ASX Small Caps Lunch Wrap: Which robo-boffins have completely lost their minds this week?

"It's burger AND chips, Andy... you idiot." Pic via Getty Images.

Local markets got off to a pretty good start on Tuesday, ahead of the Reserve Bank board body-flopping out of their monthly feeding trough to tell us that they’ve given it a lot of very careful thought, and decided to do absolutely nothing about interest rates again this month.

They’re calling it “a decision” about interest rates, but really… who do they think they’re kidding?

Anyway – the Aussie markets opened this morning, just like they do most weekdays, jolting up 50 points in a matter of minutes, with the banks leading the charge because blah blah blah interest rates.

There’s other stuff happening, and I’ll tell you all about it shortly.

But first, we’re off to the Swiss Federal Institute of Technology Lausanne, where a team of scientists has been working on one of the most cheerfully baffling and pointless robotics developments ever devised.

The group, with representatives from Wageningen University, the University of Bristol, UK, the Italian Institute of Technology, and the Netherlands – no university mentioned, so I’m assuming they’re just rando Dutchies – have developed edible robots.

As in, “they’re little tiny robots you can eat”.

They’ve called it “RoboFood”, which is a blatant rip-off of RoboCop, but instead of murdering bad guys in brutal and interesting ways, these little robots are unlikely to do more than give the bad guys a bit of indigestion.

The program’s director, Dario Floreano, says he was inspired by a comment made by his colleague, Jun Shintake, who provided this observation: “the main difference between robots and living systems is that robots can’t be eaten by other life forms”.

Shintake’s amazing Big Brain insights into the inedible nature of robots gave Floreano the idea that the world, for some unfathomable reason, actually needed fully edible robots – and so, the and the team set to work making “robots that can be eaten and foods that behave like robots”.

Which is utterly, brain-spankingly bonkers – so it should come as precisely zero surprise that the project has been operating for a couple of years now, thanks to a 3.5 million Euro (that’s 5.6 million of our pathetically Casper Milquetoast Aussie currency) grant from the EU.

If you ever needed proof that Europe has lost its goddamn mind, there it is – irrefutable evidence that the EU will throw money at just about anything, and that I’m in entirely the wrong line of work.

But that ridiculous grant money has been put to good use – RoboFood has so far managed (and I promise you I’m not making this up) to create a drone made from rice cakes, which is held together using edible oils and chocolate.

It gets better – they built that drone on the premise that it could be flown out to look for a lost hiker in the Alps, who could use the drone to signal to rescuers where they are, and then eat the drone to stave off hunger.

The ultimate goal, though – if I’m reading this correctly – is to produce tiny edible robots that could do useful things, like deliver drugs… which would put my neighbour Nathan out of a job.

Or in an even more utilitarian outlook, the robots could be made simply to be eaten, like a bowl of breakfast cereal, which – if i’m being honest – doesn’t sound all that appealing.

The researchers haven’t made a lot of mention about how their edible robots taste, but if I had to take a guess, I reckon they’d taste like chips.

… I’ll see myself out.

TO MARKETS

Local markets have opened with a nice 50 point bang on Tuesday morning, which shunted the ASX 200 benchmark +0.84% in the right direction as we trundled towards sandwich time.

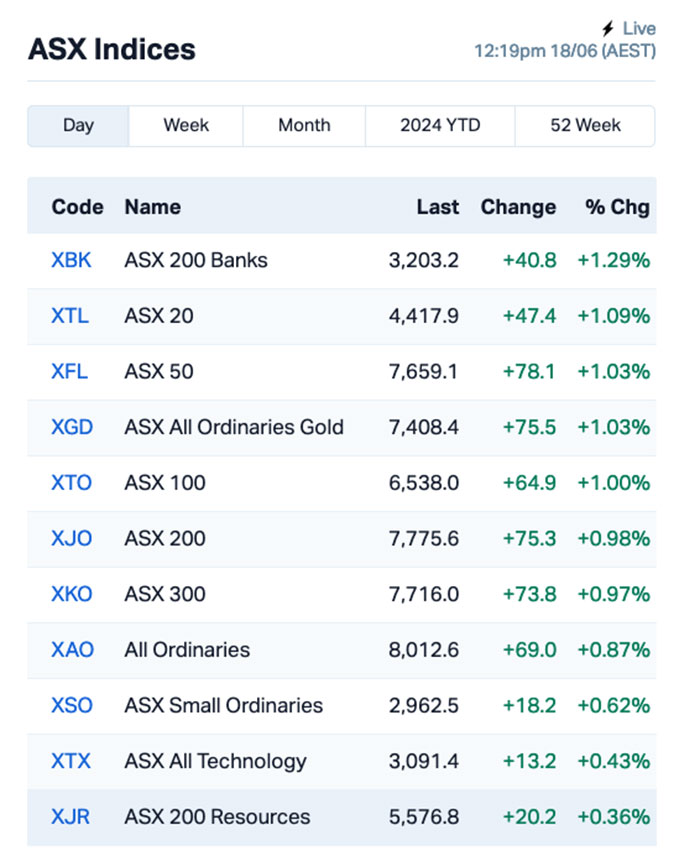

Up the top of the market for Tuesday are the big banks, with the XBK ASX 200 Banks index leading the way on +1.15% while the market waits for the RBA Board to shuffle listlessly out of the activities room and tell us that the interest rate needle isn’t going to move this month.

The excitement is palpable. I can barely contain myself. I’m on the edge of my seat… just holding my breath and waiting for nothing to happen. I’m not sure how much more of this excitement I can take.

I think I’m having an existential crisis. How did I go from test riding motorcycles and writing about 4WDs, to being utterly consumed by the goings on around interest rates, for crying out loud?

I used to go camping for a week in someone else’s brand new off-roader, and that was work… and now, here I am, struggling to find a new and exciting way to tell you that the RBA Board and its collective 9 billion IQ points won’t be doing anything today.

Maybe they’ll shock us all – pull a wild Bank of Japan move, and take interest rates below zero for a while, just for a bit of fun. Or jack them up to shonky high-risk credit card rates, just to hear the nation scream. But I doubt it.

So, yeah. The big banks are doing okay today, with CBA up +1.32%, NAB is up +1.16% and Macquarie Group is absolutely cranking it, up +3.11%.

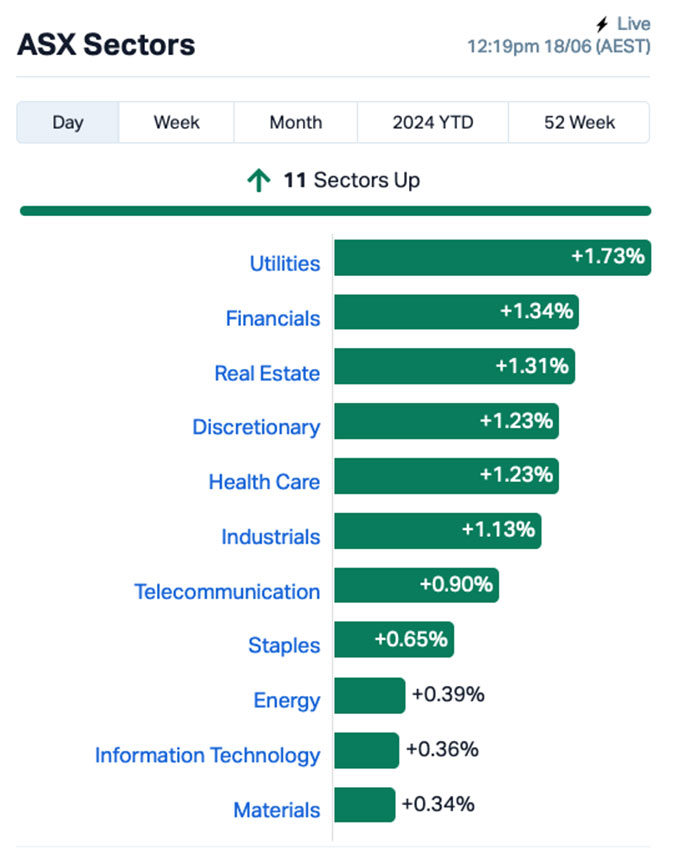

The market sectors look lovely and verdant for the morning:

The ASX indices look like this:

It’s not been all beer and skittles this morning, though, with a few of the big diggers hitting turbulence in the hours since the session began.

Fortescue (ASX:FMG) took a fairly horrible pounding for a Tuesday, shedding -4.6% in the two hours leading into lunch – a slump due almost entirely on one chunky investor deciding to cash out, with about $1.1 billion of stock hitting the market floor.

That’s roughly 1.6% of Twiggy’s business up for grabs – and despite the size of the fire sale, it’s not immediately clear whose shares they are. But whoever it is, they’re not doing the other shareholders much of a favour today.

OR ARE THEY?

While it’s a big fall for FMG, the rest of the Materials sector is covering it and keeping the needle in the green, with segment giant BHP (ASX:BHP) up +0.6%, Mineral Resources (ASX:MIN) up +1.43%, Pilbara Minerals (ASX:PLS) adding a very handy +2.23% and lithium lovers Liontown Resources (ASX:LTR) up 3.5%.

NOT THE ASX

Overnight in New York, the S&P 500 rose by +0.77% to its 30th record high in 2024, the blue chips Dow Jones index was up by +0.49%, and the tech-heavy Nasdaq lifted by +0.95%.

In US stock news, AI related chipmakers were once again front of mind for investors, who piled in on the likes of Micron Technology which lifted by +4.5% and reached a record high as several analysts increased their target price on the stock, and chipmaker Broadcom Inc rose by +5.5%.

Also, Tesla did a thing and now it’s +5%, with Apple and Microsoft adding about 2% apiece, because gadgets are cool, and will only ever get cooler with AI baked into them.

However, the question about how much AI consumers are ready to cope with is starting to loom for the big players.

Apple recently held its annual skivvy convention, and told iPhone users that the next iteration of their ubiquitous lifestyle controllers will feature AI right there in the device, so it can do stuff like scan your text messages and emails, and tell you what time your mother-in-law’s flight home from Bali is going to land, so you can be at the airport to laugh yourself sick at how appallingly sunburnt she got after a nine-martini blackout by the pool at the resort.

Microsoft has also given users a rude AI shock in recent weeks, suggesting that its getting set to roll out a properly horrifying new “feature” called Recall, which – in layman’s terms – is going to outright spy on everything you do, taking screenshots of your work and feeding them into the huge, gaping maw that is Microsoft Copilot, so it can recommend which app you might want to be using, or recommend you to the police for thought crimes.

And Gamestop – poor, wretched Gamestop – was down 12% on news from CEO Ryan Cohen that told investors that the video game retailer plans to downsize its network of stores.

In Europe, rising political tensions and emerging fascism took their toll on markets last week, prompting Citigroup to downgrade the region’s equities, citing “heightened political risks”.

All eyes are on France at the moment, after Emmenuel Macron channelled his inner Rishi Sunak and called a snap election, which could be politically disastrous, given just how soundly Macron’s cronies were pantsed in the recent EU elections.

French people will head to the polls in two weeks’ time, and the rest of Europe has already started stockpiling marshmallows, so they can sit around the inevitable bonfire that is set to envelope Paris, regardless of the electoral outcome.

In Asian markets, everything’s lookin kinda sporty – Japan’s Nikkei is up 1.05%, the Hang Seng is +0.5% better off and Shanghai markets are also making headway, up +0.40%.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 17 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Name Price % Change Volume Market Cap CNJ Conico Ltd 0.0015 50% 45022 $1,805,095 LNU Linius Tech Limited 0.002 33% 2550000 $8,320,111 VML Vital Metals Limited 0.004 33% 1035515 $17,685,201 PL3 Patagonia Lithium 0.125 32% 1949040 $4,667,208 ME1 Melodiol Global Health 0.038 27% 942479 $1,093,493 AAU Antilles Gold Ltd 0.005 25% 989994 $3,986,140 VRC Volt Resources Ltd 0.005 25% 249999 $16,634,713 QHL Quickstep Holdings 0.21 20% 155227 $12,552,087 CRB Carbine Resources 0.006 20% 129166 $2,758,689 KRR King River Resources 0.012 20% 15884155 $15,535,249 SI6 SI6 Metals Limited 0.003 20% 1000000 $5,922,149 IR1 Irismetals 0.33 18% 35185 $37,389,795 RCR Rincon 0.087 18% 7218869 $21,334,620 AKM Aspire Mining Ltd 0.35 17% 620441 $152,291,096 BFC Beston Global Ltd 0.0035 17% 3892519 $5,991,141 IRX Inhalerx Limited 0.029 16% 250000 $4,744,174 SRI Sipa Resources Ltd 0.015 15% 109224 $2,966,056 MM1 Midasmineralsltd 0.069 15% 13677 $6,199,781 TNY Tinybeans Group Ltd 0.071 15% 1370473 $8,890,808 AML Aeon Metals Ltd 0.008 14% 2279553 $7,674,804 ECT Env Clean Tech Ltd. 0.004 14% 21136 $11,101,336 EPM Eclipse Metals 0.008 14% 625000 $15,755,989 RKT Rocketdna Ltd. 0.008 14% 70000 $4,592,804 BCC Beam Communications 0.16 14% 192324 $12,099,069 IBX Imagion Biosys Ltd 0.09 14% 75849 $2,579,078

Lithium brines explorer Patagonia (ASX:PL3) was boosted on Tuesday morning by reports “exceptional” results from well 2 at the Formentera project in Argentina.

“These results are exceptionally encouraging – high porosity, with lithium values concentrating at depth,” PL3 exec chair Phil Thomas said. “I have never seen core porosity at such high levels of 47% at 280m depth and lithium values at that porosity of 572ppm.

“Pumping from well 2 during the 48 hours didn’t reduce the brine level in well 1, 300m away, so we are confident we have a very large aquifer open at depth.”

Independent aerospace composite business Quickstep Holdings (ASX:QHL) was also flying high, after delivering an update to the market on how things are progressing with its role in producing components for the F-35 fighter jet, as it approaches the midpoint of its initial volume buildout.

While the company notes that overall demand for its product related to the F-35 project is going to decline by as much as 8% in the near term, it has streamlined its production process to ensure that program margins remain consistent despite this lower demand.

And privacy-focused photo sharing app Tinybeans (ASX:TNY) has secured a major US strategic partnership with leading digital parenting platform Babylist. The partnership is expected to deliver brand awareness, subscriber growth and sales revenue for Tinybeans in the US, the company says.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 18 June [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap AXP AXP Energy Ltd 0.001 -50% 1,757,361 $11,649,361 MAY Melbana Energy Ltd 0.04 -39% 48,044,240 $222,433,471 MTB Mount Burgess Mining 0.001 -33% 97 $1,947,220 EVR EV Resources Ltd 0.005 -29% 277,554 $9,248,900 RC1 Redcastle Resources 0.019 -27% 2,607,937 $8,535,388 ERL Empire Resources 0.003 -25% 45,000 $5,935,653 LSR Lodestar Minerals 0.0015 -25% 317,734 $4,046,795 MHC Manhattan Corp Ltd 0.0015 -25% 5,000,000 $5,873,960 SHP South Harz Potash 0.011 -21% 2,224,314 $11,580,590 BCT Bluechiip Limited 0.004 -20% 9,207 $5,910,198 CTO Citigold Corp Ltd 0.004 -20% 800,000 $15,000,000 ROG Red Sky Energy. 0.004 -20% 1,649,752 $27,111,136 YPB YPB Group Ltd 0.002 -20% 24,000 $2,019,904 NYM Narryermetalslimited 0.033 -20% 75,000 $4,358,549 EMH European Metals Hldg 0.265 -17% 20,455 $66,382,306 EG1 Evergreen Lithium 0.054 -17% 202,972 $3,654,950 TFL Tasfoods Ltd 0.015 -17% 34,250 $7,867,719 1MC Morella Corporation 0.0025 -17% 1,123,891 $18,536,398 AUK Aumake Limited 0.0025 -17% 73,333 $5,743,220 AVE Avecho Biotech Ltd 0.0025 -17% 29,164,841 $9,507,891 BXN Bioxyne Ltd 0.005 -17% 10,225,000 $12,279,872 DGR DGR Global Ltd 0.01 -17% 60,000 $12,524,322 HLX Helix Resources 0.0025 -17% 1,166,658 $9,792,581 LPD Lepidico Ltd 0.0025 -17% 456,248 $25,767,358 POS Poseidon Nick Ltd 0.005 -17% 591,688 $22,281,209

ICYMI – AM EDITION

Comet Ridge (ASX:COI) has expanded its position in the Mahalo gas hub in Queensland with the award of a new block that hosts part of a high quality, shallow fairway that has been extensively appraised and proven to be capable of excellent gas production from three separate pilot production tests.

And Corazon Mining (ASX:CZN) has received firm commitments to raise around $340,000 via a placement at $0.0065 per share – plus up to $1m via a share purchase plan – to fund accelerated exploration at its Mt Gilmore project in NSW, with a maiden drilling program at the May Queen porphyry copper-gold target planned for July.

At Stockhead, we tell it like it is. While Comet Ridge and Corazon Mining are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.