ASX Small Caps Lunch Wrap: Which pastor was putting the meth in Methodist this week?

The best part about having a meth dealer as your pastor is it's always only two sleeps until Christmas. Pic via Getty Images.

Local markets have opened higher this morning, thanks to a change of heart among US tech investors that allowed New York’s indices to retake some of the ground they lost on Tuesday.

That, coupled with a major acquisition announcement for an Australian tech heavyweight has helped propel local markets back into the good graces of investors, and at lunch time the ASX 200 needle was pointing 0.65% higher.

I’ll get into the details of that shortly, but first there’s some alarming news from the US state of Connecticut, where one local community has been left reeling by allegations that a local pastor has been supplementing his income by running an ice dealing operation on the side.

Police in the tiny town of Woodbury say that local Methodist preacher Herbert Irving Miller has been selling methamphetamine from his home, right next door to the church, after neighbours noticed an increase in the number of visitors at odd hours, and someone found a meth pipe in the street outside the home.

A subsequent investigation uncovered allegations that the pastor from the Woodbury United Methodist Church had been providing the drugs in exchange for watching gay couples have sex, which I’m fairly certain definitely breaks the commandment about coveting thy neighbour’s ass.

And on that note, it’s probably best we all move along to more palatable news from the ASX.

TO MARKETS

The headline news from the ASX this morning is talk of a massive takeover for Aussie tech company Altium, after the multi-billion dollar market cap “global leader in electronics design systems” revealed that a deal has been struck that would see Renesas Electronics acquire “all outstanding shares of Altium for a cash price of A$68.50 per share, representing a total equity value of approximately A$9.1 billion” – a juicy premium to yesterday’s $51.26 close for ALU.

See if you can spot what time the announcement dropped:

“Addition of Altium will enable us to deliver an integrated and open development platform, making it easier for businesses of all sizes and industries to build and scale their systems,” Renesas boss Hidetoshi Shibata said.

“We look forward to working with Altium’s talented team as we continue to invest and drive our combined platform to the next level of value for our customers.”

By lunchtime, Altium was up more than 28% to just over $66 per share.

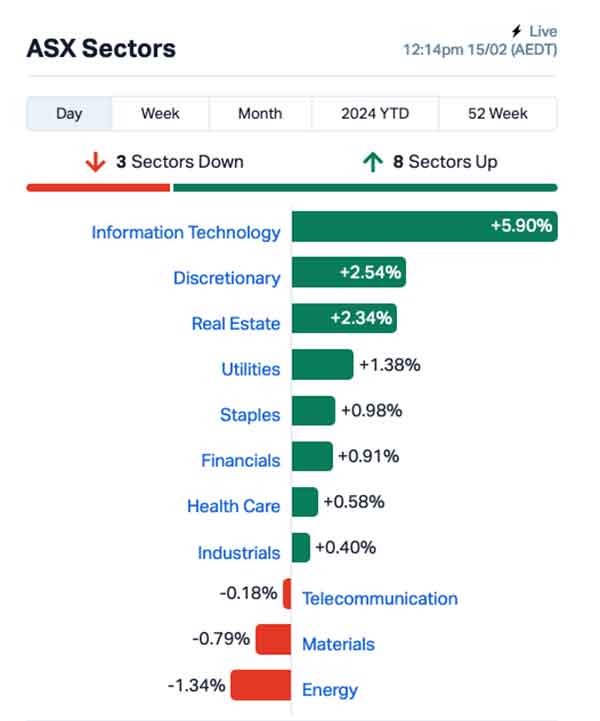

That huge boost has helped put the InfoTech sector miles out in front of the rest of the market, up 6.2% as we head towards lunch, while the Energy and Materials markets struggle to gain traction.

It’s been a pretty solid morning for a number of other large caps today, with the likes of Wesfarmers (+4.9%), Life360 (+6.91%) and Goodman Group (+5.94%) all making significant gains, while Downer Edi continued its run of gains from yesterday, up another 5.4% today.

Let’s see… what else is happening? The banks are up this morning, Small Caps are performing well and the goldies are flat. That’s about it, really.

In broader economic news, the Australian unemployment figures for January arrived this morning, showing a seasonally adjusted increase to 4.1% in January – the first time since early 2022 that it’s been above 4.0%.

That might sound a little dire, but it’s partially by design – the RBA board has been clear on its desire to see an increase in unemployment, which is part of its strategy to get inflation under control and pave the way for interest rates to start coming down.

According to the Australian Bureau of Counting Things, an estimated 500 jobs were created in the first month of the year, which is not a lot.

NOT THE ASX

There was a tech rally on Wall Street overnight, and that helped lighten the mood throughout New York, leaving the the S&P 500 up by +0.96%, while the blue chips Dow Jones index was up by +0.4%, and the tech-heavy Nasdaq climbed by +1.3%.

It was a solid run for six out of the so-called Magnificent Seven, with Apple the only outlier losing ground after dropping 0.5% during the session.

In US stock news, ride-sharing stock Lyft jumped +35% after earnings per share for the quarter came in at US18c per share, versus the US8c expected by analysts. However there was a bit of drama after Lyft mistakenly said in the company release that margins would expand by 500 basis points, or 5%, year over year in 2024, instead of 0.5%.

Tesla rose by +2.55% despite an informal poll of the company’s institutional investors showed that most expect the stock to underperform over the next six months.

Salesforce jumped almost +3% after the company launched Slack AI, a bot designed to make it easier to catch up on work threads and Slack channels.

Meanwhile, over the Atlantic, UK inflation unexpectedly held steady at 4% in January, compared to the expectations of 4.2%.

“We slightly overshot last month and slightly undershot this month,” said Bank of England boss Andrew Bailey, adding that the results “pretty much leaves us where we were.”

Thanks to Earlybird Eddy Sunarto for that overseas reporting. What a legend he is.

In Asian markets, China is still closed for business, as New Year celebrations threaten to carry all the way over to next Lunar New Year, crippling the Chinese economy and leaving the nation’s population in a permanent state of public holiday.

In Japan, the Nikkei is up 0.91% in early trade, despite the nation once again finding itself in the grip of “food terrorism” fears after a worker at Domino’s Pizza was fimed picking his nose and depositing his nasal treasure in a wad of the company’s dough.

Thankfully, social media worked in Japan’s favour in this instance. Video of the incident spread quickly enough that the worker, and the outlet where he is – or rather was – employed was identified before the dough was used for a customer order… or so says Domino’s Japan.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 15 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap JBY James Bay Minerals 0.19 36% 1,051,683 $4,542,300 IS3 I Synergy Group Ltd 0.008 33% 2,000 $1,824,482 NVQ Noviqtech Limited 0.004 33% 1,495,012 $3,928,336 PRX Prodigy Gold NL 0.008 33% 22,462,626 $10,506,647 OLY Olympio Metals Ltd 0.07 32% 273,245 $3,370,773 ALU Altium Limited 65.76 28% 1,067,051 $6,762,569,716 YOJ Yojee Limited 0.054 26% 68,339 $7,297,299 ATH Alterity Therapeutics 0.005 25% 309,167 $17,531,019 RMX Red Mount Min Ltd 0.0025 25% 245,721 $5,347,152 RR1 Reach Resources Ltd 0.0025 25% 1,047,285 $6,420,594 W2V Way2Vatltd 0.017 21% 44,605,962 $9,122,518 MGU Magnum Mining & Exp 0.023 21% 2,466,118 $15,377,867 BLZ Blaze Minerals Ltd 0.006 20% 302,633 $3,142,791 GCM Green Critical Min 0.006 20% 26,334 $5,682,925 PNX PNX Metals Limited 0.006 20% 3,444,013 $26,903,124 ATC Altech Batt Ltd 0.075 19% 8,130,437 $104,159,531 ARV Artemis Resources 0.019 19% 582,933 $27,059,138 SGC Sacgasco Ltd 0.013 18% 186,265 $8,576,558 AAP Australian Agricultural Projects 0.02 18% 14,500 $6,266,263 E33 East 33 Limited. 0.023 15% 680,324 $10,741,774 CAY Canyon Resources Ltd 0.085 15% 1,581,093 $101,281,322 ICL Iceni Gold 0.039 15% 541,367 $8,383,076 GSR Greenstone Resources 0.008 14% 1,182,146 $9,576,794 NRZ Neurizer Ltd 0.008 14% 1,200,137 $9,897,376 IPX Iperionx Limited 2.19 13% 874,977 $439,589,756

James Bay Minerals (ASX:JBY) was at the top of the leader charts early on Thursday, posting a 42% gain on news that a review of aeromagnetic and spectromagnetic survey results across its flagship Joule Property, within the 100%-owned La Grande Lithium Project in the James Bay region of Quebec, Canada, has generated significant new rare earths and uranium targets.

The announcement includes this nugget of information from Joel Dube from Dynamic Discovery Geoscience, who commented: “As a comparison, Joule is only one of two projects over the entire James Bay area, including the Matoush Uranium Project area, with maximum eU values exceeding 20 ppm, while the global average is approximately 0.5 ppm. This is considering a thorough review of over 80,000 l-km of public airborne gamma-ray spectrometric data.”

James Bay executive director, Andrew Dornan, was quick to point out that the company “will remain firmly focused on LCT pegmatites with potential for world-class lithium discoveries”, but these results “cannot be ignored”.

“As we have been doing for lithium, we will continue to sample and understand all relevant minerals on our properties,” Dornan said.

Olympio Metals (ASX:OLY) surged throughout the morning despite no fresh news, as did Yojee (ASX:YOJ) – they were trading 32% and 25% higher respectively by lunchtime.

Way2VAT (ASX:W2V) was surging on news that it’s set to roll out a new product called “AI-AP Compliance”, which the company says is a world-first AI-driven automated accounts payable auditing product, which is says has been built out to tie in seamlessly with the rest of its AI-driven software suite.

Large capper Altium (ASX:ALU) was also on the winners list – it’s not often we get to see an $8 billion company this high up in the rankings – so it’s definitely worth another mention, because it’s currently trading 28% higher than it was yesterday.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 15 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap H2G Greenhy2 Limited 0.006 -33% 1,441,413 $3,768,802 SIT Site Group Int Ltd 0.002 -33% 10,000,000 $7,807,471 ZMI Zinc of Ireland NL 0.012 -25% 250,000 $3,410,308 EXT Excite Technology 0.007 -22% 6,349 $11,963,176 OXT Orexplore Technologies 0.019 -21% 234,810 $4,689,976 CTN Catalina Resources 0.004 -20% 500,000 $6,192,434 TTI Traffic Technologies 0.008 -20% 1,734,869 $7,576,702 VML Vital Metals Limited 0.004 -20% 1,769,637 $29,475,335 INV Investsmart Group 0.125 -19% 70,000 $22,115,475 CNJ Conico Ltd 0.0025 -17% 1,000,000 $4,710,285 DMG Dragon Mountain Gold 0.01 -17% 5 $4,736,060 LNR Lanthanein Resources 0.005 -17% 208,000 $7,738,871 RLG Roolife Group Ltd 0.005 -17% 1,536,718 $4,335,349 ECG Ecargo Hldg 0.031 -16% 13,159 $22,764,250 IND Industrialminerals 0.26 -16% 582,963 $21,315,600 ILT Iltani Resources Lim 0.16 -16% 11,403 $6,461,996 WSR Westar Resources 0.017 -15% 349,435 $3,707,150 VTI Vision Tech Inc 0.23 -15% 10,000 $14,332,410 AML Aeon Metals Ltd. 0.006 -14% 603,448 $7,674,804 BUY Bounty Oil & Gas NL 0.006 -14% 175,000 $10,489,507 DTR Dateline Resources 0.012 -14% 8,049,889 $18,613,786 FFF Forbidden Foods 0.012 -14% 543,874 $2,826,048 JTL Jayex Technology Ltd 0.006 -14% 200,000 $1,968,950 ODE Odessa Minerals Ltd 0.006 -14% 209,913 $7,302,978 WMG Western Mines 0.155 -14% 249,183 $12,251,978

ICYMI – AM Edition

Sovereign Metals has appointed highly experienced environmental and social specialist Marco Da Cunha, as its new lead Environmental, Social and Governance (ESG) officer, bringing with him close to 20 years’ of experience in the field of environmental and social management.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.