ASX Small Caps Lunch Wrap: Which US city was home to the world’s unluckiest criminal this week?

Kate Winslet stars as a bear in this delightfully twisted rom-com, alongside Leonardo DiCaprio and TV's Richard Dean Anderson. Pic via Getty Images.

Local markets were struggling for traction this morning, with the ASX 200 opening lower, gaining briefly and then gently sliding back under the water, glubbing gently as it went, just like Leonardo DiCaprio at the end of that dreadful movie he was in.

Not that one… the one with the bear that looked like Kate Winslet, and she murders him with a cupboard door or something.

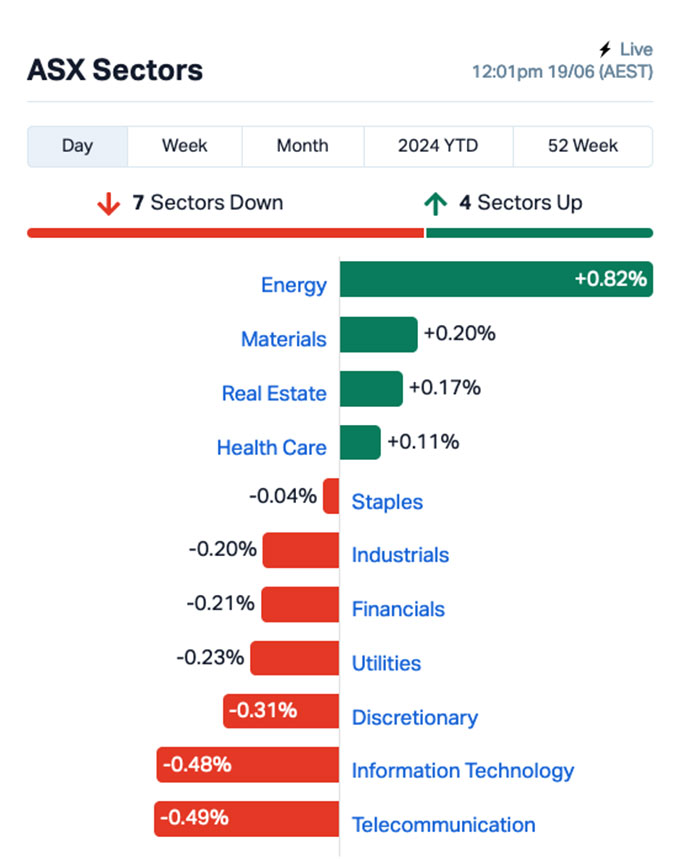

Anyway – there’s a bit happening on the market this morning, with most sectors in the red, Materials hovering around break-even and the Energy sector having a lonely day so far at the top of the market.

I’ll get into the details of that shortly, but first to a lightning-quick story from Los Angeles, where an apparent bag thief should probably be thinking about buying a lottery ticket, after robbing a man for the bag he was carrying around 9.30pm that night.

The thief attacked their victim while he was coming home from work Saturday night in the residential community in Tustin, about an hour’s drive southeast of Los Angeles.

It’s odds-on that the thief had no idea who they were robbing, because they might have chosen more wisely had they known it was a US Secret Service agent – the kind that does all that urban ninja business and protects the President and all that guff.

According to local media, US President Joe Biden had been in town that evening for an event with former President Barack Obama – but it’s unclear whether the agent who was robbed later that night was part of the presidential protective detail and, therefore, completely hardcore and the last person you’d want to pull a gun on.

But given that the agent reportedly did manage to pull their own gun on the robber and get a few shots off – apparently without hitting their target – suggests that the Secret Service agent might be more of a “yeah, that’s Agent Kevin. He works in the mail room and likes watching anime” kinda guy.

Local police still haven’t found the thief, but they did reportedly recover the bag and some of the agent’s belongings nearby… but it’s a pretty sure bet that their dignity will be among the stuff that they’re never going to get back.

I can only imagine how brutal that workplace banter’s going to be for the next six months.

TO MARKETS

The ASX was labouring hard and not really getting anywhere this morning, which is pretty much what you’d expect given the RBA’s two-day gabfest produced little more than a hefty lunch bill, and zero in the way of rate relief.

There’s one standout sector this morning, and that’s Energy – it’s well out in front of the rest of the market, but still only posting a modest +0.8% rise before lunch, largely thanks to Woodside Energy Group’s (ASX:WDS) +1.2% rise and Santos’ (ASX:STO) +0.5% gain.

It’s probably worth noting that Beach Energy (ASX:BPT) is having another shocker today, down -4.0% since the market opened this morning.

The company has been in a steep decline since 13 June, when it announced that the first gas has started to flow from its Enterprise project to the Otway Gas Plant. Since then, BPT has shed $0.147 to $1.468, a drop of more than -9.5%.

Overall, the market sectors look like this:

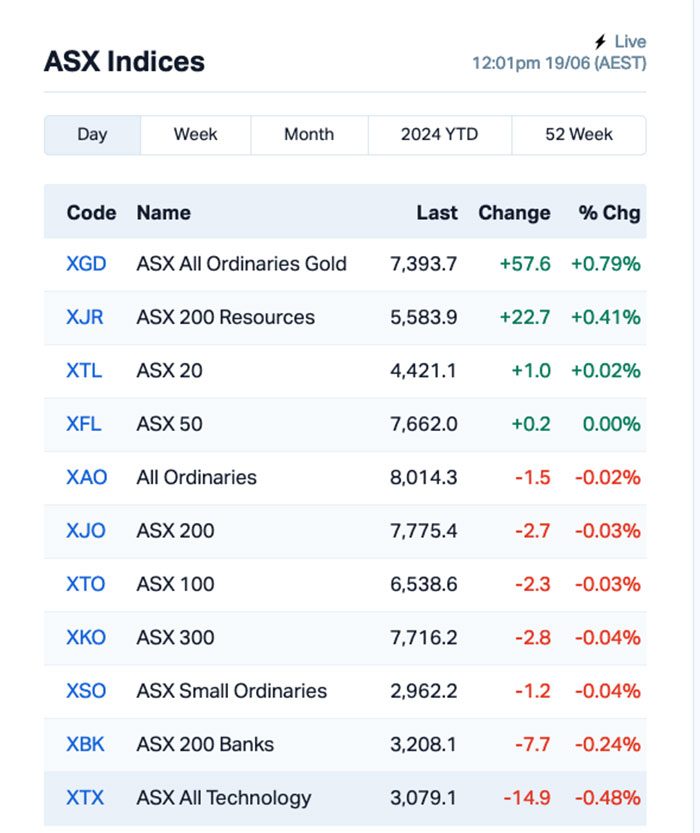

And the ASX indices look like this:

The goldies are performing well again this morning, after spot gold prices climbed +0.35% to US$2,328.86 an ounce overnight, and oil prices were up around +1.5%, with Brent crude now trading at US$85.32 a barrel before the market opened this morning.

THere’s not a whole lot more than that happening up in the expensive seats this morning, so the market’s left to wait until tomorrow for fast foodie Guzman Y Gomez to go through with its IPO.

Why they picked Thursday, and miss out on all of the greasy, refried market goodness of giving the ASX a proper Taco Tuesday is anyone’s guess – and an uncharacteristically badly-whiffed marketing opportunity.

The company has been everywhere with coverage of the IPO, even managing to get a six-and-a-half minute, slathered-in-corporate-logos video presented on the famously brand-averse ABC news website.

NOT THE ASX

On Wall Street overnight, while most of you were sleeping, the S&P 500 rose by +0.25% to its 31st all time high in 2024, the blue chips Dow Jones index was up by +0.15%, and the tech-heavy Nasdaq lifted modestly by +0.03%.

The US market’s headline news wasn’t the 31st record high for the S&P 500 – it was the fact that Nvidia has risen to the top of the leaderboard, adding +3.5% and becoming the world’s largest and most valuable company, with a staggering market cap of US$3.34 trillion.

For those of you who are still refusing to accept US Dollars, that equals AUD$5,012,117,560,000 – eclipsing Microsoft in second place and Apple in third.

Microsoft is capped at US$3.32 trillion, while Apple is in third spot at US$3.29 trillion – and while that makes it look like it’s a pretty close race at the top, the difference between Nvidia and Microsoft is about 76 billion Aussie dollars.

So… if you took Microsoft and shoved Australia’s Wesfarmers (ASX:WES) inside it, like an unholy economic turducken, it’d be (briefly) worth the same as Nvidia, and Bill Gates would know what you bought at the supermarket.

In other US stock news, Boeing fell -2% as CEO Dave Calhoun encountered sharp criticism during his Senate hearing, where he was accused of prioritising profit over safety and not adequately addressing the company’s manufacturing issues.

Philip Morris slipped -0.8% after halting online sales of its popular nicotine pouch brand, Zyn, in the US following a subpoena from the District of Columbia concerning the sale of prohibited flavoured products.

Dollar Tree tumbled -1.3% after US regulators said the company has continued selling children’s apple sauce with “extremely high” lead levels, despite a recall issued over contamination concerns – which seems silly, because kids love lead.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 19 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap YPB YPB Group Ltd 0.003 50% 333,333 $1,615,923 HMD Heramed Limited 0.025 39% 2,336,583 $7,078,497 KPO Kalina Power Limited 0.004 33% 3,021,762 $7,459,182 LPE Locality Planning 0.115 26% 997,776 $16,398,601 88E 88 Energy Ltd 0.0025 25% 5,431,926 $57,785,344 AUH Austchina Holdings 0.0025 25% 1,800,000 $4,200,767 MTL Mantle Minerals Ltd 0.0025 25% 996,333 $12,394,892 CC9 Chariot Corporation 0.2175 24% 359,800 $14,659,759 DRE Dreadnought Resources 0.026 24% 11,564,835 $73,774,532 OZM Ozaurum Resources 0.059 23% 123,206 $7,620,000 ASE Astute Metals NL 0.033 22% 2,816,331 $11,448,813 KNG Kingsland Minerals 0.225 22% 180,821 $11,368,213 AVE Avecho Biotech Ltd 0.003 20% 35,199 $7,923,243 MCL Mighty Craft Ltd 0.006 20% 150,000 $1,844,546 WA1 WA1 Resources 19.435 20% 442,776 $994,262,460 GW1 Greenwing Resources 0.049 20% 20,408 $7,431,311 AMA AMA Group Limited 0.046 18% 3,946,398 $70,449,738 SRJ SRJ Technologies 0.073 18% 49,148 $9,876,255 RR1 Reach Resources Ltd 0.02 18% 6,651,638 $14,865,333 CE1 Calima Energy 0.007 17% 21,998,861 $3,800,616 GGE Grand Gulf Energy 0.007 17% 70,006 $12,571,482 ILT Iltani Resources 0.325 16% 76,177 $9,522,941 FFM Firefly Metals Ltd 0.8025 15% 3,383,796 $334,092,034 NMR Native Mineral Resources 0.03 15% 16,700 $5,456,113 KNI Kuniko Limited 0.19 15% 133,011 $14,296,304

Health tech company HeraMED (ASX:HMD) was back in the headlines on Wednesday morning, announcing to the market that it has achieved a record number of active and accumulated users in June.

“The number of accumulated mums on the HeraCARE platform reached 3,553 registered mums (+365 accumulated users or 12% sequential growth since 31 March 2024), including 560 active mums (previously record was 517 active users as at 21 July 2022),” the company said.

Locality Planning Energy (ASX:LPE) climbed Wednesday morning with a takeover bid from River Capital on the table, which has upped its bid from $0.08 per share to $0.105 per share – however, the LPE board is currently recommending that shareholders take no action.

Drilling is underway at AustChina’s (ASX:AUH) early stage Chenene lithium project in Tanzania, with hole number 1 intersecting pegmatite (a host rock for lithium) from a depth of 6m.

Chariot Corp (ASX:CC9) was up on news that the company has launched into its summer lithium hunt in Wyoming.

And Dreadnought Resources (ASX:DRE) was rising through the morning session on news that an RC drill rig has been secured to commence drilling the Gifford Creek Nb-REE carbonatite targets in July 2024, immediately following the Tarraji-Yampi drill program.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 19 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap JAV Javelin Minerals Ltd 0.001 -50% 856,699 5,002,462 ME1 Melodiol Global Health 0.025 -38% 3,588,057 1,457,991 CLZ Classic Minerals 0.002 -33% 2,528,515 1,467,489 LSR Lodestar Minerals 0.001 -33% 214,000 3,035,096 NGY Nuenergy Gas Ltd 0.017 -32% 416,200 37,023,887 IMI Infinity Mining 0.02 -26% 182,801 3,206,342 AML Aeon Metals Ltd 0.006 -25% 4,616,138 8,771,205 BFC Beston Global Ltd 0.003 -25% 1,043,584 7,988,188 MRQ Mrg Metals Limited 0.003 -25% 4,442,906 10,100,475 TD1 Tali Digital Limited 0.0015 -25% 174,569 6,590,311 CDT Castle Minerals 0.005 -23% 9,544,788 7,959,204 ICE Icetana Limited 0.014 -22% 94,441 4,763,312 WBE Whitebark Energy 0.011 -21% 1,001,800 2,688,005 BUY Bounty Oil & Gas NL 0.004 -20% 16,956,226 7,492,505 CRB Carbine Resources 0.004 -20% 750,000 2,758,689 GTR GTI Energy Ltd 0.004 -20% 22,527,824 10,249,735 ROG Red Sky Energy 0.004 -20% 2,888,999 27,111,136 TMR Tempus Resources Ltd 0.004 -20% 294,520 5,154,994 TX3 Trinex Minerals Ltd 0.002 -20% 3,375,088 4,571,631 BNL Blue Star Helium Ltd 0.009 -18% 25,000 21,364,918 SIX Sprintex Ltd 0.041 -18% 339,891 26,356,240 AMD Arrow Minerals 0.0025 -17% 1,988,529 31,618,095 HLX Helix Resources 0.0025 -17% 400,000 9,792,581 LPD Lepidico Ltd 0.0025 -17% 1,595,640 25,767,358 PRX Prodigy Gold NL 0.0025 -17% 29,065,637 6,353,323

ICYMI – AM EDITION

European Lithium (ASX:EUR) has noted that Critical Minerals Corp. (CRML) has acquired an initial 5.55% equity interest in the Tanbreez Greenland rare earths deposit for a cash consideration of US$5m.

CRML, in which EUR holds a 83.03% interest in, completed the initial investment as part of its recently announced plans to acquire a 92.5% controlling interest in Tanbreez.

“By acquiring Tanbreez, Critical Metals Corp will be strategically positioned to become a reliable and sustainable supplier of both light and heavy rare earth elements to meet the growing demand of these materials from the technology and defense industries in western countries,” CRML chief executive officer and EUR chairman Tony Sage said.

At Stockhead, we tell it like it is. While European Lithium is a Stockhead advertiser, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.