ASX Small Caps Lunch Wrap: Which Spanish criminal is living up to his super-gross nickname this week?

Waiter! There's a soup in my hair... Pic via Getty Images.

Local markets are down again, despite a lot of us trying our best to remain upbeat. This, obviously, is causing quite significant quantities of cognitive dissonance, as the more feeble brains (okay… just mine) struggle to stay happy, when things on the market are quite clearly a bit sh-t.

I could try to explain it ‘using my words’ like the nice lady who used to visit me at school tried to teach me when I was a boy, but that’s a fool’s errand.

Instead, have a listen to this absolute banger from 1999 which sums it up perfectly… a satisfying, happy tune that describes today’s market in a manner that is almost perfectly dour.

While that’s playing, I’ll tell you a quick tale of a man who came up with the ultimate plan to eat for free all around Alicante, a port city on Spain’s southeastern Costa Blanca.

The fella – a Lithuanian, or so the legend says – is so notorious that he’s known by the locals as El Gastrojeta de Alicante… which sounds fabulously dark and mysterious to anyone who does speak Spanish.

It translates (roughly) to ‘The runny sh-t of Alicante’, which should give you a pretty solid (pardon the pun) idea of just how despised he has become.

El Gastrojeta is a man who loves fine food, but hates having to pay for it, which led him to develop a fine strategy to eat for free.

He’ll order his food, enjoy his meal, “have a heart attack”, get carted off to hospital and then run away… and boom! – that’s a free dinner and ride home, thankyouverymuch.

It’s a plan so devious and fiendishly clever, that it’s worked at least 20 times at different eateries around Alicante, absolutely flawlessly right up until the time it didn’t.

While trying to get out of paying €34.85 (approx 60,000 of our increasingly-puny Aussie dollars) for two whiskeys and a paella-for-one, El Gastrojeta launched into his heart attack routine.

Restaurant staff called the police instead of an ambulance, and the local cops took him into custody for the umpteenth time. When contacted for comment, local authorities confirmed that he’d been locked up, but were apparently unsure of whether he’d since been released.

Hopefully, he remains behind bars, safe from angry restaurateurs and thriving in new accommodation where the food might be terrible, but it’s absolutely free.

TO MARKETS

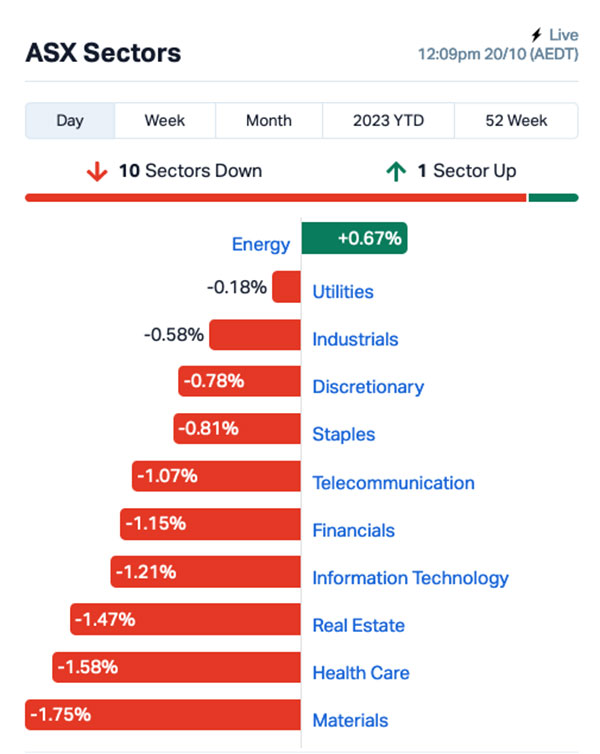

Local markets are struggling again today, for all the same reasons as we’ve been facing all week – the Middle East is in full-blown crisis mode again, things there are escalating dangerously towards an actual US/Iran showdown, while Wall Street is losing its mind over interest rates and bond yields.

Locally, the only sector offering any kind of hope is Energy, which is always going to do well when oil prices are climbing the way they are today.

At the time of writing, Brent Crude had popped above US$93 a barrel, with the less-fancied WTI Crude breaking through US$90 a barrel as well.

The Materials sector is copping the worst of the beating on the ASX this morning, with everything else lining up behind it leaving at least five of the major sectors more than 1.0% lower for the day so far.

As it almost always is the case when the market’s in this kind of mood, there’s one index shaping nicely for the day – the XGD All Ords Gold index is up 0.2%, and that’s because Australian gold prices have hit record highs.

It’s due to rising spot gold prices and a weakening Aussie dollar, which ganged up to push gold to a record $3,138 an ounce this morning, leaving many people smiling… except for those of us with gold teeth who aren’t really in the mood to get mugged just for grinning today.

The big news on market, though, is Liontown Resources (ASX:LTR). the former target of The Big Albemarle Caper and subsequent Rinehart Shennanigans was in freefall this morning, after revealing that it had completed what looks like an unfortunately timed placement.

LTR said it had raised $365 million through an institutional placement of approximately 203 million shares at $1.80, well below the heavily-inflated price stemming from the non-starter takeover by Albemarle that pushed the price beyond $3.00 a share in the middle of last week.

LTR shares had been in suspension prior to the announcement, but came out on the heels of the heavily discounted placement, to a round of deafening boos and a major sell-down to open at $1.86.

Ouch.

NOT THE ASX

In New York overnight, Wall Street delivered a not particularly stealthy blow to any hopes that the ASX might end the week on a happy note.

The S&P 500 tumbled by -0.85%, the blue chips Dow Jones index was down by -0.75%, and the tech-heavy Nasdaq crashed by -0.96%, after US Fed Chair Jerome Powell comprehensively J-Powed investor sentiment.

As if the escalating war in the Middle East wasn’t a big enough problem, Powell stepped up to the microphone and demonstrated his uncanny ability to really ‘read the room’, opened his mouth and said “inflation is still too high”.

Powell gets paid US$190,000 a year, which is nuts when you consider that it would probably cost less than a third of that to have Wall Street burnt to the ground by professional arsonists.

To US stock news, and Earlybird Eddy reports that Tesla slumped -9% after its Q3 profits dropped by 44% following big price cuts, as announced after the bell yesterday.

CEO Elon Musk added to negative sentiment on the stock after saying “there will be enormous challenges in reaching volume production with Cybertruck, and making the Cybertruck cash flow positive.”

“Tesla is an incredibly capable ship. We’re not going to sink, but, even a great ship in a storm has challenges,” Musk stoically told analysts, as $24 billion of his personal net worth evaporated.

What a brave, brave man.

Meanwhile, Netflix, as expected, surged 16% after reporting swelling subscriber numbers post-market on Wednesday.

Taiwan Semiconductor (TSMC) also popped +4% after beating analysts estimates for Q3 sales.

In Japan, the Nikkei is down 0.87% as the nation grapples with an Olympics snub after Japan’s beloved sport of Sumo was once again left off the agenda for any upcoming Olympic Games.

The IOC recently announced that five ‘new’ sports are being added to the roster for the 2028 Games in Los Angeles including, god help us, cricket for some unfathomable reason.

But Sumo Wrestling remains stuck on the fringes of world sport, quite possibly because its got a bunch of weird rules that make a lot of people unhappy, especially a young man named Abdelrahman Elsefy.

Elsefy was the first Egyptian ever to win a gold medal in an intertnational Sumo championship, taking out the lightweight division last year in Alabama, an amazing achievement that was sullied only by his disqualification immediately after the event.

Elsefy’s crime: he performed a celebratory backflip after winning the final, which annoyed the sport’s governing body as “excessive celebrations” are against the rules.

Elsefy perhaps should have displayed “Elon Musk losing $24 billion” levels of grim-faced stoicism – he’d still have his medal, and Sumo might finally make it onto the Olympic stage.

In China, Shanghai markets are proving to be remarkably immune to outside pressures, tracking flat today while in Hong Kong the Hang Seng is down 0.58% in early trade.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 20 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap TRI Trivarx Ltd 0.002 100% 1,221,501 $6,714,378 AHN Athena Resources 0.003 50% 11,119,333 $2,140,935 YOJ Yojee Limited 0.007 40% 563,314 $5,676,023 MXC MGC Pharmaceuticals 0.002 33% 257,128 $6,641,952 NZS New Zealand Coastal 0.0025 25% 1,967,541 $3,334,020 XST Xstate Resources 0.017 21% 383,427 $4,501,268 FML Focus Minerals Ltd 0.175 21% 60,821 $41,551,004 FAU First Au Ltd 0.003 20% 40,000 $3,629,983 LBT LBT Innovations 0.006 20% 621,947 $1,779,502 BMM Balkan Mining and Minerals 0.155 19% 89,664 $8,944,933 NYR Nyrada Inc. 0.025 19% 43,460 $3,276,183 ETR Entyr Limited 0.007 17% 500,000 $11,898,623 EFE Eastern Resources 0.008 14% 125,841 $8,693,625 HNR Hannans Ltd 0.008 14% 21,250 $19,072,234 IXR Ionic Rare Earths 0.025 14% 12,975,576 $87,034,308 WBT Weebit Nano Ltd 3.77 14% 993,364 $623,677,152 PRM Prominence Energy 0.017 13% 500,000 $2,308,146 1ST 1St Group Ltd 0.009 13% 197,833 $11,335,930 ALM Alma Metals Ltd 0.009 13% 1,047,667 $8,912,006 RIM Rimfire Pacific 0.009 13% 556,646 $16,841,958 ETM Energy Transition 0.038 12% 130,534 $46,095,296 LIO Lion Energy Limited 0.019 12% 75,131 $7,295,241 TSO Tesoro Gold Ltd 0.019 12% 2,779,827 $17,911,414 FG1 Flynn Gold 0.068 11% 20,000 $8,319,338 TTM Titan Minerals 0.04 11% 31,131 $54,898,317

With the local market in a state of mild chaos, there’s a ton of small caps moving around on no particular news, including the likes of Balkan Mining and Minerals (ASX:BMM) , which has bounced a tidy 19% this morning after shedding significant value over the past few days.

Ionic Rare Earths (ASX:IXR) is enjoying a nice gain this morning, up around 12% on news that it has received, via Rwenzori Rare Metals, advice from the Ugandan Directorate of Geological Survey and Mines (DGSM) that the Large-Scale Mining Licence for the Makuutu Heavy Rare Earth Project has been approved.

Solid performer from earlier in the week Whitebark Energy (ASX:WBE) is still rising, up another 12% this morning on previous news that the company’s Wizard Lake gas play is back online.

Likewise, Tesoro Gold (ASX:TSO) is driving skywards again today, adding another 20.5% to yesterday’s gains.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 20 October [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CLE Cyclone Metals 0.001 -50% 7,522,443 $20,529,010 AVW Avira Resources Ltd 0.001 -33% 729,996 $3,200,685 LTR Liontown Resources 1.935 -31% 29,670,928 $6,144,293,085 CCE Carnegie Clean Energy 0.0015 -25% 3,468,464 $31,285,147 ICE Icetana Limited 0.032 -20% 81,250 $10,219,423 MCT Metalicity Limited 0.002 -20% 605,890 $9,340,215 ADV Ardiden Ltd 0.0045 -18% 30,987,180 $14,785,844 DGR DGR Global Ltd 0.024 -17% 13,750 $30,267,111 ROG Red Sky Energy 0.005 -17% 5,533,322 $31,813,363 ROO Roots Sustainable 0.005 -17% 25,546 $919,875 LRV Larvotto resources 0.105 -16% 178,764 $8,406,840 CL8 Carly Holdings Ltd 0.016 -16% 43,478 $5,099,037 SRI Sipa Resources Ltd 0.022 -15% 2,400 $5,932,112 MSG Mcs Services Limited 0.017 -15% 331,800 $3,961,993 WOA Wide Open Agriculture 0.145 -15% 1,566,313 $24,357,901 M24 Mamba Exploration 0.03 -14% 468,272 $2,134,417 CY5 Cygnus Metals Ltd 0.13 -13% 667,395 $43,506,396 SOM SomnoMed Limited 0.52 -13% 6,538 $65,154,838 KGD Kula Gold Limited 0.013 -13% 617,072 $5,598,179 TIA Tian AN Aust Limited 0.265 -13% 54 $26,415,693 FLN Freelancer Ltd 0.2 -13% 10,000 $103,710,423 A4N Alpha Hpa Ltd 0.68 -13% 955,479 $685,623,564 NTM NT Minerals 0.007 -13% 254,071 $6,879,223 CAY Canyon Resources Ltd 0.042 -13% 821,288 $48,756,792 ATV Active Port Group 0.11 -12% 527,056 $39,455,984

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.