ASX Small Caps Lunch Wrap: Which utterly stupid word has been named Word of the Year today?

Crushed by the news that Rizz is word of the year, Andrew and Wanda Worthington cemented their pact to take as many young people with them as possible when they die. Pic via Getty Images.

Local markets are down a little this morning, tracking Wall Street lower after investors in New York reacted to some significant political posturing aimed squarely at chipmaker Nvidia.

Local investors were also holding their breath this morning, ahead of a will they/won’t they call on interest rates from the RBA board today.

The big money going into the meeting was behind the RBA pushing ahead with its well-established “hurry up and wait” strategy, which fell out of favour in a very big way when lettuce began selling for $12 a head.

Current price for a head of lettuce is $1.50, according to Woolworths – so my guess is that interest rates aren’t going anywhere today.

For the word-lovers among you, there’s news out of the UK that will surely set your teeth a-grinding and your fists a-clenching, after those wags at the Oxford Dictionary announced that “Rizz” is their Word of the Year.

Like most recent winners of the accolade, it’s a stupid word that kids say too much, and as such as further proof that this Word of the Year malarkey is just a desperate attempt by a 139-year-old tome to stay somewhat relevant in a world of automatic spell-checkers coupled to the kind of wilful, youthful ignorance that makes words like “rizz” popular in the first place.

For those of you who are clearly way too unhip to know what it means, “rizz” is a shortening of the word “charisma”, and is defined by the Official Word Mutilation Team at Oxford as “Pertaining to someone’s ability to attract another person through style, charm, or attractiveness.”

I will admit that it’s highly possible that I think it’s a poor choice because my own perennial – dare I say it, terminal – lack of rizz has hung like a millstone around my neck from the moment puberty arrived three years late and turned me into a skinny-fat abomination that has haunted the nightmares of potential partners since the mid 1980s.

But it’s far more likely that it’s just a dumb choice, especially considering some of the alternatives that were shortlisted for the award this year.

Those included a genuinely interesting word, “parasocial”, defined by Oxford as “designating a relationship characterised by the one-sided, unreciprocated sense of intimacy felt by a viewer, fan, or follower for a well-known or prominent figure (typically a media celebrity), in which the follower or fan comes to feel (falsely) that they know the celebrity as a friend.”

Parasocial’s place on the shortlist is made all the more interesting by the inclusion of “Swiftie” on the list as well, a word used to describe the rabid collection of Taylor Swift fans whose feverous love of their favourite singer is matched only in intensity by the venomous nature of their response to the slightest of anti-Swift provocation.

“De-influencing” also made the short list, reminding me that I really should have worked harder on the pitch I had planned to take to Nike a few years ago, when my life was in such a catastrophic state that I figured the company might pay me sizeable sums of money not to wear their products in public.

The rest of the list is pretty boring, which is another indication of how rizz ended up taking the gong – but, considering that past winners include such gems as “youthquake”, and the crying while laughing emoji which isn’t even a f@#%ing word, it’s pretty much par for the course.

TO MARKETS

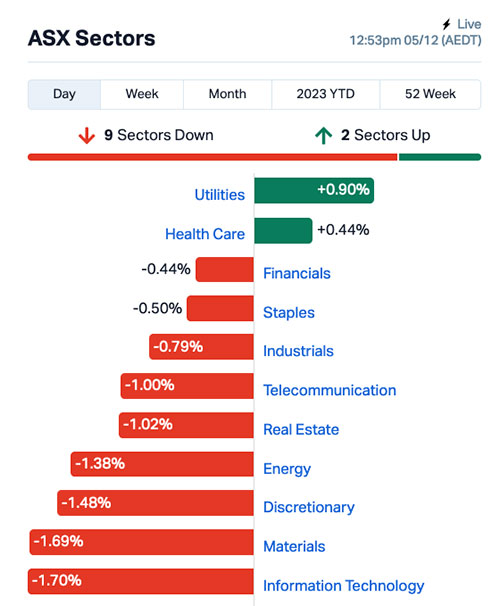

As previously mentioned, things aren’t super-great on the ASX so far today. Taking the market’s temp around 1pm, it’s Utilities out in front and doing kind-of okay, Health Care’s putting in a weak-kneed effort of sorts… and then the rest of the market is losing ground.

InfoTech has taken the biggest hit today, tracking the US market’s tech sector lower after some of the monstrously out-sized tech giants there took a beating overnight – more on that shortly.

The gold rush of recent days has apparently come to an end, despite spot gold prices holding steady above US$2,000 an ounce. The XGD All Ords Gold Index has fallen sharply this morning, shedding a lot of yesterday’s gains to hit lunchtime 3.3% down on yesterday’s close.

There aren’t any of the mega-buck ASX players in the winner’s circle, but there’s a smattering of them taking some solid losses today.

That includes Liontown, which is apparently still bleeding heavily since the Albermarle deal fell through in early October – it’s down another 5.7% today, despite no market-moving news to report.

Similarly, Capricorn and Emerald are both reporting heavy losses today, down 6.7% and 6.4% respectively.

NOT THE ASX

In the US overnight, things went south when the recently-crowned Greatest Stock in the World Nvidia got all shook up by a very stern talking-to from the government.

The chipmaker is, by some accounts, headed for a showdown with US regulators over the company’s current efforts at redesigning its products to circumvent a US government ban on selling AI-capable chipsets to China.

US Commerce Secretary Gina Raimondo has fired a not-even-remotely-veiled warning shot across Nvidia’s bows, using an interview with Fortune as a platform to let the chipmaker know that any move by the company to try to weasel around the export restrictions probably won’t end well.

“We cannot let China get these chips, period,” Raimondo said. “We’re going to deny them our most cutting edge technology … If you redesign a chip around a particular cut line that enables them to do AI, I’m going to control it the very next day.”

Nvidia responded by falling 2.7%.

That set the mood for Wall Street’s session, and the S&P 500 fell by -0.54%, the blue chips Dow Jones index was down by -0.11%, and the tech-heavy Nasdaq slipped by -0.84%.

In other stock news, Earlybird Eddy reports that Uber was up by 2.2% after S&P Global said it will include the stock in the S&P 500 Index later this month. Inclusion in this coveted index typically draws buying from funds that track the benchmark.

The biggest mover overnight was Hawaiian Airlines, which soared by 192% after Alaska Air agreed to pay roughly US$1 billion for the troubled airline.

In Asia, The Nikkei is down 1.38%, Shanghai markets are down 0.65%, Hong Kong’s Hang Seng is 0.93% lower in early trade and Thailand’s exchange is closed today because it’s the King’s birthday.

I was going to make a joke about that, but given that nation’s impossibly harsh lèse-majesté laws, I won’t.

15 years in a Thai prison sounds like a very raw deal.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 5 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap ATH Alterity Therapeutics 0.0085 113% 182,075,871 $11,209,442 YOJ Yojee Limited 0.007 56% 1,040,000 $5,877,325 ATP Atlas Pearls Ltd 0.12 36% 7,800,034 $37,652,715 BP8 BPH Global Ltd 0.002 33% 3,056,032 $2,423,345 GLV Global Oil & Gas 0.0205 28% 59,870,820 $7,472,005 ADD Adavale Resource Ltd 0.01 25% 7,731,181 $5,842,954 KPO Kalina Power Limited 0.005 25% 500,000 $6,060,783 MRD Mount Ridley Mines 0.0025 25% 19,618,340 $15,569,766 HTA Hutchison 0.04 21% 5,540 $447,892,783 ESR Estrella Res Ltd 0.006 20% 375,000 $8,795,359 CST Castile Resources 0.077 17% 105,600 $15,965,560 BFC Beston Global Ltd 0.007 17% 1,692,059 $11,982,281 KNM Kneomedia Limited 0.0035 17% 650,469 $4,599,814 MEM Memphasys Ltd 0.014 17% 414,523 $11,514,245 MOM Moab Minerals Ltd 0.007 17% 70,000 $4,271,781 SRN Surefire Resources NL 0.011 16% 37,954,605 $17,449,154 EEG Empire Energy Ltd 0.195 15% 2,287,170 $131,430,595 NSB Neuroscientific 0.055 15% 76,612 $6,941,034 FGL Frugl Group Limited 0.008 14% 700,000 $6,727,434 M4M Macro Metals Limited 0.004 14% 6,498,750 $8,634,772 NTM Nt Minerals Limited 0.008 14% 614 $6,019,320 SER Strategic Energy 0.016 14% 175,075 $6,801,412 RWD Reward Minerals Ltd 0.09 13% 717,144 $18,228,251 LSR Lodestar Minerals 0.0045 13% 24,891 $8,093,589 ZAG Zuleika Gold Ltd 0.019 12% 362,733 $12,513,454

Leading the way early this morning was Global Oil and Gas (ASX:GLV), following news of a “transformational” turnover in the boardroom that dropped after hours yesterday.

Global has shed two non-exec directors – Chris Zielinski and Patric Glovac – in favour of Invictus founder and MD Scott Macmillan and Steinepreis Paganin legal eagle Matt Ireland, who have joined the board as non-executive director and non-executive chairman respectively.

Additionally, Lloyd Flint has taken over as company secretary, following the departure of Anna MacKintosh.

The shake-up comes at a time when Global is preparing for “a future high impact exploration campaign” at its 4,858km2 offshore oil and gas block in Peru.

Another junior gassy doing well this morning was Empire Energy (ASX:EEG), rising on news that the company has spent $2.5 million to buy up AGL’s Rosalind Park Gas Plant, as a means to accelerate its own Carpentaria Pilot Project.

The purchase provides Empire with a fit for purpose facility with a design capacity of 42TJ per day, which has been surplus to requirements for AGL since the latter shuttered its Camden Gas Projecct in August of this year.

Empire says the purchase will save the company up to $30 million in future expenditure, and knock about 12 months off the time the company was expected to take to get things flowing, compared to the process of building out its own bespoke facility.

Atlas Pearls (ASX:ATP) has had a big win this morning, on the heels of a wildly successful auction in Kobe, Japan, that saw an enormous lift in YoY revenue, despite noticeable drop in volume of sales.

Atlas has reported a 272% increase in average pearl price, from $37.77 to $102.69 on pcp, off the back of a revenue bump from $12,122,852 in H1 FY23 to $26,126,523 for the same period current year, while reporting a 21% decrease in the number of loose pearls sold at auction.

SaaS logistics firm Yojee (ASX:YOJ) is up this morning on news of a 1:1 entitlement issue at 0.002 per share to raise up to approximately $2,611,970.

Reward Minerals (ASX:RWD) was rising early on news that it has entered into a binding share sale agreement with the receivers at Kalium Lakes, to acquire the Beyondie sulphate of potash project for $20 million.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 5 December [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap GTG Genetic Technologies 0.002 -33% 2,045,400 $34,624,974 SLB Stelar Metals 0.25 -29% 489,076 $18,167,774 ICN Icon Energy Limited 0.005 -29% 842,757 $5,376,096 IND Industrial Minerals 0.785 -28% 1,596,109 $74,403,400 RMX Red Mount Mining 0.003 -25% 67,666 $10,694,304 TSL Titanium Sands Ltd 0.01 -23% 4,071,210 $23,033,461 NUH Nuheara Limited 0.1 -20% 649,598 $28,798,893 CT1 Constellation Tech 0.002 -20% 16,356 $3,678,001 WEL Winchester Energy 0.002 -20% 183,000 $2,551,055 MSB Mesoblast Limited 0.3175 -17% 9,199,675 $329,752,954 LBT LBT Innovations 0.015 -17% 516,720 $20,806,206 AGR Aguia Res Ltd 0.01 -17% 2,239,122 $5,620,044 IVX Invion Ltd 0.005 -17% 487,100 $38,529,793 SKN Skin Elements Ltd 0.005 -17% 1,614,835 $3,536,917 HVY Heavy Minerals 0.096 -17% 61,060 $6,626,710 NNL Nordic Nickel 0.135 -16% 16,875 $9,353,601 SHO Sportshero Ltd 0.017 -15% 16,299 $11,500,022 SP3 Specturltd 0.017 -15% 260,000 $4,590,698 VN8 Vonex Limited 0.023 -15% 579,678 $9,769,373 CTN Catalina Resources 0.003 -14% 24,534 $4,334,704 SBR Sabre Resources 0.03 -14% 6,507,609 $12,673,107 RDN Raiden Resources Ltd 0.037 -14% 53,310,888 $114,087,062 PPG Pro-Pac Packaging 0.25 -14% 9,500 $52,689,436 NXM Nexus Minerals Ltd 0.051 -14% 860,976 $22,954,548 ERW Errawarra Resources 0.13 -13% 1,130,270 $14,388,100

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.