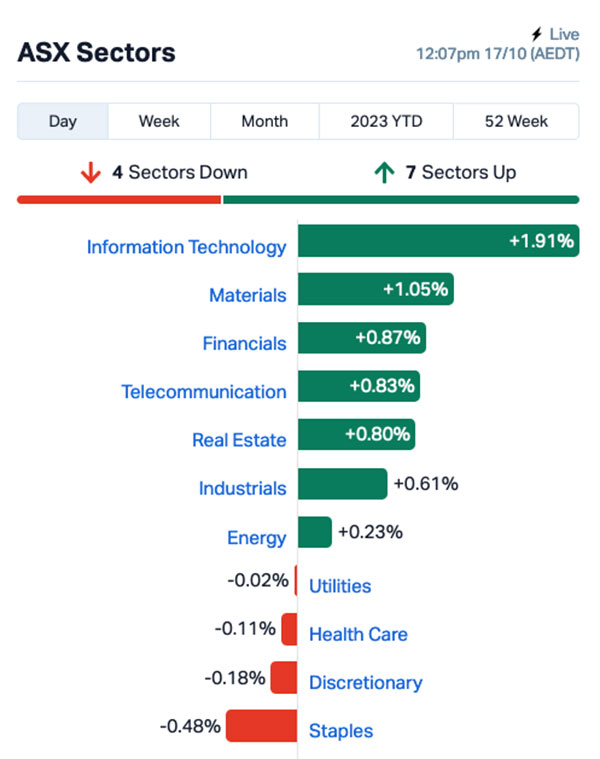

First, though, a look at the sectors shows that things are looking a lot rosier for InfoTech stocks today, well out in front of the rest of the market and rallying hard after a pretty awful sell-off to start the week.

Materials is up slightly as well, and Energy is up by a much smaller margin – worth mentioning, though, because we’re still at the mercy of the war in the Middle East potentially driving up oil and gold prices even further.

In fact, the Big Brains at Bloomberg were saying overnight that if the current conflict between Israel and Gaza gets larger and drags Iran into the fray, there’s a solid chance we could see oil prices break US$150 a barrel.

Mad Max, here we come.

NOT THE ASX

In New York, the S&P 500 rose by +1.06%, the blue chips Dow Jones index was up by +0.93%, and the tech-heavy Nasdaq rallied by +1.2% after US markets staged something of a welcome rally overnight.

Earlybird Eddy reports that was due to a host of corporate earnings this week, and diplomatic efforts to contain the Israel-Hamas conflict, as well as easing oil prices and an overall fade of the safe haven flight to bonds.

I’m inclined to believe him, because he’s a very smart fella when it comes to this sort of stuff.

Social media company Snap Inc jumped 12% after a leaked internal memo showed the company has big goals next year including raising its daily active users to 475 million, well above analysts’ expectations.

Athletic apparel brand Lululemon rose 10% after reports the US$52bn company would replace game giant Activision Blizzard in the S&P 500 index next year.

Tesla was up 1% ahead of its quarterly results release later this week, while Apple slid modestly as iPhone 15 sales in China are said to be off to a disappointing start so far.

In Japan, the Nikkei is up 1.26% on news that the national “food licking” scandal has finally come to an end, with the conviction of 21-year-old Ryoga Yoshino on charges of “obstruction of business”.

Yoshino was arrested after posting a video of himself licking a soy sauce bottle at a Nagoya ‘Sushi Train’ in February.

“I did it to satisfy my desire for recognition and wanted to be popular. What I did was very stupid,” Yoshino told the judge, who promptly sentenced him to three years in prison, suspended for five years.

Harsh, but fair.

In China, Shanghai markets are falling (-0.14%) and in Hong Kong, the Hang Seng is up 0.54% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 17 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AYM Australia United Mining 0.003 50% 241,000 $3,685,155 BAT Battery Minerals Ltd 0.037 48% 350,705 $2,990,112 PIM Pinnacle Minerals 0.13 44% 6,845,404 $2,301,750 KEY KEY Petroleum 0.002 33% 25,855,880 $2,951,892 RIM Rimfire Pacific 0.008 33% 4,861,556 $12,631,468 PPK PPK Group Limited 1.04 27% 91,147 $73,217,220 ADS Adslot Ltd. 0.005 25% 1,553,195 $12,897,982 CNJ Conico Ltd 0.005 25% 2,800,000 $6,280,380 ERL Empire Resources 0.005 25% 973,546 $4,451,740 VMS Venture Minerals 0.011 22% 1,265,462 $17,550,117 ZEU Zeus Resources Ltd 0.011 22% 602,158 $4,133,529 CPM Cooper Metals 0.14 22% 271,606 $6,120,030 ADV Ardiden Ltd 0.006 20% 19,064,313 $13,441,677 ECT Environmental Clean Tech 0.006 20% 502,160 $14,237,776 SI6 SI6 Metals Limited 0.006 20% 1,000,000 $9,969,297 HFY Hubify Ltd 0.019 19% 314,788 $7,938,181 BMR Ballymore Resources 0.13 18% 296,276 $16,081,699 RLG Roolife Group Ltd 0.013 18% 1,409,300 $7,948,139 DCN Dacian Gold Ltd 0.265 18% 6,237,210 $273,780,211 A1M Aic Mines Ltd 0.31 17% 697,960 $122,554,717 JPR Jupiter Energy 0.021 17% 16,000 $22,865,945 YRL Yandal Resources 0.052 16% 257,692 $7,101,139 SAU Southern Gold 0.015 15% 1,181,615 $6,321,709 SPX Spenda Limited 0.015 15% 13,323,487 $47,804,024 MGT Magnetite Mines 0.46 15% 111,661 $30,706,020

Pinnacle Minerals (ASX:PIM) is leading the way in small caps this morning, up 50% on news it is set to acquire a 75% interest in the Adina East Lithium Project in the James Bay lithium district.

The project covers 72.7km2 of land in the red-hot lithium region, just down the road from Winsome Resources’ (ASX:WR1) Adina Lithium Project, and next door to Winsome’s Tilly Lithium Project and Loyal Lithium’s (ASX:LLI) Trieste Lithium Project.

Pinnacle has acquired the interest from Electrification and Decarbonization AIE, which will also stump up US$500,000 in offtake pre-payment in consideration for offtake rights to 25% of any minerals extracted from Adina East Project.

Next best this morning is Battery Minerals (ASX:BAT), up 44% on news that the company has entered into a binding agreement to acquire the advanced Spur Gold project, in the heart of the highly prospective Lachlan Fold Belt.

The Spur Project is located 14km west from Newcrest Mining’s (ASX:NCM) Cadia Valley Operations, which boast a 32.1Moz Au, 7.2Mt Cu, Measured and Indicated Mineral Resource in central western New South Wales.

“We are delighted to announce the acquisition of the highly prospective Spur Project,” Battery Minerals managing director, Peter Duerden, said. “This deal represents a transformative opportunity for the company, providing high-quality, nearterm drill targets, down-dip from open wide historic gold intercepts in the East Lachlan.”

And in third place, PPK Group (ASX:PPK) is up more than 40%, after its subsidiary, BNNT Technology, announced it would significantly reduce the price of its Australian-made boron nitride nanotubes (BNNT) following a series of production improvements.

For those not in the know, BNNT is a “multi-use super material that can produce a ‘fibre’ 100 times stronger than steel but as light as carbon fibre, super flexible, more thermally conductive than copper, and able to sustain high temperatures of up to 1000 degrees without degrading”.

BNNT Technology says it can now sell its product at around $150 per gram, down from the $400 per gram it was previously being sold at.

There’s more to this story, but luckily Eddy Sunarto’s been super-busy and has this longer update for us all to absorb.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 17 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MXC MGC Pharmaceuticals 0% -25% 1,930,000 $8,855,936 WIA WIA Gold Limited 3% -25% 3,149,666 $36,827,398 ILA Island Pharma 6% -24% 156,335 $6,501,477 JAN Janison Education Group 31% -21% 697,411 $97,178,247 HYD Hydrix Limited 2% -21% 100,039 $7,372,347 GTG Genetic Technologies 0% -20% 100,000 $28,854,145 MTL Mantle Minerals Ltd 0% -20% 150,000 $15,368,615 SIS Simble Solutions 1% -17% 2,238,000 $3,617,704 HFR Highfield Res Ltd 28% -16% 909,934 $131,381,551 SES Secos Group Ltd 4% -15% 78,126 $28,487,072 CZN Corazon Ltd 1% -14% 18,772 $8,618,371 LRL Labyrinth Resources 1% -14% 54,486 $8,312,806 NGS NGS Ltd 1% -14% 3,983,905 $3,517,184 AMN Agrimin Ltd 16% -14% 94,247 $53,345,210 DTC Damstra Holdings 10% -13% 48,218 $28,367,030 IPB IPB Petroleum Ltd 1% -13% 2,811,525 $9,041,959 LML Lincoln Minerals 1% -13% 182,586 $11,365,694 MOM Moab Minerals Ltd 1% -13% 100,000 $5,695,708 RDS Redstone Resources 1% -13% 534,666 $6,971,028 TG1 Techgen Metals Ltd 3% -13% 26,264 $2,469,385 YOJ Yojee Limited 1% -13% 150,000 $9,081,637 DES Desoto Resources 11% -13% 40,686 $7,191,180 SMS Star Minerals 4% -13% 19,934 $1,450,112 BME Black Mountain Energy 2% -13% 225,536 $4,397,380 FTZ Fertoz Ltd 7% -12% 136,618 $20,884,621

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.