ASX Small Caps Lunch Wrap: Which nation learned (again) that pigeons aren’t into espionage this week?

This specially trained pigeon is using its ultra-sensitive cloaca to intercept telephone calls outside Australia's embassy in Mumbai. True story. Pic via Getty Images.

Local markets are struggling to stay afloat this morning, with the ASX 200 benchmark wavering either side of break-even since the bell rang, following modest gains on Wall Street overnight, which included an impressive milestone for the S&P 500.

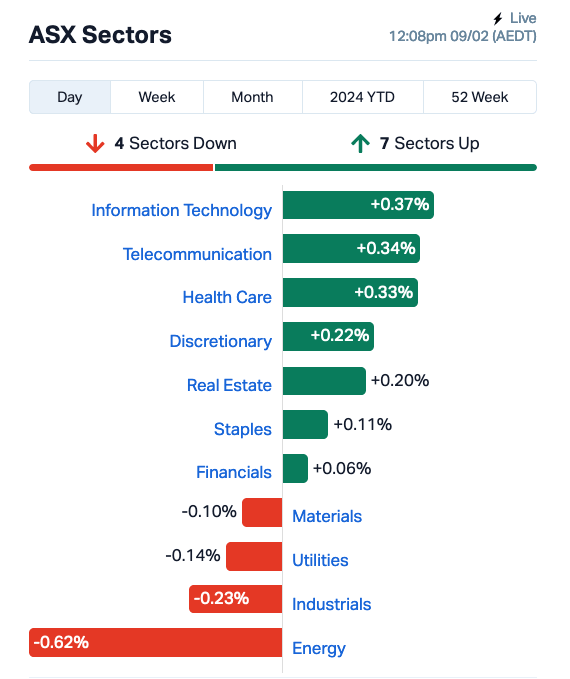

But with an Energy sector-shaped millstone around its neck today, Aussie markets are doing it tough, and by lunchtime the benchmark was flat, just 2.1 points higher than when things kicked off this morning.

I’ll get into the details shortly, but first there’s news from the darkly thrilling world of international espionage, after Indian officials revealed that they had released a pigeon that they suspected of being a Chinese spy after eight long months in captivity.

Indian officials reported that the bird had been captured at a port in Mumbai, after it was spotted with “messages written in a Chinese-like script” on its wings – leading them to the obvious conclusion that the animal was trying to smuggle state secrets out of the country.

It turned out not to be the case, though, and the bird was finally released from “prison” this week, after the eight-month investigation failed to find anyone connected with the bird, or – as it turns out – any evidence at all that it was involved in any form of spying whatsoever.

The fact that the pigeon had been detained in a hospital lock-up for eight months.

The release prompted a remarkably sane message of gratitude to Indian police from the Indian branch of People for the Ethical Treatment of Animals – which, as an aside, would have to be one of the wildest places in the world to be working.

I imagine the monthly reports alone would be amazing: “All the cows are fine, having the time of their lives being venerated as living deities. Everything else… not so much.”

But I digress.

The bird turned out to be a Taiwanese racing pigeon that had been blown off course during an event, arriving in India as confused as the locals who caught it and declared that the only rational reason it was there was ‘because it’s a spy’.

Which sounds bonkers, until you understand that India has form when it comes to arresting birds for spying.

In 2016, Indian officials arrested a bird that was reported to have been carrying a threatening message to Indian Prime Minister Narendra Modi.

Prior to that, in 2010, Indian police also detained a different pigeon after it was captured near the border with Pakistan, wearing a ring around its foot and an address and phone number stamped on it in red ink.

Which, as anyone with even a passing familiarity with the greatest magazine of all time – The Global Pigeon Fancier – will tell you, are the hallmarks of a bird involved in the noble sport of pigeon racing… and not the kind of hugely unpredictable, low-tech spying operation that Indian authorities appear to be deathly afraid of.

TO MARKETS

Local markets are doing things the hard way so far today, and as the lunch bell starts to ring at midday, despite two solid hours of effort, the ASX 200 benchmark’s needle has effectively moved 2.1 points, a +0.03% mini-gain.

That’s despite RBA boss Michele Bullock fronting a parliamentary economics committee for the first time in her capacity as guvnor, and has used the morning’s grilling to declare that she would be super-happy to reduce interest rates before inflation figures were back within the target range “if the economy looked like it was heading in the right direction”.

But, I wouldn’t recommend holding your breath until that happens… because Bullock is sounding not-at-all optimistic about that happening any time soon.

“While there are some encouraging signs, Australia’s inflation challenge is not over,” she said in her statement to the committee. “An inflation rate with a ‘4’ in front of it is not good enough and still some way from the midpoint of our target.”

Bullock followed that up with a sliver of hopium for Aussie borrowers, though.

“If we think monetary policy’s restrictive now, which we think it is, there’s a question: when do we reduce restrictiveness back to neutral, and do we have to be in the band at 2.5% before we think about doing that?” she asked, before answering her own question because she’s a real go-getter, and that’s what go-getters do.

“No I don’t think we do, but we do need to be very confident that we’ll get there as we start to remove the restrictive nature of policy.”

Away from the bread and circuses of parliamentary committees, it looks like the doldrums have struck the Energy sector this morning, and it’s languishing at more than 0.6% the wrong side of Happy Times.

The reason for that has been a whiplash sell-off on uranium stocks this morning, in the wake of overseas uranium giant Cameco’s blustering that it is more than able to step up to fill the hole in the market left by Kazatomprom, the Kazakhstan producer that is in a bit of a hole.

The brief from Cameco must be a doozy – last time I checked, uranium prices were up 6% today, which by rights should have investors piling in. Instead, they’re dropping uranium stocks like they’re (sorry) radioactive (I’m so, so sorry).

Up the happier end of things, InfoTech has rebounded today after a few sessions in the weeds, with the sector’s volatility dying down a little as tech stocks went back to the business of making people rich.

And the morning’s earth-moving large cap is Boral (ASX:BLD), which dropped its 1H24 report this morning to a stunned ASX – because things at Boral are lookin’ gooood.

The company reported that its net revenue came in at $1,839.9 million, up 9.4% on PCP, delivering an underlying EBITDA of $313.6 million, up 51.8% – which is a lot.

The company says it’s left with a Statutory NPAT of $122.0 million, and an underlying NPAT of $138.6 million, up a whopping 143.9%, prompting the company to declare that its FY24 Underlying EBIT guidance is $330-350 million, up from an earlier estimate of $300-330 million.

To sweeten the pot even further, the company says it has resolved to issue a divvy, on account of its “low franking credit balance”.

NOT THE ASX

Overseas, the big news from New York was the S&P 500 cracking 5,000 points for the first time ever, a massive milestone that lasted a few minutes before the index retreated back out of the spotlight, to close at 4,997, a +0.05% gain.

The blue chips Dow Jones index was up by +0.13%, and the tech-heavy Nasdaq lifted by +0.24%, the latter helped along by chipmaker Arm Holdings which rocketed +48% after reported Q3 earnings that beat estimates, and provided a strong profit guidance for the current quarter.

In other share news, Disney spiked by +11% after CEO Bob Iger said the company would enter the gaming industry with a US$1.5 billion stake in Epic Games, the maker of blockbuster Fortnite.

You have no idea how much I am looking forward to one-pumping Mickey Mouse in the face with Peter Griffin’s hammer-pump shotty. #IYKYK.

Disney also it will stream an exclusive version of musician Taylor Swift’s Eras Tour movie on Disney+, sending ripples of excitement through the bizarrely massive ranks of Walmart Delta Goodrem’s fanbase.

Paypal meanwhile crumbled by -11% despite Q4 results beating analyst estimates on both the top and bottom lines – probably due to the eye-wateringly massive fees the company is charging for international transfers.

I was recently forced to use PayPal to shift money to a family member in the US, and the fees totalled close to 11% of the transaction. I would have been better off tying the cash to a pigeon and hoping the Indian government didn’t get its hands on it mid-flight.

In Asian market news, Japan’s Nikkei is up 0.69% this morning, as the nation celebrates the capture of notorious criminal fugitive Shigeyuki Kin.

Kin’s capture came about almost by accident, after an entirely different fugitive called Satoshi (no, not that Satoshi) Kirishima, who had been on the run for 50 years before breaking his silence with a deathbed confession a week or so ago.

Kirishima confirmed that he was behind the 1974 bombing of Mitsubishi Industries that levelled a building and claimed eight lives, just three days before his death from stomach cancer.

When that story broke, the wanted persons poster issued by Japanese police featured very heavily in the coverage – largely because the photo of Kirishima has him smiling like he’s being photographed at a social event, rather than a mugshot.

The bloke to his immediate left is Shigeyuki Kin, who was wanted for attempted murder, following a shooting in Nagano Prefecture in 2020 – and who was arrested after someone dropped a dime on him after recognising his picture that featured so heavily in the media coverage of Kirishima’s death.

In China, Shanghai markets are up 1.28% because it’s New Years Eve there, and locals are preparing to usher in the Year of the Dragon, which is super-exciting for lots of reasons, most of them dragon-related.

Hong Kong’s Hang Seng, however, is not in the partying mood this morning – it’s down 1.79% in early trade, after reports that the city’s dragon crop had failed.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for 09 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap VMS Venture Minerals 0.013 63% 59,788,264 $17,680,104 AOA Ausmon Resorces 0.003 50% 129,936 $2,117,999 KNM Kneomedia Limited 0.003 50% 1,000,000 $3,066,543 BP8 Bph Global Ltd 0.002 33% 776,892 $2,753,345 AVA AVA Risk Group Ltd 0.2 23% 2,237,194 $41,622,119 A8G Australasian Metals 0.12 21% 698 $5,159,929 ARV Artemis Resources 0.019 19% 6,802,779 $27,059,138 NVX Novonix Limited 0.725 18% 6,677,255 $300,648,077 LPD Lepidico Ltd 0.007 17% 3,596,610 $45,829,848 MTL Mantle Minerals Ltd 0.0035 17% 1,103,252 $18,592,338 AN1 Anagenics Limited 0.015 15% 132,324 $4,924,112 CXZ Connexion Mobility 0.023 15% 4,845,348 $18,060,837 DRO Droneshield Limited 0.675 14% 6,767,518 $361,170,630 1MC Morella Corporation 0.004 14% 1,717,513 $21,625,798 TMG Trigg Minerals Ltd 0.008 14% 147,225 $2,623,293 ALA Arovella Therapeutic 0.17 13% 5,279,657 $137,763,435 ADG Adelong Gold Limited 0.0045 13% 700,028 $2,798,623 AXN Alliance Nickel Ltd 0.046 12% 1,483,644 $29,759,424 CL8 Carly Holdings Ltd 0.02 11% 33,333 $4,830,667 ESR Estrella Res Ltd 0.005 11% 300,000 $7,917,173 MKL Mighty Kingdom Ltd 0.01 11% 50,000 $4,283,314 MSG Mcs Services Limited 0.01 11% 200,000 $1,782,897 WGN Wagners Hld Company 0.9425 11% 136,324 $159,475,865 HYD Hydrix Limited 0.021 11% 32,638 $4,830,158 FOS FOS Capital Ltd 0.21 11% 500 $10,223,166

Top of the Pops among the small caps today is Venture Minerals (ASX:VMS), up 63% before lunch on news that the company has delivered a record drill hit at its large-scale, clay hosted Jupiter Rare Earths prospect in the Mid-West region of Western Australia, with the intercept measuring in at 48m @ 3,025ppm TREO, alongside assays up to 10,266ppm and 20,538ppm TREO from nearby holes.

Aussie tech minnow AVA Risk Group (ASX:AVA) is also rising nicely this morning, on news that it has inked a Telstra Supply Agreement with Telstra Group (of course… duh) that will see the telco putting the company’s risk assessment tech to use.

The deal follows 10 months of collaboration through product trials with Telstra and its customers, including monitoring the urban fibre network in metropolitan Melbourne and the subsea fibre cables in the Port of Darwin.

BPH Global (ASX:BP8) is getting in on the Chinese New Year festivities, up 33% this morning ahead of what is likely to be a productive period for the company.

BPH Global’s wholly-owned subsidiary Foshan Gedishi Biotechnology recently signed a major supply deal with Chinese tobacco company China Tobacco, to supply birds’ nests for distribution and consumption throughout Guangzhou City and the surrounding Province of Guangdong.

And lastly Novonix (ASX:NVX) is gaining weight this morning on news that it has signed a binding off-take agreement for high-performance synthetic graphite anode material to be supplied to Panasonic Energy’s North American operations from Novonix’s Riverside facility in Chattanooga, Tennessee.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for 09 February [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap ARC ARC Funds Limited 0.105 -45% 60 $5,714,507 M4M Macro Metals Limited 0.002 -33% 20,000 $7,401,233 RBR RBR Group Ltd 0.002 -33% 374 $4,855,214 RR1 Reach Resources Ltd 0.002 -33% 16,979,478 $9,630,891 INV Investsmart Group 0.105 -32% 51 $22,115,475 RHY Rhythm Biosciences 0.12 -31% 623,017 $38,699,953 ENT Enterprise Metals 0.003 -25% 18,318 $3,207,884 M24 Mamba Exploration 0.035 -20% 1,243,968 $8,099,620 DOU Douugh Limited 0.004 -20% 1,297 $5,410,345 PUR Pursuit Minerals 0.004 -20% 209,194 $14,719,857 PIM Pinnacleminerals 0.088 -20% 1,130,542 $3,812,943 CG1 Carbonxt Group 0.1 -17% 336,558 $38,990,598 NVQ Noviqtech Limited 0.0025 -17% 64,257 $3,928,336 EEL Enrg Elements Ltd 0.011 -15% 112,916 $13,129,545 GMN Gold Mountain Ltd 0.003 -14% 1,202,121 $7,941,775 GAP Gale Pacific Limited 0.155 -14% 277,153 $51,122,636 DYL Deep Yellow Limited 1.45 -13% 7,928,145 $1,280,893,159 FGH Foresta Group 0.013 -13% 699,664 $33,673,311 ENX Enegex Limited 0.02 -13% 82,223 $8,485,068 1CG One Click Group Ltd 0.007 -13% 964,046 $5,505,431 BME Blackmountainenergy 0.007 -13% 585,401 $3,065,793 POS Poseidon Nick Ltd 0.007 -13% 540,006 $29,708,278 GTR Gti Energy Ltd 0.0105 -13% 1,558,398 $24,599,365 BOE Boss Energy Ltd 5.29 -12% 5,519,652 $2,447,827,535 AGE Alligator Energy 0.07 -11% 27,742,920 $305,122,411

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.