ASX Small Caps Lunch Wrap: Which tiny Scottish village has a killer clown problem this week?

Sorry Bevis. Pic via Getty Images.

Local markets blipped upwards early this morning, before the benchmark faded to flat within the first hour of trade.

It follows a fairly weak session on Wall Street overnight, which was on track to deliver a flattish result across the board, until Nvidia told the market that the US government is saying a big, fat “National Security No” to selling advanced AI chips to China.

I’ll get into the details of that shortly, but first comes a story from a Scottish village, which is being stalked by an evil-looking clown.

Skelmorlie is a small village in North Ayrshire, in the southwest of Scotland, boasting a population of around 2,000 people and one killer clown.

Until the clown’s appearance, it was most famous for being home to the “Skelmorlie Mile”, an accurately-measured nautical mile that was used by shipbuilders to figure out how fast their boats were able to go – thrilling stuff, indeed.

However, it’s now firmly on the map as being home to the gruesome character, who has been daring police to catch him, and even sent local residents on a treasure hunt through the village.

The prize was a small lock-box, containing a mirror with the word “clown” scrawled on it, which would be hilarious if wasn’t accompanied by the highly unnerving knowledge that your village has someone creeping about in the dead of night, dressed like they’ve been summoned from hell via wish.com.

The villagers all reckon it’s “just a spot of fun”, with local woman Isy Agnew claiming “there is nothing sinister or creepy – just a way to bring the community together.”

Brave words from a woman how clearly doesn’t realise that she and her neighbours are being “brought together” to be murdered and eaten. Probably.

Because the clown is undeniably a sinister and malevolent presence in the village, as this footage of him sitting down for an interview with Sky News shows.

Yeah… nah. Halloween or not, that thing can f–k right off.

TO MARKETS

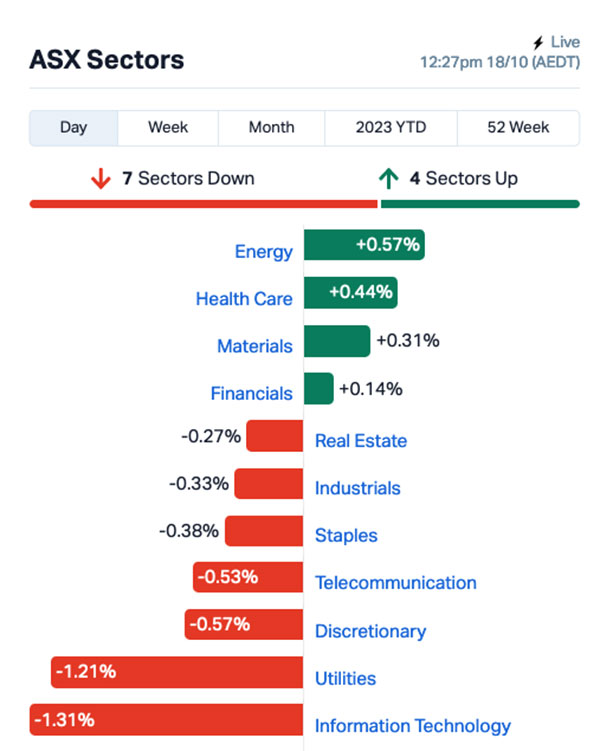

Things are a little mixed on the ASX this morning, as the ASX 200 benchmark flirts with going absolutely nowhere while InfoTech stocks do their best to drag the market down again.

It’s pretty easy to point fingers at Wall Street for InfoTech’s suffering this morning, so I will. It’s America’s fault, because the US government is getting super-cagey about China’s access to Good Ol’ American Silicon Chips’n’such again.

The Energy sector is the morning’s star performer4, driven largely by solid results among some of the bigger names, including Paladin Energy (ASX:PDN) (up 3.5%) and Boss Energy (ASX:BOE) (up 4.8%), and another small surge in oil prices overnight that saw Brent Crude break through US$90 a barrel.

Up the top end of town, Latin Resources (ASX:LRS) is enjoying a return to positive form this morning, up more than 5.6% on news that it’s oh-so-close to being able to slap a “Tier 1, baby!” sticker on the front gate of its Salinas Lithium project.

“Step out drilling immediately to the southwest of Colina has added significant strike extensions to the already considerable mineral resource footprint at Colina with the discovery of a new pegmatite cluster,” the company says.

“Our understanding of the regional potential of the Salinas lithium project grows with every new discovery we make, with now three well defined mineralisation systems and Colina, Colina Southwest and Fog’s Block, with potentially a fourth now emerging.”

It’s big news, but hardly surprising – Latin’s been steadily building towards becoming a star performer for ages… but if you’re after more insight on the company and how it’s tracking at the moment, we’ve got you covered.

Stockhead newbie Sarah Hughan sat down with LRS head honcho Chris Gale a couple of days ago for a quick chat, which you can watch right here.

NOT THE ASX

It wasn’t a fantastic session in New York last night, and the S&P 500 and blue chips Dow Jones index closed flat, while the tech-heavy Nasdaq dropped by -0.25%.

The late selloff was triggered by Nvidia’s announcement that the US government was restricting shipments to China of more advanced artificial intelligence (AI) chips designed by Nvidia and other US chipmakers.

Nvidia shares fell -5%, while other chipmakers like Advanced Micro Devices and VMware also slipped on the news.

General Motors was flat after the company said it was delaying its electric vehicles production plan.

Goldman Sachs shed -1.5% after reporting a 33% slide in profit, while Bank of America advanced 2.5% after profit beat estimates, and its trading desk reported their best Q3 in a decade.

Earnings season in the US is still in early days, but there are signs corporate America may have turned the corner. Tesla and Netflix will be reporting their results later today, with the latter rumoured to be readying to up its prices structuring again, following a “successful campaign” to stop people from sharing their passwords.

Market sentiment meanwhile was boosted after US retail sales data smashed expectations, rising by 0.7% in September which was more than double Wall Street’s estimates.

In Japan, the Nikkei is down 0.5% on news that the company has launched its fourth Taigei-class diesel-electric attack submarine “Raigei”, an interesting designation for a country that’s not really meant to have a standing armed forces capable of aggression.

I asked the Japanese government for a photo of their shiny new Taigei-class sub, and they sent me this:

The naming convention of the subs is actually pretty interesting – all of the The Taigei-class submarines incorporate the word “Gei” into their names, which translates as “Whale”.

“Taigei” itself means “big whale”, leading many to suspect that it will be hunted mercilessly by its own government for “research purposes”, with the most delectable parts of the submarines kept aside to “mysteriously appear” on the menu at the fanciest of Japan’s restaurants.

It’s still too early for news out of China or Hong Kong but as soon as I hear anything, I’ll update this space.

(Ed: Will you though)

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 18 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CLE Cyclone Metals 0.0015 50% 2,048,581 $10,264,505 NOX Noxopharm Limited 0.135 41% 4,387,376 $28,054,843 GES Genesis Resources 0.007 40% 717,850 $3,914,206 PSC Prospect Res Ltd 0.1 35% 4,242,378 $34,207,200 CTN Catalina Resources 0.004 33% 865,591 $3,715,461 MCM MC Mining Ltd 0.14 33% 157,000 $41,964,846 NWF Newfield Resources 0.18 33% 415,610 $119,076,378 LPI Lithium Power International 0.545 31% 27,045,076 $261,133,587 SCL Schrole Group Ltd 0.32 23% 9,500 $9,273,572 IAM Income Asset 0.12 20% 59,308 $28,002,082 RML Resolution Minerals 0.006 20% 1,000,033 $6,286,459 PAR Paradigm Biopharmecuticals 0.755 20% 2,960,890 $176,704,474 RLT Renergen Limited 1.045 19% 80,684 $26,535,229 BPH BPH Energy Ltd 0.031 19% 29,291,071 $26,541,824 AIV Activex Limited 0.02 18% 6,663 $3,663,544 JCS Jcurve Solutions 0.04 18% 97,535 $11,163,677 RIM Rimfire Pacific 0.01 18% 8,066,654 $17,894,580 NSM North Stawell Minerals 0.035 17% 12,121 $3,603,810 LRL Labyrinth Resources 0.007 17% 916,666 $7,125,262 SXL Southern Cross Media 0.85 16% 1,157,528 $175,126,379 STM Sunstone Metals Ltd 0.015 15% 2,600,637 $40,065,803 PAB Patrys Limited 0.008 14% 1,787,999 $14,402,131 FRB Firebird Metals 0.165 14% 897,279 $10,595,875 EPN Epsilon Healthcare 0.033 14% 155,837 $8,710,266 EQR EQ Resources Limited 0.075 14% 558,360 $103,607,201

Top of the charts for Small Caps (with news) today is Noxopharm (ASX:NOX), which has jumped more than 40% after announcing new data that shows its SOF-VAC mRNA vaccine enhancer significantly reduces inflammation driven by mRNA in an animal model.

The company’s research with its strategic partner, the Hudson Institute of Medical Research in Melbourne, found that inflammation was reduced by around 50% when comparing the inflammation induced by mRNA alone to mRNA plus SOF-VAC.

“This is an important finding, as many side effects of mRNA vaccines are due to inflammation,” the company says.

Prospect Resources (ASX:PSC) has also lifted this morning, up 35% on news of a significant new discovery from the Phase 3 diamond drilling programme at its 90%-owned Step Aside Lithium Project in Zimbabwe.

Prospect says Scout drilling in the area south of the Pegmatite B and C deposits returned a 25.73m intersection of pegmatite from a vertical depth of 36m, which assays have confirmed at 23.08m @ 1.03% Li2O from 45m, including 11m @ 1.51% Li2O from 54m.

And Lithium Power International (ASX:LPI) is in the news this morning, up 31% after revealing the company has entered into a binding scheme implementation deed under which Codelco will acquire 100% of LPI at $0.57 a share.

It’s big news that values LPI at approximately $385 million, with the offer price coming in at a very juicy premium of 119% compared to the undisturbed closing share price of $0.26 per share on September 26, 2023. There’s more to the story, and Rob “I write about rocks now, too” Badman has it all covered here.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 18 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MXC MGC Pharmaceuticals 0% -25% 1,930,000 $8,855,936 WIA WIA Gold Limited 3% -25% 3,149,666 $36,827,398 ILA Island Pharma 6% -24% 156,335 $6,501,477 JAN Janison Education Group 31% -21% 697,411 $97,178,247 HYD Hydrix Limited 2% -21% 100,039 $7,372,347 GTG Genetic Technologies 0% -20% 100,000 $28,854,145 MTL Mantle Minerals Ltd 0% -20% 150,000 $15,368,615 SIS Simble Solutions 1% -17% 2,238,000 $3,617,704 HFR Highfield Res Ltd 28% -16% 909,934 $131,381,551 SES Secos Group Ltd 4% -15% 78,126 $28,487,072 CZN Corazon Ltd 1% -14% 18,772 $8,618,371 LRL Labyrinth Resources 1% -14% 54,486 $8,312,806 NGS NGS Ltd 1% -14% 3,983,905 $3,517,184 AMN Agrimin Ltd 16% -14% 94,247 $53,345,210 DTC Damstra Holdings 10% -13% 48,218 $28,367,030 IPB IPB Petroleum Ltd 1% -13% 2,811,525 $9,041,959 LML Lincoln Minerals 1% -13% 182,586 $11,365,694 MOM Moab Minerals Ltd 1% -13% 100,000 $5,695,708 RDS Redstone Resources 1% -13% 534,666 $6,971,028 TG1 Techgen Metals Ltd 3% -13% 26,264 $2,469,385 YOJ Yojee Limited 1% -13% 150,000 $9,081,637 DES Desoto Resources 11% -13% 40,686 $7,191,180 SMS Star Minerals 4% -13% 19,934 $1,450,112 BME Black Mountain Energy 2% -13% 225,536 $4,397,380 FTZ Fertoz Ltd 7% -12% 136,618 $20,884,621

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.